fmarrr

@maflora89

Followers

41

Following

30

Media

33

Statuses

79

🐢📊🤹🏻♀️ Data and operational support at @GyroStable Gyroscope exploring and learning things, just like the status of 🐼 here picture credit: myself

Joined January 2022

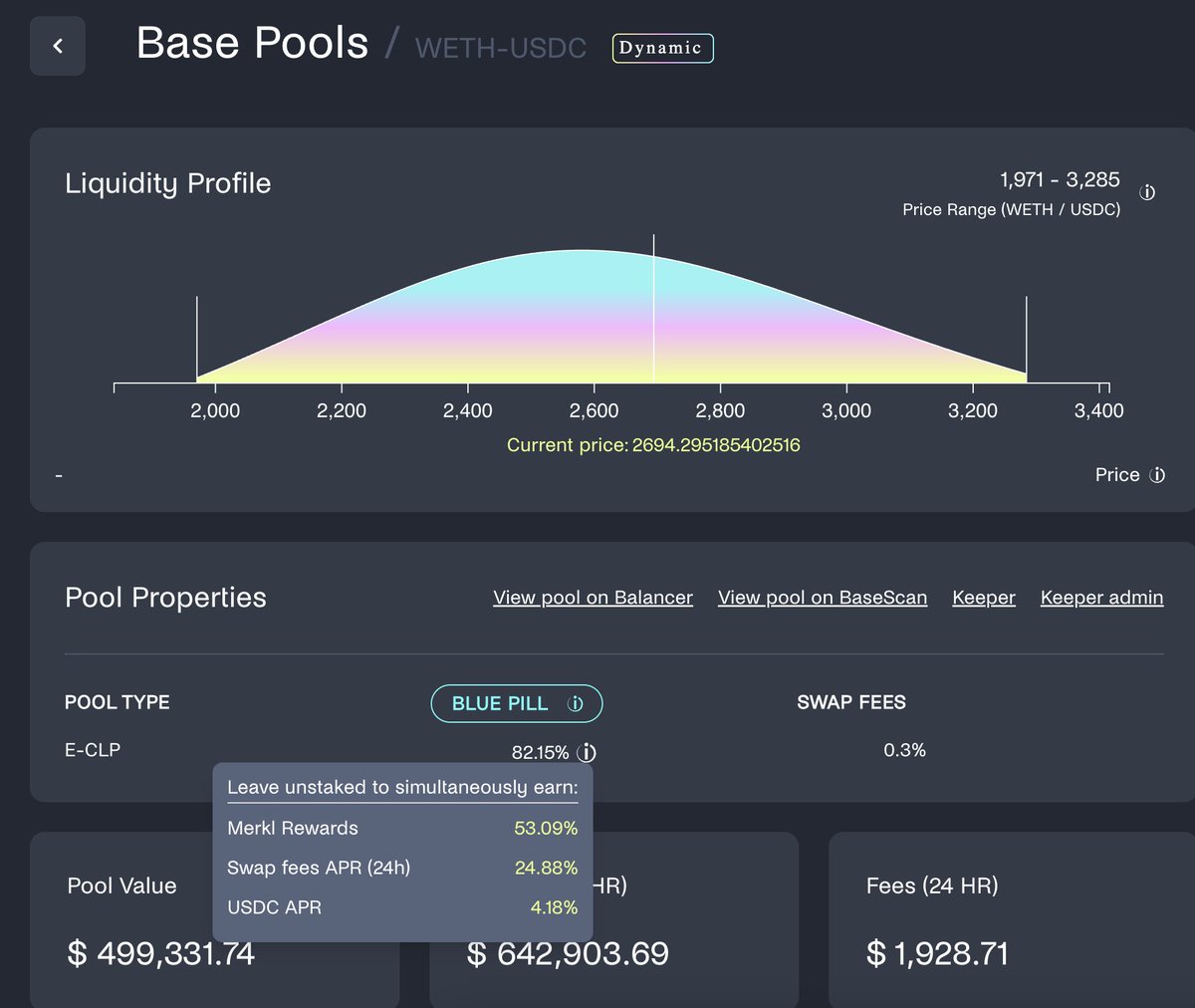

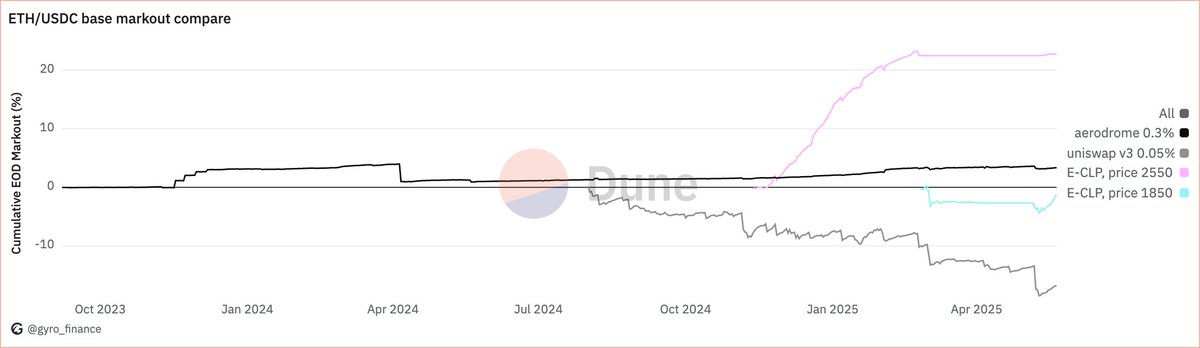

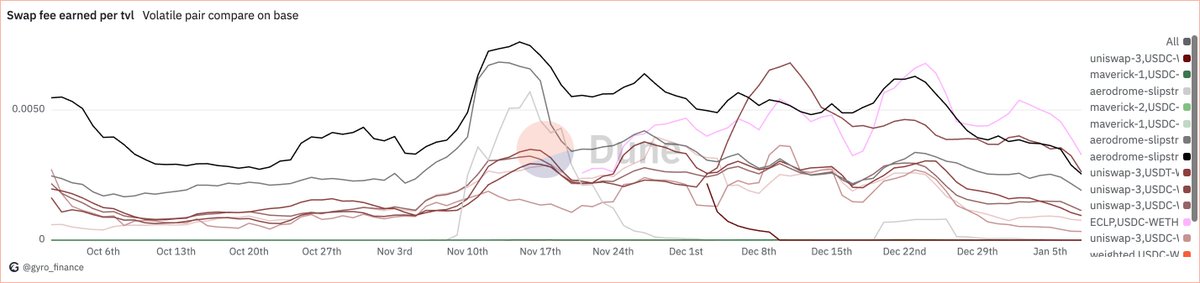

High APR does not always equal to high LP returns. This analysis offers: .- why Markouts should be the go-to metric and how it is computed. - a comparison of ETH/USD markets across major DEXes, showing how Dynamic E-CLPs @GyroStable stand out.

