Volker Nitsch

@nitschv

Followers

589

Following

158

Media

69

Statuses

586

Professor of International Economics Technische Universität Darmstadt

Joined May 2010

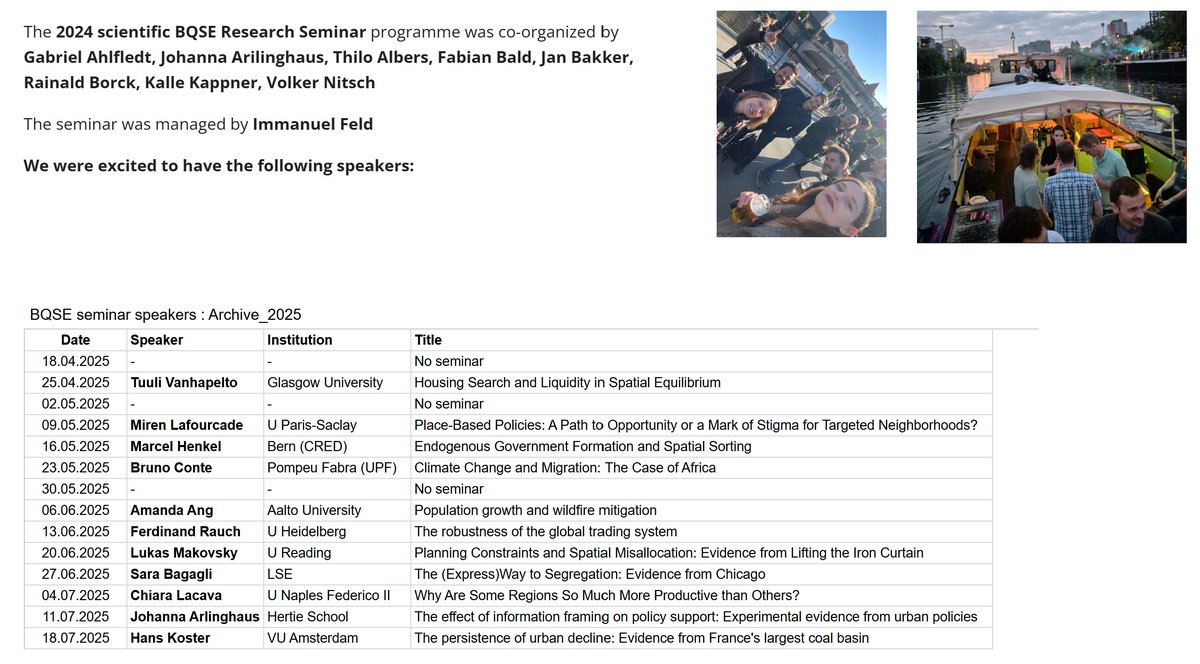

Huge thanks to Gabriel @Ahlfeldt for taking the initiative! The seminar offers an excellent research environment. Super inspiring and truly motivating, even on a Friday afternoon. 😃.

What a fabulous 2025 seminar season it has been! Thanks to all the co-organizers, our manager @immanuelfeld, all speakers, guests, and locals! You have been a fantastic spatial community!

0

0

3

Welcome, Johanna.

Delighted to welcome @joarlinghaus as a co-organizer for the 2025 season of the @BSE_Berlin Quantitative Spatial Economics Research Seminar May it be as fun and interesting as in 2024! @RainaldBorck @thiloalbers @kallekappner @JanDavidBakker @nitschv.

0

0

1

Happy to announce that our paper "Cryptocurrencies and capital flows: evidence from El Salvador’s adoption of Bitcoin" (together with @nitschv) is forthcoming in Applied Economics Letters.

0

0

2

RT @sgoldbach: Happy to announce that our paper "Retained Earnings, Foreign Portfolio Ownership, and the German Current Account: A Firm-Lev….

degruyterbrill.com

In some countries, a sizable fraction of savings is derived from corporate savings. Although larger, traded corporations are often co-owned by foreign portfolio investors, current international...

0

4

0

RT @Flx_Geiger: Where to look for the analysis of economic sanctions? . Here is a special issue in the Review of Inernational Economics. I….

onlinelibrary.wiley.com

Click on the title to browse this issue

0

2

0

Check out this paper if you are interested in the impact of financial sanctions on Russia, examining daily cross-border payment flows.

Happy to announce that our paper "The effects of sanctions on Russian banks in TARGET2 transactions data" (together with Constantin Drott and @nitschv) is forthcoming in Journal of Economic Behaviour and Organization.

0

2

7

I greatly enjoyed this fantastic conference at a great location. A very warm thank you to the @kielinstitute for making this possible.

We had a fantastic first day of our #geoeconomics conference - together with @cepr_org, hosted by @GermanyDiplo, and are very much looking forward to the second day (already underway). Thanks to all who contribute(d) on both days. 👉Livestream 👉

0

0

7

RT @CESifoNetwork: Smart or Smash? The Effect of Financial Sanctions on Trade in Goods and Services | @TBesedes, @sgoldbach, @nitschv .#Eco….

0

3

0

RT @AlfonsJ64: New WP on German current account: missing correction for retained corp earnings attributable to foreign portfolio investors….

0

4

0

It's official now. 😃.

#RFS #Forthcoming: Freeze! Financial Sanctions and Bank Responses . Matthias Efing @HECParis.Stefan Goldbach @sgoldbach @bundesbank.Volker Nitsch @nitschv @TUDarmstadt.

1

1

8

It has been a loooong, but excitingly successful journey for this paper which was awarded the best paper in corporate finance prize at the SFS Cavalcade Asia-Pacific back in 2019.

sfs.org

The Best Paper in Corporate Finance Award is presented at SFS Cavalcade North America and SFS Cavalcade Asia-Pacific. 2025 North America, $1000 "Financially Sophisticated Firms" Kerry Siani and Lira...

Happy to announce that our paper "Freeze! Financial Sanctions and Bank Responses" (together with Matthias Efing and @nitschv ) is forthcoming in The Review of Financial Studies.

0

0

5

Thanks for organizing this insightful workshop and your great hospitality, @MariaPerssonLU! I very much enjoyed my stay in Lund.

0

0

5

Excited to see that @bundesbank covers our new research on #sanctions in their latest research brief. English version is available here: @sgoldbach.

bundesbank.de

In recent years, the European Union has imposed various types of financial sanctions against Russian banks. A new study examines whether these measures have affected payment flows in TARGET2.

Neuer #ResearchBrief: Geringere TARGET2-Zahlungsströme durch #EU-Sanktionen gegen #Russland. Der SWIFT-Ausschluss russischer Banken scheint die stärksten Effekte auf die Zahlungsströme in TARGET2 aufzuweisen. #Sanktionen #Ukraine @sgoldbach @nitschv

0

0

5

Excellent article! A must read for everyone interested in current economic research on #sanctions .

Cliff Morgan, Costas Syropoulos, and I offer an interdisciplinary perspective on the evolution and consequences of economic #sanctions. Many thanks to @TimothyTTaylor, @NinaPavcnik, and all other editors at the JEP for their guidance and support!.

0

0

1

RT @sgoldbach: Happy to annonce that our paper "Capital Controls Checkup: Cases, Customa, Consequences" (together with @nitschv) is forthco….

0

1

0

Always nice if research is relevant and reaches policy circles. @sgoldbach @bundesbank @TUDarmstadt.

It is often difficult to tell which individual #sanction is responsible for which economic outcome in #Russia. With regards to Russian #banks, this Bundesbank Discussion Paper argues that the exclusion from SWIFT was the most effective measure.

0

0

1