Daniel Yergin

@DanielYergin

Followers

42K

Following

49

Media

187

Statuses

1K

Author: The New Map: Energy, Climate & Clash of Nations - https://t.co/tabM3AxibC; The Quest; The Prize; Pulitzer Prize winner; Vice Chairman S&P Global

Joined October 2012

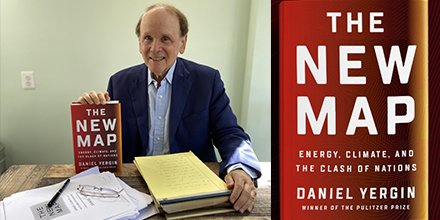

From its beginnings writing longhand on dozens of legal pads, to innumerable manuscripts and now the finished product, I am so pleased to share my latest book, #TheNewMap ( out today from @penguinpress.

74

127

583

The energy transition is proving to be more difficult, costly, and complicated than expected. It is time to rethink priorities, polices and investments in light of the complicated realities. My new article w/ Peter Orszag & Atul Arya in @ForeignAffairs.

68

197

662

U.S. LNG export capacity is poised to double in next 5 yrs. Our new @SPGlobalstudy finds LNG exports would support nearly 500,000 jobs per year and add $1.3 trillion to GDP by 2040. Meanwhile, domestic prices remain among lowest in the world. Read Here:

22

136

350

“Big Shovel” will increasingly compete w/ “Big Oil” as mining ramps up to supply the vast increase in minerals for energy transition. But there remains a very big gap between Net Zero aspirations and the availability of supply. My latest in @WSJ. (1/2)

19

128

292

Some personal news: Excited to share the cover for my next book, The New Map: Energy, Climate and the Clash of Nations. Available Sept. 15 from @penguinpress. I'll be sure to share some interesting sneak peaks, etc. in the days leading up. Pre-order:

20

71

236

Demand for critical minerals and copper heats up 1 yr after Inflation Reduction Act. Our new @SPGlobal study shows demand materially higher by 2035 than what was projected pre-IRA. Lithium: +15%.Cobalt: +14%.Nickel: +13%.Copper: +12%. Full Report:

5

120

233

Important new study on U.S. clean energy innovation by @IHSMarkit & @EFIForTheFuture. Proud to co-lead this with @ErnestMoniz. What is state of the U.S. innovation ecosystem? How to strengthen it? Which technologies have the most potential? READ HERE:

8

28

214

Europe now views Russia as not just an unreliable oil/gas supplier, but an “unwanted” one at that. Assuming EU was just too dependent on Russia supply proving to be one of #Putin's major miscalculations of the #Ukraine invasion. My talk w/ CNBC @PowerLunch

12

47

147

The global #oil market is over. The stakes are going up and the battle between Russia and EU/G7 in a new era of a partitioned world oil market is beginning. My talk w/ @KellyCNBC and @CNBCTheExchange on an historic day for global energy.

4

44

184

Going to try something new here. Leading up to the Sept. 15 release of my new book, #TheNewMap (@penguinpress; I’ll be posting #NewMapMoments – glimpses of some of the key people and events in the book. Look for them in my feed starting this week.

10

35

144

Amid #Ukraine crisis it is becoming increasingly clear in Washington, DC what #Putin saw early on—The US #shale revolution and #LNG exports are an important geopolitical asset. The situation in Ukraine would look very different without them. My article in today’s @WSJ.

While the Ukraine crisis was raising anxiety about Europe’s dependence on Russian natural gas, something remarkable happened, writes @DanielYergin. America’s position as a top energy producer has provided new influence and greater flexibility.

3

28

141

How tight energy markets gave Putin leverage and are causing a rethink on the importance of energy security and the risks of “preemptive underinvestment” in new resources. My Q&A w/ @andrewrsorkin. @NYTimes @dealbook

8

44

135

What once seemed undoable—banning Russian oil and gas sales in Europe—is becoming increasingly likely. But how? Will need to be done right if is going to work. My new column w/ @CarlosEPascual for @washingtonpost on just what it would take. @PostOpinions.

