mhonkasalo

@mhonkasalo

Followers

29,435

Following

2,100

Media

1,188

Statuses

11,038

Investment Partner @equilibrium_co (prev. @paraficapital , @TheBlock__ , @AccessProtocol ).

Onchain

Joined May 2010

Don't wanna be here?

Send us removal request.

Explore trending content on Musk Viewer

Celtics

• 155745 Tweets

Pacers

• 131600 Tweets

中尾彬さん

• 109956 Tweets

Norway

• 101861 Tweets

Tatum

• 77601 Tweets

声優さん

• 71757 Tweets

State of Palestine

• 61681 Tweets

Omar Geles

• 53106 Tweets

#RYOHairTHwithFourth

• 37860 Tweets

古谷さん

• 37668 Tweets

Ireland and Spain

• 26073 Tweets

妊娠中絶

• 23762 Tweets

安室さん

• 21229 Tweets

PRABOWOfokus SIAPKANygTERBAIK

• 20518 Tweets

KerjaTERBAIK UntukNKRI

• 19870 Tweets

声優交代

• 19216 Tweets

النرويج

• 19063 Tweets

死刑求刑

• 17697 Tweets

ブートヒル

• 17182 Tweets

Estado de Palestina

• 16708 Tweets

Noruega

• 13345 Tweets

袴田さん

• 12994 Tweets

KupasTuntas KasusTimah

• 10209 Tweets

Last Seen Profiles

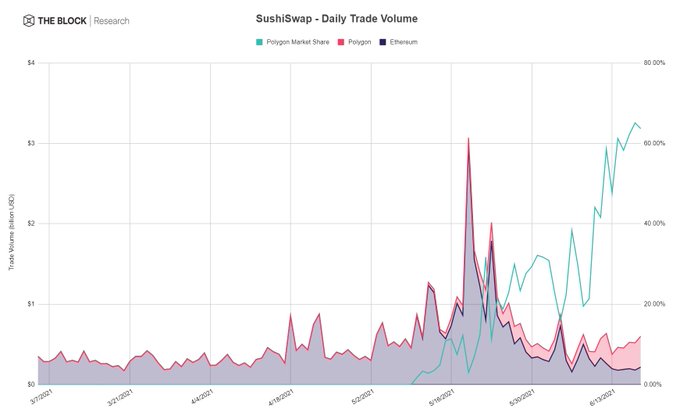

TVL by chain. Jan 1st, 2022:

- Solana $6.68b

- Polygon $5.10b

- Arbitrum $1.69b

- Optimism $354m

TVL today:

- Polygon $1.11b

- Arbitrum $945m

- Optimism $551m

- Solana $286m

(h/t:

@DefiLlama

)

93

190

2K

LFG sold ~80k $BTC in just over 3 days.

Actually impressed how well the market managed to absorb that.

73

73

790

BTC is now officially at an all-time high in EUR terms.

The apparent stabilisation of bitcoin’s value is likely to be an artificially induced last gasp before the crypto-asset embarks on a road to irrelevance.

#TheECBblog

looks at where bitcoin stands amid widespread volatility in the crypto markets.