Markouts = how much an LP gained (lost) from trade execution vs a benchmark of CEX pricing. Positive markout means the pool sold ETH above market price or bought ETH below market price (both profit). Markouts describe performance independent of asset exposure, which may be.

1

0

2

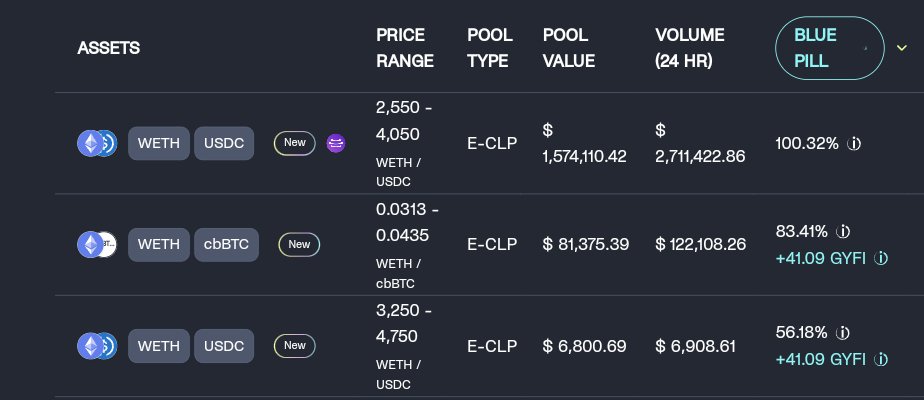

Set-and-forget market making is entering a new era with @GyroStable Dynamic E-CLPs launch. With incentives waiting to be claimed.

