IRS Small Biz

@IRSsmallbiz

Followers

28,288

Following

229

Media

17,894

Statuses

19,032

IRS news and guidance for small business owners. The IRS does not collect comments or messages on this site. Privacy Policy:

United States

Joined December 2010

Don't wanna be here?

Send us removal request.

Explore trending content on Musk Viewer

Gojo

• 220389 Tweets

#jjk261

• 199435 Tweets

Yuta

• 127166 Tweets

Tabasco

• 122063 Tweets

Emiliano

• 110872 Tweets

Kyrie

• 99570 Tweets

Maynez

• 98433 Tweets

キスの日

• 80618 Tweets

Nuevo León

• 65393 Tweets

Mavs

• 61082 Tweets

#MyLoveMixUpTH

• 60820 Tweets

Gege

• 59836 Tweets

真島さん

• 43656 Tweets

Karan Thapar

• 42057 Tweets

真島茂樹さん

• 40716 Tweets

बुद्ध पूर्णिमा

• 40023 Tweets

サマソニ

• 36847 Tweets

Kenjaku

• 34436 Tweets

San Pedro Garza García

• 32151 Tweets

Yuji

• 30611 Tweets

Movimiento Ciudadano

• 29692 Tweets

アンバサダー就任

• 25258 Tweets

#Survivor46

• 25257 Tweets

#デンティス

• 21348 Tweets

भगवान बुद्ध

• 20366 Tweets

ペーパーマリオ

• 20278 Tweets

マツケンサンバ

• 18776 Tweets

#BuddhaPurnima

• 17114 Tweets

Lorenia Canavati

• 15004 Tweets

Shoko

• 14175 Tweets

Kenzie

• 12355 Tweets

Last Seen Profiles

Businesses with less than 500 employees can get funds to provide employees with paid leave, either for the employee’s own health needs or to care for family members. More on this and other

#IRS

info related to COVID-19 outbreak at:

8

149

126

Victims of winter storms that affected Texas will have until June 15 to make estimated tax payments that were originally due April 15.

#IRS

61

35

117

#IRS

Update: The tax filing due date is extended from April 15 to July 15. All taxpayers -- individuals, corporations, other non-corporate filers and those who pay self-employment tax -- can also defer income tax payments. See

1

103

87

#IRS

has three new credits to help your business through these rough times, including immediate assistance to keep your employees in your payroll. See:

#COVIDreliefIRS

9

66

65

Beginning Jan. 1, 2021, through Dec. 31, 2022, businesses can claim 100% of their food or beverage expenses paid to restaurants. See more

#IRS

information on guidelines at:

4

45

51

The new employee retention credit is 50% of up to $10,000 in wages paid by an eligible employer whose business has been impacted by COVID-19. More

#IRS

information available at:

#COVIDreliefIRS

0

41

44

The employee retention credit encourages employers to keep employees on their payroll, despite experiencing economic hardship related to COVID-19.

#IRS

has posted FAQs to help you understand this new credit. See

#COVIDreliefIRS

3

38

38

#IRS

will mark

#SmallBusinessWeek

launching

@IRSsmallbiz

with tax tips and updates for your business. Stay tuned – Follow us and share starting Sunday, May 5.

#CincodeMayo

2

22

40

Has your business suspended operation because of limited commerce due to COVID-19? An

#IRS

credit may help you keep your employees on your payroll. See FAQs on the Employee Retention Credit at

#COVIDreliefIRS

7

41

39

This year and throughout 2022 businesses can claim a 100% deduction for food or beverage expenses paid to restaurants. Learn more from

#IRS

at:

2

21

38

#IRS

: Three new tax credits are available to many businesses hit by COVID-19. Learn more:

#COVIDreliefIRS

4

38

35

Businesses that got first-round PPP loans to cover payroll, mortgage interests, rent payments, and utility payments can now also tax deduct corresponding expenses. See

#IRS

info on safe harbor at:

#COVIDreliefIRS

0

32

36

#IRS

does not have information available yet on stimulus payments. There’s no need to call or sign up for anything. Watch for updates to

1

34

33

#IRS

: Three new tax credits are available to many businesses hit by COVID-19. Learn more:

#COVIDreliefIRS

2

31

36

Are you concerned about your staff? The new

#IRS

employee retention credit can help qualified tax-exempt organizations keep employees on their payroll. See if you qualify:

#COVIDreliefIRS

10

36

30

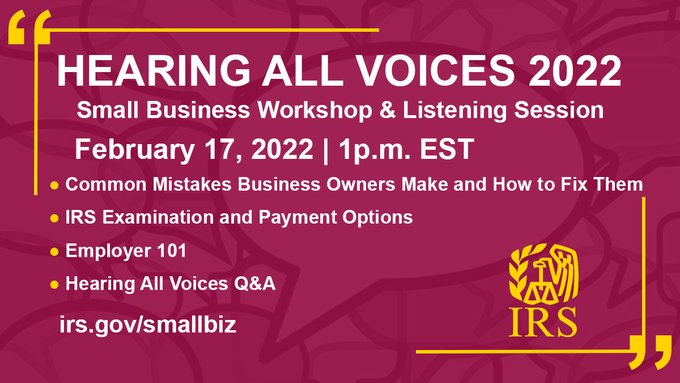

#IRS

will offer a free webinar for small business organizations and owners called

#HearingAllVoices2022

. Register to join us on February 10 at 11 a.m. (ET):

1

19

25

#WeCanDoThis

: If you’re a small employer, a tax credit may help you provide paid leave to employees receiving COVID-19 vaccines. Learn more from

#IRS

at

@SBAgov

@HHSGov

@HealthGov

6

22

27

Employers eligible for the new Employee Retention Credit include those experiencing a significant decline in gross receipts.

#IRS

has posted FAQs to help you figure out this new credit:

#COVIDreliefIRS

4

31

26

⬇️This Thursday at 2 pm ET,

@IRSsmallbiz

will be joining

@IRSnews

to offer tips for small businesses. Don't miss it!

Marking National Small Business Week, join us for a Twitter chat hosted by

#IRS

(

@IRSnews

). We’ll share tips to help you navigate the unique challenges brought forth by COVID-19. Follow along using

#IRSsmallbiz

Thursday, September 24

2:00 pm ET | 11:00 am PT

10

37

46

0

23

26

The Work Opportunity Tax Credit is available to employers for hiring workers from groups who’ve consistently faced significant barriers to employment. If you’re hiring, the

#IRS

urges you to check out:

0

15

24

This year and throughout 2022 businesses can claim a 100% deduction for food or beverage expenses paid to restaurants. Learn more from

#IRS

at:

0

21

27

As part of

#COVIDreliefIRS

, tax credits are available to reimburse employers now for providing paid sick leave and paid family and medical leave to employees unable to work because of the Coronavirus.

#IRS

0

27

25

This

#IRSTaxTip

explains how businesses can deduct expenses that help them bring in new customers and keep existing ones:

#IRS

1

16

26

Got a new business? The form of business you operate determines what taxes you pay and how you pay them. See the general types of

#IRS

business taxes.

2

21

26

Small and midsize employers can claim two new refundable payroll tax credits to reimburse them, dollar-for-dollar, for the cost of providing employee leave related to the COVID-19 outbreak. See

#IRS

info at:

1

23

24

Businesses that got first-round PPP loans to cover payroll, mortgage interests, rent payments, and utility payments can now also tax deduct corresponding expenses. See

#IRS

info on safe harbor at:

#COVIDreliefIRS

0

24

22

Whether you cut hair or cut lawns, keeping good records is part of running a successful business:

#IRS

0

13

21

#IRS

guidance explains the changes to the Employee Retention Credit for the first two calendar quarters of 2021, including the increase in the maximum credit amount, revisions to the definition of qualified wages and more. Read:

#COVIDreliefIRS

3

13

20

This year and throughout 2022 businesses can claim a 100% deduction for food or beverage expenses paid to restaurants. Learn more from

#IRS

at:

0

8

21

Scammers posing as

#IRS

agents may know your address, SSN or other personal details. Don’t confirm any info or release any money:

#IRSDirtyDozen

2

25

21

An

#IRS

reminder during

#NationalSmallBusinessWeek

: Hiring certain workers could result in a business tax credit:

1

13

18

There are nine factors to consider when determining whether or not you have a business or hobby and whether or not that activity should be reported as income on your tax return. Read this

#IRSTaxTip

for more info:

#IRS

0

16

15

ICYMI: Businesses can claim 100% of their food or beverage expenses paid to restaurants between Jan. 1, 2021 and Dec. 31, 2022. See more

#IRS

information on guidelines at:

1

17

19

Last day for employers to file W-2 Forms is Jan. 31.

