Cumberland

@CumberlandSays

Followers

29,161

Following

89

Media

155

Statuses

656

A global leader offering 24/7 access to deep crypto liquidity. Not investment advice.

Chicago, London & Singapore

Joined September 2017

Don't wanna be here?

Send us removal request.

Explore trending content on Musk Viewer

Kendrick

• 647325 Tweets

Drake

• 549975 Tweets

Rio Grande do Sul

• 266814 Tweets

Madonna

• 186475 Tweets

Ole Miss

• 105733 Tweets

Nicki

• 99088 Tweets

Sony

• 86192 Tweets

Porto Alegre

• 67484 Tweets

Star Wars

• 67286 Tweets

Hope Hicks

• 45926 Tweets

ウズベキスタン

• 44098 Tweets

#David69

• 36467 Tweets

Leclerc

• 31960 Tweets

#الاتحاد_ابها

• 30486 Tweets

Helldivers 2

• 23474 Tweets

Mark Hamill

• 21785 Tweets

Luton

• 21054 Tweets

日本優勝

• 19128 Tweets

Keyshia

• 17973 Tweets

みどりの日

• 15007 Tweets

Verstappen

• 14898 Tweets

David Raya

• 14802 Tweets

McLaren

• 11589 Tweets

Lando

• 10928 Tweets

Getafe

• 10041 Tweets

Last Seen Profiles

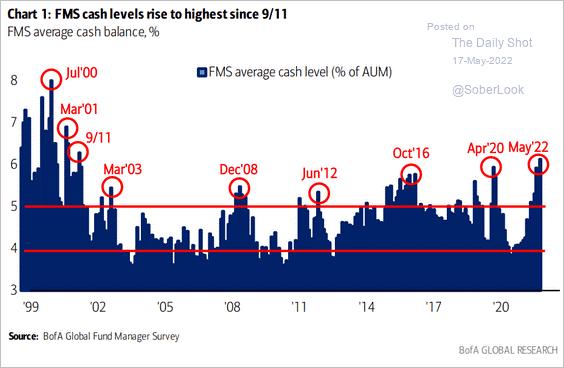

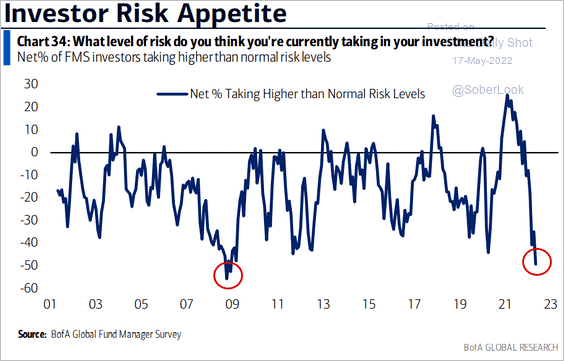

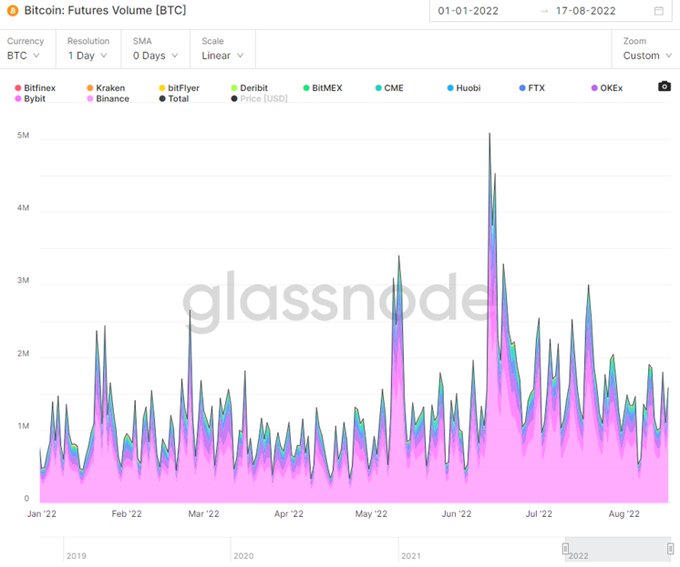

“Don’t fight the Fed” is a trading truism whose validity appears to be manifesting itself across many markets in the wake of yesterday’s 75bp hike. After a dead cat bounce, everything from

#Bitcoin

to Brent is steadily grinding lower.

🧵👇

13

110

629

You love to consume crypto content, but you're looking for a podcast hosted by traders, not journalists.