Dynamic E-CLPs are now live, starting on the Superchain. - Real yield from volatile pairs.- Set-and-forget liquidity.- Efficiency and safer wide range liquidity of the E-CLP. 🧵👇

1

1

11

Did this analysis to compare market making performance. E-CLP(Pink) outperformed from Dec to Feb - making it profitable for LPs. But this was just static E-CLP. When this pool design goes dynamic, set-and-forget market making may be entering a new era. @GyroStable

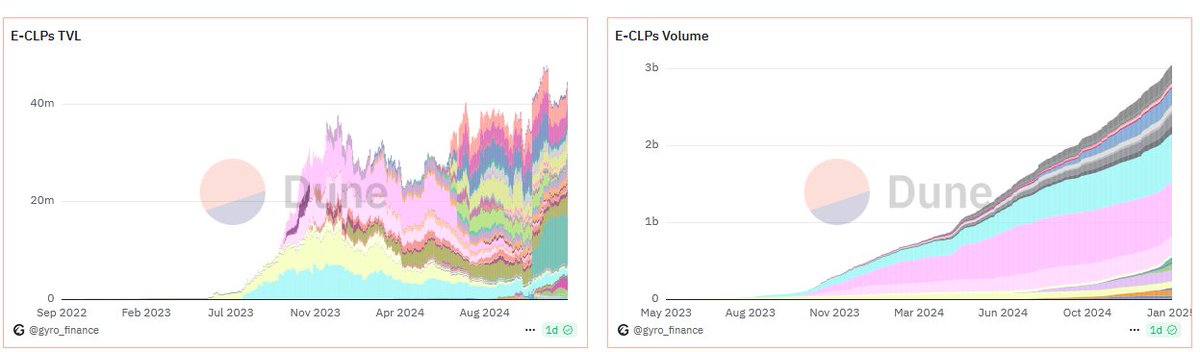

Why to be excited about Gyroscope's dynamic pools 👇. Gyroscope's revenue model focuses on high volume Volatile Pair pools. The profitability was demonstrated in Dec-Feb. Dynamic pools make scaling Volatile Pairs more efficient with.1) 2x volume ability.2) reduced churn.

0

0

4

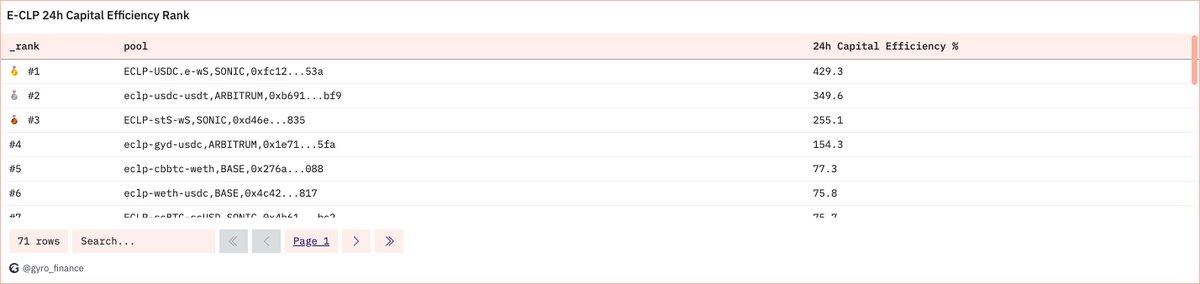

Spotted the USDC/USDbC pool on @base is doing great with a 24h capital efficiency of 2258%. This showcases the power of the Concentrated Liquidity E-CLP from @GyroStable, plus there are incentives to collect

New @base pools now live with GYD rewards. - sUSDe/GYD.- USDC/USDbC.- WETH/cbBTC. Plus renewed rewards on key ETH & GYD pairs.

0

4

14

and here it shows how efficiently capital is being utilised from the Gyro @GyroStable pools on @beets_fi @SonicLabs . i.e. wS-USDC.e: 430% 24h capital efficiency

2/ Powered by @GyroStable, Elliptical CLPs (E-CLPs) are redefining passive concentrated liquidity. Unlike traditional CL pools, they don't require manual and technical range configuration by users. Instead, ranges are pre-configured to optimize depth where it matters most.

