Bloomberg Tax

@tax

Followers

34,684

Following

722

Media

4,339

Statuses

40,136

Leading source of tax & accounting news #TaxTwitter 📈 ✉️ Newsletter: 🎧 Podcast:

Arlington, VA

Joined February 2013

Don't wanna be here?

Send us removal request.

Explore trending content on Musk Viewer

Kroos

• 732293 Tweets

Chelsea

• 277896 Tweets

Ángel

• 256945 Tweets

The FBI

• 226560 Tweets

Mar-a-Lago

• 172860 Tweets

Poch

• 76221 Tweets

Espinoza

• 75272 Tweets

#TierraDeNadie11

• 63448 Tweets

Fede

• 50813 Tweets

Alleged

• 43124 Tweets

Tuchel

• 41557 Tweets

Secret Service

• 39459 Tweets

#LAMeetandGreetxENGLOT

• 36822 Tweets

Tarcísio

• 34246 Tweets

Blanca

• 32529 Tweets

Luna Park

• 32504 Tweets

Alesp

• 25199 Tweets

Lava Jato

• 24073 Tweets

Mikael

• 21862 Tweets

Greenfield

• 20881 Tweets

Estudantes

• 20494 Tweets

Aurah

• 17415 Tweets

José Dirceu

• 14140 Tweets

Marcelo Odebrecht

• 13898 Tweets

週の真ん中

• 13147 Tweets

Kaytranada

• 11075 Tweets

Last Seen Profiles

The revelations from President Trump’s tax returns reported by the New York Times give new definition to the phrase “shocking but not surprising,”

@SethHanlon

says.

7

117

219

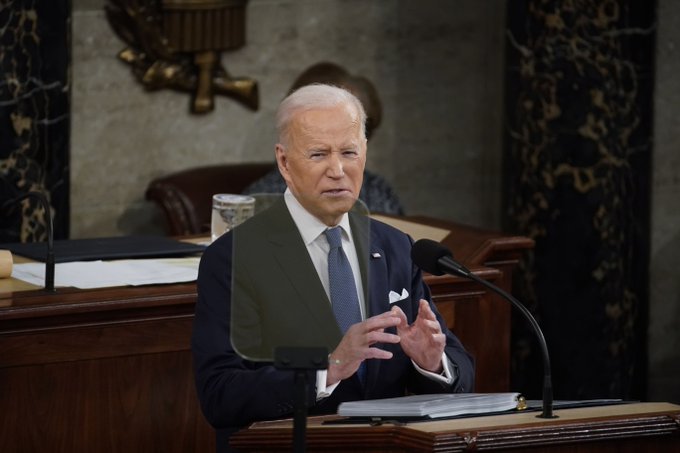

"When we use taxpayer dollars to rebuild America – we are going to Buy American: buy American products to support American jobs," says Biden during his

#SOTU

address.

#TaxTwitter

47

70

195

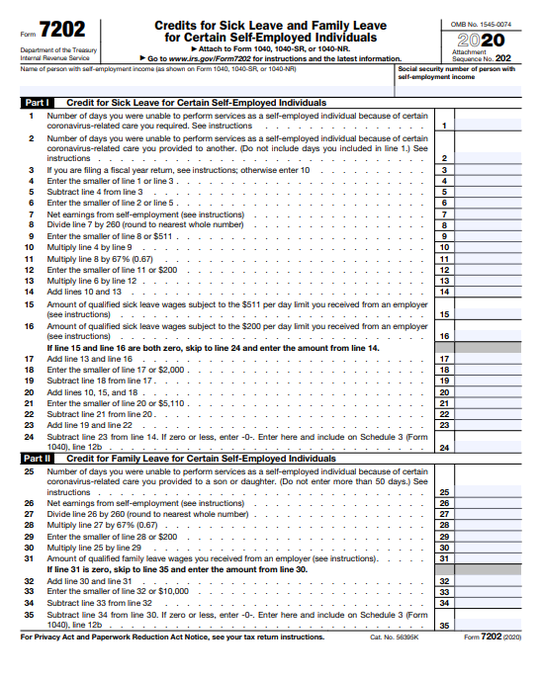

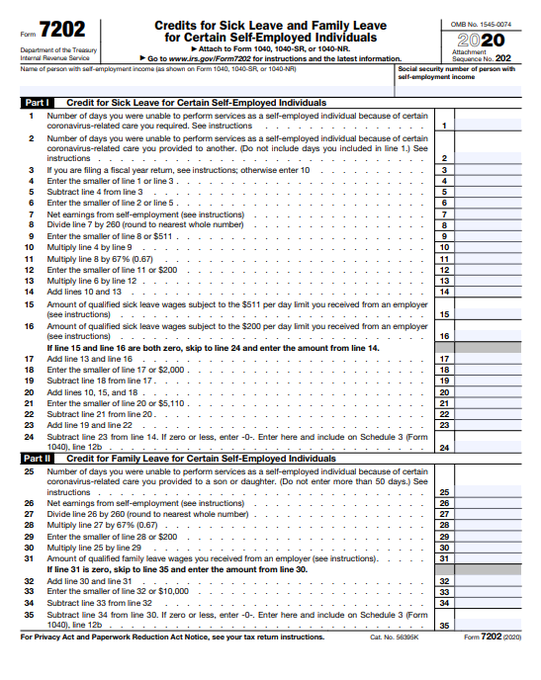

The IRS released a new form that allows self-employed taxpayers to claim tax credits available under a pandemic relief law.

