Geralt Davidson 🐺

@CryptoInsider23

Followers

4,631

Following

1,743

Media

140

Statuses

2,312

Independent Market Analyst ■ #Crypto trader since 2017 ■ Stablecoin Researcher

Rivia

Joined March 2013

Don't wanna be here?

Send us removal request.

Explore trending content on Musk Viewer

#ขวัญฤทัยตอนจบ

• 574087 Tweets

オーロラ

• 477961 Tweets

Joost

• 327556 Tweets

jeonghan

• 127459 Tweets

Fulham

• 79631 Tweets

#SixTONESANN

• 76439 Tweets

Man City

• 74328 Tweets

#الهلال_الحزم

• 61542 Tweets

自分これ

• 61279 Tweets

HeavenlyVoice WithMrC

• 54936 Tweets

Gvardiol

• 51763 Tweets

Ali Koç

• 44051 Tweets

カクレンジャー

• 38465 Tweets

太陽フレアのせい

• 38155 Tweets

キンスパ

• 37413 Tweets

Dremo

• 36451 Tweets

マリノス

• 29498 Tweets

Burnley

• 27714 Tweets

SUPER READY FOR SUPERNOVA

• 25151 Tweets

SEE YOU NEXT MONTH JIN

• 24910 Tweets

Luton

• 19603 Tweets

Haley

• 18797 Tweets

Dursun Özbek

• 17255 Tweets

#AdayOlAzizYıldırım

• 16137 Tweets

やまとなでしこ

• 13543 Tweets

Last Seen Profiles

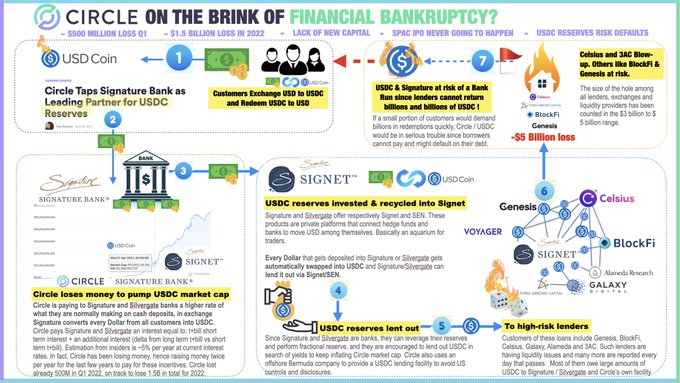

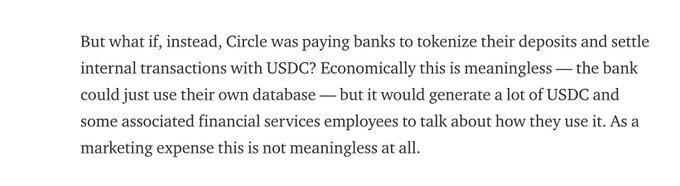

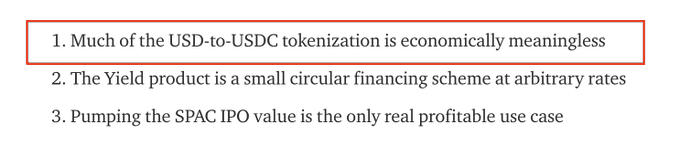

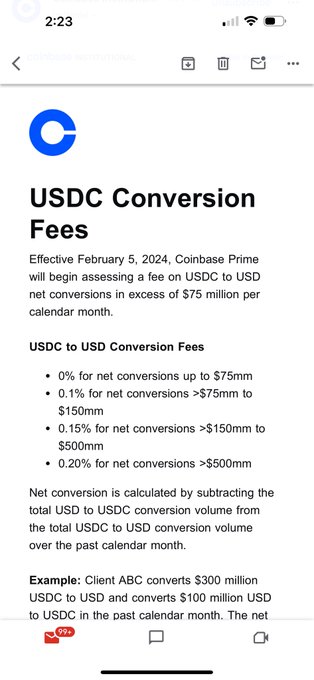

BREAKING: Circle USDC will collapse if the company can't raise money. Circle is over paying banks to pump USDC market cap!!!

12

7

29

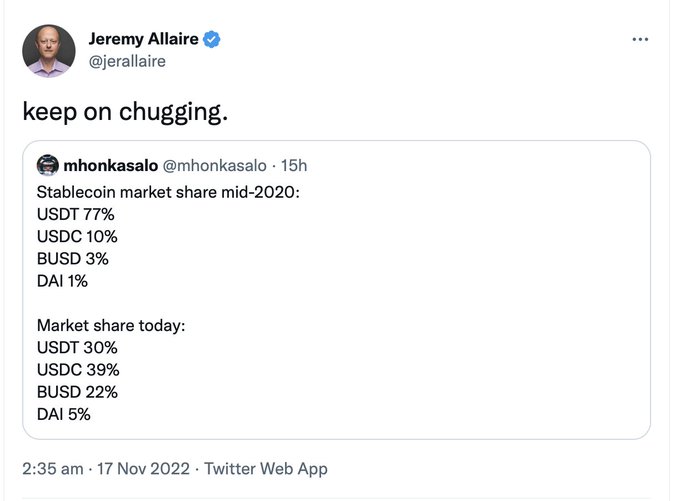

Hey

@jerallaire

, it looks like you are supporting in spreading FALSE data blatantly, the information you tweeted is clearly wrong. If you can’t see it, then It makes me wonder if you have performed due diligence on any of your business decisions. This is absurd.

12

12

80

Circle also uses an offshore Bermuda company to provide a USDC lending facility to avoid US controls and disclosures.

@GaryGensler

1

13

177

USDC jeopardy continues as another affiliated institution find themselves on the verge of collapsing. Silicon Valley Bank is a crypto & tech-friendly lender which recently sold off a 21B bond portfolio for a considerable loss to shore up its liquidity.

Bitcoin and ether fall to two-month lows as issues at Silicon Valley Bank triggers fears of a banking sector crisis. Analysts at ING, however, do not see any evidence of widespread stress in the system. Reports

@godbole17

.