0

3

16

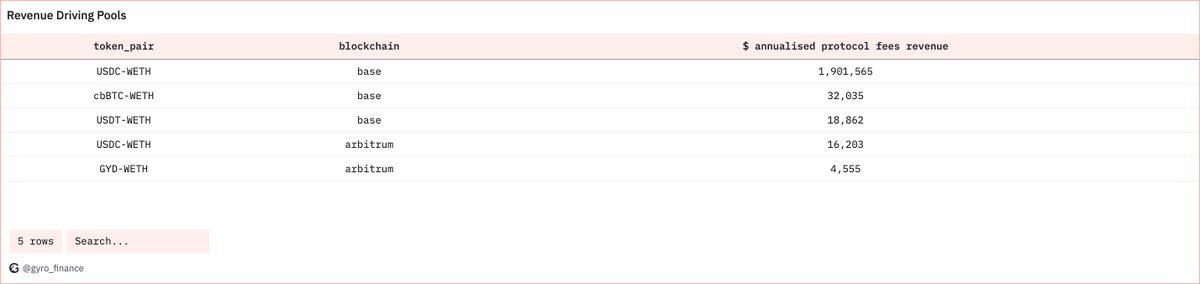

Revenue driving pools of @GyroStable got extended. more Gyro's volatile pools, more revenue. Now with GYD rewards on the pools, even better for the LPs.

1

0

4

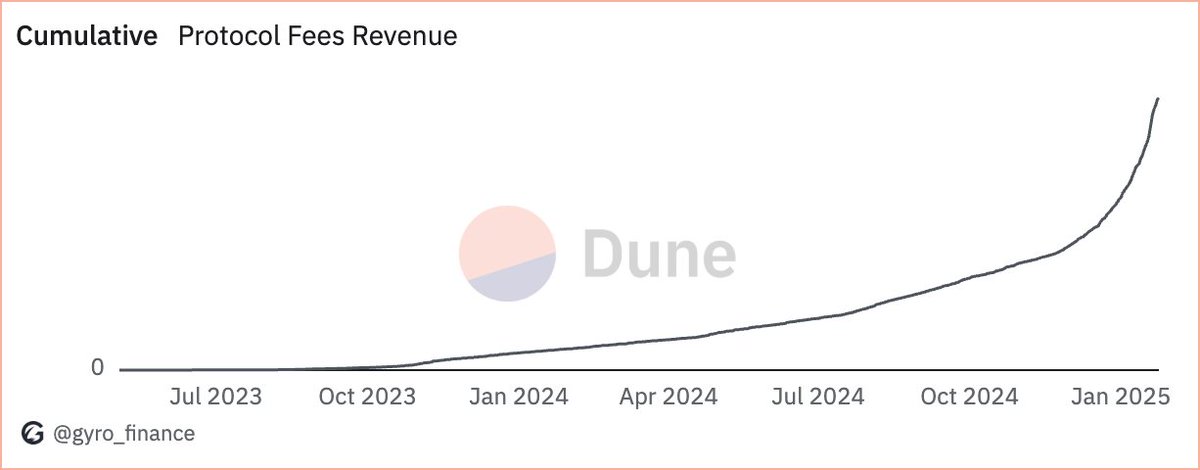

Wonder how @GyroStable is doing at generating protocol fees revenue?. Check out the updated revenue section on Gyroscope's Dune dashboard. Reply with stats request or feedback!

0

4

24

94% of $GYD from @GyroStable in circulation were used in transactions over the past 30days. A lot of these transactions use GYD as a connecting asset, facilitating ECLP swaps. This demonstrates strong adoption & utility of GYD in trading. Now imagine GYD volatile ECLP👀

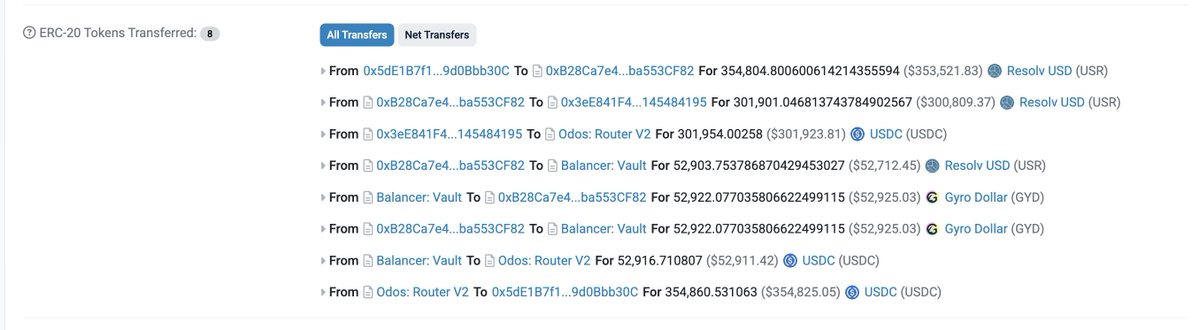

The Gyro $USR | $GYD ECLP is doing up to 13x its TVL in daily volume. Even better: GYD is a connecting asset here, facilitating ECLP swaps between USR -> USDC (that originate on Pendle/ Euler/ and co). See, for example 👇

