Stefan Goldbach

@sgoldbach

Followers

95

Following

217

Media

0

Statuses

79

Economist at @bundesbank; views are my own.

Frankfurt am Main

Joined March 2011

Happy to announce that our paper "Internationalisation as a boost for many firms: evidence from Germany" (together with Rainer Frey) is forthcoming in Review of World Economics. https://t.co/EbvaRQlwtN

link.springer.com

Review of World Economics - The advantages of globalisation have been increasingly called into question, and protectionist tendencies have entered the stage. So what experiences have firms had...

0

0

6

Yesterday I presented ongoing research on intra-firm cross-border interest flows and tax incentives (with @sgoldbach, @ArneNagengast and Georg Wamser) at ESHCC @erasmusuni Rotterdam in the interdisciplinary Workshop “The Netherlands a Tax Paradise?”

1

1

5

#Monatsbericht Oktober: Deutsche #Direktinvestitionen im Ausland wachsen weiter, mit starkem Fokus auf den USA. Deutschland bleibt ein attraktiver Standort, muss sich aber im internationalen Wettbewerb u.a. gegenüber Frankreich und Spanien behaupten. 👉 https://t.co/KmkWI3XlAe

0

3

6

1/6 Der @bundesbank #Monatsbericht September zeigt, dass die #Klimapolitik der #EU bislang noch nicht zu signifikanten #Standortverlagerungen der deutschen #Industrie ins nicht-europäische Ausland führte.

1

4

6

#Monatsbericht: Bisher gibt es keine signifikanten Hinweise darauf, dass deutsche emissionsintensive Unternehmen Produktionsprozesse an außereuropäische Standorte mit einer weniger strengen #Klimapolitik verlagert hätten. Weitere Informationen: https://t.co/2r2einwjEV

#EUETS

3

5

11

Happy to announce that our paper "Cryptocurrencies and capital flows: evidence from El Salvador’s adoption of Bitcoin" (together with @nitschv) is forthcoming in Applied Economics Letters. https://t.co/OYsrhN2Nyj

tandfonline.com

This paper explores a monetary experiment, the adoption of Bitcoin as legal tender in El Salvador in 2021, to analyse the impact of digital currencies on international capital flows. Using a differ...

0

1

10

Happy to announce that our paper "Retained Earnings, Foreign Portfolio Ownership, and the German Current Account: A Firm-Level Approach" (together with Philipp Harms, Axel Jochem, @nitschv and @AlfonsJ64) is forthcoming in German Economic Review. https://t.co/7I7PL6M5Z5

degruyterbrill.com

In some countries, a sizable fraction of savings is derived from corporate savings. Although larger, traded corporations are often co-owned by foreign portfolio investors, current international...

1

4

22

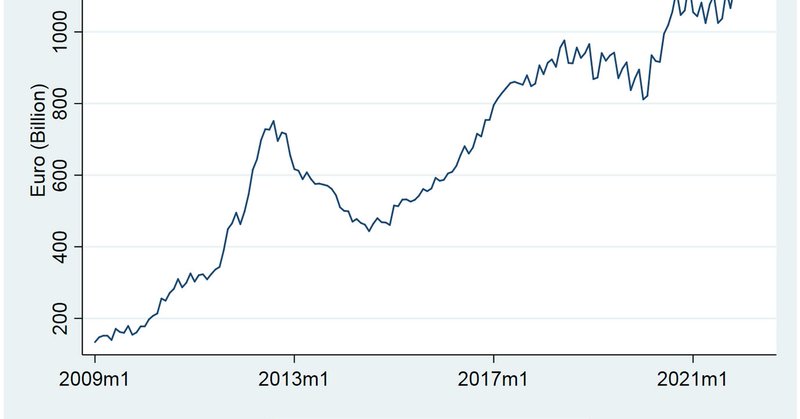

Happy to announce that our paper "Determinants of Net Transactions in TARGET2 of European Banks Based on Micro-data " (together with Constantin Drott and Axel Jochem) is forthcoming in Open Economies Review. https://t.co/BzO0qkzzOa

link.springer.com

Open Economies Review - This paper examines German and foreign bank factors that can explain net flows of cross-border central bank liquidity between Germany and the rest of the euro area. Using...

