Tim Ludwig

@tsludwig

Followers

23,304

Following

1,152

Media

136

Statuses

5,090

Owner of and investor in exceptional small businesses. Tweet about PE, small business (SMB), search funds, management.

San Diego, CA

Joined March 2009

Don't wanna be here?

Send us removal request.

Explore trending content on Musk Viewer

BECKY X MAYBELLINE LIVE

• 230469 Tweets

Northern Lights

• 211450 Tweets

オーロラ

• 170154 Tweets

#Auroraborealis

• 92475 Tweets

DeNA

• 61864 Tweets

#baystars

• 61443 Tweets

THE SIGN in MANILA

• 43046 Tweets

京王杯SC

• 22051 Tweets

Fulham

• 21610 Tweets

太陽フレアのせい

• 18177 Tweets

ベイスターズ

• 18129 Tweets

ハマスタ

• 17413 Tweets

バチコン

• 16802 Tweets

ウインマーベル

• 10671 Tweets

Last Seen Profiles

I was curious to estimate how many SMB PE/CEO-types are active on Twitter, so I started to make a list. Thought others would like to see (and maybe add to) it. So, here goes:

1

@BrentBeshore

2

@LongvueMatt

3

@rudman_ben

4

@mgirdley

5

@awilkinson

6

@MatthewGHinson

/1

9

23

283

Required for launching a new fund:

☑️ The right partner (

@JustinEBurris

)

☑️ Funding - Millions of $ from leading business families

☑️ Compelling strategy - Search fund-like model w/ no PG, full $ support, long-term holds

🔲 8-10 top operators who want to buy & grow a SMB

30

18

198

This is really geeky, but I think this is among the most valuable content that

@BrentBeshore

and the

@adventur_es

team has produced and it should have more widespread attention.

5

9

148

This email is awesome. From this, you can see what made Barbara Corcoran successful in an ultra-competitive field. Tremendous sales ability, confidence, smarts, and storytelling.

6

14

129

In a tweet today,

@Post_Market

said “strong communication lowers the cost of capital”.

I’m fascinated by the idea and think it is absolutely true for public companies. I’m wondering if this concept extends to private markets, too? I think it does, but curious if others do, too?

25

5

118

@theSamParr

I’m not quite 50, but maintaining flexibility through yoga or regular stretching would be high on my list. I feel like most of the injuries I have had since about age 35 can be traced back to lack of mobility/flexibility.

3

0

101

I’m going to borrow

@sweatystartup

’s thread idea, but try to crowdsource it and change it from RE to PE.

Here’s a starter list of terms (you add the definitions and other terms you’ve heard/used):

- ebitda

- multiple expansion

- unitranche

- turns

- sponsor

Comment and GO!

11

1

95

In searching for a business to buy, effort does not equal progress.

Progress is binary - you've bought a business or you haven't.

Tracking effort, however, in terms of emails sent, meetings, held, IOIs issued, etc is also critical bc the journey is long and success is a

#s

game

7

3

94

Related, corporate jobs have as much embedded career risk as entrepreneurship, and maybe more.

Boss doesn’t like you, company merges, you’re not good at politics, etc. Any, and more, can be career killers.

Founders answer to the markets/their customers

Which risk is greater?

8

7

89

Business buyers: what are the best ways to create proprietary, differentiated deal flow?

Less common (& hard to build) ideas:

1) unique referral sources (best friend is a banker, etc.)

2) content marketing (

@BrentBeshore

)

3) reputation that leads to inbound deals (Buffett)

28

1

90

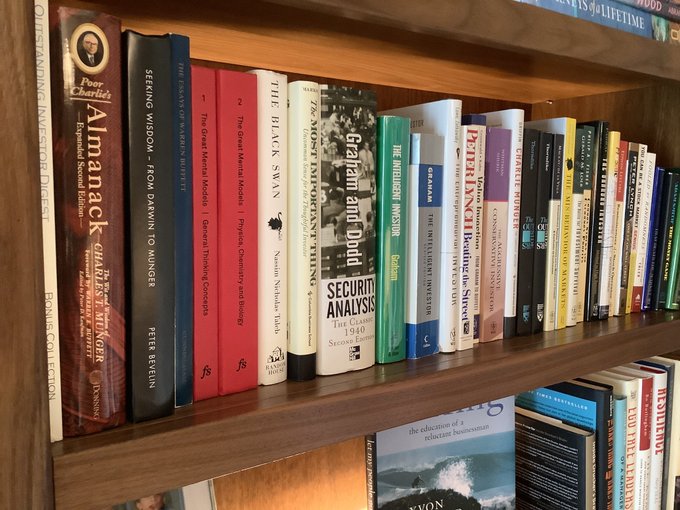

The Great Mental Models series by

@ShaneAParrish

is outstanding and a great addition to any investor’s library. Book 2 just arrived yesterday...looking forward to diving in this week!

10

3

88

Today is launch day for my podcast, Transitions!

I'm honored to have

@moseskagan

as my first guest and there's no one that I can think of whose story I'd be more excited to share than his.

Moses is incredibly thoughtful and well-spoken. Combining that with his humility,…

21

8

88

My Twitter all-stars for 2020:

@brentbeshore

- Most impactful retweeter. Brent kindly shared some of my very 1st posts and encouraged people to follow me. Can’t overstate how much that moved the needle. And, he’s as nice and generous off Twitter as he is on it.

1/3

5

1

86

I like this idea, so I’m going to steal it ;)

Substitute SMB/micro-PE for FinTwit in the call to action below and introduce yourself with a reply to this post.

h/t

@valueterminal

65

6

81

Traditional SMBs that figure out how to leverage no code solutions to drive quality and efficiency in their operations are going to have a distinct advantage over those that don’t...at least until everyone catches on 😀

I’ve been digging in with

@airtable

/ no-code consultants over the past few weeks. Most work with SMBs. It was eye-opening.

My takeaway:

I spend a lot of time talking to startups about the power of these tools...I think I’m completely missing the plot.

46

113

911

8

4

78

🚨 For the past two years I've been pretty quiet about things going on with Majority Search, the investment firm I co-founded with

@justineburris

. It would be a mistake to think that the lack of updates indicates a lack of activity.

Today I wanted to share some big news and…

19

3

78

If you follow SMBTwit, you might think everyone knows about the opportunity to buy a business. But as this eloquent thread demonstrates, it is still early days and there are thousands and thousands of good companies that need a buyer. 2022 is a great time to start!

5

4

74

I’d love to see a Google for podcasts. The service would vacuum up and transcribe podcasts and make all of the content searchable. Like what

@patrick_oshag

has done with Colossus, but for all podcasts. Organize the world’s (podcast) information.

9

0

73