Harry Chris

@hchris999

Followers

5,261

Following

155

Media

481

Statuses

2,671

Just a guy who likes to invest for himself.

Joined October 2020

Don't wanna be here?

Send us removal request.

Explore trending content on Musk Viewer

Arsenal

• 426235 Tweets

#QueenOfTearsEp16

• 199876 Tweets

Spurs

• 111016 Tweets

Tottenham

• 110740 Tweets

Flamengo

• 100465 Tweets

Will Jacks

• 94925 Tweets

#TOTARS

• 62306 Tweets

Raya

• 61585 Tweets

North London

• 52576 Tweets

Botafogo

• 48916 Tweets

One Kiss

• 41621 Tweets

Kai Havertz

• 32930 Tweets

Gunners

• 30524 Tweets

ارسنال

• 23823 Tweets

Ange

• 22365 Tweets

D-8 to BLOSSOM

• 21737 Tweets

17 IS FINALLY RIGHT HERE

• 17958 Tweets

Maracanã

• 15837 Tweets

Nottingham Forest

• 15172 Tweets

توتنهام

• 13914 Tweets

Ben White

• 13754 Tweets

Göztepe

• 11895 Tweets

#الاجتماع_الخاص_بالرياض

• 11316 Tweets

Klaus

• 10969 Tweets

Rutu

• 10307 Tweets

アーセナル

• 10049 Tweets

Last Seen Profiles

Pinned Tweet

At the start of 2023 I looked to previous bull markets to understand where

#uranium

prices are headed. I am now convinced that what lies before us is unprecedented.

9

21

142

1-

#uranium

is all about supply and demand. Here are some points about 2021 you may not have realized.

19

91

656

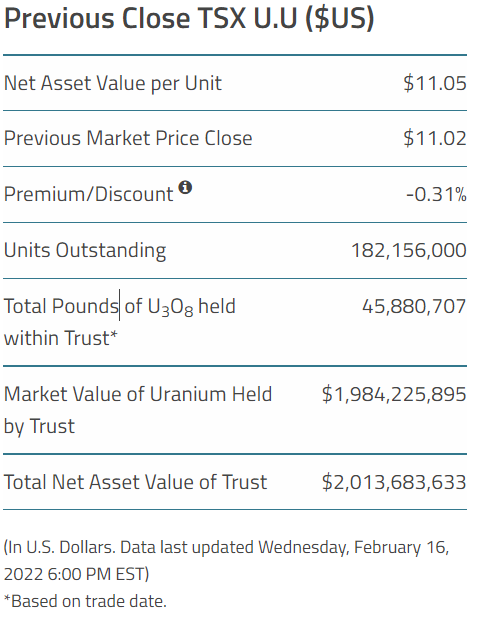

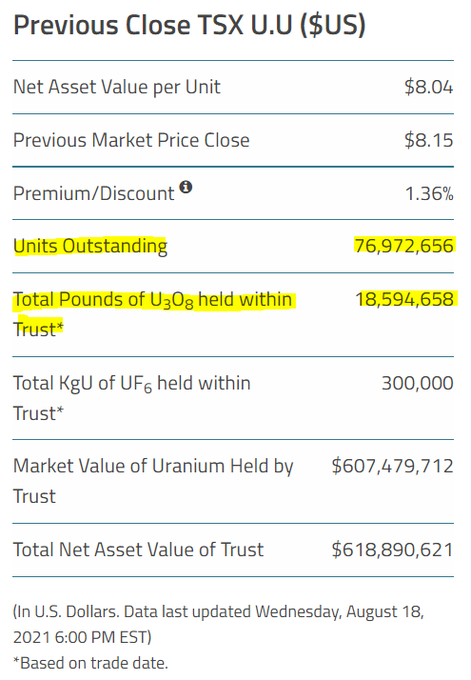

1-In 3 months SPUT has purchased and locked away 21 million lbs of

#uranium

.

You have to appreciate that this equals France's entire consumption for its fleet in 2021. Soon it will exceed China's 2021 number.

(WNA, France 8233 tU=21.4 mm lbs, China 9563 tU=24.9 mm lbs)

8

46

298

1-I've been away but looking to catch up.

