Simon Taylor

@sytaylor

Followers

57K

Following

81K

Media

2K

Statuses

55K

#Fintech Geek. Ranting @ https://t.co/u3KhcpA0w9

Joined January 2009

I JUST TRIED THIS AND OMG IT WORKS. Wow. Wow. Wow. I'm sorry, I try to stay away from hyperbole I really really do. But lets face it everyone when making a website uses a few other sites as inspo. This is that but 100x faster.

this AI is incredible. Gamma AI now can clone any website in mins and. you just need to copy & paste the link, no coding needed. step by step tutorial:

21

81

1K

So @Europol say €2/3bn is laundered via crypto. If a €500bn market that's 0.5%. Compared to an estimated $2trn of money laundering in wider financial services this is tiny and much easier to detect / prevent. Im surprised it's being briefed against. Cc @ukhomeoffice.

22

273

503

Thing I didn't realize until just now. @ensdomains supports DNS domain names. Meaning your .com can also be your .eth. Delightful backward compatibility choice.

18

47

512

This is precisely what working in a bank is like (by @gapingvoid). We need to do something meaningful!

15

215

382

People now spend more on emotes and skins for video games than the movie industry made in 2019 📈 💸.

In 2020, people spent $54B on skins, virtual goods, and extra lives in games like Fortnite & Candy Crush. It's one example of how fungible and non-fungible tokens enable an internet-native economy, says Patrick Rivera. And it's just the beginning.

11

87

381

Instagram now has NFTs on @0xPolygon . While JP Morgan conducted DeFi trades on Polygon. Of all the "L2's" - Polygon is becoming the Redhat / enterprise default.

14

55

359

Hands up if every time you discover a new Neobank or Fintech company you scroll to the bottom to see who the sponsor bank is?. #fintechnerds where you at?. ✋.

