Warren Hatch

@wfrhatch

Followers

1K

Following

1K

Media

46

Statuses

406

CEO and Superforecaster® at Good Judgment

Joined February 2011

With some modest funding, we could: 1) Tidy up the question so that it is testable (e.g., how do we attribute 50% of white collar job losses to this one factor?) as much as possible in the spirit of the original question. 2) Invite the original question writer to correct while

We should be better at keeping track of falsified hype. This was 10 March, six months ago. There are many more predictions of extremely fast progress coming up for resolution. H/t @peterwildeford

0

0

1

If @elonmusk is willing, we could ask leading decision makers in business and government to anonymously nominate topics and take a vote. Then it will have real-world usefulness and be more than just a game.

An Elon-sponsored competition--Grok-vs-top-human-forecasters--would be fun. But the devil lurks in methodological details: question selection, time frames,… and size of prizes for winners

0

0

2

"The ability to predict the future is the best measure of intelligence." Agreed! https://t.co/YilfhC59ZC

0

0

3

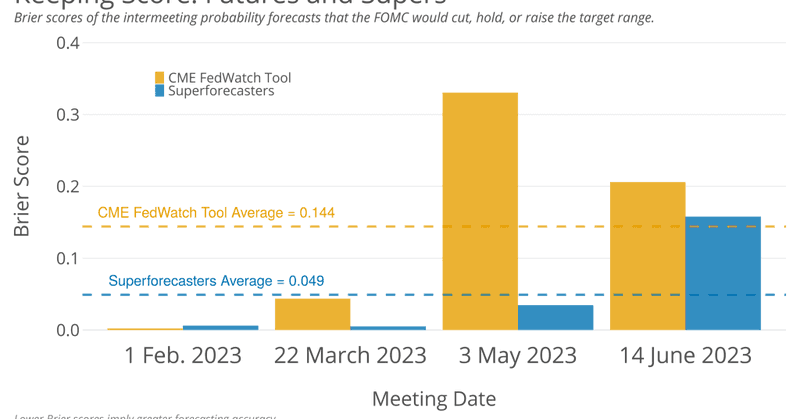

As expected for some time by the Superforecasters and more recently by the CME futures, the Fed paused again in May. For June, the Superforecasters have had high odds for another pause with the latest forecast at 70%, where the futures have caught up with the Supers—for now

0

2

13

Where are tariffs headed? As of this morning, the Superforecasters' median forecast is that US tariffs will average 6.1% globally over the next year, up from 2.4% but below the 22% announced to date. More on FutureFirst. https://t.co/CDG1Gq9Oqa

0

2

7

Superforecasting the Fed 2025: YTD, the Supers (Brier Score of 0.005) are beating the CME futures (0.125). Jan was close while Supers led in March. The futures were flirting with a May cut, but have caught up with the Supers for another pause. Daily updates on FutureFirst.

0

4

17

Thank you @LynnThoman for inviting me to join a terrific discussion.

0

0

6

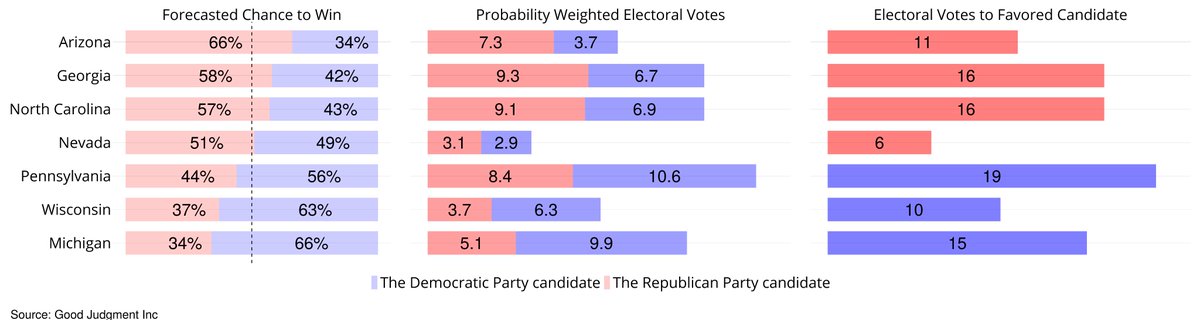

Good Judgment's @superforecaster panel currently has 54% odds that Harris will beat Trump on Tuesday. Of the seven major swing states, Trump is currently ahead in four and Harris leads in three, just pushing Harris to 270 electoral votes if non-swing states go as expected.

3

9

35

Back from a long weekend in the mountains, I was amused to find these dueling WSJ/NYT headlines about Friday's labor market report and what the Fed will do next. Current @superforecaster odds of a Fed pause in September: 91%

0

0

11

Superforecasters are 66% better at forecasting the Fed funds rate Quick, let's ignore the whole thing https://t.co/VXlRKaKu2H

0

2

7

Compare @GoldmanSachs: that a shutdown looks "more likely than not" https://t.co/j7axOHbNjl

reuters.com

The U.S. government looks "more likely than not" to shut down later this year due to political differences on spending that could temporarily hit economic growth, Goldman Sachs analysts said in a...

Current @superforecaseter odds of a shutdown of the US federal government before 1 November 2024: 64% The Superforecasters point out this has occurred four out of five times since 1990 when the presidency and the House were held by opposite parties. https://t.co/v20iHJejp7

0

1

4

Current @superforecaseter odds of a shutdown of the US federal government before 1 November 2024: 64% The Superforecasters point out this has occurred four out of five times since 1990 when the presidency and the House were held by opposite parties. https://t.co/v20iHJejp7

0

2

16

Current @superforecaster odds that Putin is no longer president: Oct-23: 4% Jan-24: 6% Jun-24: 7% With Russia in fast forward, it's critical to sift through noisy headlines and not over-extrapolate the signals, as Superforecasters have done for years https://t.co/VRASDDxgP7

0

1

11

With the pause today, Brier scores for forecasting the Fed in 2023 (lower is better): CME FedWatch Tool: 0.14 Superforecasters: 0.05 Here's a summary with all the current charts:

goodjudgment.com

Superforecasting® the Fed: A Look Back over the Last 6 Months The Federal Reserve’s target range for the federal funds rate is the single most important driver in financial markets. Anticipating...

The Federal Reserve has decided to hold rates steady. Anticipating inflection points in the Fed’s policy has immense value, and Good Judgment’s Superforecasters have been beating the futures markets this year. See our new whitepaper for details. https://t.co/liFdaMt2Gi

0

1

8

Here are the charts for cut/hold/raise for the last three FOMC meetings. The @superforecaster probabilities are the less volatile, dark blue lines. The green checks show the outcome.

0

2

3

Our data scientists have been keeping score of forecasts about the Fed. So far this year, the CME FedWatch Tool, using probabilities from futures markets, has a Brier Score of 0.123 (lower is better) roughly 10x higher than the Superforecasters' stellar 0.013. Next update is Wed

1

5

20