In May the EIA puts out their annual

#uranium

marketing report. While we wait, the US utilities have completed their annual 10K filings giving us a view of their nuclear fuel purchases. In summary, it ain't great.

15

56

288

“History never repeats itself, but it does often rhyme.” - Mark Twain

A long thread on interest rates and the stock market, compared to

#uranium

prices and a stock.

The bull market of 2004-07 as compared to that of the current 2021-202? /1

11

54

265

I am a fan of history. There is a lot to learn from it.

If the price pattern followed by spot prices is consistent, we may finally see a significant move up in the spot price of

#uranium

in 2023. 🧵/1

16

59

256

1-A short thread on $CCJ $CCO Cameco's

#uranium

contracting news from last week. The impact of this event, and what it signals, is still understimated in my opinion. To understand what it means, we have to go way back starting with Fukushima.

7

36

254

Some thoughts on

#uranium

stock performance in the bull market of "2021 to ?".

At the end of 2020 the spot price of uranium was $30/lb. Fast forward to today and it is $78. A rise of 2.6x. As beneficiaries of ⬆️ prices, you would expect the miners to exceed this result.

A 🧵/1

14

27

229

1-With the markets closed today, I thought it would be a good time to write about Kazatomprom and their future impact on the

#uranium

market. There is a lot to unpack. So grab a coffee if you like and feel free to add to anything I may have missed.

15

36

223

How early are we in the

#uranium

cycle? Developers would have to rise by 4× to match valuations reached in 2007 when spot was $75. The equivalent level today would $114/lb.

#Uranium

equities are cheap or overpriced; it's time to look back and compare to 2007 and $75 spot price. For starters, let's ignore inflation.

7

25

180

9

30

218

8-SPUT still has seven more weeks to continue buying driving that number further downward, creating the largest annual deficit I could find in the last 20 years. With no choice but to consume their inventories, the tipping point for utilities, and the

#uranium

price, is near.

