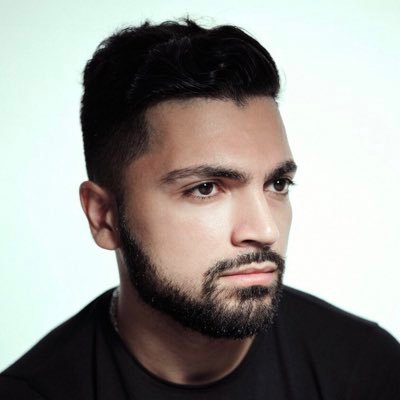

Xavi

@sigmaxavi

Followers

6K

Following

17K

Media

558

Statuses

5K

Founder @ampli_inc. Market strategist. I’m writing about blockchain, payments, DeFi, stablecoins & AI on https://t.co/9vIxQi44qD

Miami, FL

Joined November 2019

Finally. After a year in stealth mode. Building, testing, and obsessing over every detail. We’re live!

Introducing ampli^: end-to-end protection for AI-driven capital management The infrastructure for autonomous treasury management, built for institutions, fintech, businesses, and DAOs that want capital to move on its own. Let’s redefine what it means to activate your capital. ^

2

2

14

We are proud to be one of the first companies to pilot Chainlink’s CRE to secure how AI agents can transact on chain. The industry is shifting faster than ever (and we are rapidly replacing manual inputs with verified autonomous actions...) The next couple years will be

AI agents managing capital need infrastructure that institutions can trust. We’re leveraging @Chainlink to solve agent validation without centralized points of failure. Our approach using the Chainlink Runtime Environment (CRE) 👇

0

2

15

From the future of finance to securing the financial future.

As a startup, becoming early design partners in an alpha was a risk but we knew that @chainlink was the partner to take it with. Very proud about the decentralized validation engine for agentic intents that our engineers built within CRE. Shoutout to @_AshNathan and his team for

1

1

8

And we’re kicking things off in New York City! We’re unveiling our end-to-end protection layer for AI funds management live on stage today at SmartCon. Next stop: Miami Futurist, tomorrow.

ampli^ is attending Chainlink SmartCon in NYC! 🗽 Our CEO, @Stillm4n, will be showcasing our end-to-end infrastructure for autonomous treasury management on the panel: "An Economy of Agents: Rails and Guardrails" 📆 Nov 5th, 11:30 AM EDT (3:30 PM UTC) 📍 Fulton Street Stage

0

0

3

$BTC dropped more in one week than its price at the start of the cycle.

1

0

5

@brucefenton Hi Bruce, back in 2018 I wrote a very comprehensive article on RVN with my friend Xavi ( https://t.co/Fi5slstb9V). Last year we did a deep dive on Ampleforth’s low volatility money and I think it could be what you are looking for:

medium.com

A Paradigm Shift in Digital Currency

6

1

22

If you bought gold at the pico-top in 1492 it would have taken 533 years for you to breakeven in 2025.

324

592

9K

Is this the future of DeFi @AmpleforthOrg ? $AMPL and $SPOT unite to deliver a sophisticated, decentralized monetary system: an elastic supply paired with low-volatility innovation. A must-read for forward-thinking investors.

1

1

22

The genius of PoW over PoS isn't decentralization but that PoW forces the L1 asset to be valued as a SoV scarce commodity rather than a P/E DCF asset since you can't coherently model cash flows in PoW. ETH was the only other credible SoV digital silver/oil in the world pre-PoS.

ETHBTC made fresh lows 0.02210 ether is down 74% against bitcoin since switching from proof of work to proof of stake

26

10

109

I think all stablecoin issuers assumed yield will necessarily be passed back to consumers. Just look at Coinbase - we're passing back yield on USDC held on Coinbase AND ALSO onchain. It's not stablecoin issuers that are afraid, it's banks. They're the ones most vulnerable to

34

63

490

Stablecoins quietly added $1B in the past 24 hours. That’s $4B in the past week. $7B in the past month. This is the most important macro trend of the decade, and almost nobody is paying attention. Millions in the developing world now hold and spend USD—not through banks or

107

219

1K

Why are so many shocked by devs not playing by the rules? Let me just remind you of this:

544

730

6K

LP $SPOT allows holders to earn fees from volatility with minimal impermanent loss by returning to a long-term mean value (peg to 2019 USD). Probably the second best thing in crypto @saylor

I am fascinated by mean reverting stable coins like SPOT from @AmpleforthOrg , so this asset allow you to earn fees from the volatility, but guaranteed to returned to a long term mean to minimise IL. Pretty cool!

2

3

33

The uninitiated minds, still grappling with basic economic concepts and primitive crypto game theory, fail to grasp the limitless potential of a global denationalized, elastic financial system built on-chain. They won’t comprehend unlimited $ampl rewards, perpetual returns, and

Update on Bootstrap - Troposphere (Day 1) We are roughly 16 hours into the official launch of operation bootstrap’s first phase: Troposphere. A staggering $3.3 million in SPOT-USDC liquidity has been staked so far. The rewards pool was initially funded with 518k AMPL ($673k)

13

26

72

3/ Here’s the problem: Monolithic design. Both Bitcoin and Ethereum tie their consensus directly to their base layer. It’s like having a skyscraper with one elevator for everything. Congestion, high costs, and inflexibility are baked in.

1

1

12

Amazon is about to order even more Tesla Optimus @elonmusk

JUST IN: Amazon workers officially begin nationwide strike, marking the largest strike against Amazon in US history.

0

1

12