brent

@vanderbrook

Followers

551

Following

2K

Media

13

Statuses

619

The flame of knowledge must be protected. Not from nature—but from ourselves.

Joined December 2012

Switching to an automatic transaction based tax would save a staggering $313 billion in wasted annual compliance costs associated with the current system per data from the @TaxFoundation. There is so much wasted time spent on tax compliance. Taxes are a necessary evil. The.

The burden of complying with the US tax code is staggering, currently estimated to consume 6.5 billion hours at a cost of about $313 billion per year, equal to 1.4 percent of GDP.

1

4

7

This is why we need to switch to an automatic receipts tax in lieu of all other taxes. A simple 0.5% fee when funds are received. Would @TaxFoundation support such a shift?.

Americans will spend nearly 7.1 billion hours on IRS tax filing and reporting in 2025. That’s equal to 3.4 million full-time workers—about the entire population of Los Angeles—doing nothing but tax paperwork for a year.

0

0

1

So unnecessary… is we only changed the basis of taxation to taxing the bank account in the receipt of funds we could avoid the entire IRS and have a simple, easy, and fair system. An automatically collected receipts tax. Clearly the path forward as the income tax no longer is.

0

0

0

RT @matthew_d_green: This battle will keep playing out over and over again until they achieve something that their own citizens have made i….

techradar.com

The EU Commission unveiled the first step in its security strategy to ensure "lawful and effective" law enforcement access to data

0

102

0

Now it’s time to get serious. This failure proves that hoping for @RepLaHood’s bill or relying on grassroots “call your congressperson” campaigns pushed by @ACAVoice and @DemsAbroadTax is a dead end. It also shows that “revenue neutrality” is just a polite excuse politicians.

0

1

3

The entire bill is revenue negative! That’s not why ending double tax didn’t make it. It wasn’t and never has been about revenue neutrality. Anyone telling you that is stringing you along. And if anyone tells you that in the future just ask “how does ending tax on tips.

Both sausage making and babysitting were my desire and plan. It didn't work out. Ending double taxation was revenue negative. But I also learn my lesson which is whatever I am going to do in DC next, I need to keep my mouth shut on X. #Happy4thofJuly.

1

7

19

Why won’t a senator do the same for residency based taxation as Murkowski does for fisherman? Politics isn’t about calling your congressperson. In real life, politics is about horse trading and last minute deals. To end citizenship based taxation, Americans need only find one.

The New York Times reports that Senator Lisa Murkowski voted to advance Trump’s “Big Beautiful Bill,” which adds $3.9 trillion to the national debt and cuts healthcare for millions of working people, only after securing special carveouts for Alaska, including exemptions from food

0

0

1

And yet still no relief for Americans abroad despite President Trump’s campaign pledge. The Senate should at the very least insert residency based tax into the bill as it’s not even expensive and it would deliver real relief.

Some of the surprise new tax breaks that popped up overnight in the new Senate text they're trying to shove towards a vote:. 1) tax subsidies for spaceports (who asked for this?).2) tax credits for coal (including exports).

1

4

14

If @RepLaHood really saw potential he’d add it to the Big Beautiful Bill. An FT article today observed how a tax break for private credit in the House version is being hard lobbied into the Senate version … a provision that just a handful of people want… and it reveals the.

Rep. LaHood sees potential for “long overdue” bipartisan elective RBT bill later this year — Tax Fairness For Americans Abroad

2

3

7

RT @ExpatriationLaw: Rep. LaHood sees potential for “long overdue” bipartisan elective RBT bill later this year — Tax Fairness For America….

taxfairnessabroad.org

A bipartisan bill to end the double taxation of Americans abroad could come by the end of the year, Rep. Darin LaHood , author of the Residence-Based Taxation for Americans Abroad Act , said Monday....

0

10

0

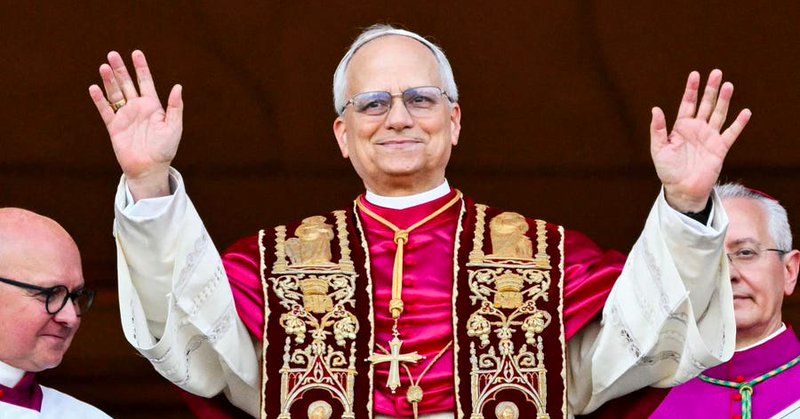

RT @TaxNotes: "The real issue is not how the U.S. government chooses to tax the pope but how it taxes the scores of other U.S. citizens liv….

forbes.com

Robert Goulder considers whether the election of Pope Leo XIV could prompt a broad rethinking on U.S. policy toward citizenship-based taxation.

0

15

0

Project 2025 calls for ending income tax. Literally. Maybe Congress should just jump right to that idea now and ditch this silly tinkering with the existing broken tax system. @FairTaxOfficial is one idea. The Automatic Receipts Tax is another. @Heritage @TaxFoundation.

Anyone who votes against this is voting for a TAX HIKE. ONE. BIG. BEAUTIFUL. BILL. Let’s get it done.

1

0

2

RT @WSJopinion: The notion that the IRS would audit the pope may sound implausible. But the absence of a formal exemption—even for the pope….

wsj.com

Like many American expatriates, Leo XIV may find himself tangling with the IRS.

0

13

0

Do you think they’re just going to pretend to themselves that they’re selling them? . There’s been no legislative proposal or any regulatory change (not that it can be done by regulation) to advance the gold card concept. This is quickly becoming a laughingstock.

Lutnick: "The attention on the Trump gold card -- I mean, it makes me very popular. Last night, I was out for dinner and somebody came up and said, 'Can I buy 10?' And I'm like, that's pretty good, that's $50 million for dinner. So it's paying for my dinner."

1

1

3

This is utter nonsense. Chris totally ignores the reality of AML/KYC regulations. Until the regulators are willing to allow payments without anti money laundering or sanctions checks, stablecoins are not going to be allowed to go mainstream.

Stablecoins: Payments Without Intermediaries. The internet made information free and global. So why is it still so hard — and expensive — to move money?. The early internet promised a future where anyone could publish, build, or transact without permission. Protocols like email.

0

0

0

Much more effective than any wealth tax….

Who needs @garyseconomics! The President has just reduced global wealth inequality in under a month. 🤦♂️.

1

0

0