8

7

212

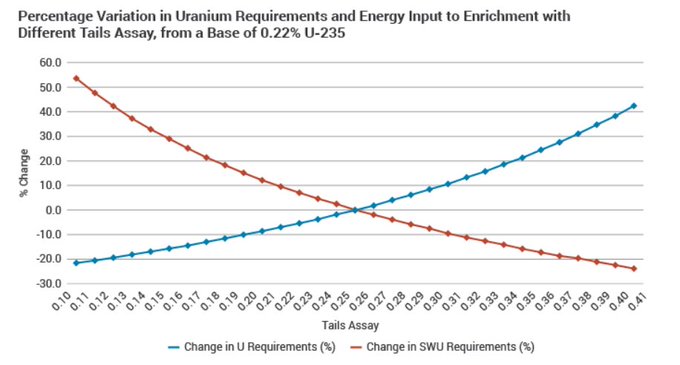

To add to

@quakes99

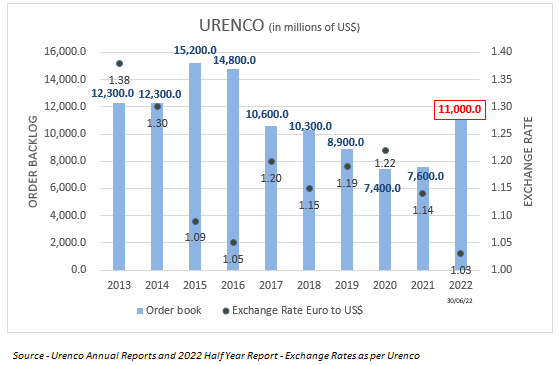

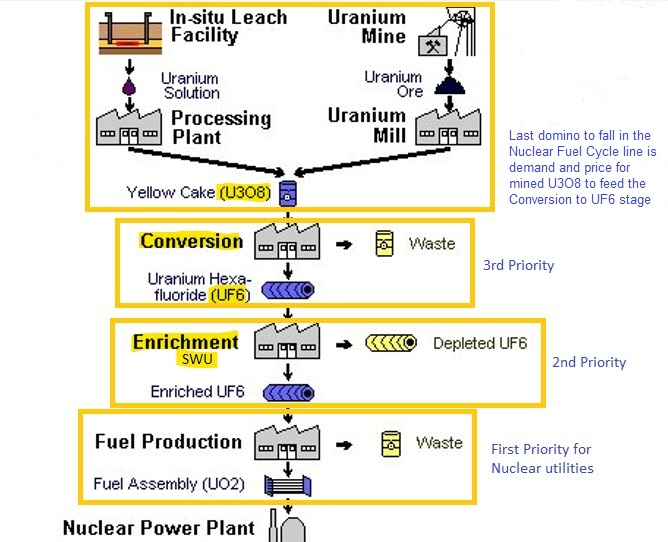

excellent thread, here is further confirmation of the seismic change from Russia to the West. After an 8 year decline Urenco reported a large rebound in orders, but not an increase in capex. They have to overfeed to meet this demand. More

#uranium

is required.

11

27

205

If your

#uranium

portfolio has gotten you down, you need to read "Would you have made a fortune in uranium?" from the last bull market. The site no longer exists but someone was kind enough to convert it to a PDF.

16

27

198

A summary 🧵on

#uranium

stocks to start your day.

It has been a great run since the lows of 2020. But we are still very early.

The market value of publicly listed miners is in the area of $50 Billion US. In 2007, at the peak, this was $130 Billion.

/1

8

26

201

The largest nuclear fleet in a single country has on average only 16 months of inventory, when the cycle from mine to fuel rods can take from 18 to 24 months. The

#uranium

inventory drawdown has come to an end.

Adrienne Hanly, Uranium Production Specialist from the

@iaeaorg

discussing U.S. inventory levels. Her study shows 16 months on average vs. their recommendation of 2Y+. This is an issue from her perspective and something governments may need to address (Europe just above 2Y now).

11

26

188

7

40

195

Mostly going unnoticed, Urenco released their 2022 annual report. As one of the largest enrichers, there are some very significant implications to

#uranium

in this report as we go through 2023. A🧵

/1

7

40

193

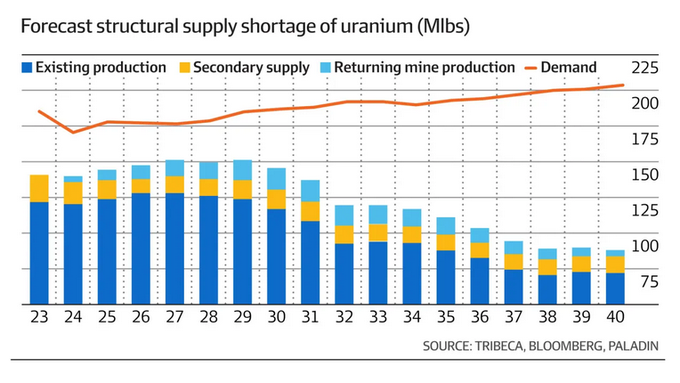

Stare at this chart for a while. In what year do we see

#uranium

supply meet demand? Never.

It will take a lot of supply from exisitng mines, new mines, new discoveries, and some new 2ndary sources to fill the gap.

Invest with tailwinds, it's a lot easier.

📊Guy Keller at

@Tribeca

always comes up with great graphics like this one👇 that makes the

#Uranium

#mining

#stocks

#investing

case as plain as the nose on your face!👃

#RideTheNuclearWave

🌊🏄

16

35

234

9

28

192

I appreciate that today was a nasty day for everyone holding shares in

#uranium

companies.

I am by no means a stock market prognosticator, but I thought some perspective might help.