16

12

51

46

46

123

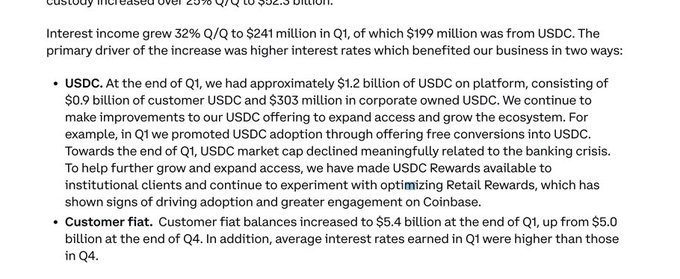

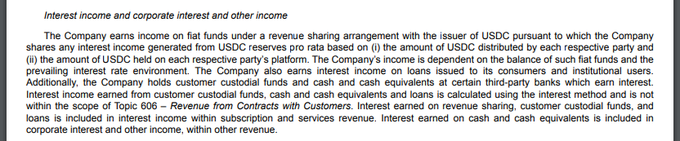

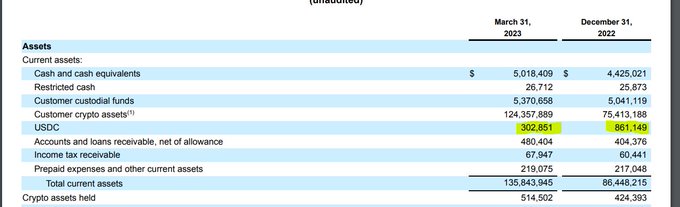

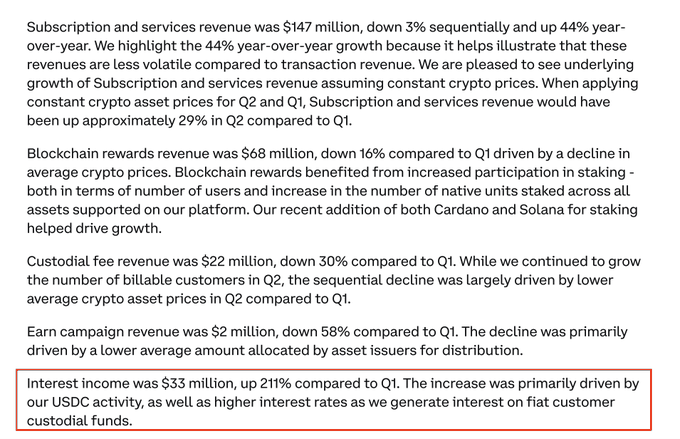

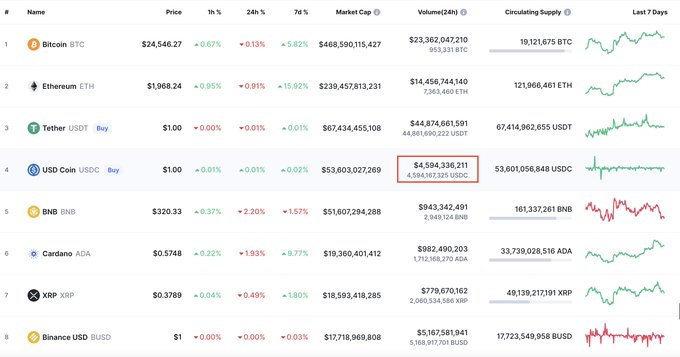

ONE FRAUD TO ANOTHER. The Coinbase-Circle relationship has took a turn into the worse as the projected Q2 performance of $COIN is expected to crash. This is due to the regression of USDC's market cap, in which Coinbase majorly depends their revenue.

36

36

127

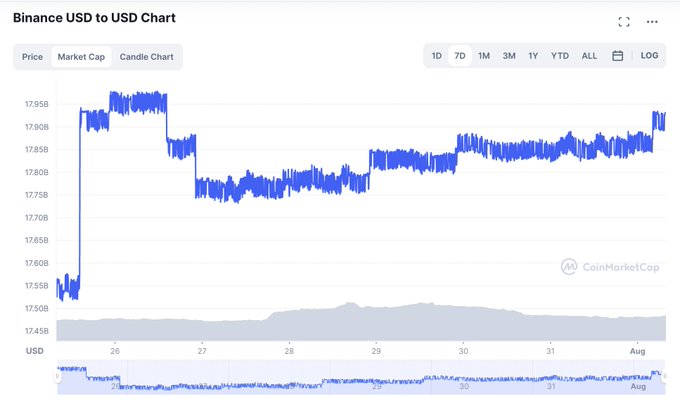

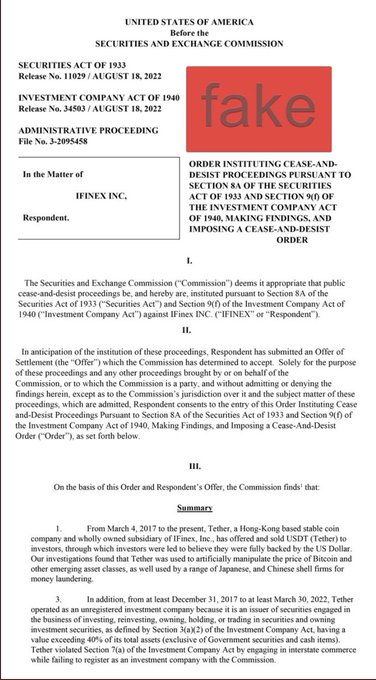

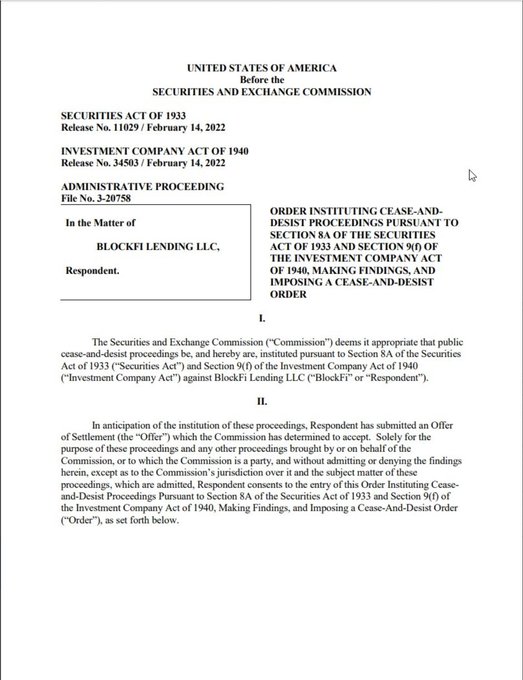

THE BINANCE SILENT MELTDOWN 🍵

The world's current biggest centralized exchange is facing serious issues that poses threat on its existence. Binance is bleeding now more than ever and the dots that would lead to its shutdown is starting to connect.

