Will Diamond

@wdiamond_econ

Followers

4K

Following

29K

Media

405

Statuses

4K

Associate Professor of Finance, @UWMadison. I study safe assets, banking , central bank policy- tools to prevent financial crises and clean up after them.

Philadelphia, PA

Joined June 2013

I'm starting a weekly reading group with (mostly) friends who work in crypto meeting this coming Thursday at 11:30am eastern time to study cryptography and zk proofs. We will start with basic theoretical concepts but are hoping to examine real-world code bases together. DM me

1

4

27

I think what this paper really adds is the ability to ask big macro questions in an institutionally rich model, a rare combo. You can say nonbanks are ``innovation" and good or "regulatory arbitrage" and bad, but you really need Clara's paper to say something more nuanced.

0

1

7

One of my favorite results is this ``U-shaped" impact of tightening bank regulation in the model. It is good for risky assets to be held by nonbanks instead of banks, but once regulation gets too tight nonbanks stop borrowing from banks. Can only get this from a rich model!

1

1

5

Clara compares an economy with credit lines to ones where nonbanks hold a cash buffer or where they borrow with more standard loans, finding that credit lines more effectively allow nonbanks to meet their uncertain investment needs and provide better risk sharing.

1

0

2

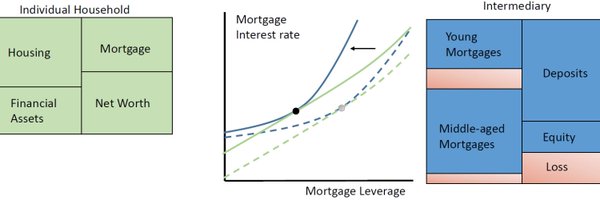

The model's credit line contract is very realistic: banks rationally anticipate that nonbanks will draw it down both for the ``good" reason of making profitable loans and for the ``bad" reason of gambling with the bank's money. This determines an optimal credit line contract.

1

0

2

The ``big question" is whether the development of non-bank intermediation is good or bad for the financial system, and whether their are policy interventions that should react to it. Clara builds a large macro model with banks, nonbanks and firms to answer these questions.

1

0

4

Next, she provides textual evidence that these lines are for liquidity support: to manage uncertainty in when lending opportunities arise, and to back up their issuance of runnable commercial paper

1

0

2

https://t.co/odoJe6rHub First, she shows empirically that non-bank originators of syndicated loans raise a very large portion of their funds from credit lines issued by banks.

1

0

2

I have an excellent student Clara Xu on the market this year, whose JMP analyzes how nonbank lenders finance themselves with credit lines from banks. After documenting how empirically common this relationship is, she shows in a GE/macro model that it is welfare improving.

3

16

79

ZK proofs are revolutionizing crypto and inflating egos. Everyone claims to have the one true proof system, but applications are the important part, proofs now a commodity. Also: if a company's new zk proof starts with 'h' or 'hyper,' they abandoned their old god for sum-check

13

10

119

This would be a great time for the government to take a look in the mirror and strongly consider a graceful step back from this case. Leave this dispute to the civil courts. This was always a confused case pushed by a previous admin that hated all things crypto and just wanted

6:51 pm Judge: There is nothing in this note indicating they could progress on Monday. This is their 11th note, no progress. I am going to declare a mistrial.

26

22

173

Significant progress towards a million dollar prize problem ( https://t.co/mbHeD3WOZG) about the security of zero-knowledge proofs that use error correcting codes which come from evaluating a polynomial. This "proximity gap" conjecture would have made such proofs more secure.

proximityprize.org

$1M in prizes to prove or disprove Reed-Solomon proximity gaps conjectures. An initiative by the Ethereum Foundation.

An exciting update from myself and @benediamond ( https://t.co/bKwowXYcMB). We show that the 𝘶𝘱-𝘵𝘰-𝘤𝘢𝘱𝘢𝘤𝘪𝘵𝘺 proximity gaps conjecture is 𝗳𝗮𝗹𝘀𝗲. More precisely, given any pair c, d we construct codes whose error grows faster than nᶜ / (q ⋅ (ρ η)ᵈ).

0

0

3

I crossed an interesting threshold yesterday, which I think many other mathematicians have been crossing recently as well. In the middle of trying to prove a result, I identified a statement that looked true and that would, if true, be useful to me. 1/3

64

305

3K

1/I'm very excited about the JMP of my PhD student Chris Kontz (Stanford GSB) who's on the academic job market this year. Chris’ job market paper analyzes the impact of the rise in passive investing on the real economy. More passive investing in a stock results in increased

39

167

972

I used ChatGPT to solve an open problem in convex optimization. *Part I* (1/N)

86

355

2K

Fascinating detail from the recent crypto turmoil- the levered to the hilt stablecoin ethena that does a spot +derivative basis trade negotiated ex ante not to be margin called like everyone else. Selling stealthy tail risk insurance never dies.

So if this is the case then you actually have a way higher chance of assignment of ADL if running same leverage as Ethena is since they have agreements in place and you don’t you can’t even use the OI to proxy since you don’t know how much of it is ethena protected positions

3

1

11

https://t.co/icAOd3G27S End of an era for the cleanest data provider in finance. This is Illinois government level selling your office buildings and renting them back to book an accounting profit level down bad.

news.uchicago.edu

$375 million transaction to provide long-term support for UChicago education and research

0

8

41

My coauthors Clara https://t.co/BZlLnPSNFY and Luigi https://t.co/KrzPLrWFVR are both on the PhD job market- so please keep an eye on them if you are interested in hiring one or two outstanding financial economists!

sites.google.com

Welcome to my website!

0

0

1

CLOs result in a financial system with more leverage and more stability than a traditional banking system where banks lend directly to firms. However, CLOs fire-sales of low-quality loans are double the socially optimal size, suggesting that CLO risk taking should be regulated.

1

0

2