Read more

6K

1K

4K

10

87

742

All-time high

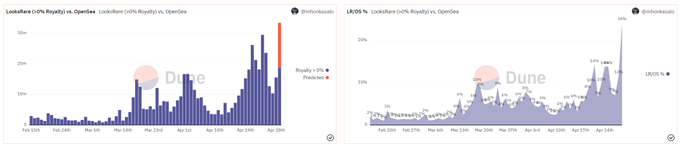

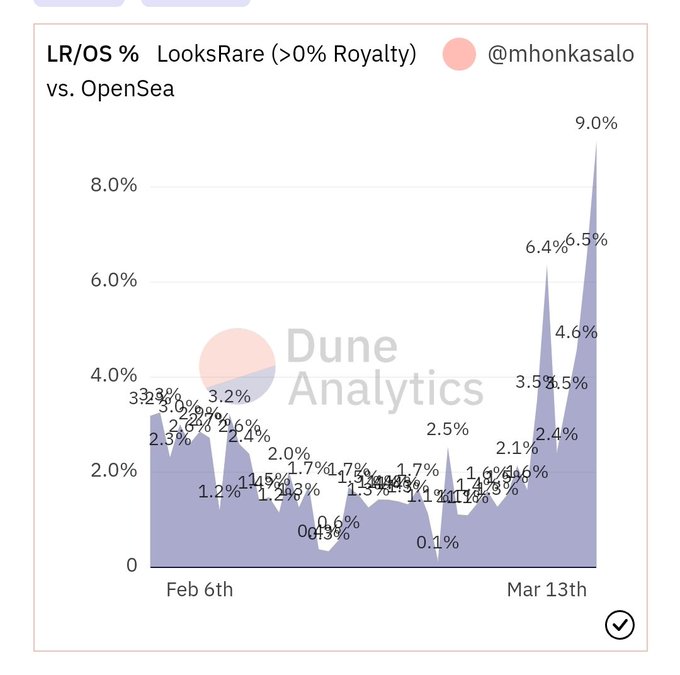

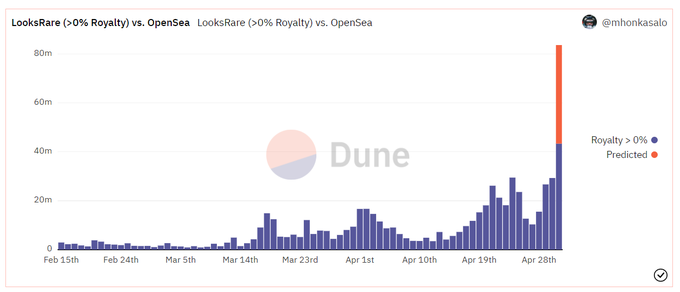

@LooksRareNFT

royalty volume vs. OpenSea today at 24%.

Also, on pace for the first >$30m total volume day.

18

86

497

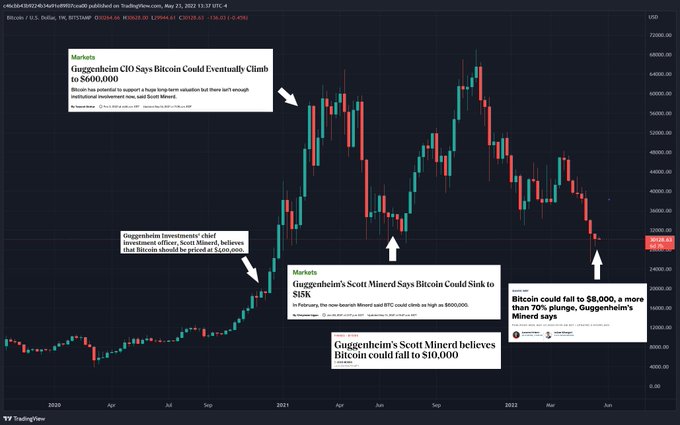

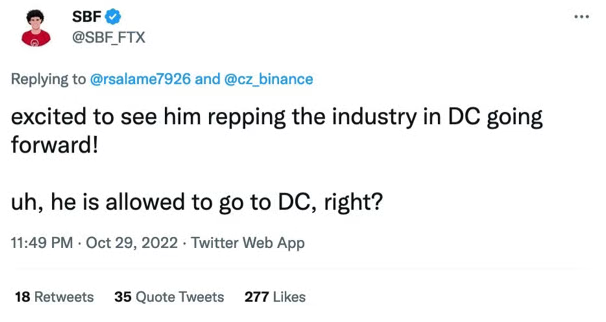

SBF never cared about saving the world.

In his words: "dumb game we woke westerners play where we say all the right shiboleths".

Stop attributing any positive intent to this habitual liar & criminal.

