yieldharbour

@yieldharbour

Followers

1,385

Following

1

Media

3

Statuses

108

Decentralized options trading. Coming soon to Kujira 🛠️

Joined September 2023

Don't wanna be here?

Send us removal request.

Explore trending content on Musk Viewer

Mother's Day

• 1277376 Tweets

Mauro

• 145377 Tweets

#DebateChilango

• 91528 Tweets

Emma

• 70398 Tweets

Nuggets

• 67045 Tweets

Wolves

• 46920 Tweets

Taboada

• 45129 Tweets

Iztapalapa

• 37952 Tweets

Clara Brugada

• 37366 Tweets

つばさの党

• 36815 Tweets

Juliana

• 34860 Tweets

Denver

• 34217 Tweets

Jokic

• 32531 Tweets

Sebastián

• 31118 Tweets

BIRTH Campaign

• 26428 Tweets

Minnesota

• 25997 Tweets

Jamal Murray

• 25814 Tweets

Cruz Azul

• 25202 Tweets

Pumas

• 23815 Tweets

Bruins

• 22801 Tweets

Benito Juárez

• 22474 Tweets

Fabra

• 20622 Tweets

家宅捜索

• 19235 Tweets

Rayados

• 17450 Tweets

Gobert

• 15995 Tweets

Tigres

• 15862 Tweets

LOSE MY BREATH REMIXES OUT NOW

• 13195 Tweets

Jordi

• 12588 Tweets

#Canucks

• 11441 Tweets

#ほっともっと16周年

• 10508 Tweets

Gambino

• 10316 Tweets

Last Seen Profiles

Help us let the entire

#CosmosEcosystem

know that

@TeamKujira

will be the best place to trade options.

6

33

117

Imagine a call option like a concert ticket reservation. You pay a small fee now to reserve the right to buy a ticket at today's price, even if prices soar later. In options trading, if the stock price climbs, you can buy at the lower locked-in price.

#DeFi

$ATOM $KUJI

8

17

98

Cash-settled DeFi Options: Provide something like $KUJI as collateral and receive premiums in $USK. A practical way to generate income, hedge investments, and access speculative opportunities in the DeFi market.

#DeFi

#CosmosEcosystem

1

11

48

Options vs. Perpetuals

Options have a set expiry date, defining strategy timelines with risk limited to the premium paid.

Perpetuals lack expiry, offer infinite holding with costs adjusted by a funding rate, aligning prices much closer to spot.

#options

$KUJI

3

4

50

Options trading is perceived as complex due to its intricate terminology and the sophisticated strategies that involve understanding and applying concepts such as "the Greeks".

Our mission is to make trading options more accessible than ever

#Options

$KUJI

4

1

31

Put options are like insurance for your stocks. Just as you insure your car against accidents, buying a put option can protect your stock investment against a market crash. You pay a premium for peace of mind, limiting potential losses.

#optionstrade

#Investing

$INJ $KUJI

5

3

26

The accelerated time decay of options near expiration stems from their value composition: intrinsic and extrinsic values. The intrinsic value reflects the in-the-money (ITM) part, while extrinsic value encompasses time value and implied volatility (IV).

$KUJI

#OptionsTrading

2

1

28

The Chicago Board Options Exchange (CBOE) was the first to formalize options trading in 1973, revolutionizing the financial markets by introducing a regulated platform for options.

#DeFi

technologies will lead the next innovation in options trading. $KUJI

3

2

26

Tokenizing Options:

Options typically correspond to 100 shares of the underlying asset. In DeFi, the tokenization of options enables a 1-for-1 representation, facilitating precision and accessibility in options trading with a more granular approach.

#DeFi

#OptionsTrading

1

1

26

Expecting high volatility?

A straddle strategy involves buying both a call and a put option on the same asset with identical strike prices and expiration dates, aiming to profit from significant price movements in either direction.

#options

$KUJI

1

4

25

What happens if you buy both a call and a put option on the same asset with the same strike price and expiry date?

This strategy allows you to profit from a large price move in either direction, The minimum cost is the premium paid if the price stays relatively flat.

