Skwigglylines

@skwigglylines

Followers

889

Following

90

Media

234

Statuses

1,577

Explore trending content on Musk Viewer

Rafah

• 1328043 Tweets

井上尚弥

• 276524 Tweets

Inoue

• 162781 Tweets

Stray Kids

• 125192 Tweets

RPWP IS COMING

• 82375 Tweets

ボクシング

• 70517 Tweets

#رفح_تحت_القصف

• 44047 Tweets

モンスター

• 38671 Tweets

Bruno Mars

• 36326 Tweets

#MetGala2024

• 29163 Tweets

Kim Namjoon

• 29024 Tweets

GW終了

• 27191 Tweets

井上選手

• 26673 Tweets

逆転3ラン

• 24972 Tweets

筒香のホームラン

• 21905 Tweets

20 YEARS OF MINJI

• 20200 Tweets

AESPA SUPERBEING TEASER 1

• 18511 Tweets

#GWを写真4枚で振り返る

• 18360 Tweets

Białoruś

• 17710 Tweets

Bernard Pivot

• 16036 Tweets

MIOTO NO VENUS PODCAST

• 15923 Tweets

#MIvsSRH

• 15143 Tweets

#VurPençeniKupaya

• 12723 Tweets

#Superman

• 11166 Tweets

横浜優勝

• 10044 Tweets

David Corenswet

• 10011 Tweets

Last Seen Profiles

Pinned Tweet

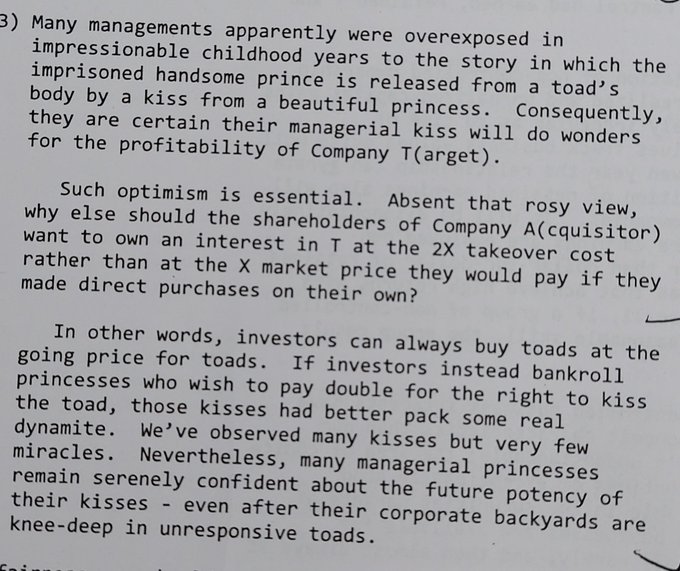

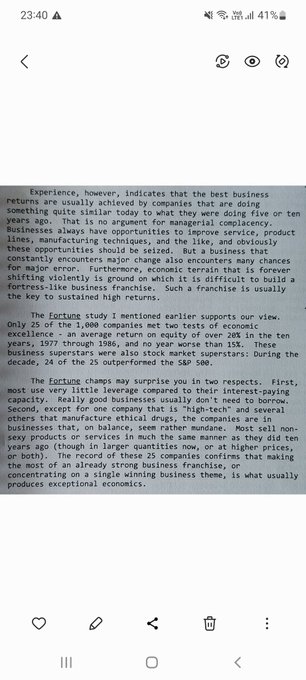

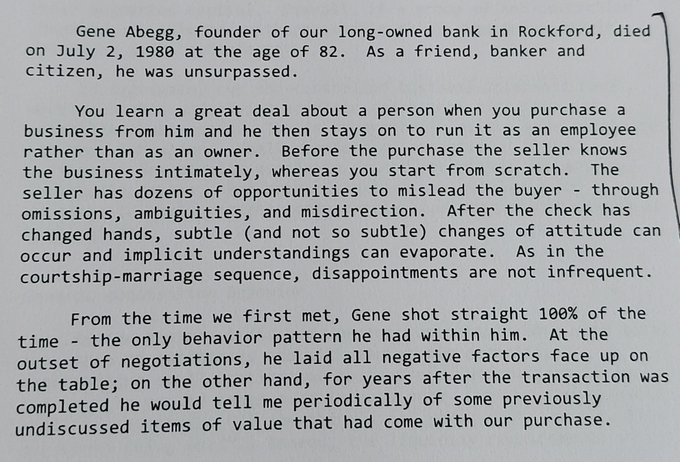

Finished reading Pulak Prasad’s book. I haven’t waited as desperately for a book as this one and it was really extraordinary. There are enough summaries of the book, so I am not gonna write another one, but I’ll share two overwhelming feelings I was left with after the book.

+

11

23

189

Read this essay for the 5th or 6th time since

@SridharanAnand

wrote it. I revisit this often and feel amazed every time, for how counter intuitive and contrarian it is to the norm in our industry, but makes so much sense.

Can't recommend this enough!

2

4

33

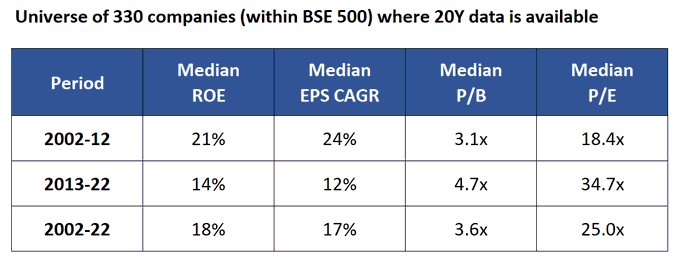

Great case study on why nothing is worth paying a nosebleed price, no matter how stellar the management, business, track record, industry tailwinds etc.

