sahil bhadviya

@sahilbhadviya

Followers

35,997

Following

90

Media

567

Statuses

1,770

YouTube Educator | Founder @Sahil ’s Academy | Ex-Data Analytics Consultant

Udaipur, India

Joined October 2009

Don't wanna be here?

Send us removal request.

Explore trending content on Musk Viewer

Israel

• 2810312 Tweets

#Eurovision2024

• 1275692 Tweets

España

• 293820 Tweets

Ireland

• 204657 Tweets

Switzerland

• 144598 Tweets

Flamengo

• 114435 Tweets

Portugal

• 110220 Tweets

Corinthians

• 105568 Tweets

Luka

• 93503 Tweets

Nemo

• 83284 Tweets

#ESC2024

• 74804 Tweets

Italia

• 73125 Tweets

#ESCita

• 72694 Tweets

Slimane

• 72182 Tweets

Irlanda

• 68366 Tweets

Suiza

• 58460 Tweets

Lorran

• 49749 Tweets

Los 12

• 45495 Tweets

Ucrania

• 42517 Tweets

Francia

• 42491 Tweets

Skenes

• 39963 Tweets

Croatia

• 39921 Tweets

Ισραηλ

• 36625 Tweets

Loreen

• 35486 Tweets

Kyrie

• 31259 Tweets

Mavs

• 30054 Tweets

Estonia

• 27444 Tweets

Finland

• 27345 Tweets

Austria

• 27315 Tweets

ABBA

• 25490 Tweets

Dort

• 23604 Tweets

Armenia

• 23091 Tweets

Olly

• 21534 Tweets

#UFCStLouis

• 19803 Tweets

Lively

• 16547 Tweets

Breath of Life

• 16184 Tweets

Baby Lasagna

• 15815 Tweets

Traverso

• 12814 Tweets

Amazonas

• 10125 Tweets

Last Seen Profiles

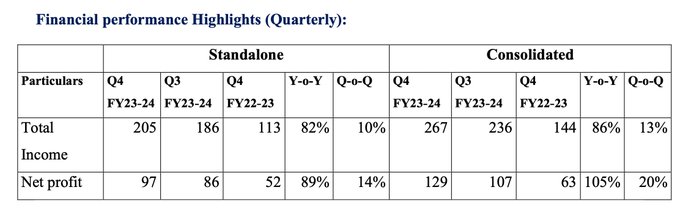

Diwali Picks 2023:

#1

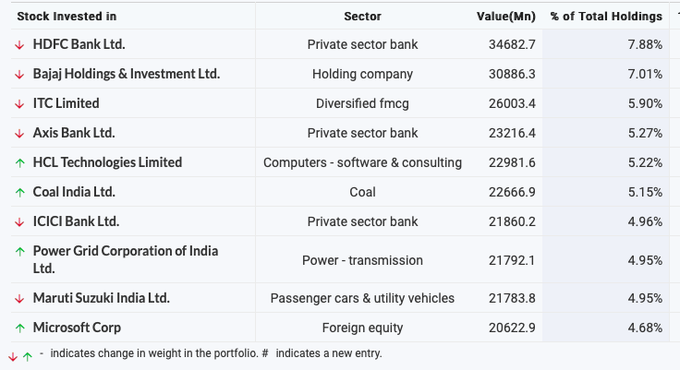

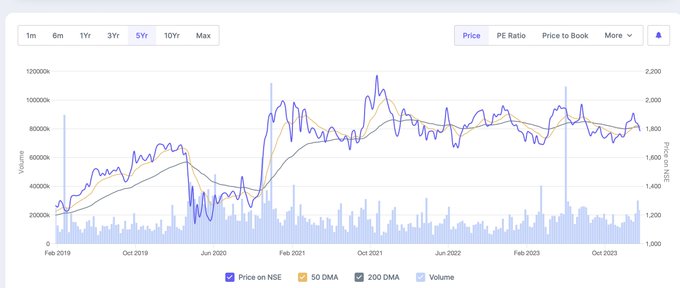

ICICI bank. One of of the best phase of growth in last many years under the leadership of Mr Sandeep Bakshi who become ICICI bank CEO and MD in 2018.

12

59

629

HCL tech - Holding 300 shares since last 3 yrs at an avg of 1032. Already shared the details long back on my youtube channel.

One of my top holding. Took a lot of test of my patience level last year but now rewarding. Cherry on the top - Great dividend player!

#conviction

49

14

602

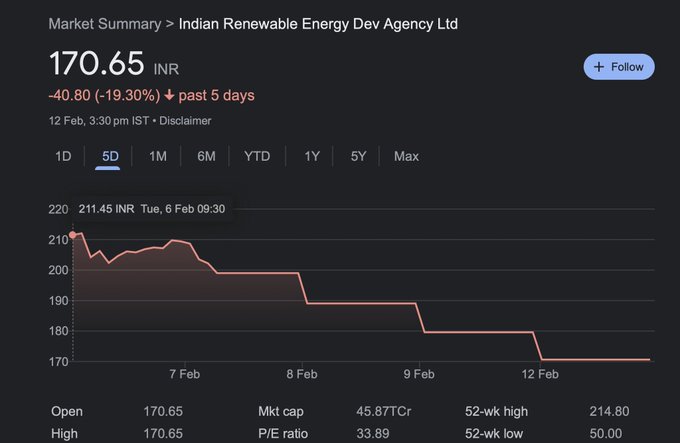

When i see such brutal corrections, it always remind me of one quote from Vikay Kedia sir - Rome was not built in a day but Hiroshima and Nagasaki were destroyed in seconds 😄

@VijayKedia1

Market really makes you humble. It destroys the arrogance in no time.

Stay strong 💪

11

24

481

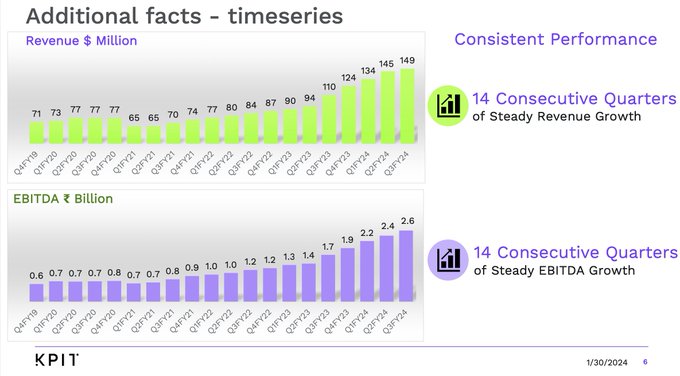

Quarter after quarter after quarter. 14 quarters of consistent growth in both revenue and profit. KPIT is just extraordinary.

#Q3Fy23results

#KPIT

11

15

415

Maymyindia

Cash in hand - 450-500 cr.

Ttm revenue : 279 cr.

Target revenue: 1000 cr.

OPM: >40%

This stock might be looking expensive today but I’m bullish from day 1. Its difficult to get such promoter quality in smallcap companies with a very bright prospects. This co will…

#OnCNBCTV18

| Automotive OEM biz will be key driver for ₹1,000 cr revenue target, says Rakesh Verma of MapmyIndia

1

5

59

24

33

409

@IamShajanSamuel

In my opinion, life is better in India only if you earn a good income. Its not good for poor people.

37

7

406