Philipp Heimberger

@heimbergecon

Followers

67K

Following

13K

Media

6K

Statuses

13K

Vienna Institute for International Economic Studies (@wiiw_ac_at); macroeconomics, economic policy, public finance, political economy, meta-science.

Joined August 2016

We have a new paper on the overstated effects of conventional monetary policy on output and prices. Results reported in the literature are plagued by p-hacking and publication bias, leading to inflated effect sizes of how interest rate hikes affect output and prices.

8

89

356

Across much of the UK and the US, home prices have risen beyond affordable levels.

3

20

56

This is a very useful list of 50 journals with explicit *short* paper options for economists.

1

34

178

This is a very useful list of 50 journals with explicit *short* paper options for economists.

1

34

178

This new AER paper finds large negative economic effects of wars: "A war of average intensity is associated with an output drop of close to 10% in the war-site economy, while consumer prices rise by approximately 20%." Negative spillovers through trade and common borders.

1

23

58

Homeowners’ spending is inelastic to home price expectations, renters reduce their spending when expecting higher prices. While renters seem to reduce current spending to be able to afford a home in the future, homeowners view expected increases in housing wealth as “paper gains”

1

10

44

This new AER paper finds large negative economic effects of wars: "A war of average intensity is associated with an output drop of close to 10% in the war-site economy, while consumer prices rise by approximately 20%." Negative spillovers through trade and common borders.

1

23

58

According to the European Commission, France and Austria will have among the most restrictive fiscal stances in 2026 (largest contraction in Romania). In countries like Italy and Poland, EU funds (RRF) will still offset national consolidation efforts, but only until 2027.

8

15

31

According to the European Commission, France and Austria will have among the most restrictive fiscal stances in 2026 (largest contraction in Romania). In countries like Italy and Poland, EU funds (RRF) will still offset national consolidation efforts, but only until 2027.

8

15

31

Academic publishing is a lucrative business for a very small number of private academic publishers. For🇦🇹, this paper estimates: public spending benefits publishing companies with a large amount - 25% of the annual basic funding universities receive from the Ministry of education

3

32

91

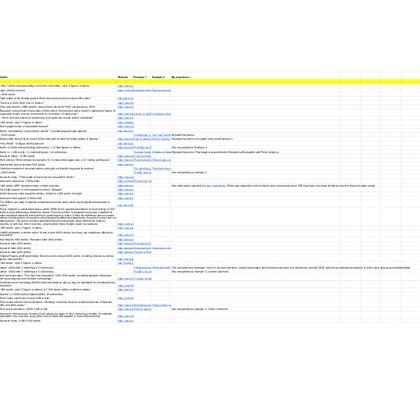

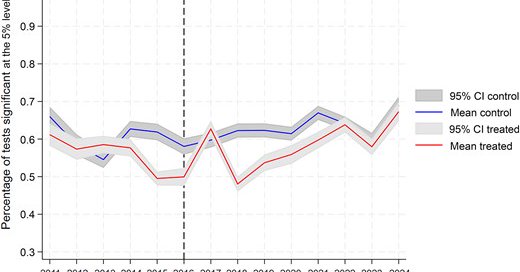

This paper examines a journal policy removing significance stars from regression tables and finds no significant effect on p-hacking, the preference for statistically significant results. It seems cosmetic changes don't eliminate the underlying incentive to chase significance.

1

8

28

This paper shows: support for lower taxes declines significantly when this comes into conflict with other fiscal policy objectives, e.g. social spending. Regressive reforms receive less support than progressive reforms. Left-leaning, high-income voters resist tax reductions more.

3

23

76

🇪🇺 Fiscal policy is once again central to Europe’s future. With defence, energy, and demographic change reshaping public priorities and budgetary choices, France and Germany face a shared question: How should national and European fiscal frameworks adapt to these new realities?

2

13

12

This paper shows: support for lower taxes declines significantly when this comes into conflict with other fiscal policy objectives, e.g. social spending. Regressive reforms receive less support than progressive reforms. Left-leaning, high-income voters resist tax reductions more.

3

23

76

Paper in "Economic Journal": https://t.co/jLQWu3hA8a Free-access version:

academic.oup.com

Abstract. In mid-2016, all journals of the American Economic Association stopped including significance stars in their regression tables. This policy aimed

0

0

2