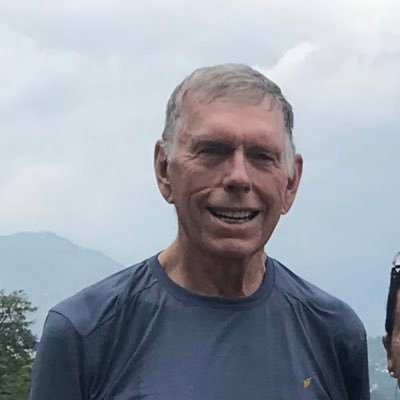

Tren Griffin

@trengriffin

Followers

97,276

Following

541

Media

16,178

Statuses

89,645

I work for Microsoft. Previously I was a partner at Eagle River, a private equity firm established by Craig McCaw. I am on the board of directors of Kymeta.

Seattle, Washington

Joined February 2009

Don't wanna be here?

Send us removal request.

Explore trending content on Musk Viewer

महाराणा प्रताप

• 101692 Tweets

ドカ食い

• 78249 Tweets

もちづきさん

• 65479 Tweets

自動車税

• 45481 Tweets

アイスの日

• 34956 Tweets

血糖値スパイク

• 29734 Tweets

タキオン

• 20975 Tweets

女性向け

• 17335 Tweets

作者の性別

• 16616 Tweets

#BACKSLIVE

• 10871 Tweets

Last Seen Profiles

@garrytan

Fred Destin: “What I do know for sure is that this old Silicon Valley proverb is grounded in age-old wisdom that still applies today: Good boards don’t create good companies, but a bad board will kill a company every time.”

13

166

1K

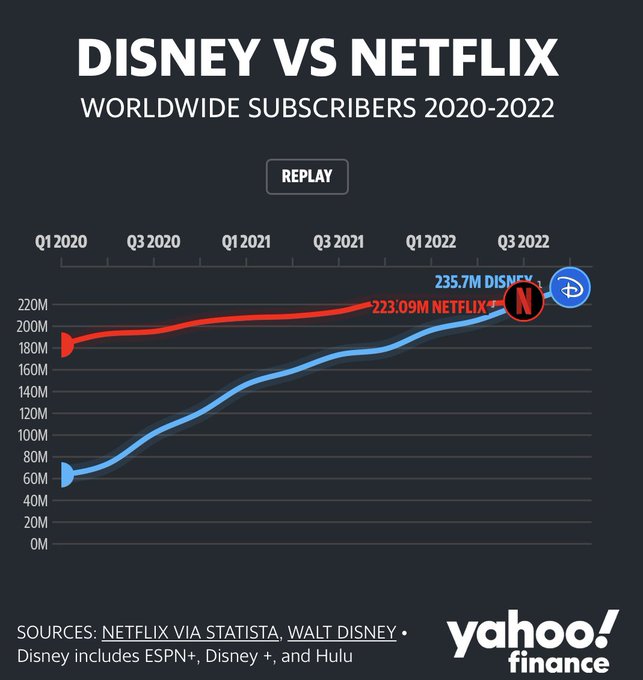

Charlie Munger describes Disney as the equivalent of “an oil company that can put the oil back in the ground after it is done drilling so it can drill it again." Re-drillable intellectual property is the new oil for a business like Disney.

14

112

638

I have been know to say:

"If you haven't read these 45 free papers by Michael Mauboussin, what the heck have you been reading?"

7

94

612

@BillAckman

@joerogan

Why should should people listen to an expert on a topic debate with a conspiracy theorist with no expertise?

