Sruthi Lanka

@sruthilanka

Followers

904

Following

932

Media

8

Statuses

777

CFO at https://t.co/ZTMtjulerd. Love finance, tech, food and the intersection of any two of the above. Passionate about enabling women in tech to succeed.

Brooklyn, NY

Joined February 2009

Tokenization of private companies is tricky and risky. Public used to offer alternative assets like music royalties, and we looked deeply into offering tokenized private company shares. Here’s why we haven’t done it: The risks come down to four aspects: 1) Liquidity 2) Supply

22

37

279

We created a watchlist app with AI superpowers. If you still use the Apple stocks app, you should use Alpha: https://t.co/5mjgubkJee Let us tell you why🧵

9

19

86

With Election Day 2024 just a week away, we're excited to introduce the best way to place a bet on your preferred candidate:

placeyourbet.us

With Election Day 2024 just a week away, we're excited to introduce the best way to place a bet on your preferred candidate.

11

25

72

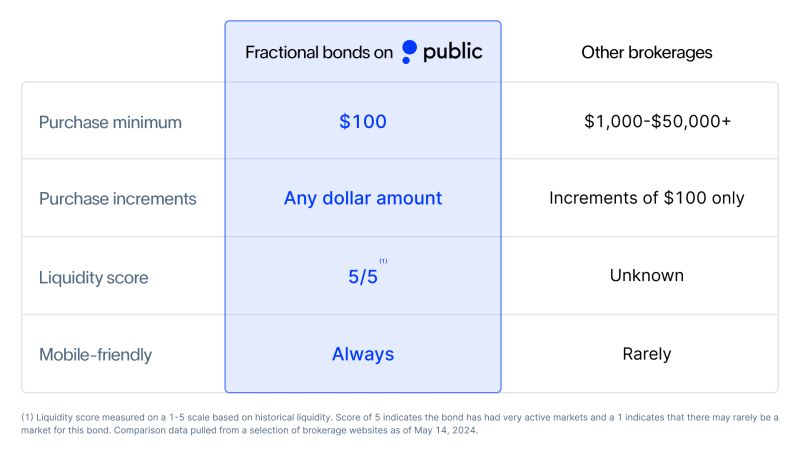

Changing the way you invest, one timely innovation at a time. Now you can earn 7.3% yield (!!!) and gain exposure to bonds without dusting up your bonds 101 textbook.

0

0

4

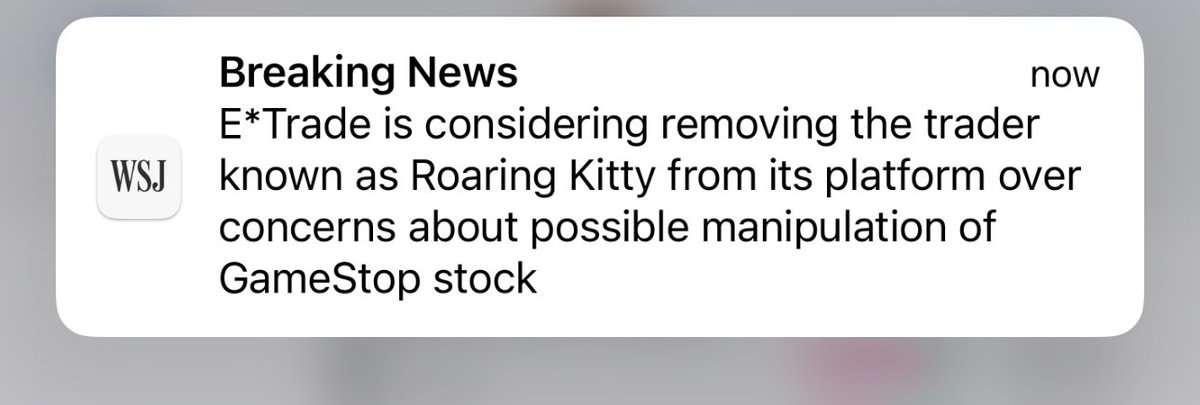

Hey @TheRoaringKitty - you’re always welcome to trade over @public (we’ll cover the ACAT fees).

254

644

4K

did you know you have a free AI-based market research assistant built into the Public app?

0

0

1

Super cool partnership, join if you haven’t already!

Our partnership with @CLEAR is officially live! We're thrilled to enhance our identity verification process, allowing new members to join in under a minute. CLEAR Plus Members can receive $100, and CLEAR Members can receive $50, when they sign up and deposit at least $20. Sign

0

0

2

Our partnership with @CLEAR is officially live! We're thrilled to enhance our identity verification process, allowing new members to join in under a minute. CLEAR Plus Members can receive $100, and CLEAR Members can receive $50, when they sign up and deposit at least $20. Sign

2

9

30

Corporate bonds are yielding anywhere from 5% to 25%... but are hard to invest in due to high minimums, antiquated/illiquid market structures, and clunky UI/UX. Fractional corporate bonds solves those problems, making it simple to buy debt in companies like Nike, Amazon, Nvidia,

The smallest thing to ever happen to bonds. Fractional bonds are here. Exclusively on Public. https://t.co/MI1TRV8TAP

2

3

20

📈🔥 🔝 5️⃣ On the back of @public's podcast The Rundown w/ @AdmaniExplains going top 5 in Spotify Business, we're announcing the Public Media Network, already including two other pods with @hopeking @ARKInvest @AnnBerry_NYC any many other great hosts. Check out the full line-up

Update: The Rundown, hosted by @AdmaniExplains, reached the Top #5 Business Podcasts on Spotify! You can check it out, along with our other shows, Leading Indicator and The Brainstorm on https://t.co/CFhLwC17Q4 See thread on how to listen/view 👇

0

4

12

Major update to our portfolio screen. Team has nailed this one. Making it more sophisticated, yet cleaner at the same time. Customize your portfolio views, see allocation breakdown by asset class, and more.

Introducing the new-look Public portfolio, with more ways to track your performance, customize your data, and organize your investments. Here are some highlights:

3

3

27

So would @karaswisher cross to the regulatory side of #tech? Throwback to our conversation on her bestseller “Burn Book” for @public (link below) 🔥🔥

1

1

13

really enjoyed this candid conversation alongside terrific panelists @jasonmok @blader @hanstung & Jennifer Kested

Last week, our CFO @sruthilanka joined @FintechMeetup alongside @brexHQ, @runwayco, @GGVCapital & @IBM to discuss modernizing the CFO suite with fintech and embracing data for finance automation #fintech

0

0

7

Can’t wait to join @sruthilanka, @blader & @jasonmok in a #FintechMeetup panel w/ Monica Proothi: Modernizing the CFO Suite w/ Fintech (10 am Mon, Venetian). I’ll explain why it’s time for a new gen of financial software to unify the office of the CFO. https://t.co/xJhhoaBlHs

1

1

13

Last week, we announced updates to options data, high-yield cash account improvements, and charts. This week, our focus has been on bonds. Keep your requests coming—we’re adding features and improving the experience every week!

2

4

17

With your feedback, we’re adding features and improving the experience every week. Keep your requests coming, and read on to discover what we’ve implemented this week.

2

7

16