Binance FUD or why

@binance

= FTX 2.0

Pressure from the SEC, DOJ, etc...

Even though CZ says everything is fine, it is not 🥲

Since the beginning of June, the following have left Binance:

- Chief Business Officer (CZ's right hand)

- Chief Strategy Officer

- General Counsel

-…

8

6

24

38

48

151

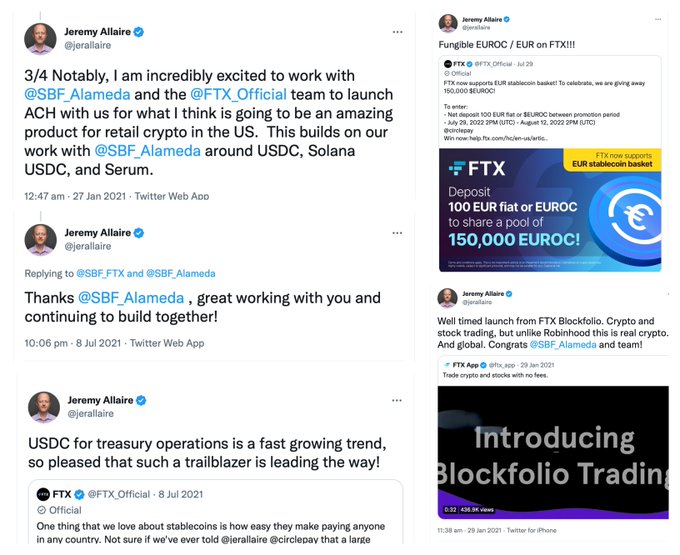

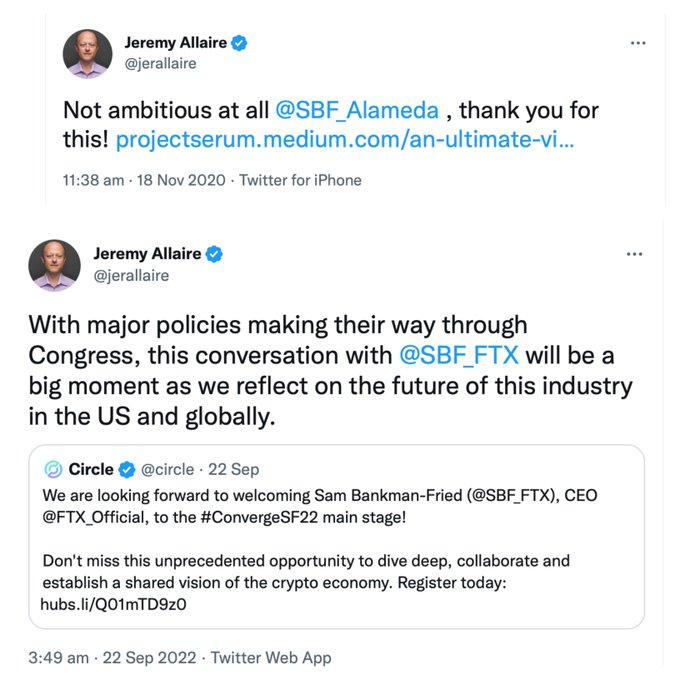

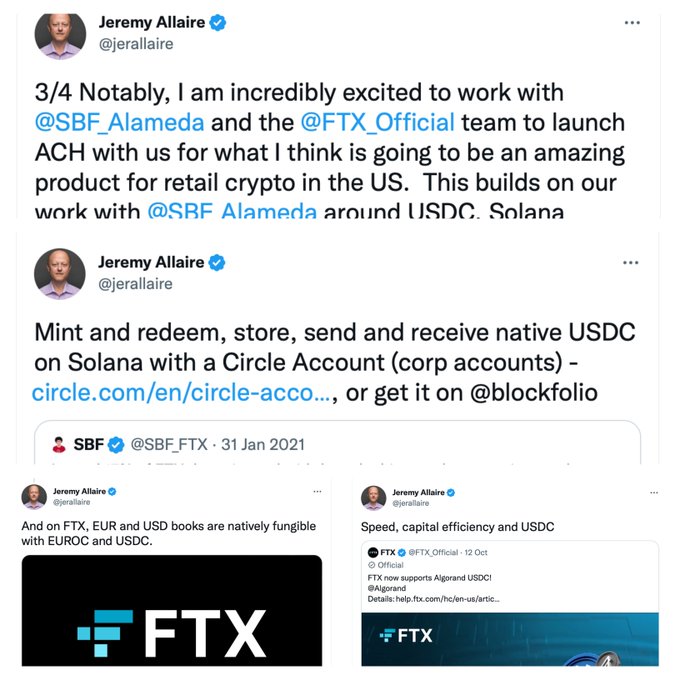

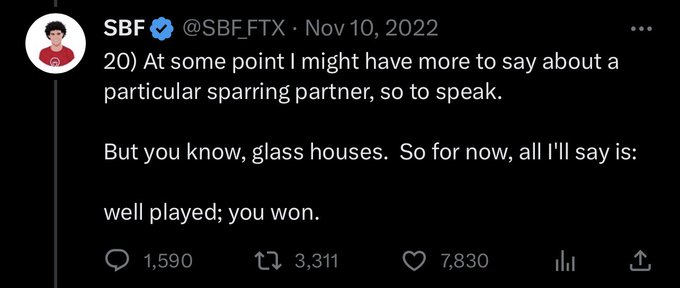

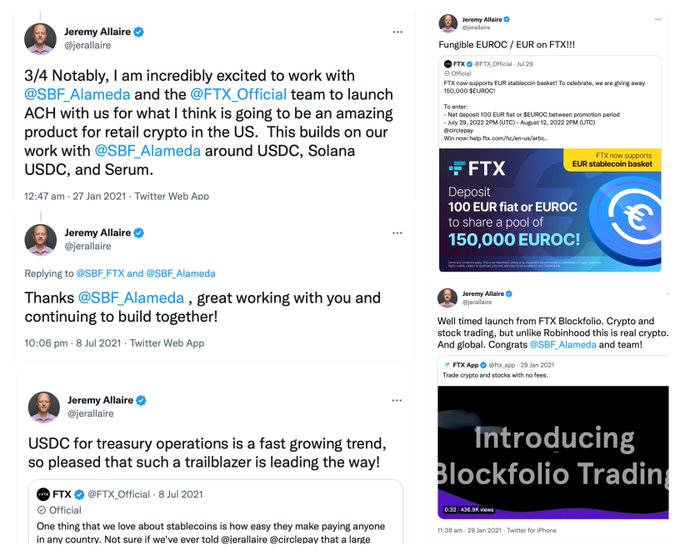

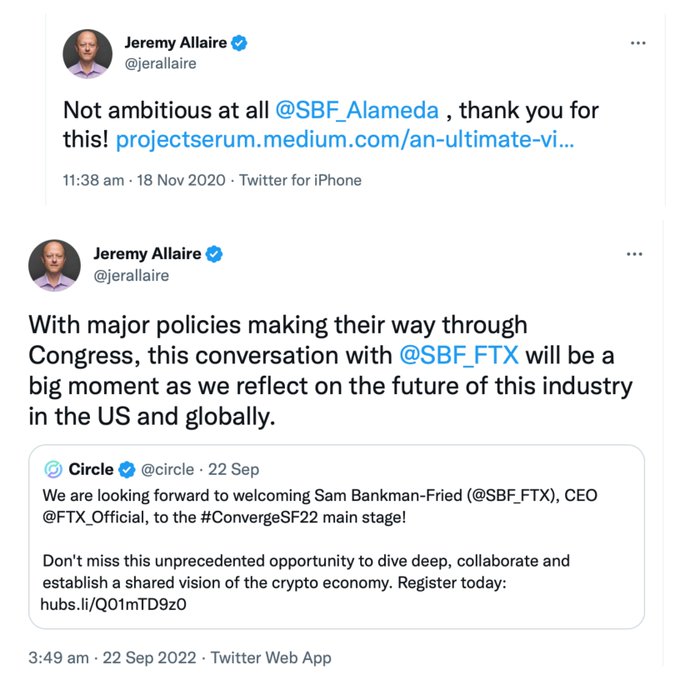

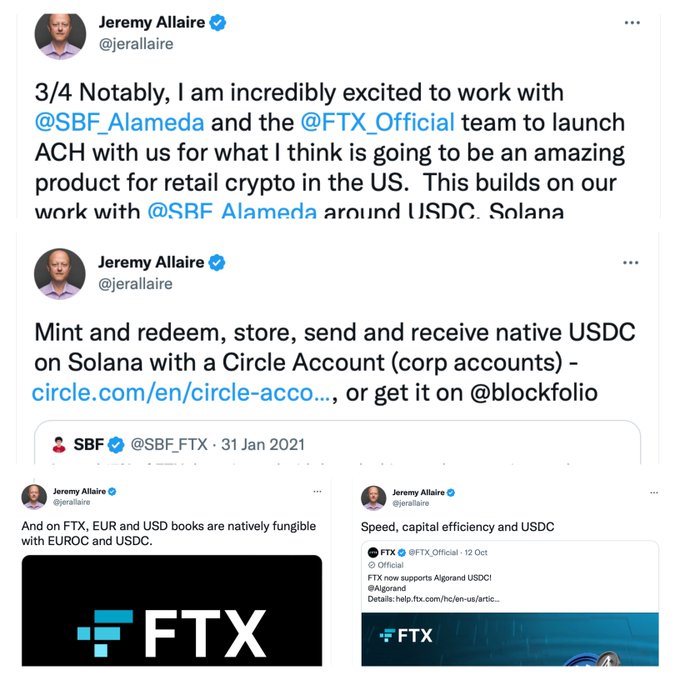

It looks like Jeremy’s butt kissing campaign on SBF has failed miserably. The moment SBF/FTX went down, he knew that SPAC IPO deal is a goner. The connection SBF had with Gary Gensler could not help Circle to get its SPAC IPO approved.

1/ Some big

@circle

news. This morning, we announced the termination of our proposed deSPAC transaction. While disappointing that we did not complete SEC qualification in time, we remain focused on building a long-term public company.

31

90

293

15

27

88

A notorious scammer

@Cryptovinco

hopes to get his main Twitter account

@Cryptowhale

unsuspended by Twitter’s general amnesty. Scammers don’t deserve free speech.

@Elonmusk

please have

@cryptowhale

deleted from the system.

