Robdog 🍾

@robdogeth

Followers

3K

Following

18K

Media

176

Statuses

3K

Building @corkprotocol - The Tokenized Risk Protocol Prev founded @toucanprotocol and Vultus (acquired)

Ethereum/Lisbon

Joined April 2019

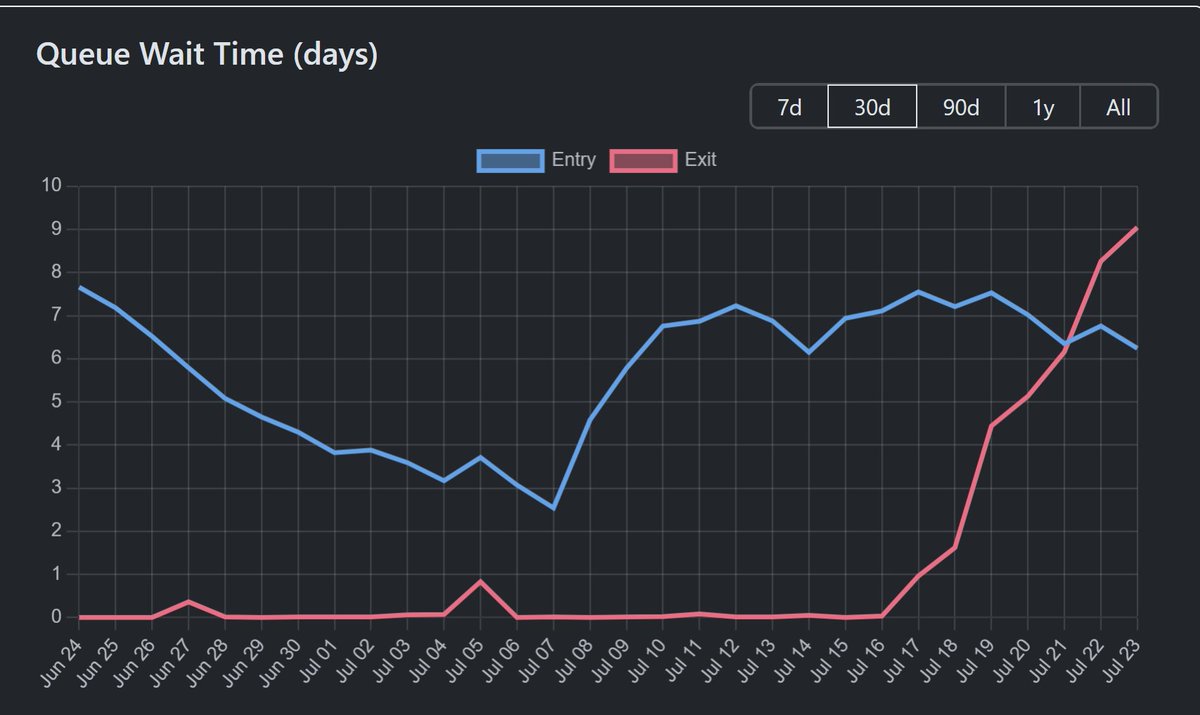

stETH is experiencing a sustained depeg - let's dig into the mechanisms driving it and how the great stETH looping unwind is playing out . stETH is a liquid staking token by Lido, which dominates it's category and is considered an exceptionally safe token. So why is it depegging?

18

47

270

RT @DefiMoon: UPDATE: Ethereum validator exit queue has started to grow again: +217k $ETH in just two days 📊📈🚀. Pretty obvious this increas….

0

4

0

RT @Corkprotocol: The Ethena → Pendle → Aave PT-USDe looping trade accounts for over $3B in TVL. Is this $3B a ticking time bomb waiting t….

0

7

0

RT @leopoldbiget: it now takes 21 days to unstake your stETH on Lido. but why in the first place is unstaking designed with waiting time? -….

0

3

0

RT @talkintokens: Tweets like the below from @eth_everstake make it clear how misunderstood DeFi debt markets are. No, validators are not e….

