samyakjain.eth 🦇🔊🥑 🌊

@smykjain

Followers

11,579

Following

808

Media

328

Statuses

4,393

Co-founder @Instadapp @avowallet @0xfluid . Ethereum. DeFi. Forbes 30 under 30 India.

Joined May 2014

Don't wanna be here?

Send us removal request.

Explore trending content on Musk Viewer

Champions

• 232355 Tweets

Dortmund

• 192101 Tweets

Senna

• 176180 Tweets

Sancho

• 137284 Tweets

Gustavo Petro

• 131829 Tweets

Mbappé

• 90312 Tweets

#BVBPSG

• 82604 Tweets

Madonna

• 81354 Tweets

Boulos

• 57813 Tweets

Paco Villa

• 56601 Tweets

Powell

• 48440 Tweets

Le PSG

• 39308 Tweets

Ramos

• 33114 Tweets

Flopou

• 32908 Tweets

Dembele

• 31432 Tweets

Bruno Mars

• 28154 Tweets

Canelo

• 20971 Tweets

باريس

• 20834 Tweets

Kolo Muani

• 20338 Tweets

دورتموند

• 16970 Tweets

Adeyemi

• 16054 Tweets

Fullkrug

• 14979 Tweets

Reus

• 14709 Tweets

Fabian Ruiz

• 14388 Tweets

Nuno Mendes

• 14137 Tweets

Ronnie

• 13707 Tweets

Hakimi

• 12777 Tweets

Luis Enrique

• 10802 Tweets

Maatsen

• 10155 Tweets

Barcola

• 10053 Tweets

Last Seen Profiles

@Uniswap

daily ETH/USD volume is >$1B on mainnet daily which is more than Coinbase even with heavy gas cost.

It's soon going live on

@0xPolygon

which has near 0 gas cost.

Will Polygon become the main hub for swaps using the most advanced swapping algorithm ever created?

47

186

750

What if…

@0xPolygon

releases a 1 click private blockchain with pre-set validators and call it web3 servers.

Just like how AWS allows you to deploy web2 servers. Polygon can allow you to deploy rollups.

23

48

534

Okay,

@0xPolygon

is my new playground. Mainnet experience with Metamask. Transfer fee = $0.000028.

Now gonna borrow $10 on

@AaveAave

! Yes! DOLLOR TEN!

21

41

329

When the workspace throws you out because of closing time so you decide to make

@Uniswap

on

@0xPolygon

live from the footpath.

15

28

294

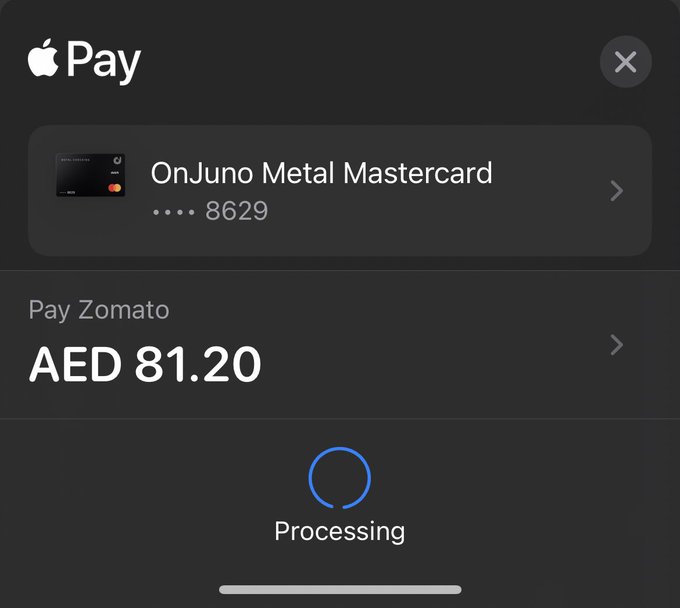

I have been waiting to use crypto for regular things since forever.

Today I bought my food on Zomato via Apple Pay paying with $USDC using

@JunoFinanceHQ

.

Next bull run we are going full on mainstream anon.