1

2

6

Where to look for the analysis of economic sanctions? Here is a special issue in the Review of Inernational Economics. It also covers a great article by my colleague @sgoldbach on the effect of financial sanctions on trade in goods and services. https://t.co/b66umKRGW9

onlinelibrary.wiley.com

Click on the title to browse this issue

0

2

5

„An economic crisis in China following a correction of excessive credit growth would arguably be manageable for the German economy. However, an abrupt decoupling, say as a result of a geopolitical crisis, would deal a far heavier blow to German industry“ - new @bundesbank study👇

Can the #German economy cope with an economic crisis in China or an abrupt #decoupling from that country? The Bundesbank’s January #MonthlyReport sheds light on Germany’s dependence on #China and the potential consequences. https://t.co/m3oY6LSROi

#economy #economicactivity

11

24

57

Happy to announce that our paper "The effects of sanctions on Russian banks in TARGET2 transactions data" (together with Constantin Drott and @nitschv) is forthcoming in Journal of Economic Behaviour and Organization. https://t.co/AmB5ltbvMo

1

0

11

📢Exciting week ahead! This Thursday & Friday we will host - with @cepr_org - our conference on #Geoeconomics at @GermanyDiplo in Berlin. An elite line-up of experts will delve into cutting-edge discussions on geopolitics, economics, sanctions, China, ... just to name a few.

2

30

76

Smart or Smash? The Effect of Financial Sanctions on Trade in Goods and Services | @TBesedes, @sgoldbach, @nitschv

#EconTwitter

https://t.co/OHhKZ5kfGa

0

3

6

Happy to announce that our paper "Smart or smash? The effect of financial sanctions on trade in goods and services" (together with @TBesedes and @nitschv) is forthcoming in Review of International Economics. https://t.co/iUieoRorAS

0

2

21

New WP on German current account: missing correction for retained corp earnings attributable to foreign portfolio investors overestimated surplus by some 5% in 2012-2020 period. @nitschv @SAFE_FRANKFURT @GFelbermayr

https://t.co/NXx8emB1AL

@MartinBraml

https://t.co/Ud27BfhyA8

0

4

7

In the new issue of #EconPolForum, our authors examine the extent to which various #sanctions have achieved their goals. How do they affect economic growth, trade, and prosperity? How can policy-makers make sanctions more effective? @CESifoNetwork 👉 https://t.co/15BPoV24V3

0

3

6

#RFS #Forthcoming: Freeze! Financial Sanctions and Bank Responses Matthias Efing @HECParis Stefan Goldbach @sgoldbach @bundesbank Volker Nitsch @nitschv @TUDarmstadt

https://t.co/fYsRwaOJ8j

academic.oup.com

Abstract. Using regulatory data, we study German bank lending in countries targeted by financial sanctions. We find that domestic banks in Germany reduce l

0

3

11

Happy to announce that our paper "Freeze! Financial Sanctions and Bank Responses" (together with Matthias Efing and @nitschv ) is forthcoming in The Review of Financial Studies. https://t.co/ILdR2ZU7PJ

academic.oup.com

Abstract. Using regulatory data, we study German bank lending in countries targeted by financial sanctions. We find that domestic banks in Germany reduce l

0

1

7

New #ResearchBrief: Lower TARGET2 payment flows due to EU sanctions against #Russia. The SWIFT exclusion of Russian banks appears to have the strongest impact on payment flows in TARGET2 https://t.co/LEUTqtqCLs

#target2 #ukraine

1

3

5

Neuer #ResearchBrief: Geringere TARGET2-Zahlungsströme durch #EU-Sanktionen gegen #Russland. Der SWIFT-Ausschluss russischer Banken scheint die stärksten Effekte auf die Zahlungsströme in TARGET2 aufzuweisen. https://t.co/mvY0ABFriz

#Sanktionen #Ukraine @sgoldbach @nitschv

0

5

8