Michael de la Merced

@m_delamerced

Followers

14K

Following

3K

Media

26

Statuses

295

Back in business. @nytimes / @dealbook reporter. DM for Signal | [email protected] + [email protected]

London (& NY) via SF (& NY)

Joined September 2007

Nothing beats a Jet2 holiday, except I guess not booking a Jet2 holiday

ft.com

Company says customers are holding off bookings

0

0

1

I've written more than a few obits — including several people featured in "Barbarians at the Gate" — but don't know that I've gotten as poignant a kicker quote as this, for the legendary deal lawyer Dick Beattie (also a character in "Barbarians").

0

0

4

RT @dealbook: In today’s DealBook: @m_delamerced examines the costs of Trump’s latest hit to Harvard; Trump antitrust cops take aim at Blac….

nytimes.com

The president escalated battles with prominent American companies and institutions, as well as a key trading partner. The damage could be extensive.

0

1

0

Fascinating analysis by @rajivatbarnard on prediction markets and the papal election. (He correctly predicted to me for @dealbook that information leakage probably wouldn't come into play: .

nytimes.com

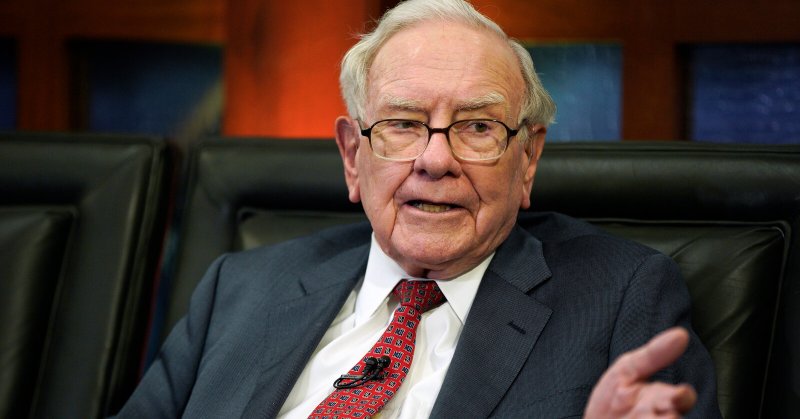

Tens of thousands were on hand to see the billionaire announce his plans to retire. Their attention is already focusing on what is next for the conglomerate he built.

0

1

3

• And he taught generations of investors how to, well, invest. @maureenmfarrell @LaurenSHirsch and I dug into why Buffett mattered to so many for @nytimes .

nytimes.com

The idea of “value investing” had long existed. But no one did it as successfully or for as long as he did.

0

2

0

• Value investing predated Buffett. But no one had done it for as long, or as successfully, as him.• Berkshire is truly a unique creation and wealth-generation machine.• Buffett transcended business fame for actual fame, and that made Wall Street, Washington pay him heed.

1

1

0

Capitalists the world over are still reckoning with Warren Buffett finally announcing that he would seek to step down as Berkshire Hathaway's CEO. But why was this so affecting — to both average investors and moguls like Bill Ackman and Jamie Dimon? 🧵.

1

1

0

Worth noting, however: As my colleagues @Fahrenthold and others have noted: DOGE has drastically trimmed its estimated cost savings, to $150 billion or so, and its numbers are still full of errors

nytimes.com

Elon Musk now says his group will produce only 15 percent of the savings it promised. But even that estimate is inflated with errors and guesswork.

0

1

0

Asked about DOGE's impact at the Berkshire annual meeting, Buffett does a dodge and focuses on a longtime bugbear, "unsustainable" government spending:. "We’re operating at a fiscal deficit that is unsustainable," he said. Fixing that is a job Buffett says he doens't want.

1

0

0

BUT, Buffett played down tariff-related volatility: "It's really nothing".

1

0

0

In case it wasn't clear: I'm following the Berkshire Hathaway annual meeting, where Warren Buffett criticized President Trump's trade fight:. “Trade should not be a weapon” . “I don’t think it’s right and I don’t think it’s wise.” 🧵.

1

0

1

RT @andrewrsorkin: Investment advice from Warren Buffett. If you can talk to a CEO, ask them this question: If you were stuck on a dessert….

0

6

0

Fascinating how an answer about insurance for autonomous vehicles at Berkshire Hathaway's annual meeting turns into Warren Buffett riffing on Einstein and "we don’t necessarily have perfect people leading some of the nine countries" that can destroy the world with nukes.

0

1

0

😬 When you get to ask a question at the Berkshire Hathaway annual meeting, and you confused BRKA with another Berkshire.

1

0

2

Each of them is getting billions to invest in various opportunities: private equity, private credit, venture capital, AI, etc. But MC is also getting another shareholder, further validating its own business. Existing backers include Silver Rock and Mike Milken's family office.

1

0

1

For most of its history, Mubadala Capital, which manages other LPs' money, has been backed by its SWF parent. But it has recently struck deals to bring on external shareholders. Enter TWG Global, which struck a complex partnership and is buying a stake in MC.

1

0

2

ICYMI: I reported on Mubadala Capital — the $30bn asset manager affiliated with the $300bn sovereign wealth fund Mubadala — forming a multibillion-dollar partnership with TWG Global, of Guggenheim, LA Dodgers and Chelsea FC fame. Here's why it's interesting 🧵.

1

0

3