23

18

241

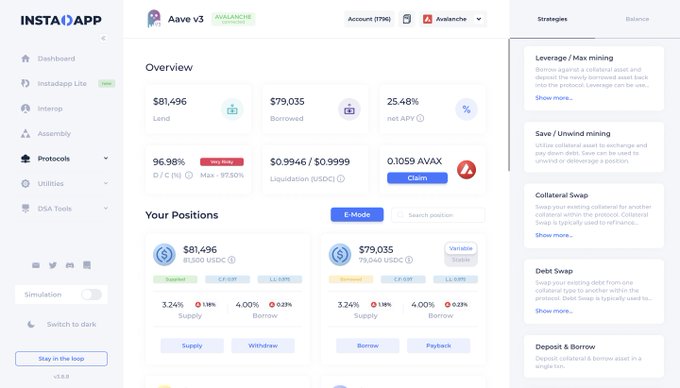

Currently, users are earning risk-free +20% APY on stable at

@AaveAave

on

@0xPolygon

via

@Instadapp

mining strategies.

17

41

209

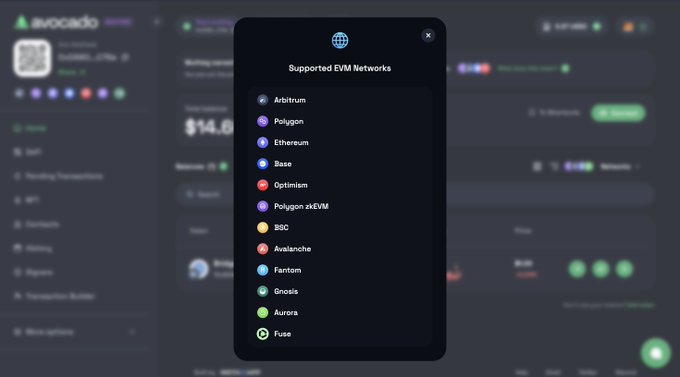

Nothing is scaling nearly as fast as Ethereum. In just over a month.

- Coinbase announced

@BuildOnBase

with

@optimismFND

.

-

@arbitrum

launched $ARB.

-

@zksync

launched Era.

-

@0xPolygonLabs

launched zkEVM.

Next bull run, Ethereum will be ready for billions of users.

Bullish 🚀

16

18

184

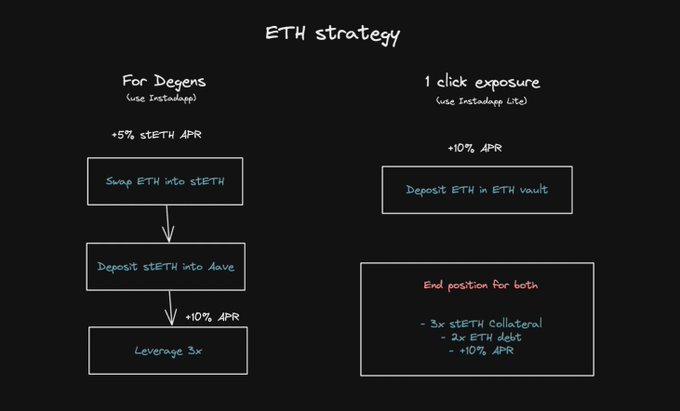

+10% APR USDC strategy by leveraging the current market conditions.

Using

@LidoFinance

's stETH,

@AaveAave

&

@Instadapp

's smart account.

21

32

184

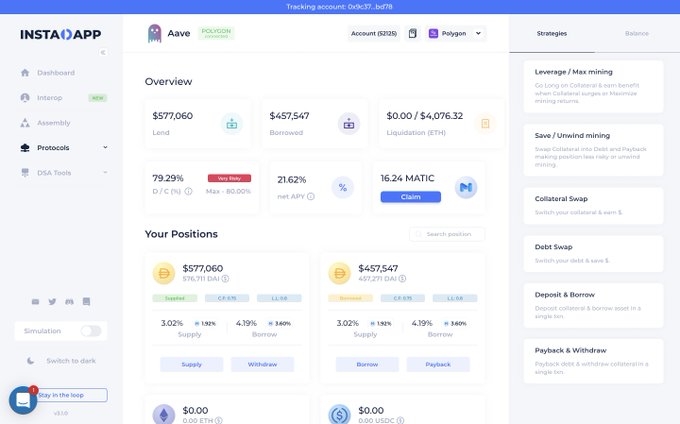

There's an opportunity of ~100% MATIC mining on

@AaveAave

on

@0xPolygon

(similar to COMP mining).

