Brandon Sello

@BrandonSello

Followers

59

Following

194

Media

6

Statuses

35

former credit portfolio manager. writing "The Stableyard" on RWAs.

Joined March 2025

RT @PaulFrambot: The more I learn about tradfi infra, the more I realize that 90% of businesses are just "reliable database reconciliation"….

0

14

0

RT @minerva_crypto: Pushing the boundaries of financial infrastructure has always been my dream. And it's what led me to leave tradfi and j….

0

1

0

Highlight quotes from Paul Atkin's Statements on #ProjectCrypto. Yes, the SEC Chairman said this:. 1) Not Securities: "Despite what the SEC has said in the past, most crypto assets are not securities.". 2) On ICO/Airdrop/Reward Exemptions: "I have asked staff to propose.

0

0

2

One of the things I admire about the @pendle_fi protocol is the animated videos in their Education / Pendle Academy section. It's great for visual learners or people who don't want to read thru dense material to get up to speed. Do other protocols have videos like this? Who.

0

0

1

I think this is going to be a step function for the vault curation business model (@gauntlet_xyz, @SteakhouseFi, @BlockAnalitica, and others), and a step function for fixed income in DeFi. This is a very open and market-based design, and I expect to see novel lending.

0

0

0

V2 is "Intent-Based", "Symmetric", and Fixed Rate. That won't mean anything immediately, but I think this is much more intuitive than a pool-based approached. To explain, @PaulFrambot goes through the flow of how lending gets done in V2.

1

0

0

It's embarrassing but I was pumping my fist listening to this @gelatonetwork pod on @MorphoLabs's V2. It's exactly what I want to see onchain. @PaulFrambot's vision for borrow/lend fits with a bond trader's view of credit markets. Highlights ⬇️.

1

0

2

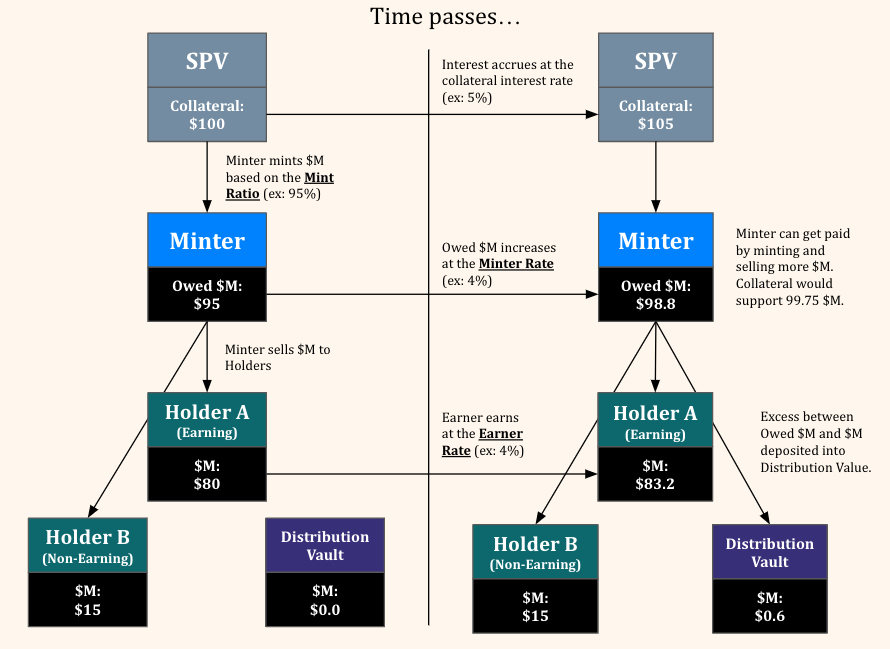

Why does simply not paying yield on stablecoins (like @Tether_to / $USDT) generate such absurd returns?. For some intuition let's do a bit of leverage math. - ~25x Leverage.- 4% Asset Yield (conservative).- 0% Cost of Debt. Gives you >100% levered return.

1

0

1

RT @SteakhouseFi: Allocations on @grovedotfinance into institutional credit markets for @SkyEcosystem at $1bn. Thank you for your attention….

0

9

0

RT @HadickM: I know everyone is really bulled up on the Robinhood announcement and tokenized equities, and not to be a bear, but the conver….

0

167

0