#IRS

encourages all employers to e-file because it’s the quickest way to file. Details at:

1

14

18

Self-employed people, including persons in the gig economy, often need to pay

#IRS

in quarterly installments. Don’t miss the September 15 estimated tax deadline.

0

14

19

A new refundable tax credit is designed to encourage businesses impacted by COVID-19 to keep employees on their payroll. Learn about the

#IRS

employee retention credit at

#COVIDreliefIRS

1

23

20

Last day for employers to file W-2 Forms is Jan. 31.

#IRS

encourages all employers to e-file because it’s the quickest way to file. Details at:

3

21

19

Business travel deductions are available from

#IRS

when employees must travel for business reasons. Learn more at:

3

10

18

Stay informed

#COVIDreliefIRS

: Sign up for

#IRS

e-news updates on topics like emerging scams and economic impact payments. Learn how at

8

21

20

Unemployment can affect entire families. Learn about the

#IRS

Work Opportunity Tax Credit and how your business could claim a tax credit for hiring new workers:

1

14

18

Most cyberattacks are aimed at small businesses with fewer than 100 employees. This

#SmallBusinessWeek

, take a moment to learn about best security practices on

#IRS

Identity Theft Central:

#TaxSecurity

0

16

19

@GoogleSmallBiz

A quick reminder if you’re starting a new

#SmallBiz

, the

#IRS

has information and resources to help you get your business on the path to success.

1

4

18

Employers eligible for the new Employee Retention Credit include those experiencing a significant decline in gross receipts.

#IRS

has posted FAQs to help you figure out this new credit:

#COVIDreliefIRS

0

17

18

#IRS

issues standard mileage rates for 2022→58.5 cents per mile driven for business use. See:

0

6

17

#IRS

has three new credits to help your business through these rough times, including immediate assistance to keep your employees in your payroll. See:

#COVIDreliefIRS

0

35

19

#IRS

Reminder: Tax credits are available to reimburse employers for Coronavirus-related paid leave. See

#COVIDreliefIRS

at:

0

17

18

If your business is helping those in need through contributions of food inventory this year, your business may qualify for a deduction of up to 25% of its taxable income.

#COVIDreliefIRS

0

18

19

As part of a broader agency effort to reach taxpayers in multiple languages, the

#IRS

will hold a presentation for business owners called

#HearingAllVoices2022

. Register to join us on February 17 at 1 p.m. (ET):

2

16

17

Taking care of business: An

#IRS

tip can help you understand the ins and outs of good recordkeeping:

0

13

17

This year and throughout 2022 businesses can claim a 100% deduction for food or beverage expenses paid to restaurants. Learn more from

#IRS

at:

0

10

16

#IRS

has increased the optional standard mileage rate for the final 6 months of 2022. Taxpayers may use it to calculate the deductible costs of operating an automobile for business and certain other purposes. See

0

11

17

Launching a business?

#IRS

has a small business calendar where you can view due dates & actions for each month.

1

15

18

Your business may now enjoy a temporary 100 % deduction for expenses that are paid for food or beverages provided by a restaurant.

#IRS

has provided guidance available at:

1

11

18

For the

#IRS

employee retention credit, employers experiencing economic hardship are those with suspended operations due to a government order related to COVID-19 or those experiencing a big decline in gross receipts.

#COVIDreliefIRS

2

16

16

Small business owner: This

#IRS

info can help you understand the difference between employment tax Form 944 and Form 941. Check:

1

6

17

#IRS

has issued guidance for a temporary exception allowing businesses a 100% tax deduction for food or beverages from restaurants.