Take the information as you wish./1

6

26

180

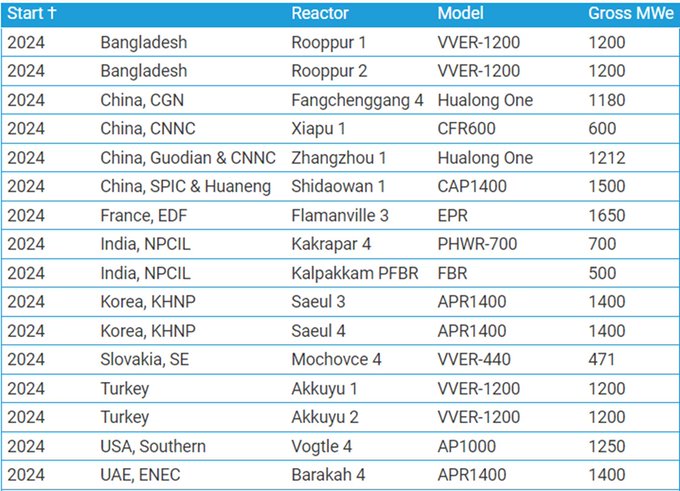

Interesting note that in 2024 there is an expectation of 16 new nuclear plants coming online. Although a certain amount will be deferred to 2025, it will be the largest increase in nuclear generation in the last decade. Annual

#uranium

demand ⬆️ 3 to 4%.

6

30

175

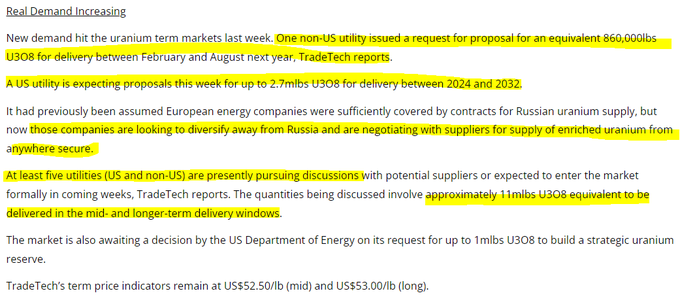

Some info on

#uranium

term contracting from FNArena & TradeTech.

1 utility 860K lbs for next year

1 utility 2.7 million lbs 2024-32

European utilities looking for enriched uranium

5 utilities looking for 11 million lbs

9

30

164

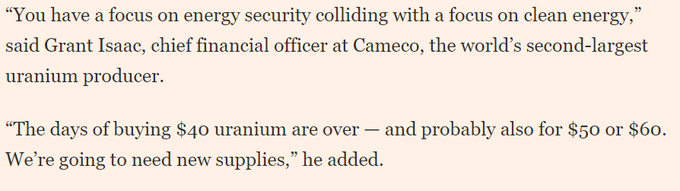

FT Article on

#uranium

.

Grant Isaac (Cameco). Days of $40,$50,$60 over. Need new supplies.

Per Jander (WMC). We are exceeding Pre-Fukushima levels.

Nick Lawson (Ocean Wall). Spot to $200 by 2025.

4

34

167

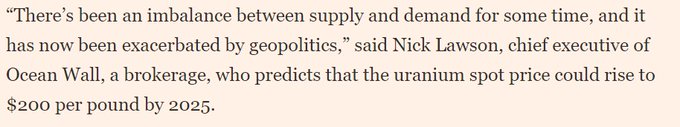

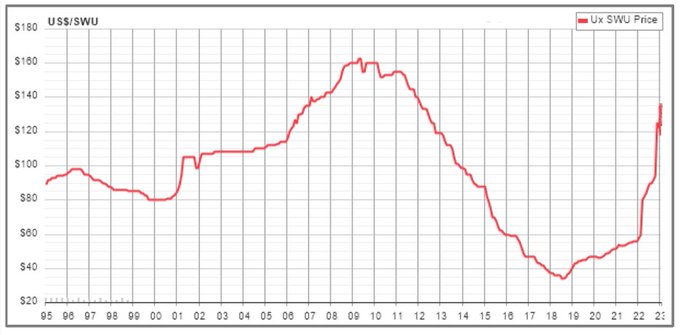

1-A few observations on

#uranium

enrichment and the impact of any sanctions.

As noted by the WNA, there are principally 4 enrichers.

If Rosatom is taken out, the west is left with Urenco and Orano, while CNNC is not open to them.

13

41

164

3-My favorite utility is Duke Energy (owns 11 NPP). The date of their report is Feb 24th. Their

#uranium

needs are covered to 2022 only, and they don't see a supply issue on the horizon. (In retrospect, maybe not a good strategy.😉)

6

16

161

Why the world's largest

#uranium

miner needs much higher uranium spot prices?