#DeFi

$KUJI

2

1

21

You can discuss all things Yield Harbour in the official

@TeamKujira

discord -

$KUJI $ATOM

#CosmosEcosystem

0

0

20

Trading market volatility:

Instead of betting on which way the market will go, traders focus on the intensity of price movements. By using options strategies such as straddles or strangles, they can gain from large swings, whether the market goes up or down

#volatility

$KUJI

1

1

16

Options pricing is complex, requiring traders to depend on frameworks like Black-Scholes.

It's not as intuitive as spot markets, due to factors like volatility and time decay.

#OptionsTrading

$ATOM

0

0

15

A straddle involves buying both call and put options at the same strike price, a strategy centered on market volatility rather than direction.

Key types include long straddles, ideal for volatile markets, and short straddles, suited for stable conditions.

#CosmosEcosystem

2

1

19

Even if an option expires in the money, investors still need to consider market value, transaction costs, tax implications, opportunity costs, cash requirements, time value and liquidity.

#OptionsTrading

1

1

15

Option Greeks are key metrics in options trading that measure an option's sensitivity to various factors.

For example, Delta (Δ) shows how much an option's price might change with a $1 move in the underlying asset.

#OptionsTrading

#Delta

1

0

17

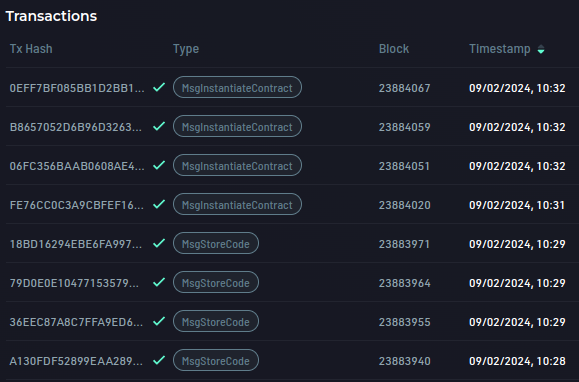

If you missed out on the first round of testnet, check your DMs - we are onboarding the next cohort soon!

$KUJI

#options

1

2

17

Vega (ν), a crucial 'Greek' in options trading, is like navigating a boat in varying seas.

High Vega is a light boat, sensitive waves (market volatility).

Low Vega is a sturdy ship, steady in waves.

Vega shows how an option's price reacts to market volatility. $KUJI

#DeFi

1

1

16

As we approach the New Year, let's flashback to

#Y2K

, a pivotal moment for financial markets. Amidst fears of computer glitches as '99 turned to '00, banks and businesses ramped up IT efforts, highlighting how tech and finance are intertwined.

#blockchain

#DeFiRevolution

2

1

14

110 years ago, on December 23, the Federal Reserve System commenced operations, revolutionizing U.S. banking. Now, it serves as an inspiration for many crypto projects seeking to enhance and modernize the financial system.

#CosmosEcosystem

$KUJI

1

1

14

Theta represents the rate at which an option's value decreases over time. It highlights the importance of timing in strategies, turning time decay into a strategic asset for optimizing returns.

#OptionsTrading

#Theta

0

2

14

DeFi options break down barriers: All you need is internet & a digital wallet to access global financial markets anytime, anywhere. No geographical limits, open 24/7 – truly democratizing finance.

#CosmosEcosystem

1

2

14

In times of market volatility, using Put Options can be an effective strategy to mitigate risk. A Put Option provides the right to sell an asset at a predetermined price, helping to hedge against potential large drawdowns.

#DeFi

#RiskManagement

$KUJI

0

3

12

Did you know that

@jimmy_wales

(co-founder of

@Wikipedia

) used to be an options pricing academic? 🤯

2

0

10

Options Timeframes:

In European-style options, the 'timeframe' (daily, weekly, fortnightly, monthly) is crucial. It's the period you wait before you can use (exercise) your option.

Once this timeframe ends, you decide whether to exercise your options or not.

#Options

0

0

12

Traditional options markets often create barriers for regular retail investors, with complex requirements and high costs.

#DeFi

options, on the other hand, offer a more inclusive alternative, providing easier access, lower fees, and transparent, decentralized platforms

$KUJI

1

0

13

Premiums:

An option premium is the price paid for an options contract. It's like a ticket fee to potentially buy (call) or sell (put) a stock at a set price.

It varies with factors like stock price, time until expiration, and market volatility.