1

6

16

You can check the query on Dune and review the code to see how this analysis was done.

dune.com

Volatile Pair Analysis on Base TVL (Total Value Locked): Measures the total capital held in a pool, indicating its size and investor confidence. Volume: Tracks trading activity, reflecting user...

0

0

1

Pink highlights @GyroStable volatile pair on @base. Over the past weeks, E-CLP has outperformed similar pools in the market in terms of profitability. This demonstrates how well Gyro's volatile pair is earning for its LPs, while also generating revenue for the Gyro treasury.

.@GyroStable Volatile Pair Pools continue their printing today on @base . On top of high swap fee APRs, choose your pick of GYFI or BAL rewards

1

2

8

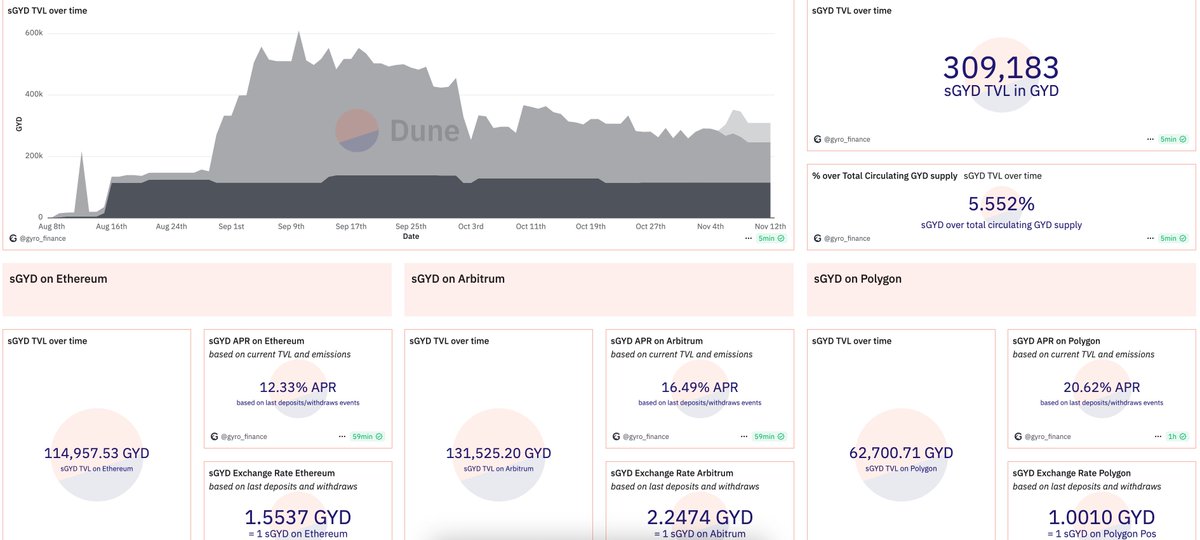

Check the sGYD TVL trend and APRs, all in one place, from the Dune sGYD dashboard 👀

Gyroscope is now live on @0xPolygon!. That brings the Gyroscope vortex of extreme liquidity and capital efficiency to the network. 🌪️. Now, natively on Polygon PoS, you can:. - Use GYD and sGYD. - LP into new Rehype pools.

1

0

1

Will be taking a walkthrough the Gyroscope Governance using the Governance Dune Dashboard. Explains Who governs and How it works in a bit.

Join in a little under an hour for a deep-dive in Gyroscope Governance! . A governance system designed from the ground-up to actually give everyone a voice.

1

0

1

Will be hosting an Open Call on @GyroStable 's Community Discord tomorrow, 3 Oct at 13:00 UTC. We'll take a data-driven dive into Gyroscope using Dune dashboards 📊. Join us tomorrow to learn more about Gyroscope!.

1

3

11