Check out 1000x, hosted by

@AviFelman

&

@jvb_xyz

Spotify:

Apple:

YouTube:

16

52

329

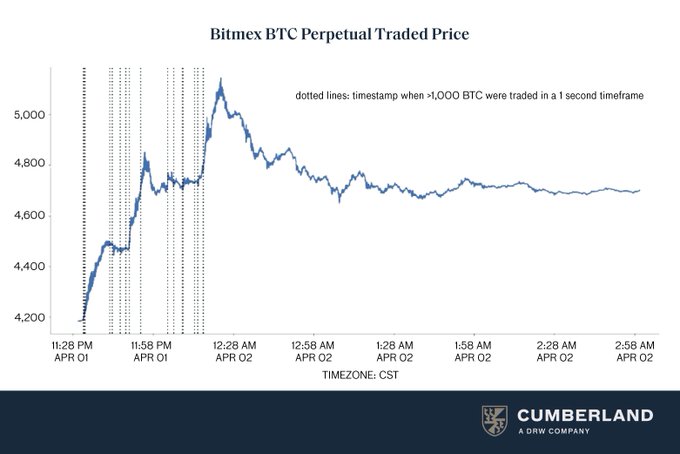

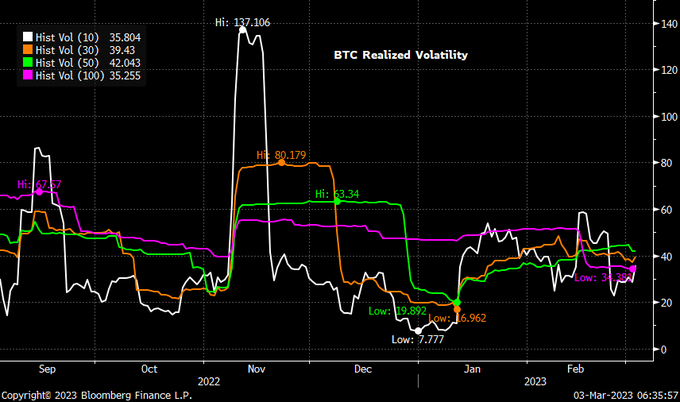

Lots of volatility overnight as speculation about

@FTX_Official

continues. With the caveat that we are not investors in FTX and do not have any non-public insight, the following features seem evident: 🧵👇

9

46

299

While it’s disheartening to watch a large digital asset empire crumble into a modern incarnation of Lehman/Enron/Madoff/Theranos, no relevant chain stopped processing blocks last week. These industry-defining events are usually the predecessors of market recovery. -

@jvb_xyz

8

32

242

Thus, unless we’re dealt a deflationary tech miracle (cold fusion?), a higher inflation target or a bankruptcy cycle are the only ways out of this situation. If our CBs choose the former, a crypto summer is around the corner. If they choose the latter, look out below. -

@jvb_xyz

14

14

216

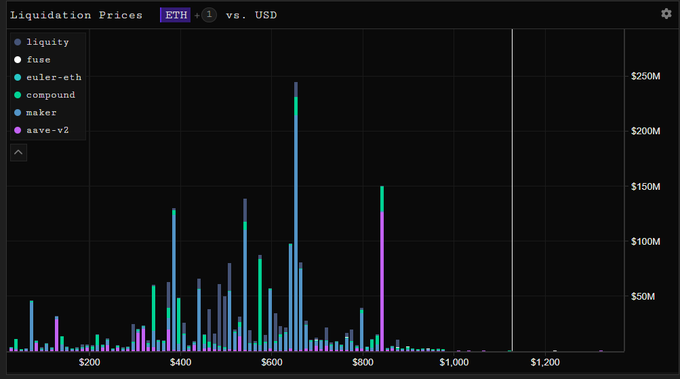

Ever since the major lenders started tightening up over the past few sessions, we started seeing forced selling in block size across the entire spectrum of counterparties – something which appears to be occurring on-chain as well (

@parsec_finance

is great for visualizing this).

2

8

217

We do not foresee a prolonged paradigm of indifference and price stability. Instead, we foresee a spat of volatility while the market rewires itself and web3 business models recalibrate. This will be followed by an eventual up-trend. -

@jvb_xyz

8

14

209

Normally, when prominent economists start calling for a resource war, markets are close to bottoming out. The same sort of dire predictions materialized during the most apocalyptic moments of 2008, just before a historic decade-long rally.