9

51

130

Some news: I am honored to have been selected as the "Energy Writer of the Year" by the American Energy Society for my book #TheNewMap. @AES_Energy #EnergyWOTY

11

15

126

Putin’s #Ukraine invasion will turn Russia into a “Reduced Energy Power” (no longer an Energy Superpower) & undo the internationalized economy he has been building for 20+ yrs. For the West: a rediscovery of energy security. My article for @TheEconomist.

6

37

120

The rise of the US as the world’s #1 energy producer has been such a profound rebalancing that many are still catching up to the reality. Pleased to join the debut episode of “Energized: The Future of Energy,” @gzeromedia’s new 5-part series.

4

24

123

Why have energy stocks under performed while the stock market boomed? How do investors really feel about the sector? My new column with @CarlosEPascual has the results of a new @IHSMarkit survey of institutional and PE investors. READ HERE:

2

56

105

My new oped on what Venezuela's turmoil has meant for the country's oil production. VZ has the largest proven oil reserves in the world but today the state of North Dakota alone produces more oil than they do.

Socialist regimes destroyed the Venezuelan oil industry. U.S. sanctions will squeeze production even further, writes @DanielYergin via @WSJOpinion.

3

92

99

Oh boy. That’s the look you get when your writing buddy—who was (literally) by your side the entire time you were writing the book—realizes that you left her out of the acknowledgements. Lucy’s going to make this a tense weekend. I can tell. #TheNewMap (

6

10

97

That oil markets have not preemptively priced in rising Middle East tensions says a lot about expectations for decelerating global demand, OPEC+ plans to up supply, the continued impact of US shale, and more. My latest talk w/ @SquawkCNBC

3

29

90

Big deal here. The U.S. exported more crude #oil and petroleum products than it imported during the month of September. Marks the end of an era that began with the oil crises way back in the 1970s. Interesting read in @washingtonpost’s Energy 202.

5

84

88

Syria oil production was always barely a footnote for global market in terms of volume--less than 1/2 a percent of world supply prior to the civil war. But it's very important now for other reasons. My new @NPR column w/ @rogerdiwan. READ HERE:

1

39

82

Pleased to join @SquawkCNBC to discuss new major @SPGlobal study. U.S. LNG exports poised to support nearly 500,000 U.S. jobs per year and add $1.3 trillion to GDP by 2040—while nat gas prices for U.S. consumers would remain among lowest in the world.

5

33

87

Very excited -- CERAWeek 2021 begins this morning with an awesome program, opening with #BillGates and over 500 speakers from all across the economy and around the world. Many different perspectives and a lot to learn as recovery looms. @CERAWeek @BillGates.

4

22

85

A Friday peak behind the scenes: When you’re on-camera talking about your new book, you do whatever it takes to get the shot. @ratemyskyperoom how am I doing? #TheNewMap

3

16

82

Putin’s #Ukraine invasion pushed already-tight energy markets from being “crisis-prone” to actually in crisis. The repercussions are everywhere—from geopolitics to pocketbooks and prices-at-the-pump. Valued unpacking it all w/ @PreetBharara for #StayTuned

What's the scope of the energy crisis facing the world in 2022? I spoke with Pulitzer Prize winning author @DanielYergin about that and more on this week’s #StayTuned:

4

26

64

For #oil markets, supply/demand is calling the shots & outweighing geopolitical risks. Demand set to hit record high in 2024, but supply growth (led by US, Canada, Brazil, etc) is higher still. My talk w/ @BeckyQuick @SquawkCNBC. 1/2

2

16

77

Pleased to join @jonfortt and @CNBCTheExchange to discuss findings of our new @SPGlobal study on the outlook for critical minerals demand 1 yr after U.S. Inflation Reduction Act.

4

17

73

The return of U.S. “Energy Dominance” factoring into wider conversations here at Davos about tariffs, taxes, the future of global trade and alliances, and the implementation of AI. My talk w/ @KellyCNBC and @CNBCTheExchange. #WEF2025 #WEF25

2

26

67

Very pleased that #TheNewMap is a @USAToday and @NPR best book of the year. But can someone explain why Amazon ranks it as number one or two best seller in Indonesian Travel Guides???.