64

53

458

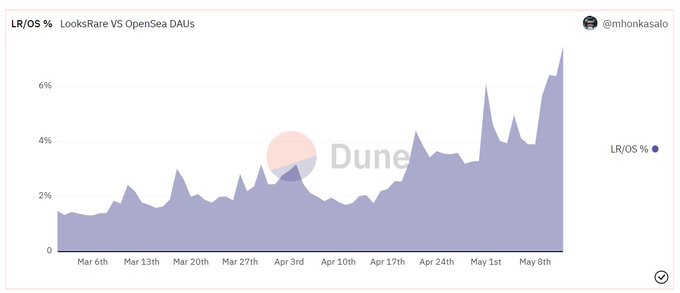

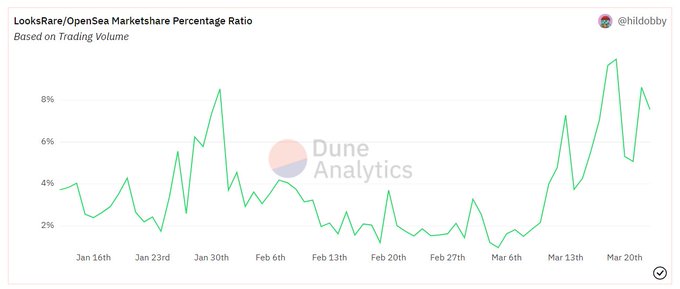

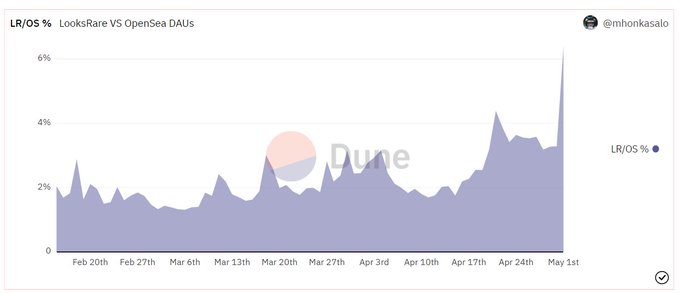

.

@LooksRareNFT

user growth vs. OpenSea is starting to look increasingly positive.

Previously, catching up on volume (~20% of OS) but now at 7.5% of users as well.

23

77

430

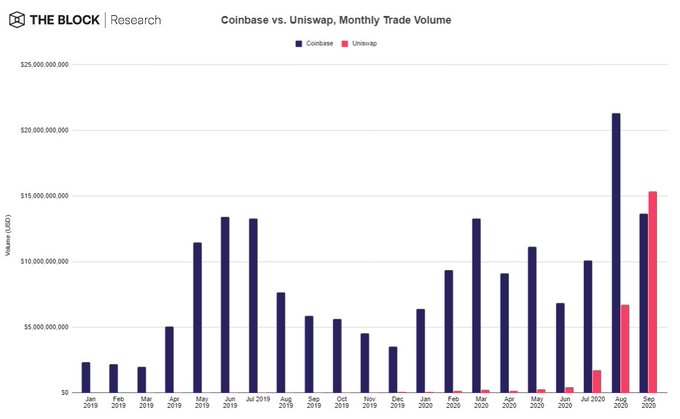

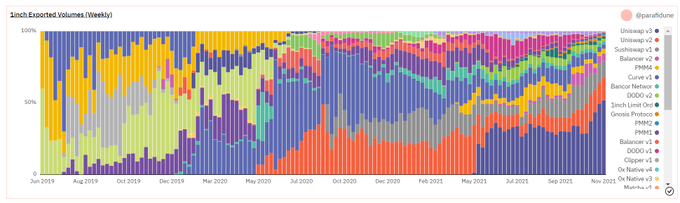

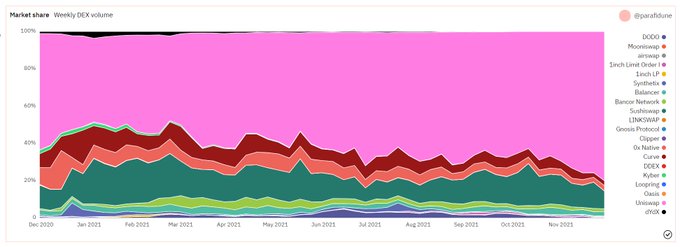

Trade volume in September 2020:

-

@UniswapProtocol

$15.4 billion.

-

@coinbase

$13.6 billion.