#TaxTwitter

4

27

79

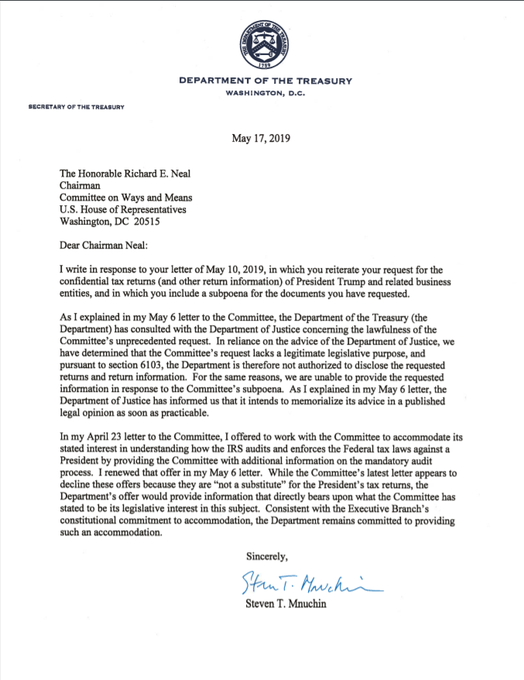

This is the long-game strategy, and would likely take months, if not years, straight through the 2020 presidential election.

Neal has indicated he would would rather go straight to court than hold Mnuchin in contempt of Congress.

Follow

@allyversprille

for more on this story.

10

22

75

Opinion: The Democrats’ latest reconciliation proposal could spur greater inflation in the short term and damage the US economy, says Sen.

@ChuckGrassley

.

76

23

60

Countering bad advice, especially during tax season, is crucial.

@taxgirl

clarifies common tax myths from whether filing taxes are mandatory and if Social Security benefits are taxable.

5

23

58

We can't wait to have

@taxgirl

on our team!

2

3

50

Some tax myths have some basis in fact such as writing off expenses with an LLC, but are you exempt from payroll tax if you file as an S corporation?

@taxgirl

takes a look at some tax takes making the rounds and explains why they're wrong 👇

0

16

44

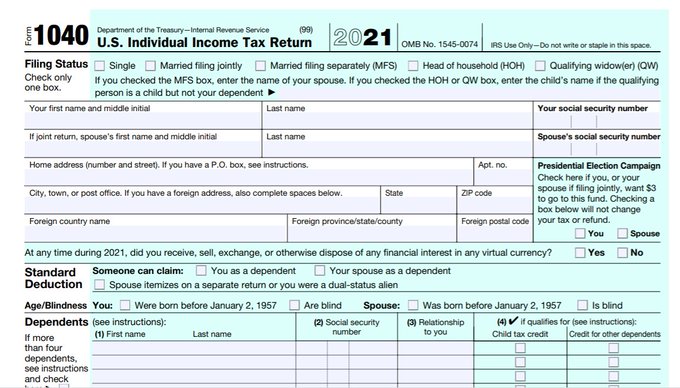

BREAKING: The IRS is planning to delay the April 15 tax filing deadline by about one month, likely to mid-May.

#TaxTwitter

4

31

38

The IRS released a new form that allows self-employed taxpayers to claim tax credits available under a pandemic relief law.

#TaxTwitter

0

13

39

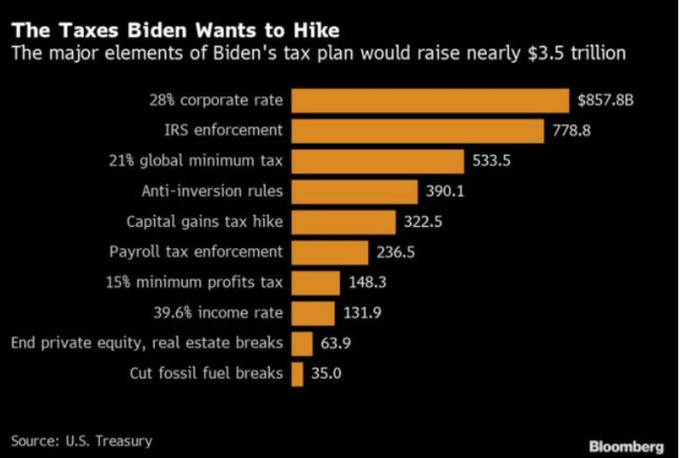

Coupled with an existing surtax on investment income, federal tax rates for investors could be as high as 43.4%, according to people familiar with the proposal.

Scoop from

@allyversprille

and

@laurapdavison

.

8

5

36

Opinion: It’s time to start considering the issues that should dominate the national and international tax agendas for the next decade or two, says

@UoS_Management

’s

@RichardJMurphy

.

1

12

33

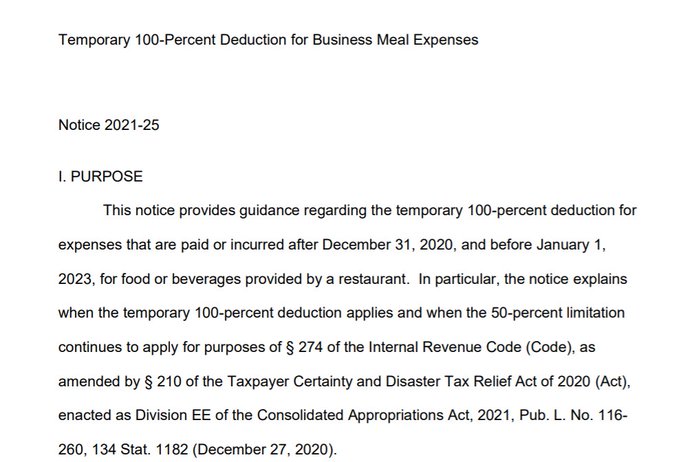

The IRS announced businesses can claim a 100% deduction on restaurant meals through the end of 2022.

#TaxTwitter

0

14

29