5

3

66

The shale gas revolution at 10 years: The pace of growth continues to accelerate - U.S. nat gas production could grow another 60 percent in next 20 yrs. See our new @IHSMarkit report on how far things have come and where they go from here at:

What lies ahead over the next decade? . Our latest report by @DanielYergin and Sam Andrus assesses the impacts of the first 10 years of the U.S. unconventional #gas revolution and looks ahead to its future potential. Discover more:

3

82

65

“Winter is coming” and Putin is counting on it. Russian pipeline gas shipments to EU are⬇️70%. The race to secure supplies ahead of colder months is on. Today's @WSJ: @MStoppard and I on how energy has become Putin’s 2nd front in the battle for #Ukraine.

5

34

62

#SuezCanal--one of the most important chokepoints in world trade. World economy counts on it. The stuck #EverGiven has put a chokehold on the chokepoint and world trade. #TheNewMap describes huge growth in container ship size since 1956 to the Ever Given –now too big to pass!.

1

26

55

In today’s @HoustonChron. A letter to the city of Houston. On the eve of what would have been the first day of @CERAWeek this year, thank you for your hospitality and support these many years. CERAWeek could not be what it is without your vibrant community. Thank you!

1

25

58

From Russia to Mexico, the Covid-19 oil collapse presents new risks and opportunities, says @OSullivanMeghan Meghan O'Sullivan points out the great risks to stability from the oil exporters who don't have sovereign wealth funds. via @bopinion.

0

40

57

Spoke at india's session world petroleum congress in Istanbul signaling new growth era in Indian energy@dpradhanbjp

1

28

57

Big Oil’s huge losses--mega mergers again? via @financialtimes Very good story comparing oil supermajor era to today. Today era of consolidation - but in shale.@Derek_Brower; @AnjliRaval @justinjfj @ft See #TheQuest.

2

20

57

OPEC+ cuts (not China econ growth) bolstering #oil prices right now. But strength of non-OPEC production the big surprise. Can meet global crude demand growth. US alone will add near 1 million b/d of production this year. My talk w/ @SquawkCNBC

3

22

57

The strain on global supply chains is not only disruptive, it’s historic. A new comprehensive review across industries by @IHSMarkit experts—shipping, manufacturing, autos, energy, agribusiness, labor & more—explains why it will continue into 2022.

3

22

59

#Copper—the “metal of electrification”—is essential to the #energytransition. Meeting #NetZero by 2050 goals would double demand by 2035. The world has never produced so much in such a short time. Our new @SPGlobal lays out the challenge. Read here:

4

33

56

To @StephenAtHome. One good turn deserves another. A fun Friday bookshelf shout out to you in turn, good sir. #TheNewMap

4

5

57

The unfolding global energy crisis poses higher risks than the oil shocks of the 1970s, according to energy historian Daniel Yergin via @markets.

4

31

54

That’s a wrap for @CERAWeek 2023. Honored to be joined by Senators @lisamurkowski and @Sen_JoeManchin, Mayor @SylvesterTurner and others for our final day in Houston. A special thanks to all speakers and delegates. And to our #ceraweek team that makes it all come together!

3

8

57

Something lighthearted for a Friday. No photo shoot is without its outtakes. A most loyal reader did his darnedest to photobomb the rollout photo for my new book, #TheNewMap ( out this week from @penguinpress.

3

10

53

By 2023 #oil production in just the U.S. Permian will more than double to 5.4 million barrels per day (that's more than current production of any OPEC country except Saudi Arabia). Discussing our new @IHSMarkit outlook on @SquawkCNBC.

3

55

54

#Putin attacks Russia oil #pricecap by quoting free market #MiltonFriedman: “if you want to create a shortage of tomatoes” put on a price cap and “instantly you have a tomato shortage. It’s the same with oil and gas.” My @wsj column ⬇️ (1/2).