11

109

400

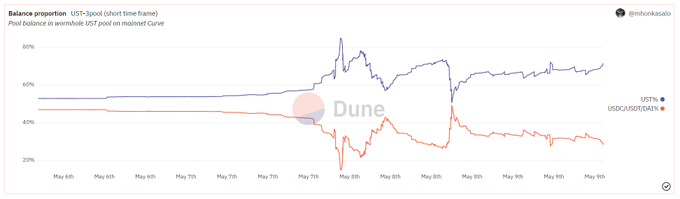

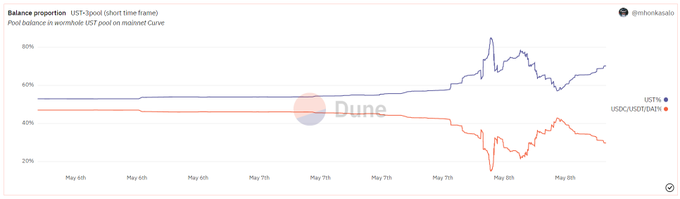

Events on Binance over the past few minutes:

- $20m added to defend UST on Binance.

- Minutes later it was $16m.

- Someone just got a sell $5m fill.

Not much defense left.

(h/t:

@lawmaster

)

10

15

399

Reminders:

1. Madoff was in cuffs the next day when his sons turned him in.

2. SBF stole customer deposits from his exchange to commit various financial crimes.

3. Losses from SBF's fraud will exceed total losses in the Madoff case (<$4bn today).

4.

@nytimes

is a clown show.

23

57

398

- Aave is still the biggest lending market.

- MakerDAO still has the largest stablecoin.

- Uniswap is as dominant as ever in exchange.

- Lido is running away w/ staking derivatives.

Many winners have been here the longest & continue to dominate the growth metrics.

8

40

350

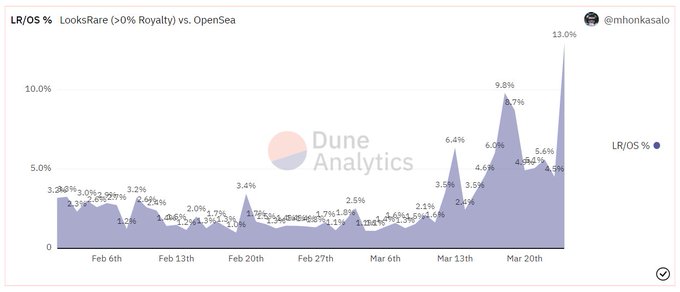

Whichever way you measure it,

@LooksRareNFT

growth is starting to look pretty undeniable.

13% of OpenSea on >0% royalty volume today, 8% using

@hildobby_

's real volume filter.

16

59

343

1. Create

@solana

wallets behind 2FA.

2. Abstract tx fees from users (trivially easy).

3. Turn on payments between users.

Congrats, X is now the fastest global payments platform — without users knowing it runs on a scary blockchain.

Path is there after

@Visa

announcement.

26

38

344

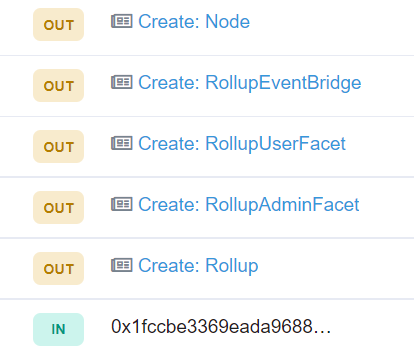

At just 4x Ethereum txs, BSC is struggling to keep up.

BSC offers a trivial tx througput addition vs. what will be required from blockchains (10,000x+) & tradeoff is large.

This is why Rollups. Linear thinking doesn't even move the needle on scaling, exponential solutions do.

No,

#PancakeSwap

isn't slow, BSC is just overloaded right now.

We also have an ATH number of people using the site.

477

444

3K

21

48

338

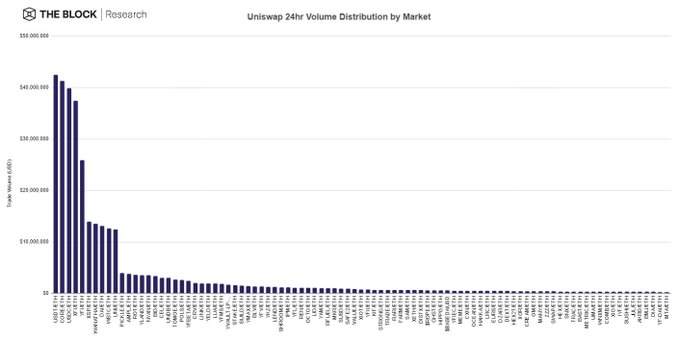

Top 93 markets on Uniswap account for 90%+ of trade volume.