A long thread...bear with me🙏/1

5

30

157

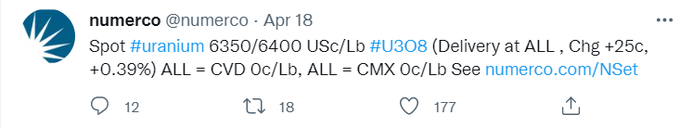

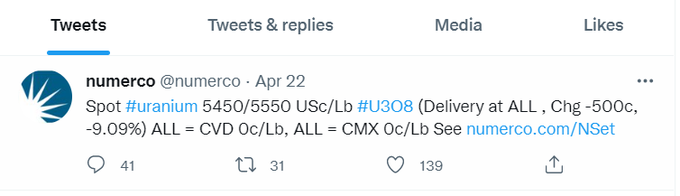

Some short term thoughts on the

#uranium

market.

Someone was selling rather heavily as spot dropped 14% in the week, with most of it taking place in the span of two days.

This was obviously a forced liquidation and traders knew as they dropped their bids. /1

5

24

155

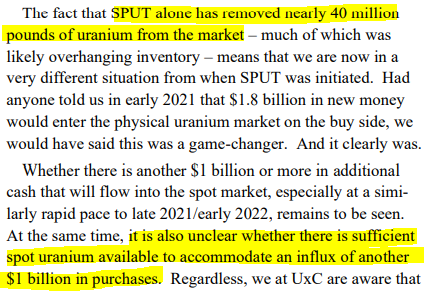

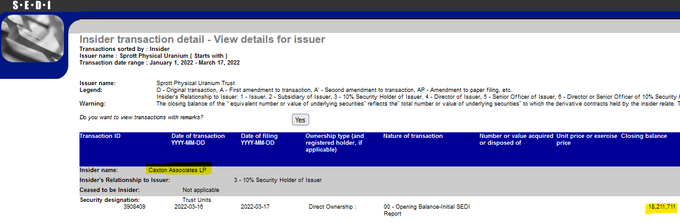

Something to think about.

#SPUT

has raised $1.9 Billion to date. As money comes back in, even UxC doesn't know if there is another $1 Billion of

#uranium

available to purchase.

If a nuclear fuel buyer has not sufficiently contracted can they find spot mat'l? 🤷& Price? ⬆️🚀🚀

11

30

155

1-Back in 2004

#uranium

equities saw a pretty strong rise early in the year, only to see a major drop in prices that spring that, with some of the speculative names really getting thrashed, beyond anything we've seen since November 2021 to now.

6

24

154

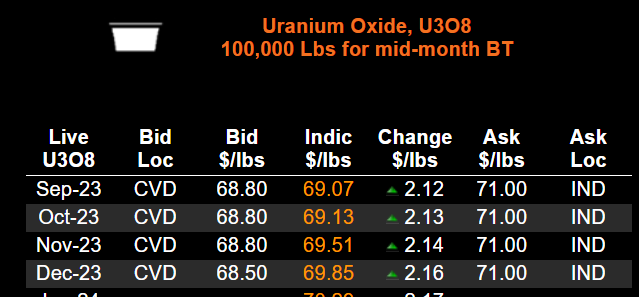

#uranium

spot price has moved from $58.50 on August 28th (UxC) to $70.50 per below.

In just 4 weeks the price is up $12/lb and 21%.

We are not at replacement rate contracting.

We await more financial buyers.

And there is not enough supply no matter the price.

5

19

152

1-3 years ago the Trump administration concluded their findings on the section 232 petition put forward by $UUUU $EFR and $URE $URG.

I believe that much of what was written has a huge impact on the

#uranium

market today.

7

29

145

How bad is it for European nuclear fuel purchasers? In 2022, 69% of their

#uranium

supplies came from Kazakhstan, Niger, and Russia, all of whom have geopolitical challenges. Canada cannot fill the gap should supplies be permanently cut from any one of these countries.

🇪🇺 Euratom Annual Report: 97% Of Europe’s Natural

#Uranium

Comes From Overseas, But

#Russia

Deliveries Fall.