APYs on DAI:

Supply: 5.34% + 10.29% MATIC = 15.63%

Borrow: 12.72% MATIC - 7.33% = 5.39%

Liquidation on DAI at 0.8. Meaning you can go 5x.

Net: 15.63% * 5 + 5.39% * 4 = 99.71% 🤯

15

32

184

Community be comparing

@Uniswap

v3 & Curve of the stable-coin swap but what innovation Uniswap brings is anyone can deploy their own pool and the stable coins don't need to be of equal value. It can also be the pair of USDC <> RAI, DAI <> RAI, etc which is an untapped market.

11

19

170

Yield farming is cool but still, my favourite thing is to go long on ETH.

1. Deposit ETH.

2. Borrow DAI.

3. Swap DAI into ETH.

4. Deposit it back again.

or do everything in a single step on

@Instadapp

20

38

165

It's been 3 hours since we released Bridge b/w

@MakerDAO

&

@compoundfinance

and already 1015 $ETH and 162564 $DAI has crossed the bridge.

This is awesome 🤯

7

28

172

Shower thought!

Use L1 AMM liquidity for L2 AMM?

With

@BalancerLabs

v2 using the asset manager it can allocate a small part of the asset for L2 AMM to kick start the AMM environment in L2 without the need of any liquidity provider on L2.

cc

@fcmartinelli

13

18

165

Due to sudden $ETH plunge CDP owners started to shift to Compound because of 75% liquidation ratio.

Currently on

@InstaDApp

more assets are managed on

@compoundfinance

than

@MakerDAO

. 🤯

6

15

153

Just captured instant 36.5% (10,652 USDC) returns on 29,186 USDC by going >10x on USDC vault with the use of DSA's flash loan on

@Instadapp

.

At the time, 1 DAI = 1.03 USDC.

Increased DAI supply by 360,000 and helped in making DAI stable.

13

26

147

Just used

@optimismPBC

for the first time to test out

@Instadapp

's integration.

UX of Optimism is by far the best in L2s imho.

Bullish 🚀

8

15

143

First-ever flashloan aggregator going live in ~2 weeks at

@Instadapp

✅ Aggregating many providers on a single chain.

✅ Multiple chains support.

✅ Access wide liquidity and most tokens.

✅ Advance routing for lower fees & better liquidity of tokens.

9

29

136

In a single day around 3,865 $ETH ($1.2M) & over 500K $DAI has crossed the bridge from

@MakerDAO

to

@compoundfinance

.

Decreasing the supply of $DAI by 500K and increasing the amt of $DAI locked in Compound due to increase in $DAI APR.

Enabling $DAI stability from both sides. 😎

Launching the Decentralized Bridge between

@MakerDAO

&

@CompoundFinance

- easily switch your debt position b/w protocols with best rates in just one click.

18

78

315

3

19

133

The proposal to increase capital efficiency on the MATIC market went live on

@AaveAave

v3 on

@0xPolygon

.

What does this mean & the opportunities it opens?

Thread 🧵

4

21

126

👀 Someone did an arbitrage txns between DAI <> USDC via DSA using Flash loan and

@1inchExchange

connector with just JS script.

Total trades ~$134,000 🤩

Net benefit ~$30 🤑

All of it is done without any initial capital.

10

21

130

Construction of Bridge 🌉 b/w

@MakerDAO

&

@compoundfinance

is almost completed. Just transferred 0.1 $ETH and 100 $DAI from Maker to Compound in one click. Inaugurating soon 😉

#Interoperobility

b/w

#DeFi

protocols

4

20

120

🤯 Someone swapped 548k USDC debt into 543k DAI debt. That’s instant $5000 discount on the debt plus 4% discount on borrow rates.

Borrow APR:

DAI - 2.7%

USDC - 6.69%

9

23

99

I just deployed my DEX platform powered by

@KyberNetwork

. I tried to make it as easy as possible. Just a one pager dapp with an easy to swap UX.

