Tomas Williams

@twilliams8

Followers

2K

Following

5K

Media

211

Statuses

3K

Economia, finanzas y futbol, no necesariamente en ese orden | Associate Prof at @GWtweets | Faculty Affiliate at @IIEPGW | Director @CERatGWU

Washington, DC

Joined April 2009

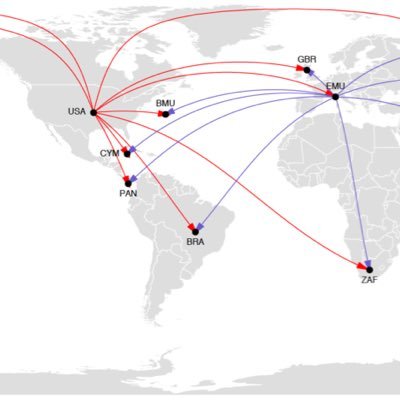

We are excited to release a public, research-ready dataset with complete holdings at the security level for U.S. mutual funds and ETFs each quarter, built from SEC Form N-PORT mutual fund filings. 👉 Access the data and code at the GCAP Data Hub: https://t.co/YzOyhwoPmE 1/3

1

32

64

Check out #CER member @TaraSinc talking on @Macro_Musings about building Synthetic FOMC using AI and what economists and policy makers can learn about it! #AI #MonetaryPolicy #FOMC #FederalReserve

New episode! Tara Sinclair on Building a Synthetic FOMC Through AI @TaraSinc lays out for @DavidBeckworth why building an AI FOMC gives macroeconomists a proprietary sandbox to run experiments.

0

2

8

📣Continuing the tradition: this year's list of JMCs in International Finance and Economic History (inspired by @TradeDiversion's list in Trade + Spatial). Check out the candidates here, and let me know if any are missing: https://t.co/herO5lMr8N

#JMCs #EconTwitter

1

18

76

On Wed, our Macro-International Seminar hosted Sharon Ross (Fed Board) presenting “Risk and Specialization in Covered-Interest Arbitrage.” Using $25T in data, the paper shows CIP arbitrage is risky — banks specialize, fragmenting markets. #EconTwitter #Macro #Finance

0

1

3

On Oct 29, our Macro-International Seminar featured Bernardo Cruz Morais presenting “Fiscal Rules, Credit Reallocation, and Expansionary Austerity.” Local Govt Debt limits in Mexico led to ↑ private credit, ↑ GDP, ↓ in moderate poverty, but ↑ in extreme poverty. #EconTwitter

0

2

13

On Monday 10/27 our Microeconomics Program Seminar Series hosted Jason Baron (Duke & NBER) presenting “Mechanism Reform for Task Allocation.” In CPS simulations: false placements ↓14% and missed cases ↓ too — while no worker is worse off. #econtwitter #MechanismDesign

0

1

1

CER member @tannerwdregan's research was featured by the Centre for Economic Performance (LSE)! His work shows how knowledge diffusion + firm networks drive innovation and economic performance. 👏 🔗 https://t.co/Jyz31JaEbk

#ResearchHighlight #EconTwitter #Innovation

cep.lse.ac.uk

The economics of greenfield urban planning

0

1

1

On Oct 9, 2025, @GWtweets hosted the 26th Federal Forecasters Conference — with the H.O. Stekler Research Program on Forecasting and the AI Economics Program from the CER as partnering organizations. 🧵👇 #FederalForecastersConference #Forecasting #GWU

1

1

1

This was a great seminar to host. @PaulFontanier did an amazing job highlighting the model they built to understand the implications of international investors for optimal monetary policy in emerging markets. Looking forward to the upcoming draft!

Our Macro-International Research Area hosted a Paul Fontanier (Yale SoM) who presented “Exchange Rate Stabilization and Monetary Transmission” (with @alpsimsek_econ). Great discussion on how global investors shape monetary policy in EMs. #Economics #MonetaryPolicy #EME

0

0

6

Our Macro-International Research Area hosted a Paul Fontanier (Yale SoM) who presented “Exchange Rate Stabilization and Monetary Transmission” (with @alpsimsek_econ). Great discussion on how global investors shape monetary policy in EMs. #Economics #MonetaryPolicy #EME

0

5

52

On Oct 11, members of @GWUEconomics’s Center for Economic Research joined the 2nd annual Washington Area Network Economics Symposium (WANES), hosted by @virginia_tech — connecting researchers studying how networks shape the economy. #Economics #NetworkEconomics #CER

1

1

1

On 10/13, our Trade & Development research area hosted Doug Gollin (Tufts) who presented “High-Frequency Human Mobility in Three African Countries”, with fascinating insights on mobility and development. #EconTwitter #DevelopmentEconomics #Africa

0

1

1

This series of charts from Sammon Shim, "Who Clears the Market When Passive Trades" has supplanted the Roman Republic in my daily considerations... So much is explained here.

15

20

210

On Wednesday 10/8, our Macro-International research area hosted Ricardo Alves Monteiro (IMF) for a seminar. He presented exciting work on the macroeconomic implications of different types of sovereign debt auctions. https://t.co/LSfmq1FEkl

#Econtwitter #sovereigndebt #auctions

0

1

3

On Wednesday 10/1, our Macro-International research area hosted Fernando Arce (IADB) who presented research on "Tax Revolts and Sovereign Defaults". #economics #sovereigndebt #econtwitter #publicdebt

https://t.co/Z4DuAbL7Pz

0

1

1

On 9/26, the 7th edition of the Washington Area International Finance Symposium (WAIFS) took place. Keynote lecture by IADB Chief Economist Laura Alfaro highlighted joint work with CER member Maggie Chen on public attitudes toward trade policies. #waifs #economics #tradepolicy

0

1

8

In a world of loneliness epidemics, as coined by the U.S. surgeon general, how do we make more friends? On Monday October 6th, Professor Amanda Pallais, Professor of Economics at Harvard University visited us as part of our ongoing microeconomic seminar series to discuss.

0

1

1

CER director @twilliams8 provided commentary for S&P Global on current long-term government bond yields and its impact on international financial markets. #econtwitter #finance #financialmarkets #bondyields

https://t.co/PDklfCwg9u

spglobal.com

Long-dated US Treasury yields have repeatedly approached 5% since late 2023, prompting investors to reassess allocation strategies.

0

1

2

Take a look at our new blog, which summarizes the man takeaways of one of the analytical chapters of the World Economic Outlook. Emerging markets have become more resilient to risk-off shocks in recent years: While favorable external conditions (good luck) helped, stronger

Emerging economies have become more robust in recent years thanks to stronger policy frameworks and improved local currency debt markets, our research shows. https://t.co/glm1q8GR4n

0

4

5

CER member and former director @TaraSinc research on AI and political pressure for FOMC meetings highlighted by Reuters and GW Quarterly. #econtwitter #economics #monetarypolicy #FOMC

https://t.co/M6Ux8YlboG

reuters.com

A simulated Federal Reserve meeting that used artificial intelligence agents modeled on real-life policymakers showed political pressure polarised members of the board in their rate-setting deliber...

0

1

2