#nuclearenergy

EU supply agency also warns of continued dependence on Moscow for VVER

#nuclear

fuel

1

19

42

9

28

146

SPUT reached NAV. Looking for a push to premium to get the spot ball rolling again.

#uranium

8

9

141

1-A thread on SPUT $U.U $U.UN, the power of incentives, and their impact on the

#uranium

market.

As part of the agreement to manage Uranium Participation Corp and convert it to a trust, Sprott agreed to spend the following sums.

8

30

135

Current market cap of all publicly listed

#uranium

stocks is $16 billion US. While this double off of the March lows, during the last bull market in 2005-07 this peaked at over $130 billion US. We have a long way to go.

Looking forward to 2021.👍

8

17

134

In a single day they raised 6% of the revised ATM, and now have 75% left. At this pace, they will be done by the end of the month and will need to amend the ATM once more. By then SPUT will have operated for a total of 6 weeks.

Wrap your

#uranium

head around that.🥴

3

8

135

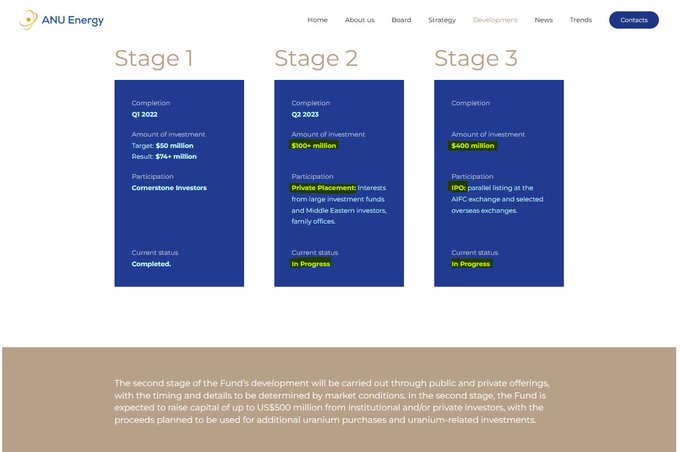

$500mm would remove 7-10 mm lbs of

#uranium

supply (subject to price). Add min. 10 mm lbs of purchases from SPUT, and 10 mm lbs of reduced secondary supply from overfeeding, and you pile onto a major deficit in

#uranium

supply in 2023.

My 2022 estimated deficit was 35mm lbs.

BTW..

#Kazakhstan

's new physical

#Uranium

Fund, ANU Energy, is on the road meeting with investors in London🇬🇧 and

#UAE

🇦🇪 ahead of its planned US$500M IPO on AIFC.💰

@OceanWall2

is hosting events on 16/17 January.👨💼 Reach out to Nick

@Lawse

for more info.👉

16

32

214

5

17

132

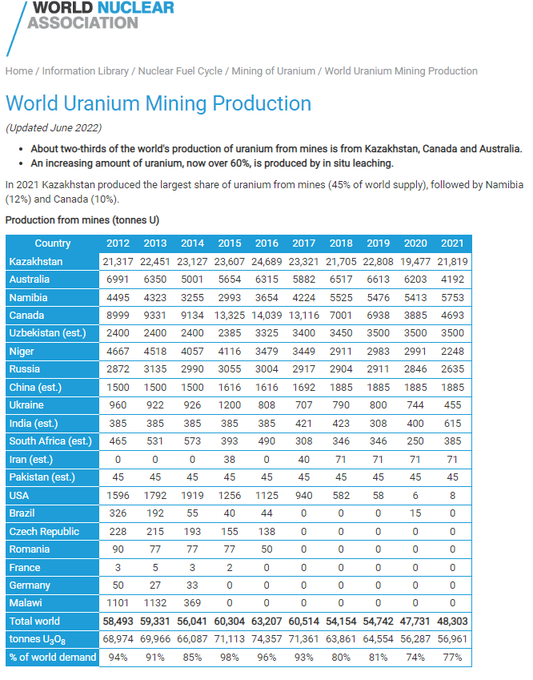

WNA published their 2021

#uranium

annual production numbers. They've unpacked a lot more data this year.

