The Capital Allocator

@theallocator_

Followers

4K

Following

8K

Media

893

Statuses

4K

Family Office Investment Lead | Long Term Capital Allocator | Not Financial Advice

Joined October 2022

RT @theallocator_: What if the next decade delivers 0% for U.S. equities and 4% for Treasuries?. The conditional historic method — which ti….

0

5

0

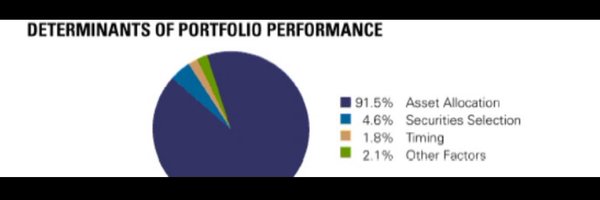

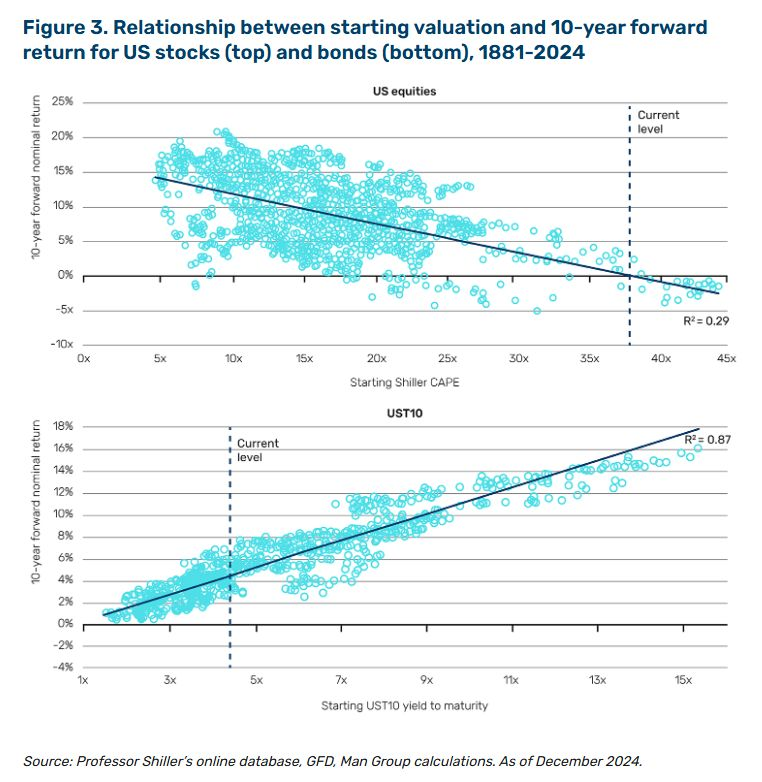

What if the next decade delivers 0% for U.S. equities and 4% for Treasuries?. The conditional historic method — which ties starting valuations to forward returns — points in exactly that direction. Based on today’s earnings yields and bond yields, history suggests:.Equities: ~0%

3

5

11

0

318

0

The cycles of USD outperformance and underperformance are long and persistent. The open question:. Will Trump’s policies be enough to trigger a lasting USD depreciation?. Or, given the Eurodollar market and the “Dollar Milkshake” dynamics, is a long-term appreciation of the USD

0

0

1

Even as passive investors, it’s impossible to ignore the implications of this: nearly 60% of U.S. Assets under Managenent are now passive. That concentration raises important questions about price discovery, market efficiency, and the risks (or opportunities) in the years ahead.