0

14

17

Check this

#IRSTaxTip

to let

#IRS

help you avoid common errors that could delay the advance payment of employer credits due to COVID-19:

#COIVDreliefIRS

0

15

17

The number of Black-owned businesses continues to grow. If you are starting a business, check the

#IRS

tips and resources available on:

2

7

15

Tax credits are available to help small businesses providing employees paid leave for COVID-19 vaccinations. Learn more from

#IRS

at:

#COVIDreliefIRS

0

13

17

Learn more about the

#IRS

home office deduction: . The simplified method can be found in Pub 587, Business Use of Your Home

#IRSTaxTip

0

11

15

Wish to learn more about your business tax responsibilities? Check out this

#IRS

video to learn about our Small Business Tax Workshop:

0

10

16

Hotel bills, airfare or train tickets – it can all add up fast. If you’re traveling for business

#IRS

has key tips on tax deductions that may help.

1

16

17

Employer deadline to file W-2 Forms is Jan. 31. Filing documents timely helps avoid penalties and helps the

#IRS

in fraud prevention. Learn more:

1

10

17

#IRS

Small Business Tax Workshop is a series of online training videos covering tax topics for new and established small business owners.

0

15

17

#IRS

is seeing common errors when filing for advance payment of employer credits—part of

#COIVDreliefIRS

. Learn how to avoid them in this

#IRSTaxTip

:

0

17

15

Learn more about the

#IRS

home office deduction: . The simplified method can be found in Pub 587, Business Use of Your Home

#IRSTaxTip

0

11

15

#IRS

urges employers to be aware of the Jan. 31 deadline to file Forms W-2 and other wage statements. Details at:

1

17

16

Your business may now enjoy a temporary 100 % deduction for expenses that are paid for food or beverages provided by a restaurant.

#IRS

has provided guidance available at:

0

9

15

Hiring family members is one advantage of operating your business. If you do, be sure to check the

#IRS

information on employment tax requirements for family employees, as these may vary from those of other employees.

#MomandPopBusinessOwnersDay

@SBAgov

0

4

16

There are 13M+ women-owned businesses employing workers across the nation. Throughout National Women’s Small Biz Month,

#IRS

highlights its online tax resources for employers:

#WomenInBiz

0

13

16

Got a new business? The form of business you operate determines what taxes you pay and how you pay them. See the general types of

#IRS

business taxes.

0

12

16

Nearly 42% of businesses are women-owned. Marking Women's History Month, we encourage new business owners to check out an

#IRS

workshop designed to help them understand and meet their tax obligations.

#WomenInBiz

1

7

16

@SBAgov

#IRS

has a section on Starting a Business in that can really help new businesses avoid mistakes related to federal taxes – from selecting the right business structure to recordkeeping.

#SmallBusinessWeek

1

3

15

This year and throughout 2022 businesses can claim a 100% deduction for food or beverage expenses paid to restaurants. Learn more from

#IRS

at:

1

12

15

This year and throughout 2022 businesses can claim a 100% deduction for food or beverage expenses paid to restaurants. Learn more from

#IRS

at:

0

13

15

#IRS

has announced a new employee retention credit available for many businesses financially impacted by COVID-19. Details at:

#COVIDreliefIRS

0

24

15

This

#IRSTaxTip

explains how businesses can deduct expenses that help them bring in new customers and keep existing ones:

#IRS

1

18

14

Launching a business?

#IRS

has a small business calendar where you can view due dates & actions for each month.

0

8

15

This year and throughout 2022 businesses can claim a 100% deduction for food or beverage expenses paid to restaurants. Learn more from

#IRS

at:

1

10

14

If your business has experienced a decrease in operations as a result of COVID-19, you can request an advance of the Employee Retention Credit from

#IRS

. Learn more at:

#COVIDreliefIRS

0

17

15

Small business owner: This

#IRS

info can help you understand the difference between employees and independent contractors. Check:

0

12

13

🇺🇸

#IRS

is marking

#SmallBusinessWeek

! 🇺🇸

Get your Employer ID Number (EIN), find Form 941, prepare to file, make payments and more.

Obtenga su número de empleador (EIN), encuentre el Formulario 941, prepárese para presentar, haga pagos y más.

15

9

12