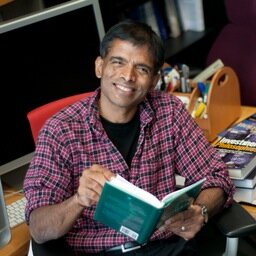

Martin Schmidt (free, free)

@martin__a__s

Followers

815

Following

6K

Media

86

Statuses

2K

finance nerd | governance connoiseur | armchair alpinist | had a monkey profile pic before it was cool | building a free and open economy at @qblockchain

Joined June 2017

"Intersubjective" is a word we don't often hear in crypto.

2

0

15

If you're looking for red flags in an investment, someone pitching it as "downside protected" AND "upside guaranteed" is pretty much as good as it gets. Madoff vibes.

Definitely highest risk/reward position in the market by far. Downside protected by guaranteed long term spot buying upside guaranteed by long term spot buying.

0

0

1

Aswath Damodaran is the voice of reason when it comes to valuation. Not that markets are always reasonable. But understanding what the reasonable position would be is usually a good starting point.

In the last few years, MicroStrategy has become a Bitcoin SPAC, with investors attributing savant-like status to Michael Saylor. Its success has led some to push companies to shift their cash into bitcoin. As a general principle, this is a bad idea, but there are four carveouts.

0

0

0

"Freedom to choose" and "safeguard monetary sovereignty" are two mutually exclusive goals. You gotta pick one. The mental gymnastics by ECB staff members trying to defend their monopoly position are becoming increasingly absurd.

A digital euro would preserve consumers’ freedom to choose how to pay. It would safeguard monetary sovereignty, enhance resilience, and ensure we have a digital means of payment that is easily accessible and universally accepted across the euro area.

0

1

6

This bears repeating. Seeing a lot of takes that RH's "tokenized stocks" (they're not really tokenized stocks, but whatever) are great because they increase liquidity by enabling out-of-hours trading. This is flat out wrong. If anything, it fragments liquidity by pulling.

@TheTakenUser @gnovak_ my somewhat unpopular opinion is that liquidity aggregation is a feature of tradfi markets while - conversely - liquidity fragmentation is a bug of crypto markets.

0

0

1

The Robinhood / Arbitrum thing is cool. But it also confuses me - here's why:. 1/ Tokenized stocks have been around for years (didn't FTX have them?). Technically, it's trivial to tokenize a stock - the challenges are exclusively legal / regulatory. 2/ Legal problems are.

Robinhood did well to clearly define its thesis. Phase 1: tokenize stocks as receipt tokens, trades are still settled in existing tradfi markets. Phase 2: integrate Bitstamp to improve liquidity and enable 24/7 trading. Phase 3: integrate blockchains for composability benefits

0

0

1

This is interesting: priority block space for humans. Like it or not, but in the AI economy, the relationship between humans and machines will need to be negotiated. Expect lots of challenging questions.

Priority Blockspace for Humans is live on World Chain. Introducing a new dimension of transaction ordering: humanness. Only possible on World, the real human network.

1

1

2