Babak 🇺🇦 🌻

@TN

Followers

9K

Following

2K

Media

5K

Statuses

18K

Whatever the opposite of 'laser eyes' is...

Joined March 2007

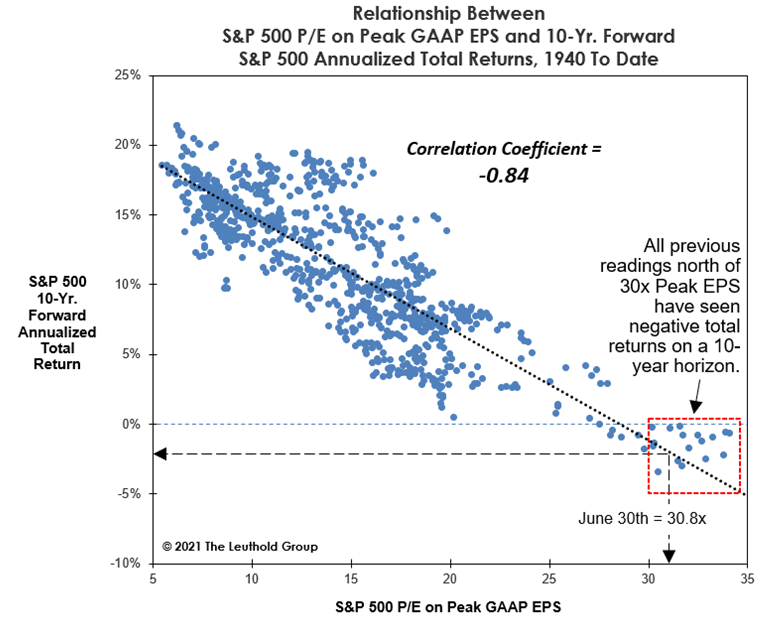

S&P 500's June 2021 peak PE at 30.8 (99th %tile, below Dec 1999's 35.8 an all time record which would put $SPX +5000) such high #valuation corresponds to poor long term returns - a slightly negative 10 year annualized total return! . chart via @LeutholdGroup

2

4

25

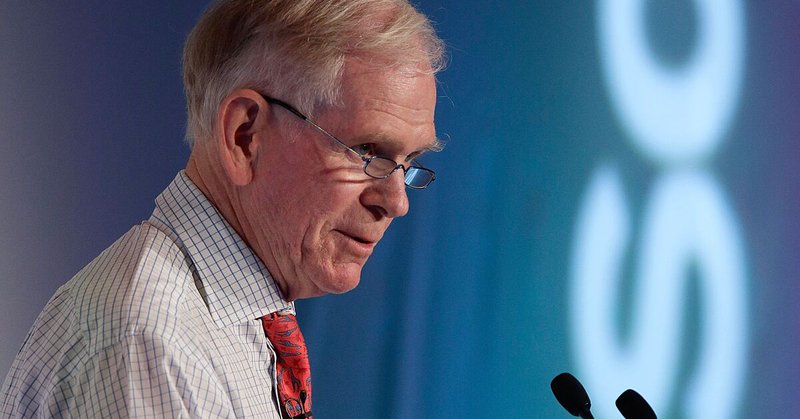

Jeremy Grantham of GMO recently spoke with @johnauthers on the same topic with less equivocation: "The last 12 months have been a classic finale to an 11-year bull market".

bloomberg.com

It’s been just over a year since the last stock market crash, and investors are wondering if another one is on the way. With economic momentum slowing as the effects of fiscal stimulus wear off, it’s...

1

1

5

ICYMI: Ray Dalio gives a quick overview of his judgement re current #valuation and whether we are in a stock market bubble:.

1

1

4

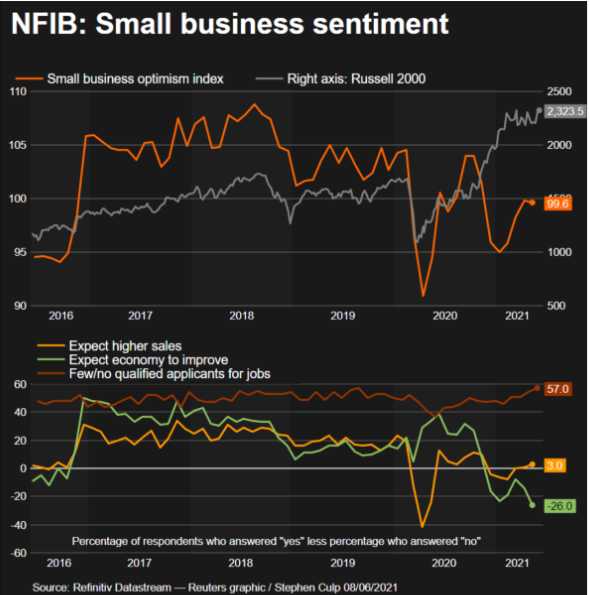

NFIB small business #sentiment 99.6 - notice the response regarding expectations of the economy improving in the lower panel

0

0

4

Rosenberg: "I have not seen a more lopsided view towards higher rates/inflation, roaring '20's economic growth. This is as much a built-in, deeply entrenched consensus view as the Dot-Com's in 1999 & housing was never going to correct in 2007" #contrarian.

2

1

3

ICYMI: David Rosenberg @EconguyRosie on the #inflation vs #deflation debate & his recommendation of long 30 year Treasury bond, potential +25% return over 1 year.

2

1

5

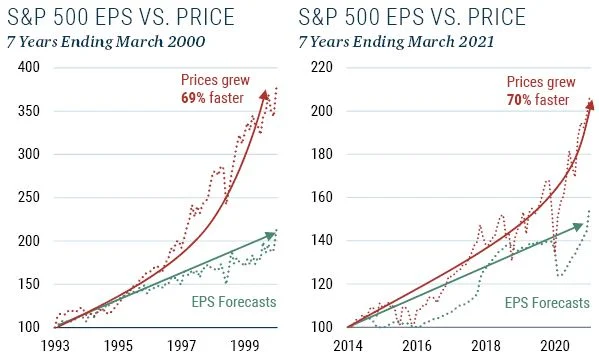

GMO cautions re #valuation by comparing EPS vs prices for 1990's market and today's. EPS forecasts are 2-year forecasts. In the first chart, EPS forecasts grew at an annualized rate of 11.1%; in the second chart, EPS forecasts grew at an annualized rate of 6.4%.

0

1

14

Investors Intelligence weekly #sentiment survey of newsletters shows little change:. bulls 54.5% (up by almost 0.9% pts from last wk).bears 16.2% (slight decline of 0.3% pts).correction 29.3%. chart via @WillieDelwiche

1

0

4

NDR Daily Trading Sentiment 67.8%.NDR Crowd #Sentiment Poll 71.5%. Both are above extreme optimism demarcation lines with negative 1 year fwd expected returns.

1

5

20

A somewhat similar picture via @sentimentrader using Justin Mamis' #sentiment cycle (featured in his book "The Nature of Risk")

1

1

10

TD Ameritrade's IMX (proprietary metric of client activity) at highest level since late 2017. #sentiment

3

16

64