Curve Llama Lend

@llamalend

Followers

923

Following

308

Media

69

Statuses

278

Borrow $crvUSD against any collateral token, while benefiting from a borrower friendly liquidation protection mechanism provided by LLAMMA 🦙

Soft Liquidation

Joined May 2024

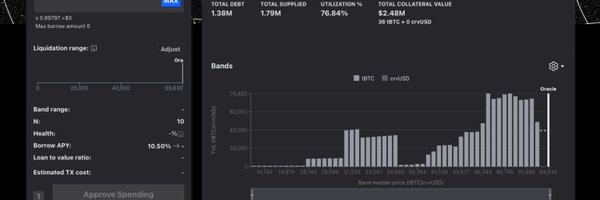

The graphic shows the user’s liquidation protection from 13–24 November 2025. The “oracle price” refers to Llamalend’s EMA oracle, not spot price. The green and blue bars represent the liquidation range ($3,200–$2,900) and the user’s shifting collateral composition.

5

12

43

Next year, the second version of the protocol will be released, which will open completely new horizons for the development of credit products. Integration vectors will be significantly expanded and will find a quick response across the entire @CurveFinance ecosystem. A huge

A proposal to grant 17.45M CRV to Swiss Stake AG for further development of technologies for Curve. Please vote at: https://t.co/Mhg1knf2Yu And read the proposal at: https://t.co/hhiZtzR696

8

18

99

Debt issuance in DeFi is becoming a serious narrative. And if I had to take debt today, here’s my Top Favourite protocols 👇 1) @llamalend (Curve) Absolute top choice. You get super cheap access to $crvUSD. Still volatile but a lots of efforts on adjusting it. Soft

5

7

53

This is interesting. @CurveFinance’s LlamaLend is flying under the radar for $wBTC and $wsteth lending markets as mentioned below, and likely many more. This coupled with soft liquidations tech and plenty of options in defi for $crvUSD utilization make this an excellent choice

You’re probably borrowing from the wrong protocol. I've been testing DeFiLlama's AI to spot actual top borrowing options for ETH and BTC as collateral. Simple prompts like: > "Best options for WBTC as collateral" > "Protocols with high liquidity for borrowing against ETH"

5

7

79

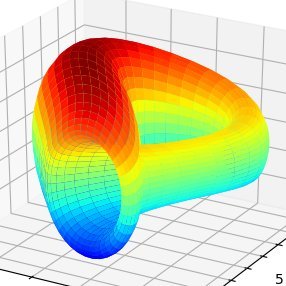

We just published Part III of The Beautiful Math Behind Curve AMMs series - this time diving into LLAMMA, Curve’s lending–liquidation AMM. TLDR: LLAMMA continuously rebalances collateral through an AMM curve - enabling soft liquidations instead of one-way liquidations. It

mirador.finance

LLAMMA (Lending-Liquidation AMM Algorithm) is an automated market-making system that continuously “rebalances” a loan’s collateral through an AMM mechanism

7

10

49

I just took out a loan with a negative interest rate. Only available on @llamalend. Created by the @CurveFinance

2

3

16

november is over, we can summarize the credit positions for this period: almost 50 million loans were close to liquidation. 96% of them retained their positions. The most popular market is WETH. Average position size is $152.51k. Created by @CurveFinance . @llamalend technology.

The market is crashing, which is always sad. I checked to see how many loans have been saved since the beginning of November on @llamalend . I'm shocked, 99%! @CurveFinance truly cares about user capital.

3

3

18

read the details of this real user experience in our article https://t.co/IFnuzuP96i

news.curve.finance

Llamalend’s liquidation protection turns sudden wipeouts into a controlled, manageable process. It helps loans survive volatility and gives borrowers more time to react and adjust. Find out how.

0

1

2

Great to see centralized exchanges sharing educational content about DeFi technologies — especially @CurveFinance. This piece from @Bybit_Official on how LLAMMA works and its liquidation protection is a solid contribution to the space. https://t.co/3O1NzEr9GU

0

0

2

Great material about the events of October 10, 2025 https://t.co/KAtaUQtFNF

dev.to

The crypto market has weathered many storms, but October 10, 2025 stands out as the most severe and...

0

4

12

The market is crashing, which is always sad. I checked to see how many loans have been saved since the beginning of November on @llamalend . I'm shocked, 99%! @CurveFinance truly cares about user capital.

4

5

35

Combination of @llamalend and @yieldbasis makes wonders

6

18

157

RESUPPLY’S PLAN IS SMART AS HELL 🤪 In the previous post I pointed out that the peg is @ResupplyFi 's main weakness, but now it’s time to give credit where credit is due. They’re already working on it. And the solution? It’s elegant, powerful, and similar in spirit to how

RESUPPLY NEEDS A STRONGER PEG 🧐 Let’s be constructive about @ResupplyFi . The model is powerful, incentives are cool, and the staking rewards remain top-tier. But none of that can scale unless one thing gets fixed: the peg. Over the past weeks, Resupply has seen a noticeable

0

1

7

Despite high utilization in stablecoin lending markets, lending rates remain low. Stay safe with @llamalend. Created by @CurveFinance

1

5

31

Because $fxSAVE is fully transparent and on-chain, all fxSAVE lending markets - @llamalend, @MorphoLabs & @eulerfinance - continue to operate normally. If there aren't black boxes, there's no liquidity crunch!

When the dust settles, transparency wins. fxSAVE is fully on-chain, fully verifiable. No black boxes. No curators. Just pure, programmatic yield sourced from protocol's economic activity! Trust math, not managers: https://t.co/ZjRWzeWVm7

3

14

54

if you like longs and ETH but don't want to get liquidated, then @llamalend from @CurveFinance is the best solution. This position was opened on March 3 at $2,350 per 1 ETH, it has x5 leverage and outlived ETH at $1,500. Just watch your health, Curve will do the rest for you

5

15

67