.

@TheEconomist

latest cover.

Almost impossible to overstate the risks/consequences of the world’s food insecurity

Another great “unequalizer” whose implications, depending on the country, may include not just livelihoods but also lives, political stability, social cohesion, etc

47

290

699

12

45

167

This past weekend,

@TheEconomist

published an article called “The end of 2%” – a reminder that the inflation target set by central banks around the world is arbitrary and anything but guaranteed to last.

2

18

147

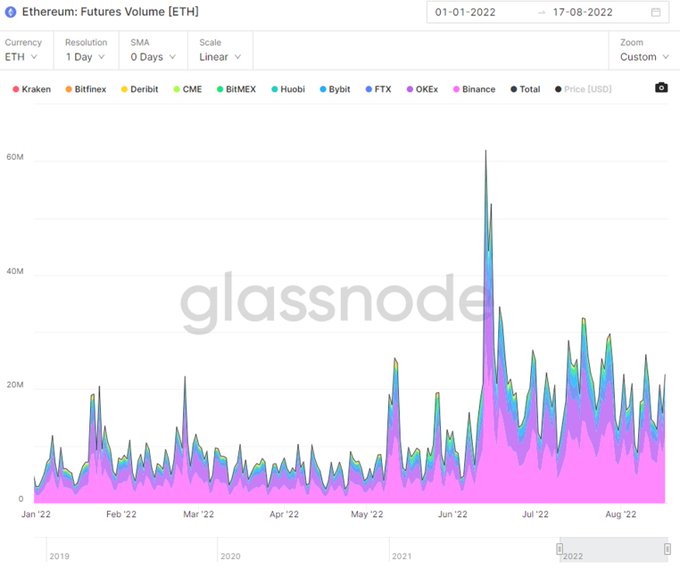

ETH just broke out above its recent range, and the fact that this is occurring against the backdrop of a generally bearish regulatory climate is worth exploring.

Doge-themed redesign of

@Twitter

notwithstanding, ETH gas spiked to 68 gwei yesterday – the highest we’ve seen since…

6

20

116

Throughout this period of challenged liquidity, Cumberland is available 24/7 to make tight, institutional-grade markets in a wide array of cryptoassets. -

@jvb_xyz

4

1

111

Ultimately, the swing vote will be cast by regulators. We think that thoughtful, well-structured regulation will spur a Cambrian explosion of technological innovation and a secular bull market. Senseless and/or overly punitive restrictions threaten to do the opposite. -

@jvb_xyz

2

6

90

FTT should remain volatile for some time. If, hypothetically, it were to trade down to $0 on forced selling (again, highly unlikely – most of it is locked), it would seem like bad risk/reward to bet that FTX relies on a positive EV for FTT to remain a going concern. -

@jvb_xyz

5

5

87

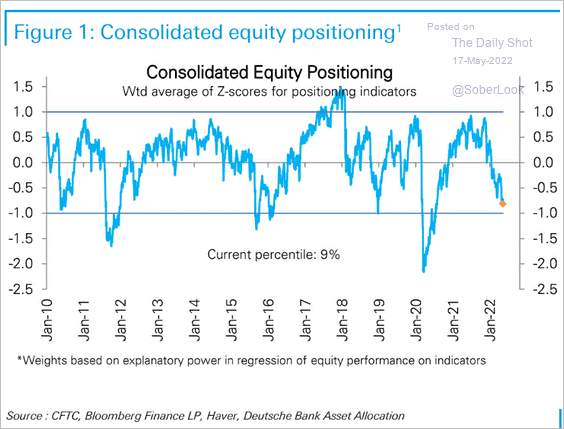

Yesterday the SEC rejected Grayscale’s bid to convert

#GBTC

into a spot ETF. While widely expected, this decision contributes to an increasingly challenging investment backdrop: Powell is now openly telegraphing that he is more concerned about inflation than a recession. 🧵👇

7

13

78

The impact of this has yet to be felt, but as we’ve seen from previous cycles, strong adoption narratives can lead to parabolic rallies. Thus, the current risk/reward feels meaningfully asymmetric. -

@jvb_xyz

0

0

78

Cumberland and

@xbtogroup

are proud to trade the first block of CME ETH/BTC future. The ETH/BTC cross has been the topic of many conversations between market participants for years. It defines how the market thinks about alts vs Bitcoin and DeFi vs. store of value. This contract…

2

10

72