Even narrowing to these markets, the volume Uniswap volume was higher than on Coinbase.

15

53

318

@MattyWTF1

@HaasF1Team

This is such a fucking stupid weekend.

Shouldn't be on the calendar for ethical reasons & because it's dangerous as fuck for drivers.

4

2

281

"but it's only wash trading" when BAYC volume is on pace to overtake on

@LooksRareNFT

vs.

@opensea

14

39

270

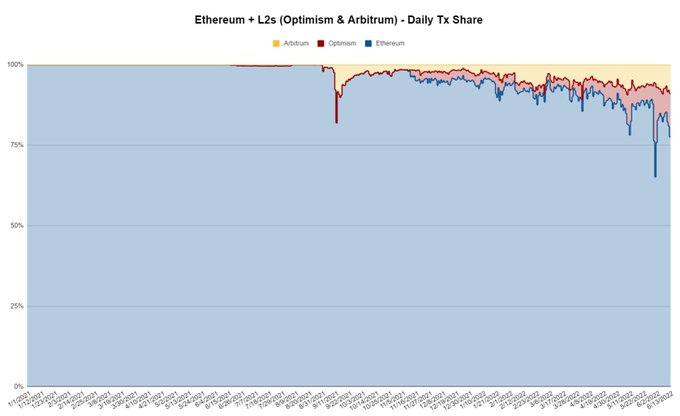

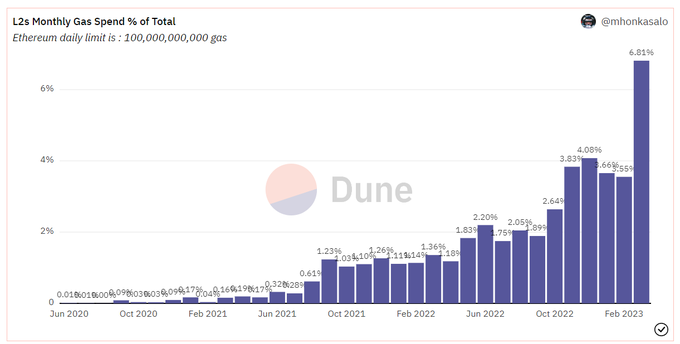

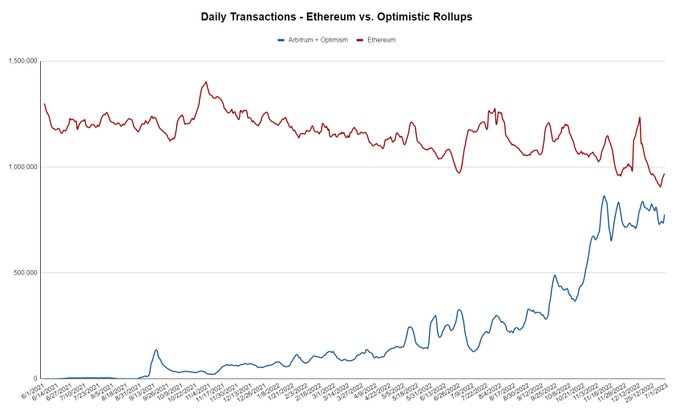

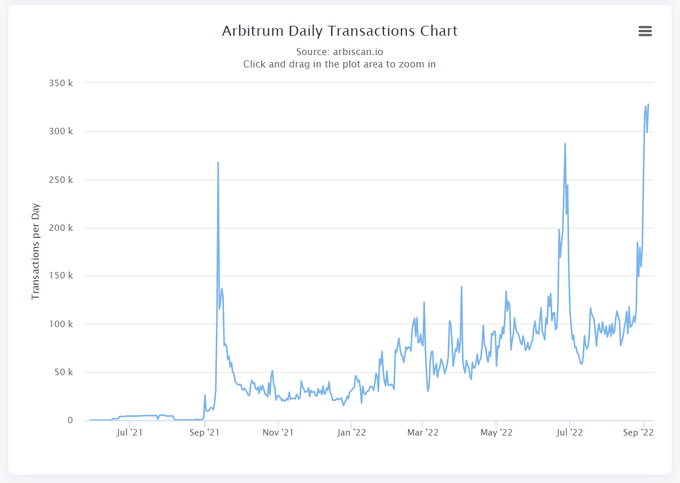

Quite clear that

@arbitrum

will be the first L2 to surpass the transaction count on Ethereum.