#OptionsTrading

0

0

12

Discover StrikeBound Liquidity: Our unique algorithmic approach to standardize strike prices for liquidity providers. It streamlines order matching, concentrates liquidity, and bolsters risk management.

#CosmosEcosystem

$ATOM

1

1

11

On January 1, 1999, the Euro was officially introduced, unifying European economies under a single currency.

Today's DeFi landscape sees a daily emergence of hundreds of new cryptocurrencies, highlighting a shift towards decentralized and diverse financial ecosystems

#DeFi

3

1

11

Traditional markets offer established structures but less flexibility and accessibility. DeFi options bring innovation with transparency, faster settlement and accessibility.

#CosmosEcosystem

$ATOM $KUJI

0

2

11

ITM vs. ATM vs. OTM

In the Money (ITM): Option's exercise price is favorable compared to the asset's market price.

At the Money (ATM): Exercise price equals the asset's market price.

Out of the Money (OTM): Exercise price isn't favorable, but potential for future gains.

#DeFi

0

0

10

In bull markets, call options capture rising values, while bear markets make put options a strategic hedge. Mastering options means opportunities in all market conditions. 📈📉

#OptionsTrading

#CosmosEcosystem

$ATOM $KUJI

1

2

9

Options Simplified: An option is a contract to buy/sell an asset at a set price. Call options = right to buy, betting on a rise. Put options = right to sell, betting on a fall.

#cosmos

$ATOM

1

0

10

European-style options, exercisable only at expiration, provide predictability and lower premiums, making them suitable for precise hedging strategies. They eliminate the risk of early exercise, allowing for more straightforward valuation and risk management.

#OptionsTrading

0

1

10

Fischer Black (1938-1995) was a brilliant economist who co-developed the revolutionary Black-Scholes options pricing model. His groundbreaking work on options theory and derivatives earned him the Nobel Memorial Prize in Economics in 1997, awarded posthumously.

#Options

$KUJI

1

1

10

'In the Money' (ITM) vs 'Deep In the Money' (DITM).

ITM means the option has value if exercised now - like a call option with a strike price below the current spot price. DITM goes further, with a strike price far below (for calls) or above (for puts) the current price.

#Options

0

3

9

Did you know options trading began in ancient Greece? Traders used olive presses as a form of early options, securing rights to use them later. New to options? You're part of a millennia-old trading legacy!

#CosmosEcosystem

1

0

10

Theta (Θ) is a crucial 'Greek' in options trading, indicating how much an option's value drops as it gets one day closer to expiration.

Say a call option has a Theta of -0.05. This means it loses 5 cents in value each day.

#OptionsTrading

#Theta

2

1

9

In this month over 60 years ago, the market experienced the 'Kennedy Slide' bear market. The S&P 500 fell 28% in 6 months amid economic challenges and a shifting auto industry.

#MarketHistory

0

0

8

In DeFi, the risk-free interest rate is often considered zero due to the absence of universally accepted government-backed securities and the high volatility inherent in cryptocurrency markets.

#decentralized

$KUJI

1

0

7

Dive into Long Straddles: Buy both call & put options at the same strike & expiry, betting on significant price moves in either direction. Ideal for high-volatility scenarios where direction is uncertain.

#OptionsStrategy

#CosmosEcosystem

0

0

7

Options vs. Futures:

Imagine futures as a binding promise to buy/sell at a future date - no turning back.

Options are like a promise with a choice; you can decide to follow through or not. It's commitment vs. flexibility in trading!

#options

#derivatives

$KUJI

0

1

6

On December 21, 23 years ago, the Commodity Futures Modernization Act was signed, exempting many OTC derivatives from regulatory oversight. This legislation reshaped the derivatives market, boosting growth but also sparking debates on risk and regulation.

#CosmosEcosystem

1

1

6

Gamma (Γ) in options trading is a 'Greek' measuring the rate of change in Delta for a $1 move in the underlying asset.

It shows how sensitive an option's price change is to market movements.

#OptionsTrading

#Gamma

0

1

6

Back in 1720, the South Sea Bubble became a classic example of market mania. The South Sea Company, with its dubious promise to monopolize trade in the South Seas, inflated its stock prices to astronomical heights before crashing spectacularly.

#Markets

0

0

3