7

25

96

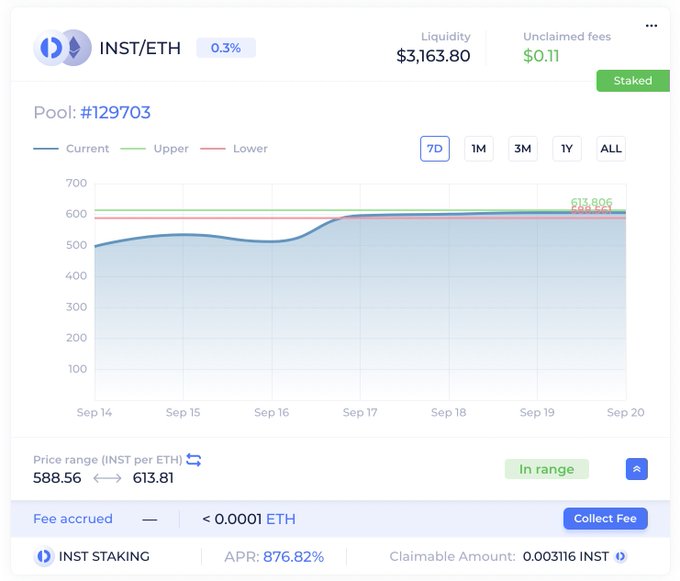

1/

@Instadapp

's new LM recently got live with a new

@Uniswap

v3 staker. Allowing ETH/INST NFTs to get APR from 9.21% to 6150.81% (at the time of writing this).

This thread explains the Uniswap v3 LM mechanism.

12

18

89

1/ I just proposed Automated DeFi Limit Orders on top of the

@Instadapp

protocol. A new kind of DEX build on lending protocols (

@AaveAave

&

@compoundfinance

) to possibly provide the best swaps for stable coin pairs (USDC, DAI & USDT).

2

17

88

Potential revenue streams for Instadapp protocol (DSL).

Exciting discussion going on at

Appreciate

@akshaybd

to kickstart this discussion

3

11

90

DEX idea better than

@UniswapExchange

. Forking

#Uniswap

and using

@compoundfinance

V2. One can make new DEX where pool liquidity will be in CTokens. CETH will be base token replacing ETH.

Liquidity provider will get benefit from swap as well as interest via

#Compound

.

1/

8

13

93

Launching

@MakerScan

Telegram Bot to track

@MakerDAO

CDPs. Would love to hear your feedback.

6

22

89

Earnings on

@Instadapp

Lite going live tomorrow.

Users will be able to track how much they have earned lifetime through a vault.

Eg: This user earned ~23 ETH within ~15 days on his ETH deposits 😍

10

18

89

How it started vs how it's going 🌊

1/ Today, we are thrilled to unveil Fluid (

@0xFluid

)

An ever-evolving DeFi protocol, base for future financial system.

Enabling highest capital efficiency and unbeatable rates.

27

72

239

4

10

80

Just batched 4

@UniswapProtocol

swaps into one txn to swap my dust tokens all into ETH using DSA with just a few lines of JS.

DSA makes is so much easier for DeFi Composability.

In the process:-

1. Saved some Gas.

2. Saved time by not doing 4 different txns.

6

9

78

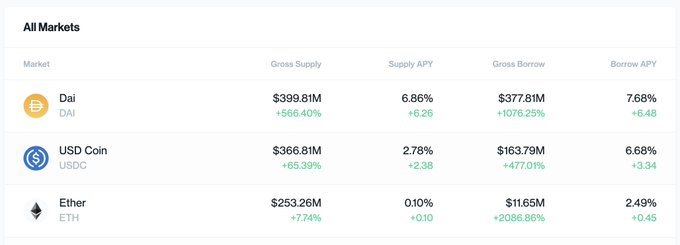

Day 2 of

@0xfluid

launch.

TVL: +$20M

Total Supplied: +$42M

Total Borrowed: +$22M

Safe to assume next week's target as $100M TVL? 🤔

Interesting! 🌊🌊🌊

In less than 24hr,

@0xfluid

has reached $11M in TVL with ~$24M in total supply & ~$13M in total borrow.

Currently, users can earn +100% in APR on stable through on-going rewards.

And users can earn +15% APR ETH collateral while borrowing stables against it.

