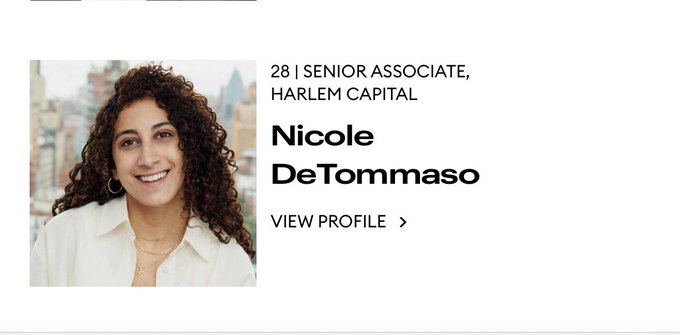

Nicole DeTommaso 🪄

@nic_detommaso

Followers

60,281

Following

556

Media

281

Statuses

6,427

Tweet about All Things VC. Providing insights to demystify the industry🪄. Investor @HarlemCapital | @Columbia alum | 🇵🇷🏳️🌈 (she/her)

LA & NYC

Joined March 2020

Don't wanna be here?

Send us removal request.

Explore trending content on Musk Viewer

#WeAreSeriesEP9

• 369256 Tweets

Gandhi

• 130326 Tweets

Hansi Flick

• 92322 Tweets

仮面ライダー

• 82405 Tweets

National Anthem

• 67941 Tweets

#HappyMameDay

• 57427 Tweets

#MAME22歳誰よりも輝け

• 53002 Tweets

海ちゃん

• 43693 Tweets

豆ちゃん

• 29485 Tweets

森林環境税

• 29109 Tweets

Jadue

• 24620 Tweets

サヨナラ

• 21953 Tweets

PABLO COSMIC RULER

• 20938 Tweets

State of Play

• 16711 Tweets

内田有紀

• 15946 Tweets

INTO THE DREAM SPOTTED J X W

• 12984 Tweets

#OneYearAndOnly

• 11745 Tweets

ファンミ

• 11635 Tweets

Last Seen Profiles

Pinned Tweet

BIG NEWS! I launched a newsletter - VC Demystified🪄

Issue

#1

went out TODAY!

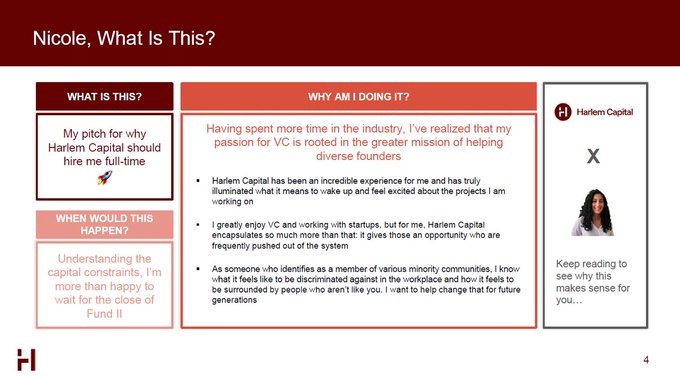

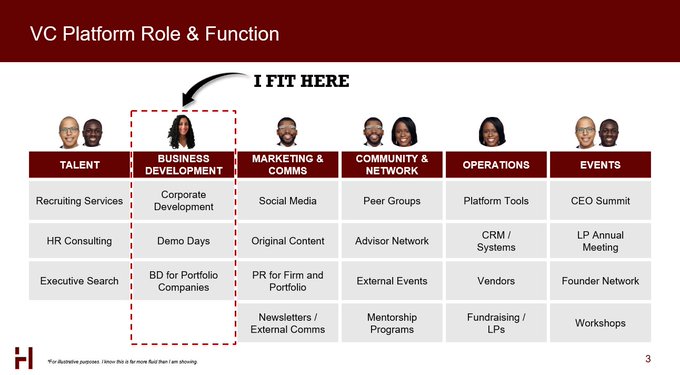

The first issue dives into the 10-page presentation I created pitching myself to the firm that landed me my FIRST full-time VC role after many no's.

Interested to check it out? 🔽

11

18

143

Breaking into VC is hard. Finding ways to differentiate yourself is hard.

When I was looking to break in, I knew

@HarlemCapital

was where I wanted to be but how did I do it?

I created a presentation showing HCP exactly where I could add value on day 1. Some snippets below👇

93

111

1K

A reminder

@HarlemCapital

is actively writing checks into diverse founders. $1-3M at pre-seed and seed stage.

Current high priority industries:

- Enterprise software

- Fintech

- Ecommerce

If you’re building, reach out! 🧱

38

117

505

Who uses

@Reddit

as a way to pick up on early trends & problems for startups to tackle?

I heard that recently & I’m absolutely fascinated.

55

26

494

Finding funds that 𝑡𝑟𝑢𝑙𝑦 invest in pre-seed is hard.

Here's a list of some I know do A LOT of pre-seed.

@HustleFundVC

@GaingelsVC

@amplifyla

@WonderVentures

@PrecursorVC

@DormRoomFund

@PlugandPlayTC

@UnshackledVC

@EverywhereVC

Symphonic Capital

What are others?

78

42

281

If we pass on a deal after doing diligence at

@HarlemCapital

, we always send the memo to the founder in the pass email w/ the top reasons why we passed.

This shows the founder:

-Merits

-Considerations

-TAM

-Financial analyses

BUT ultimately it shows the founder how VCs think.

28

15

255

Just starting in VC or looking to raise? Get to know the industry by diving into some podcasts.

Here’s a list of VC podcasts to get up to speed quickly:

- 20 Minute VC

- a16z

- Venture Stories

- The Full Ratchet

- GoingVC

& of course

@HarlemCapital

’s MORE EQUITY podcast 🪄

17

40

248