6

22

48

The war in #Ukraine is beginning of end to several eras. EU: reliance on Russian energy; Russia: energy superpower status; World: globalization to fragmentation. My talk w/ @gideonrachman of Financial Times, @FT Rachman Review podcast.

2

18

49

How #Covid_19 is threatening U.S.' place as the world's top #oil producer. Parts of my chat with @_HadleyGamble and @CNBCi.

3

24

53

In today’s @WashingtonPost. #Oil markets at an impasse. Record fall in demand due to #COVID-19 while Russia/Saudi Arabia price war floods the market with excess supply. How to restore balance? Perhaps through the G20. My new column with @RogerDiwan.

1

33

51

Russia’s days as an energy ‘superpower’ are receding. My sit-down w/ @WalterIsaacson and @AmanpourCoPBS for a deep dive on this, plus other ways that the invasion of #Ukraine is reshaping the global energy map.

2

19

49

Breaking down this weekend's big #OPEC news. What it means for #oil markets already dealing with the largest quarterly drop in demand ever. Here's @RogerDiwan and I on @CNBC today. 1) -- @CNBCTheExchange . 2) -- @SquawkCNBC.

1

24

51

Tight gas & coal markets beget higher oil prices. Price of LNG landing in EU equal to $200 per barrel. Result: higher demand for crude ($80+/barrel today) for power generation. Unpacking energy crisis collateral effects w/ @DavidWestin @BloombergTV.

1

17

51

How the new world of #oil and the era of the “Big 3”- U.S., Saudi Arabia & Russia – is playing out at #OPEC meetings this week. My chat w/ @adsteel and @bloombergtv. Watch:

0

45

50

Pleased to speak w/ @ccable & @stephenlpower for a wide-ranging discussion in the @BrunswickGroup Review on volatility in energy markets; History & future of #energytransition; “2nd age of globalization”; From “Big Oil” to “Big Shovels,” & more. (1/7)

2

8

51

Honored to be joined by the U.S. Sec. of Energy, the Hon. Jennifer M. Granholm (@SecGranholm) today at #CERAWeek. Day 3 just wrapped, capped off by an amazing Women in Energy dinner/dialogue. Likes and retweets summing it all up here. As always, follow @CERAWeek for it all.

4

11

49

Thrilled to get a 9! @ratemyskyperoom, goes to show that I took your previous advice to heart. (Now vs. then!)

4

4

44

The OPEC+ decision to again push back planned production increase shows that demand (from China in particular) is the big question hanging over #oil markets right now. My talk w/ @cnbc here at #ADIPEC2024.

0

22

50

A historic week for #oil markets and how storage capacity has become the world's most valuable commodity right now. Great chatting w/ @BeckyQuick and @SquawkCNBC.

“World demand could be down as much as 30 million barrels a day,” says IHS Markit Vice Chairman @DanielYergin on the #coronavirus toll on oil demand.

1

20

51

Current Ukraine tensions underscoring the importance of US shale production. One of the few stabilizers for tight oil markets and an alternate source of LNG to EU and elsewhere. My talk w/ @JackOtter and the Barron’s Roundtable. @FoxBusiness

1

25

51

Honored and thrilled this evening to receive the WPC #DewhurstAward at #23WPCHouston. To be just the 11th recipient in the nearly 90yr history of @worldpetroleum is a tremendous honor. So pleased to share this moment w/ all my @IHSMarkit. colleagues here at @23WPC2021.

Today is the day! @DanielYergin Vice Chair of @IHSMarkit will receive the WPC #DewhurstAward at the 23rd World Petroleum Congress in #Houston - join us at

7

7

49

Honored to celebrate @USEnergyAssn‘s 100th Anniversary and to receive its Centennial Lifetime Achievement Award. My thanks to USEA and its staff for their ongoing commitment to knowledge, information and education across the entire energy spectrum. Here is to the next 100.