96

14

580

Every year as summer vacation season starts I get asked what books I recommend. Some of the best books require a small effort to assemble. Not everyone is willing to do this work. Example: start with the first

@bgurley

post from 1996 and read them all:

12

84

578

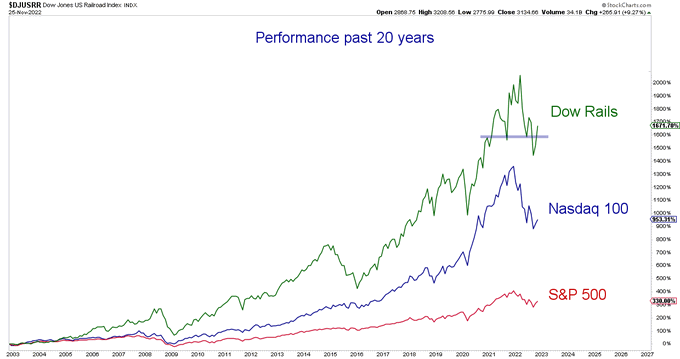

Charlie Munger: "We finally realized that railroads now have a huge competitive advantage. Bill Gates figured this out years before us – he invested in a Canadian railroad and made eight hundred percent. Maybe Gates should manage Berkshire’s money."

7

69

508

Another Griffin family secret is how to process and deal with the death of someone you love. I've lost track of how many people have told me: "Your father helped us so much when [ ] passed away." He was a doctor and a giant in my life. He passed away very early today. He was 94

79

12

443

This podcast with John Malone is self-recommending. He describes Bill Gates arriving for a meeting with a pizza and a beer 6-pack telling him to "Forget hardware since there's nothing in hardware that can't be emulated in software." Malone: "Damn, I should have listened to him."

You don’t have to wait until

#LibertyInvestorDay

to hear the latest from

#JohnMalone

on

@KindredCast

with

#AryehBourkoff

. Insights on media trends, career learnings and hard v. digital currencies before his upcoming 80th birthday.

3

15

162

7

51

410

@businessbarista

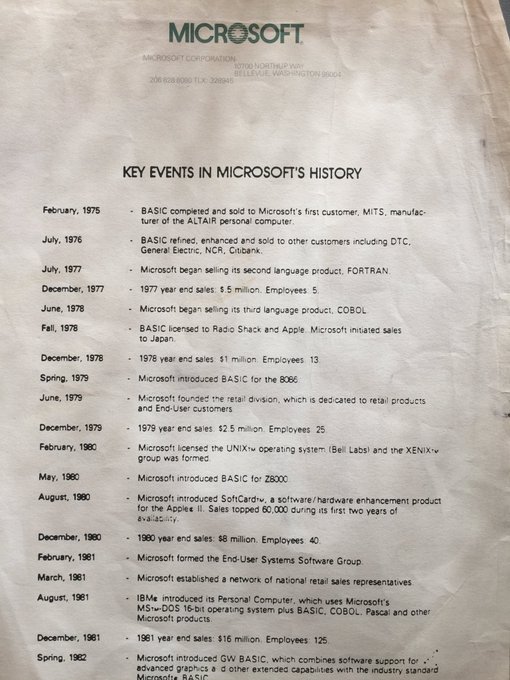

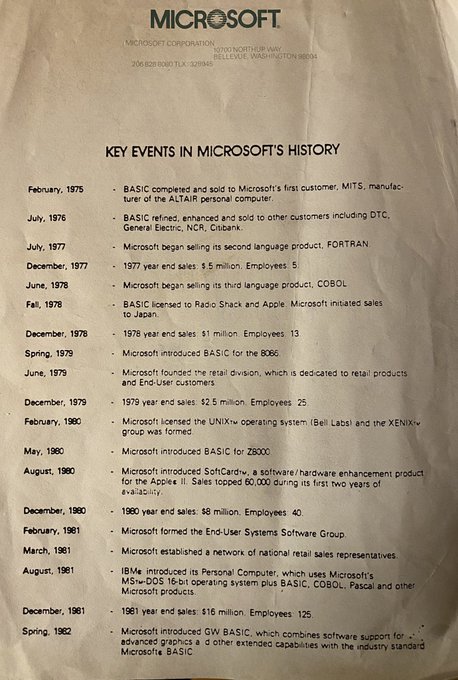

In July 1981 Microsoft purchased all rights to 86-DOS from SCP for US$50,000.

In 1987 Microsoft paid $14 million for Forethought/PowerPoint.

10

38

394