Vijay Boyapati

@real_vijay

Followers

167K

Following

56K

Media

2K

Statuses

17K

Tu ne cede malis, sed contra audentior ito

The Emerald City

Joined December 2009

"Owning bitcoins is one of the few asymmetric bets that people across the entire world can participate in." The Bullish Case for Bitcoin is now published as a single shareable article: https://t.co/q0pMX04Bcb

vijayboyapati.medium.com

UPDATE: First published as a long-form article in 2018, The Bullish Case for Bitcoin has become the most read non-technical introduction to…

465

3K

8K

This is good distinction. This is also why it's dumb to look at DXY as a measure of "dollar strength" that's somehow relevant to hard assets. All DXY tells you is dollar strength *vs other fiats*.

It's very important to understand the "strong dollar" policy has never meant strength in purchasing power of USD, but rather strength in worldwide usage (reserve currency status). The US government cares about monetary hegemony, it does not care about sound money. Own Bitcoin.

1

1

18

It's very important to understand the "strong dollar" policy has never meant strength in purchasing power of USD, but rather strength in worldwide usage (reserve currency status). The US government cares about monetary hegemony, it does not care about sound money. Own Bitcoin.

12

26

284

The type of trading you’ve been seeing in gold -- relentless bid, obvious and urgent sovereign buying, shockingly underallocated institutions grabbing the GLD ETF for exposure -- is a tiny glimpse of the trading you’d see in BTC if this gold/BTC cycle eventually plays out like it

27

98

734

I'm with Vijay, sure goldbugs are having their fun now, but Bitcoin will continue to grow in adoption.

During alt seasons Bitcoin would often slow or retreat from its bull move temporarily as capital flowed out of it and rotated into alts. I suspect something similar is happening with momentum capital rotating out of Bitcoin into gold. But as with alt season the capital always

6

4

95

During alt seasons Bitcoin would often slow or retreat from its bull move temporarily as capital flowed out of it and rotated into alts. I suspect something similar is happening with momentum capital rotating out of Bitcoin into gold. But as with alt season the capital always

25

38

392

Incredibly, the ancient and venerable forms of money (gold and silver) are today's degen memecoins.

7

10

151

Gold has many of the characteristics of ideal money, but has one fatal disadvantage in our digital world: it is costly and cumbersome to transmit. Bitcoin fixes this (literally).

101

45

685

From The Bullish Case for Bitcoin: "It is telling that gold followed the classic pattern of a Gartner hype cycle from the late 1970s to the early 2000s. One might speculate that the hype cycle is an inherent social dynamic to the process of monetization." Current gold chart:

10

12

118

You want to feel like you’re living in the future? Easy…Just follow @real_vijay Vijay telling you what is going to happen years in advance. Thank you for sharing with us all 🙏

3

1

6

One characteristic of the parabolic phase of Bitcoin bull markets are sharp corrections followed by green hammer candles. Leverage has all been purged, so seems like a hammer candle is incoming. Are we ready for full send?

31

34

546

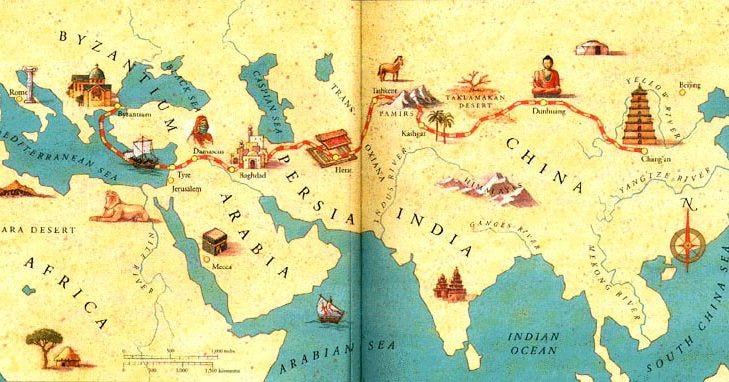

The Silk Road was shut down in early October 2013. Bitcoin dumped 25%. Two months later, Bitcoin was up 945%. Nearly a 10x in 60 days. Holders win.

40

113

2K

If you know anything about Bitcoin you know that it could be at 100k within a week, and follow that by hitting 150k by the end of the year.

18

12

380

Does anyone believe this is what a responsible steward of a new industry would say, or what an irresponsible owner of a casino trying to fleece every addict he can get his hands on would say? To ask is to answer.

We just bumped up the max leverage from 20x to 50x on international perpetual futures. A bunch of traders asked for this update. Let us know what else we can add!

81

76

1K

Bitcoin is down about 10%, which in itself is not particularly surprising since the market dropped a lot today. But alts were taken behind the woodshed and destroyed. It shows that the leverage and rampant speculation is concentrated in alts. The purge is healthy.

24

44

686

1971 vs 2025: In 1971 $35 bought an ounce of gold. Today it takes $4000 to buy a single ounce of gold. $4000 % $35 = 114.3 So since the end of the gold standard in 1971, the dollar has lost 99.1% of its gold value. What cost $1 in 1971 terms costs $114 today.

18

50

305

It's days like these that I laugh at the notion that HODLing is easy and those who held #Bitcoin for years were "lucky".

82

269

2K

Gold has made it to $27 Trillion market cap and none of your friends or family care. The same will happen to BTC. $1 million a coin will come and the world will still go on around you.

158

308

4K