Vasily Sumanov

@vasily_sumanov

Followers

2K

Following

3K

Media

87

Statuses

1K

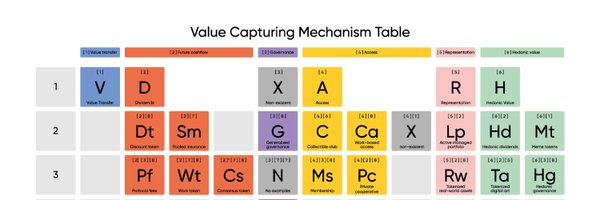

Ph.D., token engineer, @valueverse_ai founder. @tokengeneering award winner & VCT theory creator

Universe

Joined February 2019

An important step @yieldbasis $1B+ TVL era

I propose @CurveFinance to crvUSD increase credit line to @yieldbasis to 1B crvUSD, however with @yieldbasis utilizing it slowly by pieces, when required. I published the proposal here: https://t.co/UO5thOXa8s

0

0

33

Somebody understands $YB, $crvUSD and $CRV fundamentals It's called value synergy One's success drives value of all interconnected assets: $YB -> $crvUSD -> $CRV ->> $CVX, $SDT, $YFI How value synergy works? - $YB drives $crvUSD adoption, liquidity, peg, and swaps; also

+1 million $CRV tokens in two weeks. Someone continues to accumulate them in @BitGo 's custody. I'm watching. @CurveFinance

9

17

97

Totally logical: - @yieldbasis pools have bigger TVL than any other for BTC (in top 20 at Defillama) - Top Uniswap pool left behind - Why? No Impermanent Loss. 👀 With $500m TVL expansion @yieldbasis enters top 10

5

9

74

Will track live $UNI buyback once started $UNI buybacks will be funded from: - 16.7% of 0.30/1.00% pools or 0.05/0.167% from order size - 25% from 0.01/0.05% pools or 0.0025/0.0125%

With fee upcoming fee switch, $UNI gets some trackable utility According to that, $UNI Data Page added to Valueverse After switch it will have not only governance, but also cashflow. Data will be tracked once buybacks started $UNI page link👇

0

0

5

Great explanation! You can track value captured by veCRV for its holders at @valueverse_ai: https://t.co/CCQgSp8noG

app.valueverse.ai

1

2

8

The merit (“useful buyers”) launchpad principle goes mainstream: - Best projects don’t need money - They are anyway oversubscribed - What they need? Value-adding holders Legion pioneered it Congrats @matty_ @D0itdifferent @legiondotcc

Token sales are so back. Launching tokens has always been a core part of the crypto ecosystem. It’s been a source of incredible innovation and product development. But it’s also caused serious problems - unfair access, max extraction, and misaligned incentives - all of which

2

0

7

$YB fee switch, feel the difference: - @yieldbasis LPs get fees - have no Impermanent Loss - veYB also generates fees Everyone happy.

UNISWAP'S FEE SWITCH: WHO BENEFITS? 👀 Uniswap just announced fee switches and token buybacks. And guess who loved the news? @newmichwill The CEO of Curve @wagmiAlexander The CEO of Dromos Not because it’s a smart move. But because it’s so bad, it actually gives them an

0

1

30

Some additional $YB accumulation math. @StakeDAOHQ: slowly but surely gets more veYB Smart.

$YB analytics: tracking for @StakeDAOHQ's veYB added to Valueverse What's interesting: - StakeDAO subsidizes $YB inflow with 500k $SDT ($135k only) - $YB locked amount is already ~$390k (almost 800k YB) - veYB has an exposure to corresponding share admin fee, coming from $BTC

0

1

15

Great deep dive in @yieldbasis and $BTC yield

🎙️ New @edge_pod 🌽 Is This The Next Best BTC Yield In DeFi? 0:00 - Intro 5:43 - Building Curve Finance since 2020 8:36 - Why build yieldbasis? 11:53 - The challenge to productize BTC yield 19:13 - How does yieldbasis work? 26:29 - Current BTC yields and performance 28:20 -

0

0

29

Some simple stats for those who fud on $CRV @CurveFinance

$CRV yield stats: 1. 13.55 M.cap/revenue or 4.64 veCRV Mcap/revenue (the veCRV is mcap that receives yield) 2. These numbers come from onchain data: -> $0.057 per 1 veCRV/year (counting the recent epoch) or $0.067 (historical annual average) Live dashboard👇

2

4

85

Finally. Happy that it's evident. @newmichwill published a paper on that: "A Comparative Analysis of VE-Model and Buyback Model for DeFi Tokenomics: https://t.co/WQKgbpHETT example." a great read btw

curve.finance

Curve-frontend is a user interface application designed to connect to Curve's deployment of smart contracts.

The ve-tokenomics model is more efficient than buybacks because ve model can essentially lock up tokens by paying yield only. This is a fraction of the cost of buying tokens at spot price. But what if a protocol only had to pay a fraction of the yield to buyback-and-burn

2

1

27

The future for $CRV is bright Just one $500M YB pool expansion will lead to over $1B in $crvUSD. With TVL billions: 1. Massive $crvUSD adoption 2. Increasing fees for veCRV. 3. The @CurveFinance ecosystem will grow to a whole new level.

BitGo's custody has been accumulating a large amount of CRV over the past few days. Hmm, interesting.👀$CRV @CurveFinance

10

19

164

After @pumpdotfun ann it seems that it’s true feeling: we will have more launchpads than projects Everyone wants to help you to get to the market and get a slice of the success The competition for truly solid projects is getting so hot

1

0

5

My vision is - tokens are better assets than stocks since they have onchain, block-by-block reporting Excited to see that I share this vision (at least for importance of the onchain reporting) with great minds from @1kxnetwork If you a think you are deep in the space, you

We @1kxnetwork just released the most extensive report on monetization of the crypto industry to date: The 1kx Onchain Revenue Report (H1 '25) aggregates verified onchain fee data across 1,200+ protocols - mapping where users pay, how value flows, and which sectors are driving

0

0

11

If you understand how economic/business model of just one project works -> you already can get asymmetric advantage After discussion with multiple VC analysts and “consulting” people regarding $YB - I feel how early we are in terms understanding mechanism design, token value

1/ Watching $YB price action yesterday while BTC nuked again showed one thing clearly - most people still don’t understand how @yieldbasis earns revenue Days like this aren’t bearish for YieldBasis - they’re fuel. Volatility = more volume = more fees = bullish for $YB

1

1

26

When @yieldbasis delivered $BTC pools 2/3 are market leaders by TVL and liquidity depth (with $150m TVL limit only!) For $ETH it's not only pools, but the new source of yield on top of LST: - more profitable than lending/restaking - benefiting @ethereum directly - deeper $ETH

0

5

40