13

16

78

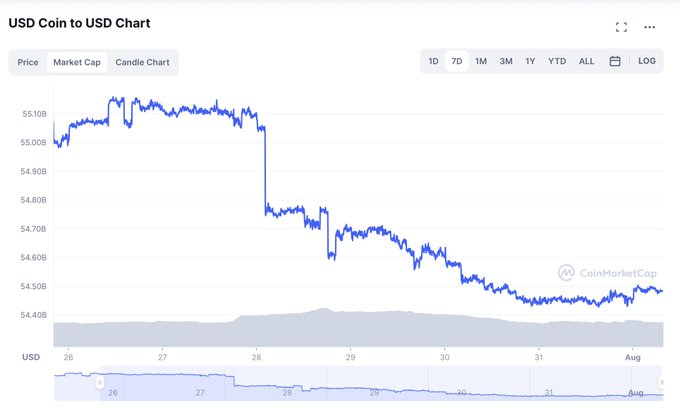

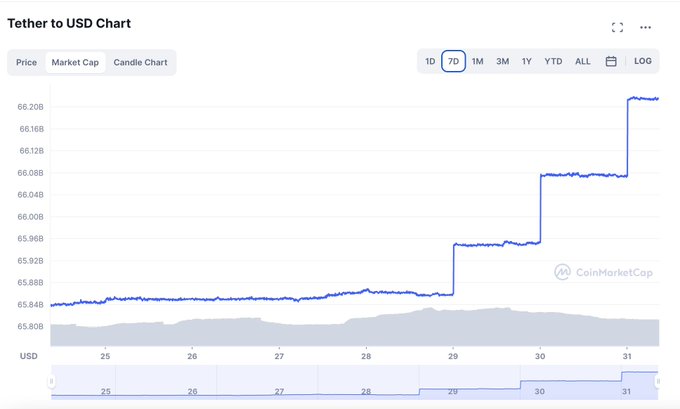

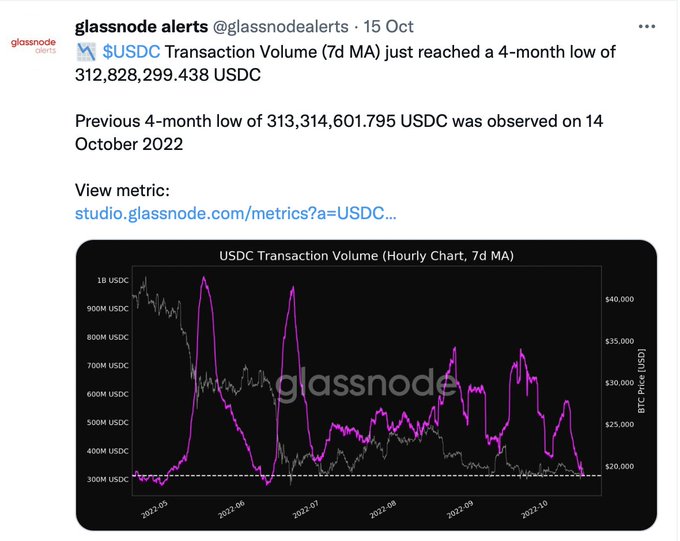

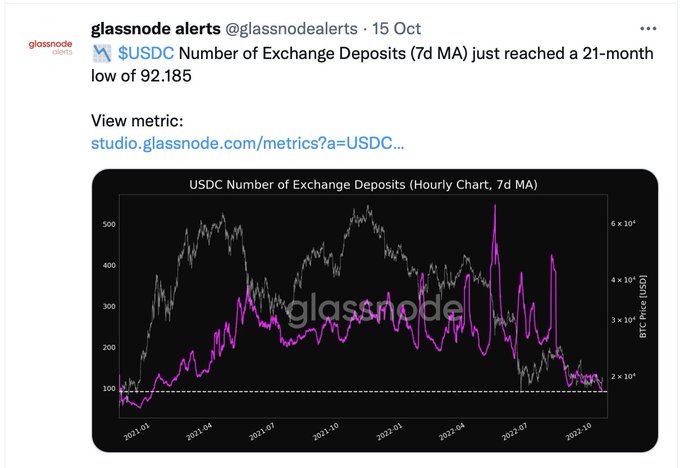

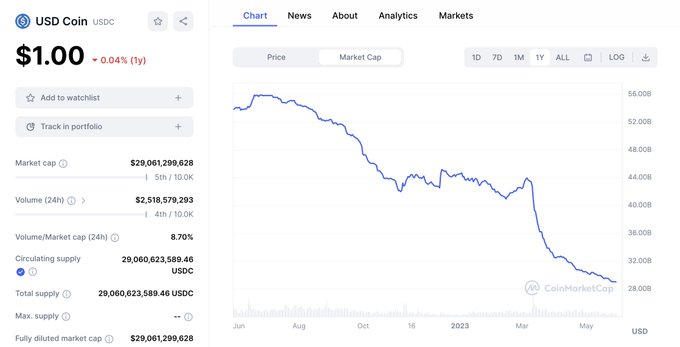

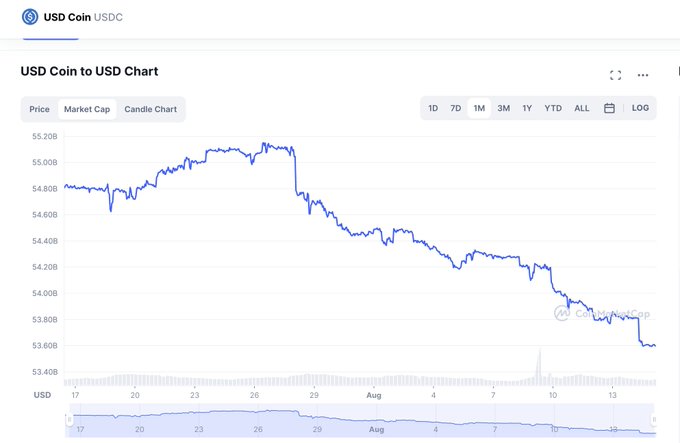

The recent rally of the

#crypto

market has revealed something strange. I noticed USDC market cap has SHRUNK while USDT/BUSD has EXPANDED.

It makes perfect sense that market rally will drive demands for more traders and funds to re-enter crypto space.

32

10

102

The money deposited by Coinbase users is now serving as a lifeline to Circle. Coinbase has lost tons of money, where did the 3 billion come from? Remember, 'Not your keys, not your coins' Please withdraw all your assets from Coinbase immediately. better safe than sorry.

31

43

128

The recent stablecoin hearing did not go well for Circle as they find themselves in shambles. They had no solid answers and seemed to be as evasive and concise as possible. Just look at how their representative tried to misdirect the topic.

34

44

93

Cross River Bank, Circle's current banking partner after SVB, has received a cease-and-desist order from FDIC because of issues in “internal controls, information systems, and prudent credit underwriting practices", suggesting that the bank is unsafe.

37

31

125

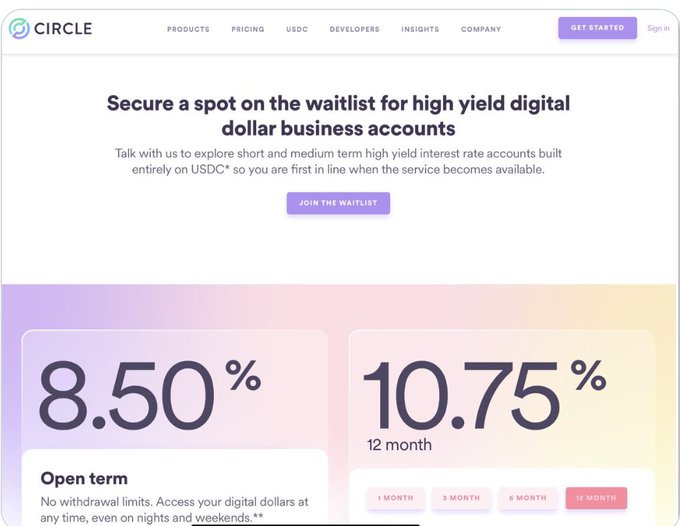

UPDATE: The USDC market cap continues to dive as more whales are dumping USDC. It’s pointless to keep its yield program, Circle Yield which only pays 0.25% annually. Depositors putting money in bank account probably earns more interest than Circle Yield.