3

0

2

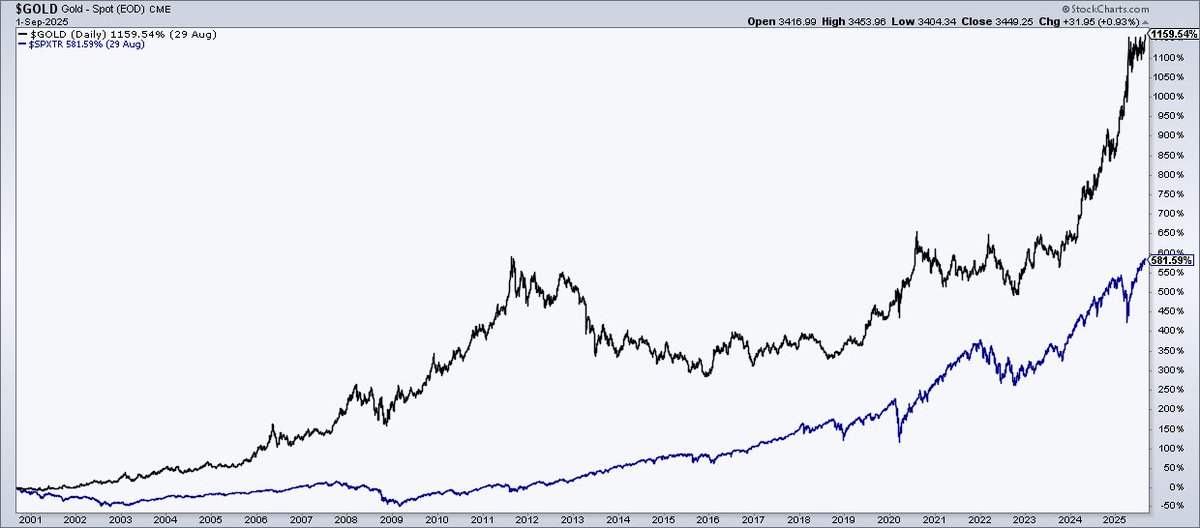

RT @WClementeIII: Gold is like Bitcoin except it actually behaves how people want Bitcoin to, and it's getting twapped by literal central b….

0

23

0

US markets closed, Europe sleepy—but changes ahead: Deutsche Bank back in Euro Stoxx 50, Rheinmetall replaces Mercedes. Bonds show stress (UK 30y at ’98 highs, Dutch pension reform looms), gold & silver surge, while S&P valuations look stretched. September could get rough.

1

0

0

How much stronger would Apple be today if the billions spent on buybacks in recent years had instead gone into R&D?. Siri might not be lagging behind. Apple’s position in the AI race might look very different. $AAPL

1

0

0

For years, media narratives painted a simple picture:. 🇫🇷 Macron as Europe’s political star, leading France into renewal. 🇮🇹 Meloni’s victory as the supposed “end of Western civilization.”. Markets, however, tell a different story. At the start of Meloni’s term, Italian

0

0

2

RT @theallocator_: Warren Buffett’s secret isn’t luck — it’s factors. For decades, the “Oracle of Omaha” has outperformed the market. Many….

0

2

0

Hopes for lower U.S. interest rates have recently sparked a strong rebound in small-cap stocks. The critical question now: can this momentum truly reverse the long-standing relative downtrend versus large caps — or is it just another short-term rally?. Chart: @johnauthers

1

0

0

RT @theallocator_: U.S. stocks still trade at a steep premium, while global ex-US, small caps, and value sit at historic discounts. The “ch….

0

7

0

Warren Buffett’s secret isn’t luck — it’s factors. For decades, the “Oracle of Omaha” has outperformed the market. Many call it genius. But a closer look shows something different. Since 1978, the market factor has been the strongest driver of returns. Momentum, quality, and

2

2

4

In 2024, the consensus was deafening: “Chinese equities are uninvestable. The only game in town is the Nasdaq.”. But markets love irony. Since that capitulation moment, Chinese stocks have quietly outperformed much of the world. A reminder: consensus often marks the end of a

0

5

4

Everywhere you look, people are forecasting Europe’s decline. And not without reason. A glance at France or Germany is enough to see that the road ahead will likely be more turbulent than the present. Yet, despite this narrative of crisis, the euro’s real trade-weighted index is

0

0

1