13

29

260

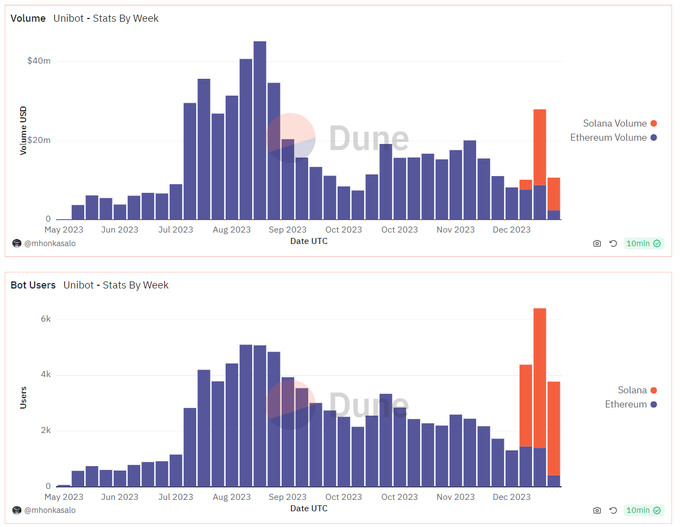

Last week

@TeamUnibot

put in a new ATH on users & will easily surpass ATH in trade volume this week.

Most of the activity now comes from Solana.

(credit:

@whale_hunter_

)

22

40

245

.

@Reuters

is so lost they are in "not even wrong" territory.

I get that crypto is esoteric but it takes real effort to misunderstand everything this completely.

30

23

243

Another day of promising numbers from

@LooksRareNFT

:

- Royalty volume on pace for $80m (2.5x previous ATH).

- Users relative to OpenSea at 6.4%. Even with growing volumes, this metric previously lagged.

- Share of

@gemxyz

txs at 18.3% (~80% increase).

15

39

236

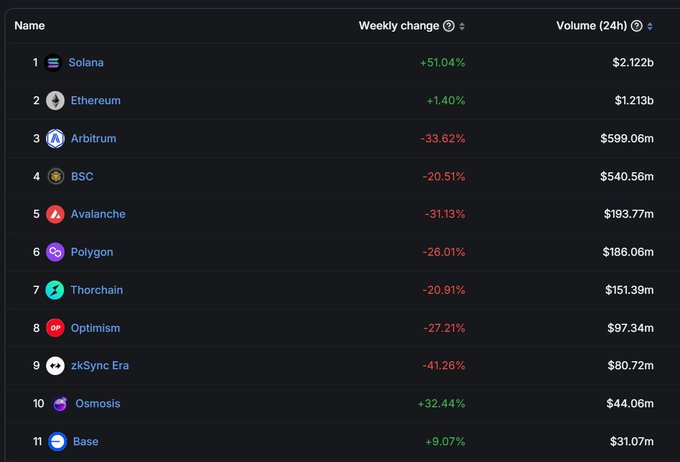

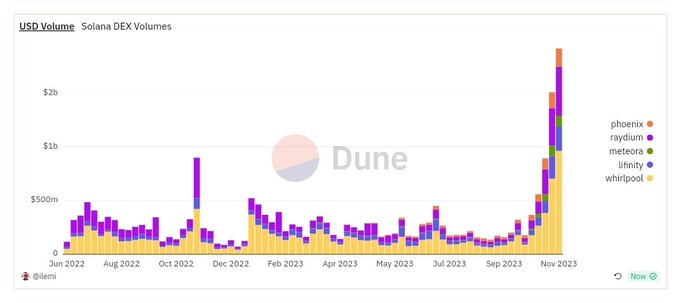

Another ATH in DEX volumes on

@solana

this week.

Passed BSC & Polygon, just behind Arbitrum. ~1/3rd of Ethereum volume.

13

41

235