Philipp Schnabl

@schnabl_econ

Followers

2K

Following

16

Media

0

Statuses

27

Martin J. Gruber Professor Professor of Finance @NYUStern, Co-Editor @J_Fin_Economics

Joined July 2021

Exciting news! Our book "SVB and Beyond: The Banking Stress of 2023" is now available! 📖 Co-authored with my amazing colleagues at @NYUStern, it's an exploration of the recent banking turmoil's events, causes, and proposed solutions.

1

11

64

RT @AlexiSavov: ***The 2023 Macro Finance Society Virtual Summer School,*** Aug 7-11. With Jesus Fernandez-Villaverde (Penn), @CarolinPflue….

0

45

0

Excellent article by @izakaminska on the risks of “banking on deposits.”.

*Reminder* that Blind Spot subscribers benefit from access to a selection of gated Politico PRO stories, hand-picked by me for markets and finance relevance. I've stuck a bit of the new cbanker content there this week.

2

0

4

RT @izakaminska: 🧵Bloomberg's Matt Levine writes today about the bank deposit franchise, and how the traditional bank model assumes deposit….

0

62

0

RT @SashaIndarte: Happy to see my first (!!!) publication in the RFS (@SFSjournals)! And just in time to shed light on recent events in the….

0

28

0

The NY Fed-NYU conference is on Friday, May 5th. All researchers are welcome. If you are interested, please register at the link below.

Academics and other researchers in the fields of economics and finance can join us for the Sixteenth New York Fed / NYU Stern Conference on Financial Intermediation on May 5. Register here.

2

2

21

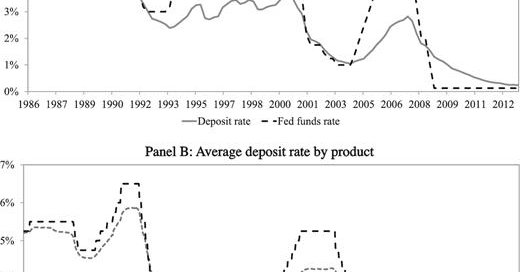

We posted data on bank-level deposit betas. This is a key measure of the value of the deposit franchise. The data is available here: . With @AlexiSavov, @idrechs, and Dominik Supera.

2

12

62

RT @NYUStern: Learn what #NYUStern Profs Viral Acharya, @schnabl_econ, and Lawrence J. White said in a recent panel moderated by @gilliante….

0

3

0

RT @idrechs: @RobinBrooksIIF You are right that it is always the case that deposits flow out when the Fed raises rates. We (@AlexiSavov @sc….

academic.oup.com

Abstract. We present a new channel for the transmission of monetary policy, the deposits channel. We show that when the Fed funds rate rises, banks widen t

0

9

0

RT @IrvingSwisher: Monetary policy does not exclusively affectdem. Room for sizably adverse supply-side effects on the financial system & c….

0

11

0

Alexi Savov, Itamar Drechsler and I have a new note on how to estimate the deposit franchise value. This is a key factor when evaluating the stability of banks @AlexiSavov @idrechs.

1. In a recent note with @idrechs and @schnabl_econ , we estimated banks’ unrealized losses on loans and securities at about $1.75 trillion. We argued they are at least partly offset by gains on the deposit franchise. We estimate these gains in a new note:.

0

0

19

RT @AlexiSavov: 11.For more, check out the note with @schnabl_econ and @idrechs on bank interest rate risk and the deposit franchise:.http….

0

8

0

Great points by my colleague @arpitrage. For more on what SVB should have done to manage interest rate risk, check out this note with @AlexiSavov and Itamar Drechsler.

Lots of great commentary on SVB, but I think a few points that get missed:. 1. You can't just mark to market the assets down with higher interest rates. You also need to account for the fact that higher interest rates *raise* bank franchise value.

0

4

14

RT @AlexiSavov: SVB got in trouble for investing in MBS. It’s certainly not alone in doing so. Why do banks invest in assets like MBS in….

0

93

0

Congratulations to Johannes Stroebel (@stroebel_econ) for winning the Fischer Black Prize. He is an outstanding researcher AND an amazing colleague. Bravo, Johannes!.

afajof.org

Johannes Stroebel is the David S. Loeb Professor of Finance at the New York University Stern School of Business. He joined NYU in 2013 from the University of Chicago Booth School of Business, where...

0

1

38

Alexi Savov @AlexiSavov , Itamar Drechsler @idrechs and I are teaching an online class on Financial Intermediation and Monetary Policy, April 4th-7th. Focus is on latest research. Deadline for applications tomorrow. Hope to see you at the class!

0

30

108

RT @MarkusEconomist: Princeton Initiative 2021: 3 days of Macro, Money and International Finance.for PhD students (at or after 2nd year).….

0

41

0