59

18

345

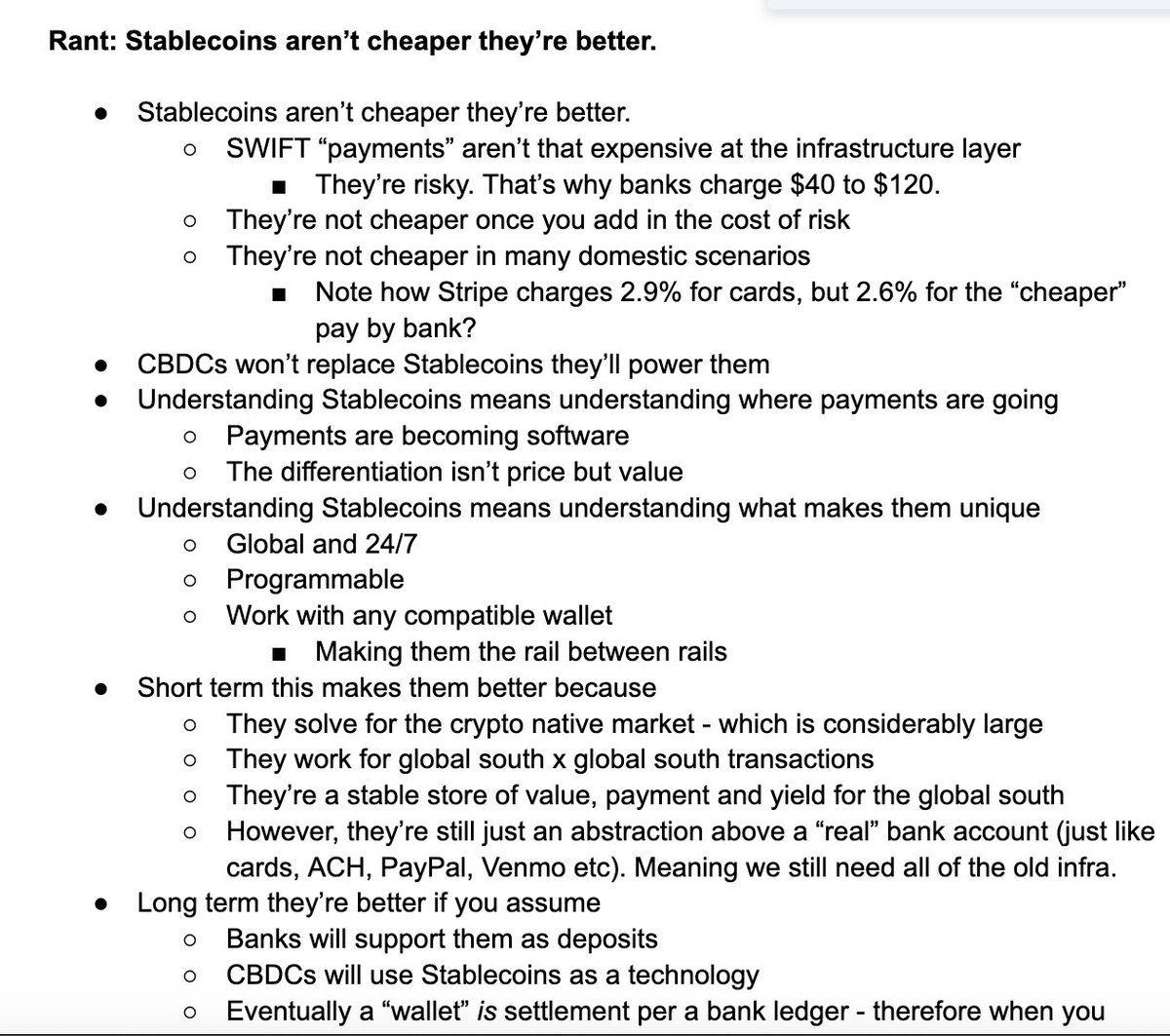

Confirmed: @stripe's biggest-ever acquisition is of the Stablecoin platform Bridge. Bridge provides software that helps businesses accept Stablecoin payments and simplifies the infrastructure (a bit like Stripe does for TradFi). 🧠 This will go down as an Instagram-like.

18

35

221

ONE HUNDRED AND TWENTY FUCKING MILLION FOR WEBINARS??!!!. Jesus Christ this is peak silicon valley boys club. is a spectacular failure and someone just needs to kill it. It's not a "hard thing about hard things story". They had insane resources and failed.

15

38

192

Fintech 1.0 = Better UX.Fintech 2.0 = Embedded finance.Fintech 3.0 = Defi (better infra). H/t @JohnStCapital.

8

31

204

So @CryptoKitties is Pokémon for Capitalists. It's #esports meets #blockchain . Oh and you can get people to pay to breed with your crypto kitties. This is the new economy. People are weird.

10

70

196

This year's @ycombinator winter batch had 25 #fintech companies (13% of the total). Here's my breakdown of each of them 👇.

9

53

168

🆕 @coinbase launches x402, the HTTP for Money, built on stablecoins for Agentic Commerce. Buzzwords aside, this could be the most significant thing to happen to payments since tokenization. That's not hyperbole. Hear me out. The internet was built to move information, not

13

26

163

So Bank as a Service is a hot #fintech topic, but what is it? 🤔. ● BaaS allows any brand to embed financial.services into its customer experience. 🍎. ● . by picking and choosing capabilities.offered by providers… 🛠️. ● …and licence holders in a modular fashion. ⛓️

9

58

138

The biggest thing happening in #fintech is every day #wealth #savings and .#investments e.g. Robinhood, Acorns, Plum and Moneybox. This is far bigger than "robo advice" and is well worth your attention if you work in product or strategy.

7

41

125

Massive massive massive news. Square is now a bank. 🤯🤯🤯🤯.

FDIC approved the deposit insurance application submitted by Square, Inc., to create a de novo industrial bank. Square Financial Services will originate commercial loans to merchants that process card transactions through Square’s payments system.

4

35

118

Wondering about @Libra_ ? Is it a #cryptocurrency? Who's involved? 🤔. I went and wrote what I think are the 11 most interesting things about Facebook's new #cryptocurrency 👇.

8

58

121

My thoughts on @RevolutApp finally getting its UK banking licence. It's UK Banking license will allow it to offer overdrafts, loans, and savings products to its more than 9m UK consumers. 🧠 This is a huge moment for Revolut and UK Fintech. Revolut has talked a big game on the.

7

21

124

Ok so Lucite AI is WILD. It's an investment banking analyst as a service. Here are some slides it pulled together about $AFRM with just the stock ticker and home page as inputs. Now everyone is @FTPartners 🤯

14

9

127