3

10

42

10

14

80

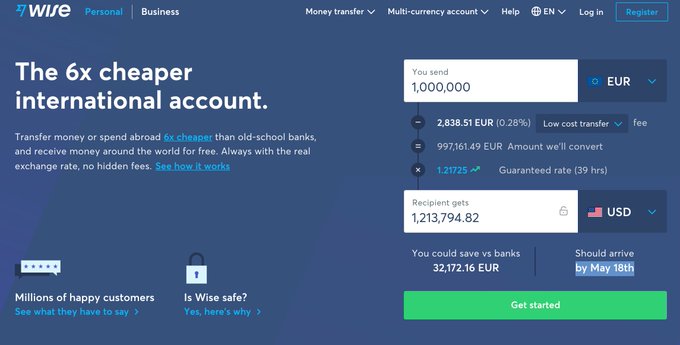

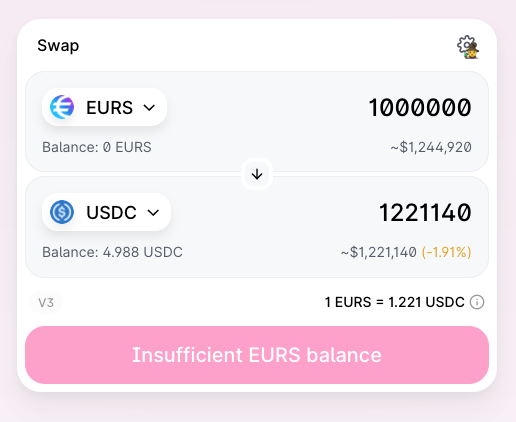

With

@avowallet

you can transfer funds from "any address on any chain to any address on any chain"

For example, in this txn, I'm transferring 200k USDT from Ethereum to a multisig on Polygon.

10

10

78

🥑 Amazing! Just 10 days since Avocado's launch, we've achieved:

- 4,000+ transactions

- 600+ users

- $10,500+ total gas spent

- $1,000+ in governance revenue

And we're just getting started! 🚀

EOY Goal: $100,000 avg. daily gas spent!

5

15

69

Current APY on USDC on AAVE mining is more than ~190%.

Math:

supply: 19.85*6.66 = +132.201%

Borrow: 10.2*5.66 = +57.732%

Net: 189.933%

You can go up to 6.66x on USDC using the Max AAVE mining strategy at

5

9

73

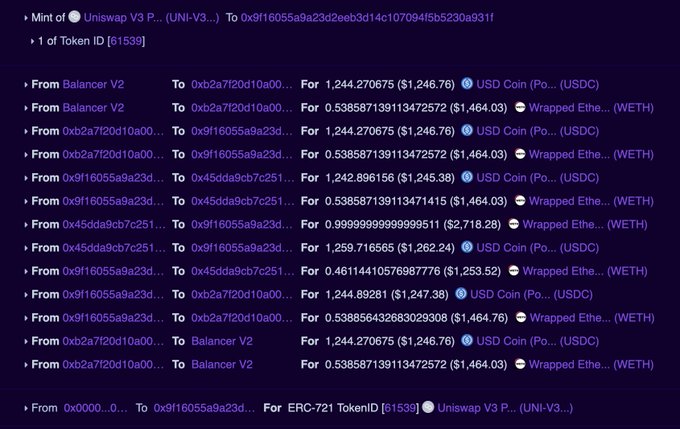

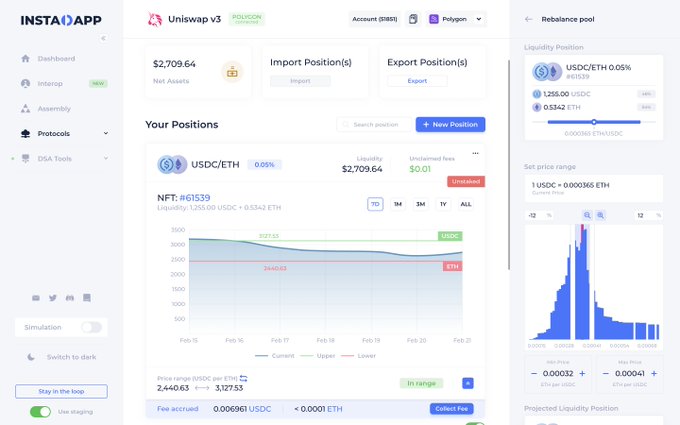

Just did 1 click Uniswap NFT rebalancing.

Removing the trouble of manually withdrawing, swapping and creating new NFT to get in range or change range.

Strategy coming soon on

@Instadapp

;)

5

12

63

@coryklippsten

@a16z

lol. I was reading so seriously and got Vitalik into this sh*t, and suddenly none of this was valid.

You probably would have called bullsh*t on many more things which have not collapsed, which you will surely not mention here.