1

0

29

Stoic company -> meet stoic investor.

Father-in-law owns Hawkins shares for 42 years. Few years ago he made me visit their Mahim office to buy a saucepan in exchange of discount coupons he receives every year as a shareholder.

1

1

27

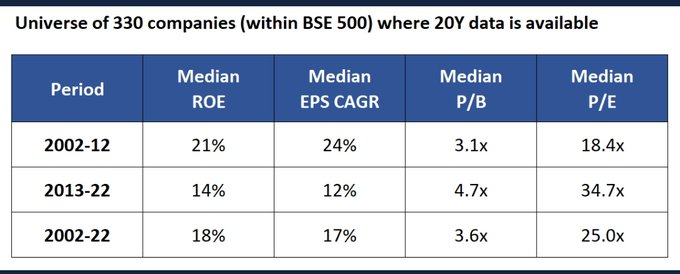

This. Is. It.

This is the job.

Say no to 98% things. Wait for remaining 2% to become unloved and trade below median valuation. Avoid shitty industries and people. Keep working hard to hone that 2% list. Sit on your ass.

So easy. Yet it's not.

@Doubledecacorn

Over 15-years & ~40 decisions, our average/median is 15x entry PE (on historic/trailing E) for 40% ROCE business. We've tried to not buy sub-20% ROCE biz. Tried to not pay >25x PE irrespective of how excited we are about biz. I think we'll stay within these bounds in future too

10

10

109

1

2

28

When I was growing up, no growth valuations were 6-8x earnings 😱

They don't make that kinda prices anymore.

3

1

22

75 pages in. Early warning if you haven't started - read this at your own peril. There's a 90% chance the book will induce major existential crisis. The What-am-I-doing-in-my-career-and-life kinds.

3

0

17

@SridharanAnand

Market's so bad that...family whatsapp groups are back to exchanging good morning messages instead of discussing grey market premium on new IPO

1

2

16

@contrarianEPS

They will take IPO subscription money from one nostril and throw out shareholder value from the other

1

1

16

@Suhanaenae

American colleague - going camping for summer, see you in sep

European colleague - going skiing in winters, see you in March

Indian bloke - going for my kidney transplant, available on phone if urgent.

0

3

14

Small talk is exhausting. I have to make prep notes before a work trip to the US -

- temperature in Fahrenheit of city i am in (weather topic in US is equal to traffic topic in India)

- did their local team win baseball/footy/NBA recently

- elections/gunfire/coffee fads

2

1

13

Was hoping to see you at the kachori station today at a big sell side conference. Happy teachers day

@SridharanAnand

. Following Nalanda closely over the years has been formative and reading your essays has helped solidify(ing) a lot of those learnings. Thank you.

1

0

13

In my experience, this trifecta is easier to spot in others' portfolio and not in one's own.

1

0

13

Visuals on the screen put our careers about sloshing money to make more money into perspective.

#Chandrayaan

0

0

11

@Kritesh_C

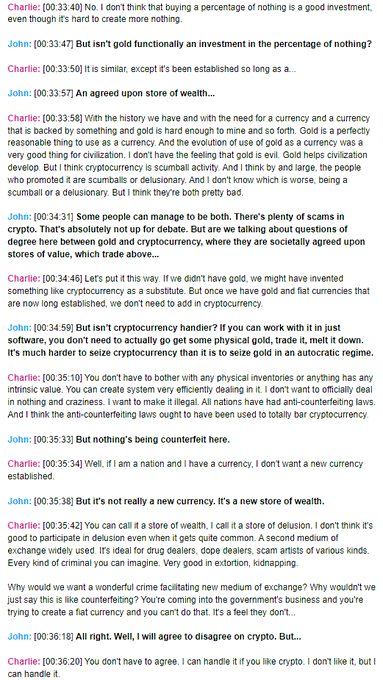

It's not a luxury. It's a right they have earned due to what Charlie Munger calls a "seamless web of deserved trust". Their investors allow them the capital call option because they have "behaved" well with that option. Most others , if bestowed with the option, would misuse it.

2

2

11

What are we pricing in:

- SIP flows are unstoppable force

- abhi FII to waapis aane baaki hain

- duniya mein aur kahan hai itni growth

- trailing chhod, 5Y forward dekh

1

0

10

Every bottom up bet has an assumption that Indians will consume more, borrow more, cos. will build more capacity and govt will put infra etc. But none of this makes it macro investing. Macro that Swensen refers to is betting on int. rate, currency, economy, inflation type bets.

2

1

10

@FalakKalyani

Until last year, I had only read stories, quotes and books about Buffett & Munger written by others and believed that I understood their approach well. But reading original letters in chronology, with proper context to each investment, seeing B&M's thinking evolve over time..

1

1

9

"We invested more in the next three months than we had in the previous six years."

Charansparsh!!!!!!!

1

0

8

@SridharanAnand

Tell me a short Private Equity joke.

Value-add

Tell me a short M&A joke.

Synergy

Tell me a short LP joke.

Uncorrelated portfolio

Tell me a short Investment Thesis joke.

Earnings visibility

Tell me a short Underperformance joke.

The joke is on you, Mr. investor

1

1

8