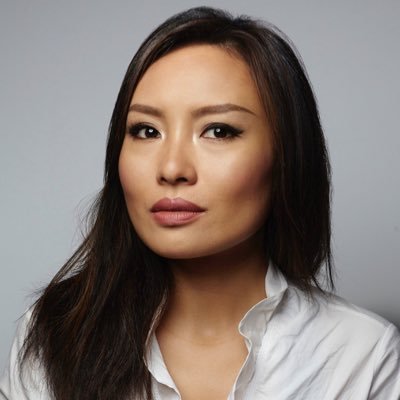

cephalopod

@macrocephalopod

Followers

65K

Following

30K

Media

2K

Statuses

18K

Zuu sufu sufu chyu chyu chyu tsu zuu fufufuuu...

Joined December 2020

Remember that FTX was illegally using **customer money** to lend to his affiliated hedge fund Alameda Research, to make illiquid venture bets, and to make political donations. And that when the customers asked for their money back, he couldn’t return it. THAT is why the

[SBF says:] I don't quite agree with every point—but, yeah, this is basically what happened. I'm not saying FTX's solvency or the Debtors' mismanagement are the reasons I'm innocent (although it's a piece of the story!). But the Debtors are still withholding funds—see, e.g.,

28

117

3K

My “OpenAI is not seeking a government backstop” t-shirt has got people asking a lot of questions already answered by my shirt.

1

6

110

Haha oh well guys never mind, I'm sure another round of fine tuning will fix it. Just one more round of hyperparameter tuning bro... I swear I'm good for it...

14

6

240

Excited to check in on the results of the LLM trading experiment! I expect that after another 9 days that DeepSeek and Qwen are up another 100% right? Oh...

Finance people dismiss this as random walk. AI people find it fascinating. Both are right - as we figure out optimising automation vs augmentation, experiments like @the_nof1 matter. BTW DeepSeek 120%+ & Qwen 100% in 9 days. Grok & Claude now both profitable. Gemini & ChatGPT

29

28

393

US Treasury Treasury Company. Who’s building this?

6

4

187

Excited to share that the Tokyo Metropolitan Government has selected the Japan Airlines @JAL_Official_jp, Sumitomo Corporation and Soracle @SCL_official_jp consortium, which features our Midnight aircraft, to be one of only a few participants in the first phase of the city’s

10

29

191

If MEXC was a real exchange then you would not need the CSO to be locked in a hotel room for 5 days, on 4 hours of sleep a night, just to allow user withdrawals. Why are there frozen funds in the first place? Why does it take so long to unfreeze them? What are you doing with

Just wrapped up my 5th day locked in a hotel room dealing with nonstop calls, endless comments, one meal a day, barely 4 hours of sleep. Not just me, the whole MEXC customer service, risk control, marketing teams have been grinding nonstop behind the scenes. We keep our word.

42

31

576

Even the most cutting edge low latency trading system isn’t fast enough to reply to this fuckin guy’s tweets

17

4

309

Sunday afternoon chicken soup (three year old’s special request)

7

1

168

Fuck …. this is actually really good.

7

4

436

We're going straight to the final boss now. How would you pronounce Featherstonehaugh?

8

1

32

libtards back in control

bbc.co.uk

Rob Jetten's D66 party celebrates but with most of the votes counted the result is too close to call.

5

3

64

Don't agree with either of these arguments really. 1) Funding will not be 20% forever (people will long underlying / short perp to collect the funding, which will collapse it down to more reasonable levels) 2) Market makers will price in dividends for perps just like they do

Perps on equities doesn't work btw. 1) Paying 20% funding for an asset that goes up 10% per year on average is just dumb. 2) No dividends yielding that should be an extra 2-3% per year (while it sounds small, it still compounds up).

22

11

385

I can’t say this enough times. Anyone who knew how to trade with the success rate implied here would not sell it for €35/mo. It’s slop. 99% of the “quant techniques” here are things you read in academic papers but never used by practitioners. You’re a fool if you subscribe.

😘I dropped a course about mean reversion trading. It’s built like a compact trading course module for practitioners. i start from first principles and the mathematics of stationarity. You’ll learn ▫️why classic mean-reversion is effectively a market making strategy with short

43

24

602

PS @innercitypress has done great work covering crypto trials over the past few years, you should donate to him here —

buymeacoffee.com

Matthew Russell Lee for/as Inner City Press covers SDNY, UN Gate, banks & IMF. books http://tinyurl.com/bdhp2j5u http://patreon.com/MatthewRussellLee

0

0

9

love to post on the everything app using my x dot com account “Spenser Basma”

2

0

13

@patio11 @TheStalwart Millions of Americans will reach retirement with no meaningful savings having gambled them away in the stock market, but on the other hand a few hedge fund managers will get really really rich, so who’s to say if it’s good or bad..?

6

4

83

This is completely wrong. Here is an incomplete list of reasons that losing money is much, much easier than making money — - fees - funding spread - bid/ask spread - market impact - volatility drag - asymmetry of leverage - latency - adverse selection The only way you can

The real issue is this: it’s just as impossible to design, or accidentally find a strategy that consistently loses money as one that consistently outperforms. (Ex-costs) Randomness, monkeys, and dartboards explain ‘alpha’. Adding assumptions to sound smart or justify being

20

28

534