4

0

64

There's gonna be a 2 digit APYs on

@AaveAave

in 2-3 hours when AAVE mining goes live.

@Instadapp

is ready for AAVE mining. Instadapp's users are getting ready for AAVE mining. Are you ready?

4

12

66

Super excited to onboard

@DeFi_Made_Here

as core team member.

Our vision together will be to take

@Instadapp

to multi-billion $ valuation and we are just getting started.

We will be fronting on all ends to make Instadapp the best DeFi hub!

- Instadapp Pro: Best DeFi aggregator.…

1/🧵 6 months ago I read an

@Instadapp

blog article that made me re-imagine the DeFi

Today I'm joining the team as a Head of Growth to build the next 🦄

This is my story of how a random Twitter guy made it to become a C-level executive in the most advanced and promising project

37

21

185

11

7

69

Earning on ideal ETH which no risk?

1. Deposit ETH & borrow DAI in ETH-A vault.

2a. Deposit DAI on Compound & Maximize COMP mining.

2b. Deposit DAI in Aave & earn 13% APY.

2c. Deposit DAI in Curve & earn >10% APY.

Secure vault with Automation on Instadapp. Sit back & relax.

Introducing Instadapp Actions! 🤖

Automate your Maker ETH-A Vaults to refinance between Maker ETH-B, Aave & Compound to protect from liquidation. More advanced automation to come!

Powered by

@gelatonetwork

13

31

122

11

8

66

In these hard times if your vault gets risky. Remember

@Instadapp

provides vault swap on

@MakerDAO

to switch from any collateral type to any collateral and have a higher margin on your liquidations.

5

14

64

One

@avowallet

user took all the 8000 weETH supply limit and is now farming 2x

@ether_fi

& 1x

@eigenlayer

points at 2.4% ETH borrow rate 👀

The

@EtherFi

weETH is on Aave.

But ppl have sniped the opportunity and supply cap was reached in a few minutes.

We’ll coordinate with

@chaos_labs

and we will propose to increase caps shortly.

6

7

101

5

11

63

We've been using our highly powerful flashloan internally at

@Instadapp

for quite sometime now.

It uses dydx, Maker, Compound & Aave to source the best available liquidity FREE OF COST.

Currently, you can borrow.

1. ~$189M of ETH.

2. ~$141M of DAI.

3. ~$141M of USDC & much more

3

8

63

Using

@0xPolygon

reminds me of the before 2017 era on Ethereum main-net and how we used to pay 1 GWEI for the transaction to get through!

Good old days!

Scalability is coming sooner than you expect!

3

12

61

It's been around 3 months since we launched

@InstaDApp

and it already covers 0.5% of total DAI creation.

This year's Target is to make it +5%. Anyone wants to contribute? 🌚🌚

~380k DAI lent via InstaDApp with USD +1 million worth ETH kept as collateral till date. We share a tiny fraction of 0.5% of overall market share in

@MakerDAO

protocol.

0

8

50

7

7

57

@Instadapp

being the middleware. It involves us working with many other protocol teams.

Recently, while working with

@LiquityProtocol

. I got to know the dynamics of the protocol which makes it one of the simplest & most secured protocols (economically too).

Thread.

4

13

53

In development since last 1.5 years. Finally it's out 👀🌊

1/ Introducing Fluid!💧

An ever-evolving DeFi protocol, base for future financial system.

Enabling highest capital efficiency & better rates.

Here's what

@0xfluid

is all about: 👇

55

195

448

5

5

58

Same multisig address allows users to get EOA like experience with multisig like security 🔐.

Rather than managing 10 different multisig on 10 different chains. With

@avowallet

you manage a single multisig.

- Manage all your assets on all chains from the same page.