0

4

0

Significant media about the ETH validator exit queue being negative for the ETH price. They completely miss the point that this is driven by the unwinding of the stETH looping trade which is neutral in ETH/USD terms. Everyone loves a fabricated bearish story on a down day.

stETH is experiencing a sustained depeg - let's dig into the mechanisms driving it and how the great stETH looping unwind is playing out . stETH is a liquid staking token by Lido, which dominates it's category and is considered an exceptionally safe token. So why is it depegging?

2

1

11

RT @Corkprotocol: Last night, a chain of events unfolded that illustrates a critical DeFi risk vector most overlook:. Even the most "liquid….

0

8

0

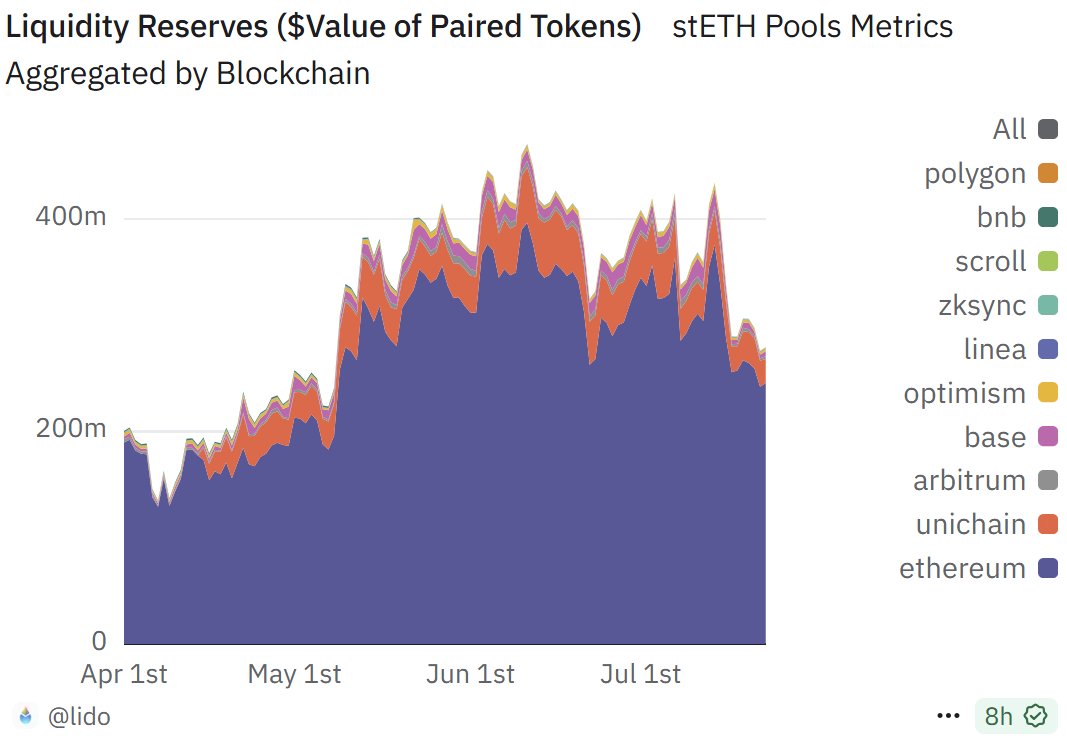

It is use cases like this which highlights even in very low risk assets like stETH, there are still time to liquidity risks which can meaningfully impact the peg . This is why we built @Corkprotocol to serve as a liquidity buffer for periods of extreme outflows.

Rough timeline of events here:.1. Justin Sun pulls ETH supply from Aave. 2. Utilization spikes ETH borrow rates on Aave. 3. stETH loopers are now unprofitable, so start de-leveraging. 4. A bunch of this de-levered stETH hits the staking withdrawal queue. 5. stETH depegs 30 basis.

1

1

12

Lfg.

Excited to share that we have joined the @Circle Alliance Program, a global community of teams focused on bringing the world on-chain, powered by USDC!.

0

0

4

Great conversation w Jack on building in crypto.

I get into the world of Web3 entrepreneurship with @robdogeth, a serial founder who’s navigated the highs and lows of building startups in carbon markets and blockchain. Rob shares his journey from leaving university to co-founding @Corkprotocol, spilling hard-earned lessons on

0

0

3