5

6

52

"#Globalization in a needle" Afshin Molavi reports -- Pfizer vaccine 280 components made at 86 sites in 19 countries. Talk about how essential and complex global supply chains! And all need to be coordinated. @afshinmolavi

4

25

48

Wow. Excited and humbled (4 Stars!) by the latest @USATODAY review of my book #TheNewMap — out tomorrow from @penguinpress.

"At a time when solid facts and reasoned arguments are in retreat, Daniel Yergin rides to the rescue.”— @USATODAY on #TheNewMap by @DanielYergin . Read the full review here:

4

7

47

EU ban of Russia #oil went from “impossible” to “likely” in just 2 months. How? Strategic stocks from EU, Japan & US adding crude to market; China COVID lockdowns; & US production poised for big increase this year. My talk w/ @DavidWestin @BloombergTV

3

16

47

Very excited to share my essay in this weekend's @WSJ from my new book, #TheNewMap ( coming out this Tuesday from @penguinpress.

China stands to gain the most from the energy transition ahead, writes @DanielYergin. For the U.S., navigating the world’s new energy map will require significant choices.

2

18

47

Very stimulating and lively discussion about #energy and future of #oil and #naturalgas on #Clubhouse. First time joining a conversation and many good points of view! And a global conversation! @clubhouse.

0

4

49

Timely remembrance! Big thank you in #HeatWaveof2019 to Willis #Carrier for inventing air conditioning. Breakthrough idea came to him on fog-shrouded Pittsburgh railway platform in 1902. Led to patent "Apparatus for Treating Air". Humidity preoccupied him. #TheQuest chapter 31.

1

17

46

My first book many years ago was about the origins of the US-Soviet #ColdWar. And now an era of "new cold wars" looms large on #TheNewMap of #energy and #geopolitics. This and more in my chat w/ @WilliamCohan on @lithub.

0

12

45

Here you'll find the wide-ranging discussion of #energy, #climate & #geopolitics that I had the pleasure of participating in yesterday hosted by @CFR_org with @JasonBordoff @LSRTweets and @GoodmanSherri.

2

7

48

The #oil market is fixated on two places at once—almost schizophrenic. China (the global oil demand growth engine for past 2 decades) is slowing. At same time, geopolitical risk in the Middle East has the world holding its breath. @CNBC @SquawkStreet

2

13

47

Nobody better to discuss geopolitics, economics & #energy markets with here at #WEF18 than my @IHSMarkit colleagues @CarlosEPascual & @N_Behravesh. Watch today's talk w/ @CNBCTV18Live here:

1

16

45

EU already determined to move away from Russia energy supply. Question was a matter of timing. Putin’s signal to use energy as a weapon (Poland, Bulgaria) adds motivation to EU to make that timeline even shorter. My talk w/ @NPRinskeep & @MorningEdition.

2

12

36

EU is at point of “no return.” It wants to be done w/ energy from Putin’s Russia. That will take some time and Russia can still export elsewhere. But its industry will deteriorate as result. It will be a lesser energy power. My talk w/ @AliVelshi & @msnbc

0

15

43

The podcast I did w @MLiebreich covered much ground -- including why paths for #solar and #hydrogen are so different. Molecules versus electrons!.

Big reveal: my guest to kick off Season 8 of @MLCleaningUp will be @DanielYergin - the world's most influential energy analyst! Wednesday 6pm UK, 7pm European, 1pm EST 10am PST.

3

9

41

History shows major #energy transitions often decades in the making, even if we don't see them coming. My latest @WSJ

http://t.co/wSCM9YgnC9.

1

61

43

Pleased to join Bridgewater Associates alongside @AngelaStent for a wide-ranging discussion on the current state of war in Ukraine--how it & Russia's role in an increasingly bipolar world are reshaping the global energy map. Listen⬇️.

3

14

43

.@CERAWeek 2022 is a wrap. Honored to be joined by Senators @lisamurkowski and @Sen_JoeManchin, Mayor @SylvesterTurner and others for our final day here in Houston. A special thanks to all our wonderful speakers and delegates. And to the #ceraweek team that makes it all happen!

0

10

41