- Bridge…

1

10

34

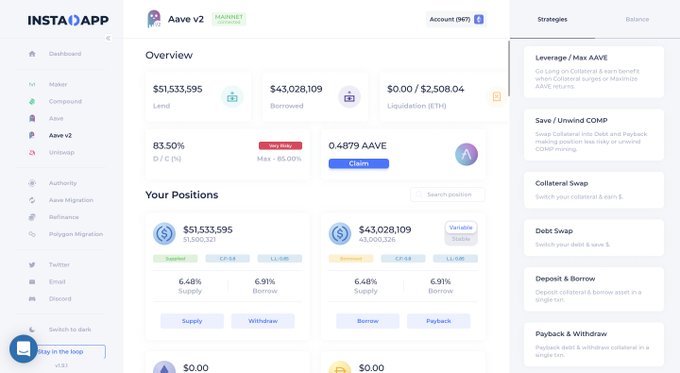

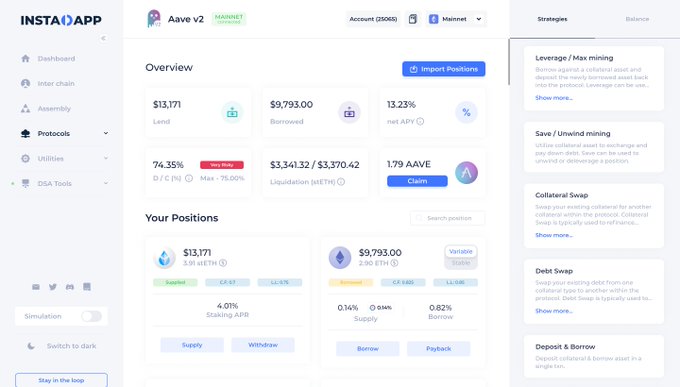

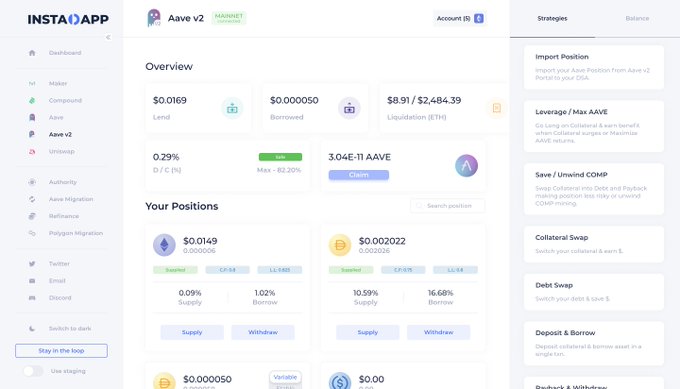

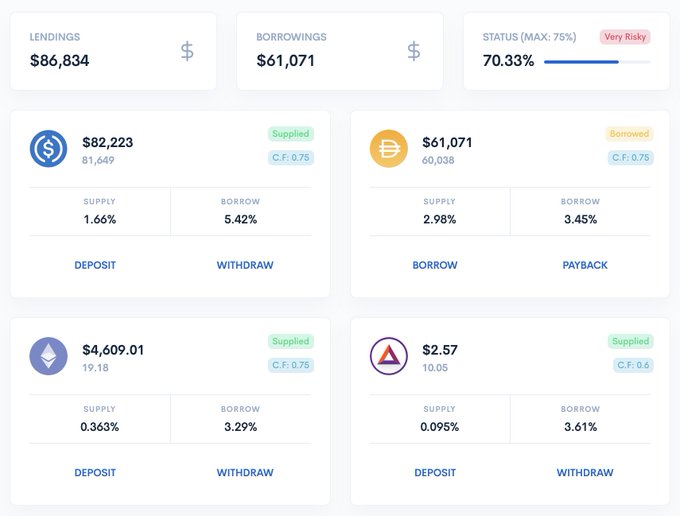

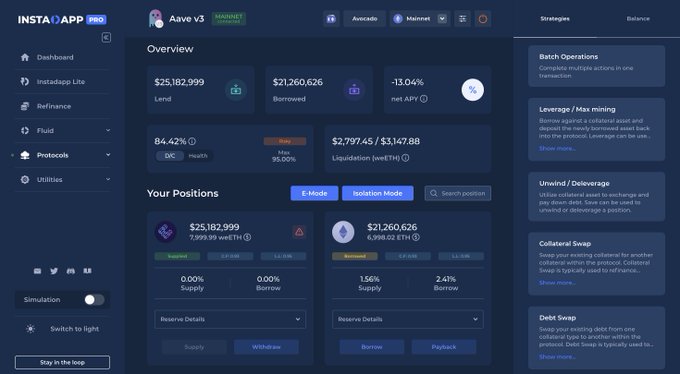

DeFi is full of opportunities but finding them takes time and effort.

Here are 3 strategies on 3 chains using only

@AaveAave

on

@Instadapp

.

Thread 🧵

2

8

55