20

21

110

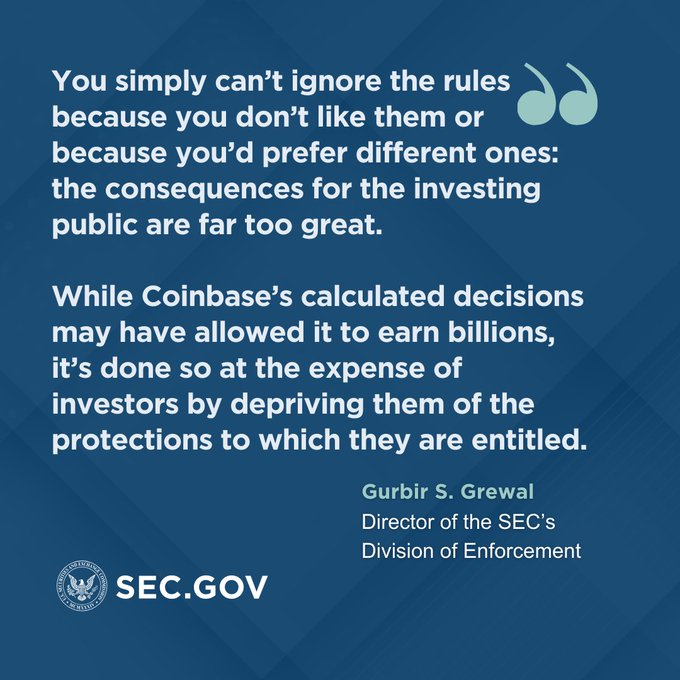

$COIN and $USDC are at highest risk as SEC go on a spree, hitting Coinbase, which has been struggling for the longest time. SEC claimed that the firm is an 'unregistered national securities exchange' that fails to comply to rules.

52

59

113

PAYPAL $PYUSD — the new stablecoin you should be CAREFUL of 🚨🚩

Paypal took a shot in catching with market & technology by expanding their presence on cryptocurrency. But don't get fooled by the name as their setup is primitive and sketchy. Look below 👇

35

35

119

THE 𝐁𝐈𝐍𝐀𝐍𝐂𝐄 FIASCO 🚨🚨🚨

Few days ago, I laid the red flags of

#FDUSD

, the new "stablecoin" on Binance. Now let us discuss the implication of these to the platform, firstly discussing how

#FDUSD

is potentially an aid to cover Binance insolvency.

23

32

110

COINBASE IS LIKELY IMPEDING THE APPROVAL OF

#Bitcoin

ETFs. In a recent finding, it is suspected by SEC that Coinbase is fully aware of violating the law as they proceed with the listings on their exchange a few years back but nevertheless made "risk".

44

56

111

See the recent potentially fraudulent things in Coinbase that you might have missed:

🚩The launch of Base, which is Coinbase's new layer-2 network.

Potentially a new avenue where more shitcoins are listed and rugged without accountability from CB.

32

39

113

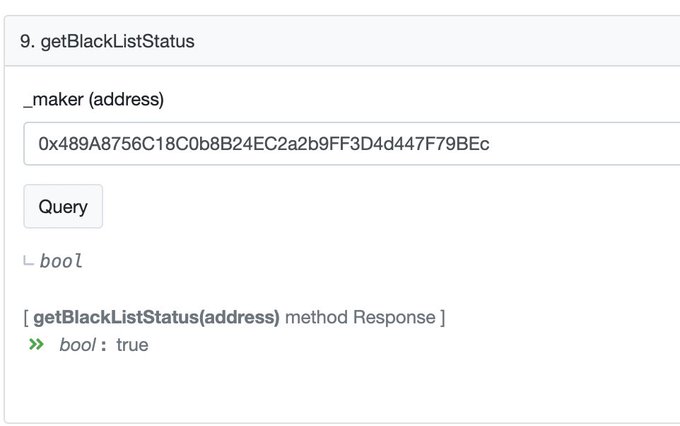

People now have realized there is more risk holding USDC, Circle blacklisted all the USDC on Tornado Cash addresses sanctioned by US Treasury. USDC seems like the only token being blacklisted while other ERC-20 tokens were not.

NEW:

@circlepay

's USDC has officially blacklisted every Ethereum address sanctioned by the US Treasury.

309

661

3K

12

2

84

I am glad to see a like minded shared same insight on Coinbase/Circle. The problem with decrease in USDC market cap is partly due to USDC holders unable to receive high interest anymore.

9

4

82

COINBASE IS NOT CRYPTO'S BEST HOPE AGAINST SEC.

Yep, you read that right. Despite their reach and capability, Coinbase isn't likely the protagonist that Armstrong is trying to play. In fact, they're likely the indirect beneficiaries of fraud.

Read ⬇️⬇️⬇️

33

40

105

When it comes to government issued sanction, Circle seems to bend their knee quicker than everyone else without order from authority.

5

5

78

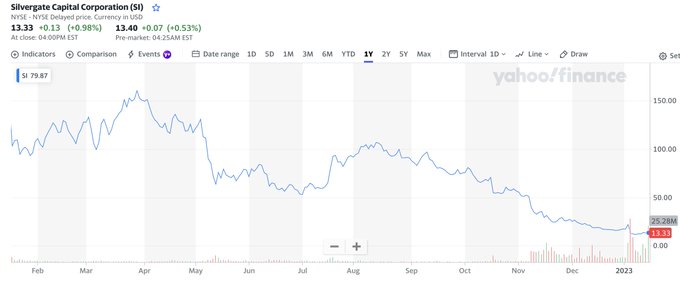

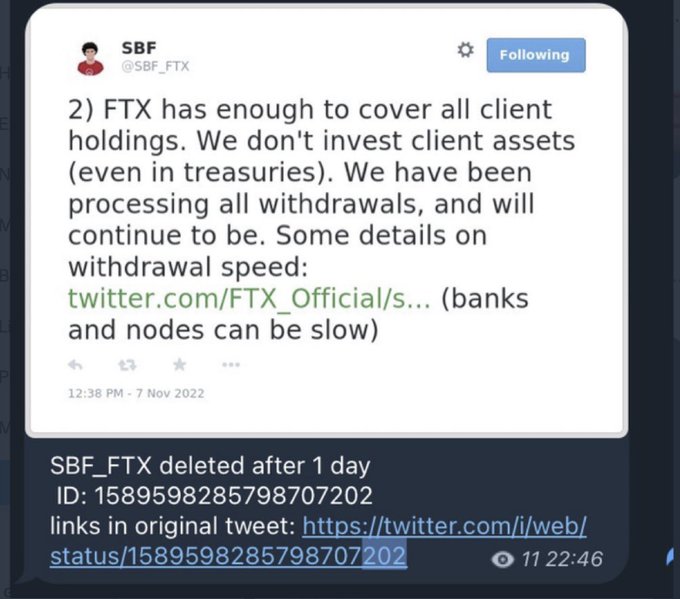

FTX - A company with huge failure on internal control.

