Heartcore Web3

@HeartcoreCap

Followers

3K

Following

17K

Media

6

Statuses

257

Heartcore Web3 is a crypto-native venture fund investing in protocols and their native tokens, with a focus on the web3 application layer.

Copenhagen, Berlin & Paris

Joined September 2018

F* it, VC mode. Thrilled to share that @heartcorecap is now the proud owner of these purrrrfect cuties 🐾 Our crypto journey started back in 2013. We’ve seen (and backed) many great protocols — but what @chameleon_jeff and team are building with @HyperliquidX is truly unique.

17

5

92

Strata’s risk-tranching in action ⚙️ • Senior USDe (srUSDe) offers predictable and the safest yield on @ethena_labs USDe. • Junior USDe (jrUSDe) offers the highest yield on USDe without any leverage. Explore all the opportunities to further boost your yield 🧵👇

6

6

50

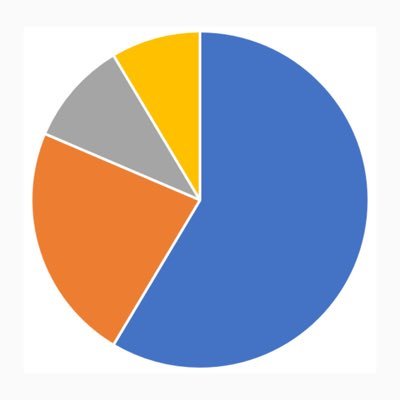

We grew by 300% on Solana in 2025 compared to 2024. Among our fastest-growing chains from the past year. Let's set a new high for 2026.

9

6

51

Thrilled to be backing @strata_fi as they add a new primitive to DeFi yields (and beyond)!

Strata is excited to announce a $3 million seed round, led by Maven 11, to build the risk-tranching layer of DeFi. Strata is a generalized risk-tranching protocol that brings structured products to any on-chain or off-chain strategy by splitting them into tokenized senior and

3

1

8

Strata is excited to announce a $3 million seed round, led by Maven 11, to build the risk-tranching layer of DeFi. Strata is a generalized risk-tranching protocol that brings structured products to any on-chain or off-chain strategy by splitting them into tokenized senior and

107

54

551

@HeartcoreCap is a proud supporter of the @AaveChan

Strong opinions, sharp vision, execution excellence, and focus on results. Become an active part of the DeFi renaissance Support the ACI by delegating your $AAVE. Just use Aave. https://t.co/OOkVjfgFfI

2

1

4

Liquidations are essential for keeping lending markets safe. Since launch, Aave has processed over $3.3B in liquidations to protect the protocol against bad debt. We've published a blog post introducing V4's new liquidation engine and how it improves on V3's approach.

25

44

353

Today we’re announcing a $29M Series A extension for LI.FI, funded by Multicoin and CoinFund. This brings our total capital raised to ~$52M. More aggressive and committed than ever to build the universal liquidity market for digital assets. Time to scale.

fortune.com

The company aims to make moving across blockchains more efficient.

191

47

662

We sat down with @PhilippZentner, Co-Founder and CEO of @lifiprotocol, to reveal the side of building that rarely gets told. What started as an idea now powers $50B+ in swaps for MetaMask, Phantom, Robinhood Wallet, and 650+ teams. Tune in. 00:00 How LIFI became the backbone

9

6

27

Spreading the gospel of Hyperliquid, the most exciting story in crypto, to the traditional finance world It's always a pleasure to be on @cnbc with @BeckyQuick and Joe Kernan Our stock starts trading this morning with the ticker $PURR Hyperliquid @HyperliquidX @HypeStrat

156

190

1K

Fluid is now the Top 2 Lending Platform by Monthly Active Users, with more than 124,000 users engaging with it every month. It is also a Top-3 Lending Platform by Active Loans across all chains. Stay Fluid. Build with Fluid.

4

9

82

Someone didn’t hear about @HyperliquidX

0

2

3

Huge respect for @santiagoroel who is a fantastic investor, thinker.. and I'm sure also a great builder now! I agree with a lot of the core premises: ~$1.5T of Alt market cap should be worth a fraction of that. Most infra/L1 valuations make 0 sense, protocol revenue quality is

You don’t value casino flow like recurring software revenue. Haven’t heard a single case why crypto projects should be worth >30x P/S when the best tech companies are valued less than that and they have recurring revenue, unlike the casino

1

1

4

Excited about this initiative by @GLC_Research. We at @HeartcoreCap would love to help. @HypeliquidX should become a Wall St household name.

0

1

4

After two years of hard work, we’re excited to announce that Aave Labs has received MiCAR authorization from the Central Bank of Ireland to operate a zero-fee on- and off-ramp for GHO and other stablecoins. Accessing Aave will soon be seamless for everyday users, bringing DeFi

Aave Labs is launching zero-fee on and off-ramping for @GHO and other stablecoins in Europe across Aave's various products. Cash to DeFi will soon be a frictionless experience across the Aave ecosystem.

198

190

2K

Aave's Horizon RWA market crossed $520 million deposits. The largest, fastest-growing market for RWA-backed loans.

32

30

268

😱 🙌

0

2

3

GEODNET Q3 highlights by @Blockworks_ Powering the robotic world’s precision backbone by👇 • Drone mapping: 4.4K RTK hrs @ 98.3% • Precision agri: 24.2K hrs @ 98.6% • Automotive: 188K hrs scaling fast • 0.47s latency | 10.8K obs • Rev → $5M annualized • 20K+ stations

1/ GEODNET is strengthening its position as the world's largest Real Time Kinematics (RTK) network through strategic improvements and sustained enterprise revenue growth. Unlocked by @GEODNET_

11

18

88

Thrilled about @HeartcoreCap investment in @375ai_ ! You'll soon hear more about them 👀

Thrilled to announce that 375ai has raised $10m to build a new data layer for the physical world. The raise is led by @Delphi_Digital , @strobefund and @hack_vc, with participation from @6thManVentures, @EV3ventures, @arca, @peaq & others. Read today's exclusive from

1

2

5