Now Silvergate bank faces lawsuit for allegedly transferring FTX customer deposits into Alameda Research accounts.

Watch out for firms associated with Silvergate bank.

29

27

89

It’s always nice to have some “stress test withdrawals” on these exchanges, so we know who is swimming naked and who deserves to stay in this industry.☮️

33

16

84

Cross River Bank is in big peril as DOJ focuses on bankers that approved 'emergency relief loans', a scheme that was prominent back in the heat of the COVID-19 pandemic. Problem arose when the liable lenders aren't found because these were 'fake loans'.

Both

#CrossRiverBank

and $CUBI were involved in massive PPP loan fraud schemes and are currently under investigation by the SBA & DOJ. The evidence is undeniable. It’s not a matter of if they’ll be subject to indictment…but when.

0

1

5

35

43

87

@coinbase

Trusted and reputable? You might want to think twice.

19

26

83

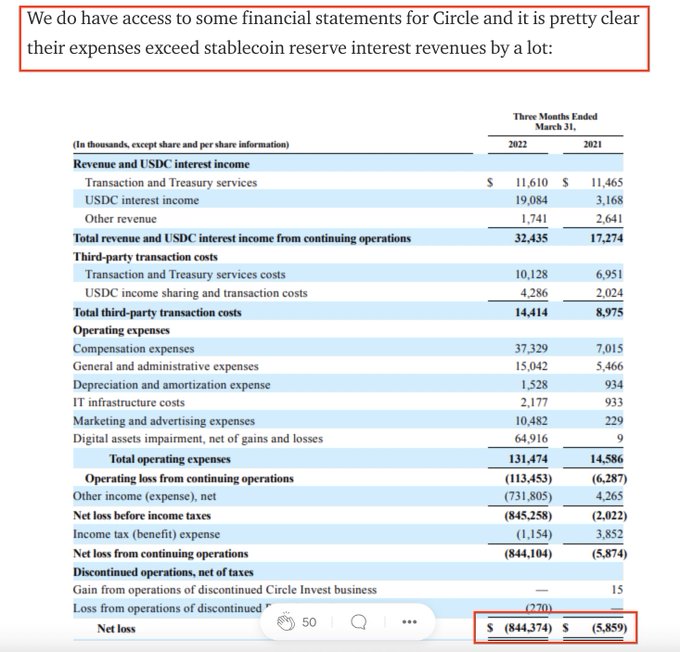

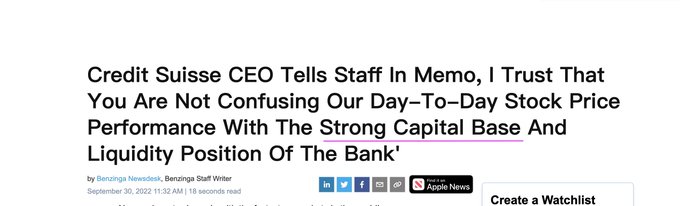

The CEO of Credit Suisse explicitly stated the bank has STRONG CAPITAL BASE and clearly its a LIE. Guess what, Circle also suffered huge losses of 800 millions and on its path to lose even more by the end of 2022.

14

9

80

Also don't forget Circle is deeply connected with FTX and its contagion is not over yet. DCG and Genesis may be the next facing bankruptcy. There is a pattern here as these interconnected companies are blowing up one after another.

8

7

80

Geralt not the only one give out warning on CB, tons of lawsuits against CB, horrible customers service and w/ their Rev heavily relied on retail trading. The open of commission-free retail trading by Fidelity might be the last straw broke the camel’s back.

24

10

74

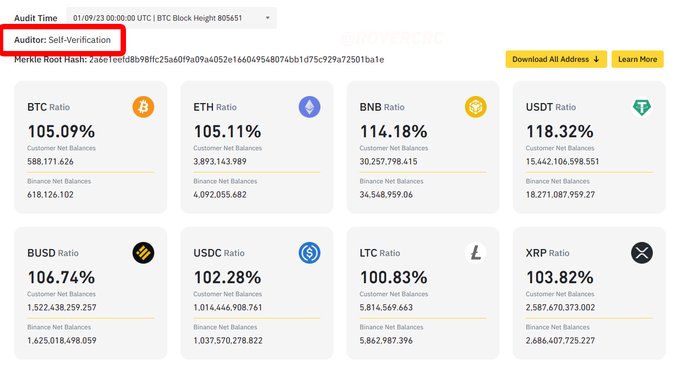

BINANCE audit report came out and the result is beyond disappointing 🤮😵💫

For starters, the data produced was audited by Binance itself, rather than a conventional 3rd party auditor. Self-audit is usually done for hiding fraud. But there may be more...

25

30

81

What’s the odds that these crypto firms who works with Silvergate are either bankrupt or on the verge of collapse? Circle has deep connection with Silvergate as they made deals to inflate USDC market cap.

1

6

75

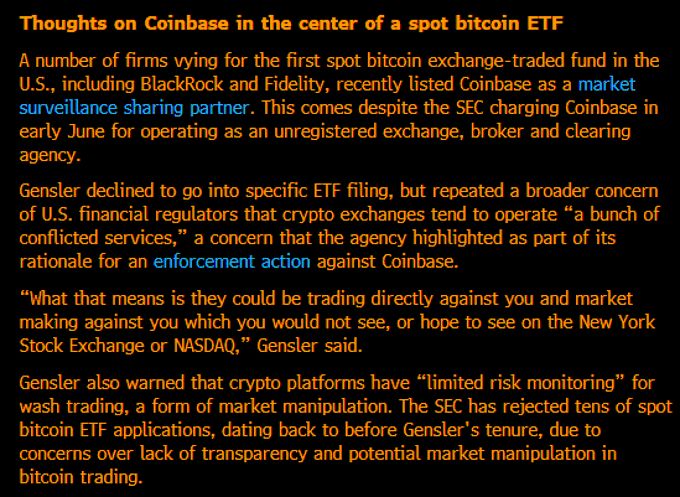

THE CATALYST OF COINBASE COLLAPSE. Coinbase has received more exposure as the firm's name gets mentioned in various ETF Filings. Either it gets approved or not, it will be bad for the CEX as the limelight exposed the platform's fraudulent tendencies.

Gensler was asked today in a webinar about Coinbase being at center of ETF filings. He couldn't comment on the filings but went pretty negative on crypto exchanges saying they operate "conflicting services" and have "limited risk monitoring" Here's full quote via

@TheBlock__

122

139

673

36

42

83

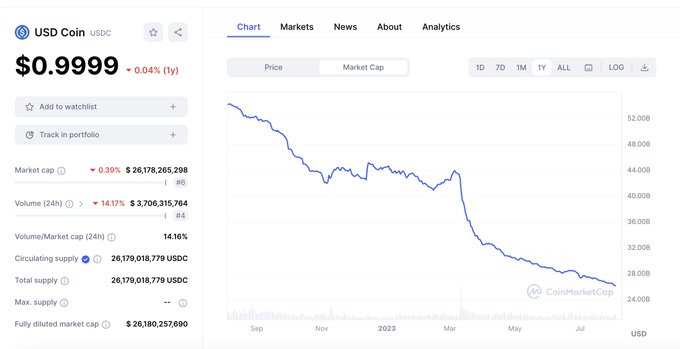

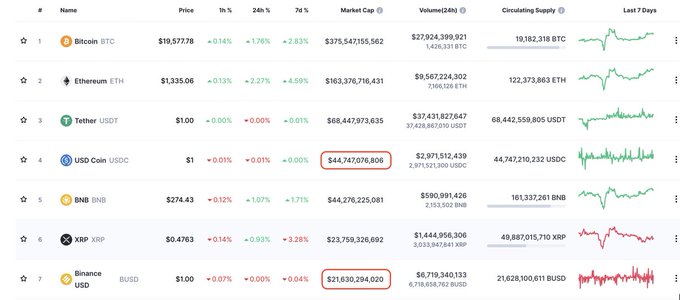

UPDATE: The market cap of USDC continues to head lower as it just dipped below 45B, it doesn’t look like it’s gonna recover anytime soon. USDC’s market valuation has dropped by more than 19% from its historical high, whilst BUSD has gain 3% during the last 30 days.

During the last three months, the

#stablecoin

#USDC

’s market valuation has dropped by more than 19%, shedding approximately $10.59 billion.

122

18

50

19

8

70

Geralt brings you another bank that's looking to be on the verge of collapsing, meet 𝐀𝐗𝐎𝐒 𝐁𝐀𝐍𝐊 🏦🚨

Axos Bank is one of Binance bankers, facing money laundering accusations, shady connections, and suspicious financial position.

🚨Ω🚨

Pumping my bags: another issue of

#TheCryptocalypseChronicles

is out on The Blogging Site That Shall Not Be Named concerning the actions of one

#AxosFinancial

AKA "

#Binance

's new US bank".

Link in bio because Elmo is pathetic and demonetizes links to That Other Site. $AX

3

19

57

22

26

79

THE COINBASE IRONY 🚨🚩

Funny to see Brian talking & schooling Google what "destroyed value" when Coinbase isn't exactly doing well. When talking about business model and gains, he isn't one of the credible persons to seek advice from.

Context below 👇

29

26

81

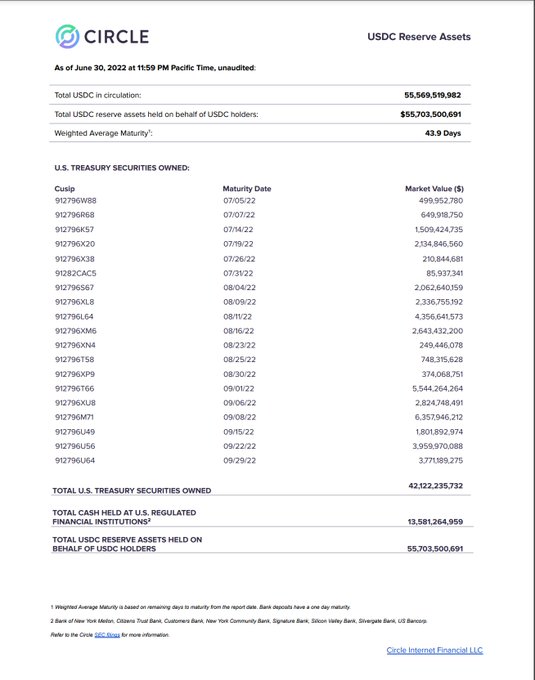

Those of you still not in a state of clear mind, once again Jeremy has tried to play you for a fool by providing an unaudited reserve report. Keep in mind Circle is paying additional interest to banks they use in order to keep money in USDC.

10

1

59

A stable coin not available for U.S. persons, can you believe that?

LOOK 👀👀👀 $USDM has one of the most unorthodox strategies in crypto space. Aside from not being available to U.S. it is also not registered under U.S. securities.

But there's more...

28

28

73

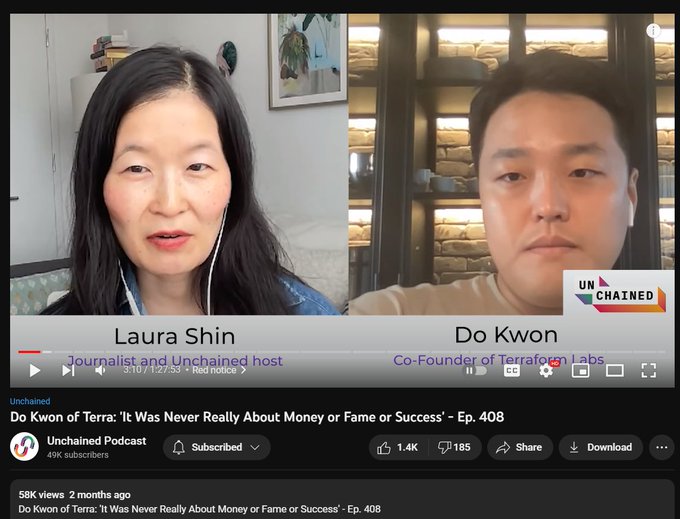

Thanks to

@Laurashin

who did good job spotting scammers which gives you the early exit signal on fraudulent biz/projects. Your 💵 should not involve with anyone she interviews.😅☮️

Hey

@laurashin

, I'm honestly convinced you are being used as a PR firm for fraudsters to boost/heal their reputations.

All of these interviews were conducted since October lmao

133

140

1K

27

13

65