2021 production = 125.6 million lbs./1

2

24

129

30:20 mark, Mike describes a discussion he had with a major nuclear fuel buyer about

#uranium

who said; "The producers think it is our responsibility to underwrite and incentivize them to put new production in. That is not how commodity markets work."

Heading for a crisis!

10

18

128

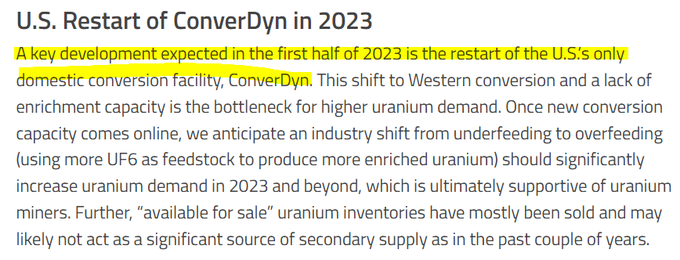

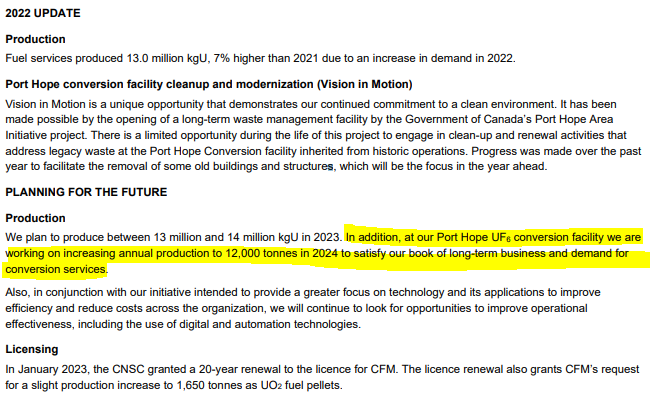

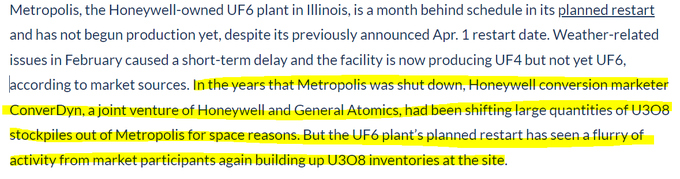

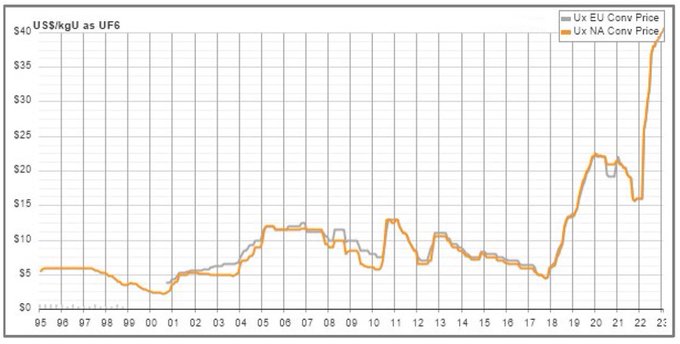

ConverDyn has finally commenced production, expanding conversion (UF6) capacity in the west.

#uranium

9

31

126

SPUT purchased 200,000 lbs

#uranium

today and issued 42,200 shares. They have $29.5 million in available funds. In a month and a half they've purchased 4.6 million lbs.

Since Feb 1st they've issued 8 million units and bought 1.9 million lbs.

4

17

124

Western

#uranium

conversion on an expansion drive.

-ConverDyn restarts in 2023

-Port Hope increase in production in 2024

-Continued ramp up of Philippe Coste plant to 2024

Will lead to overfeeding and significantly higher uranium demand

6

25

126

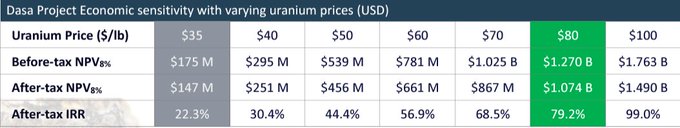

I think it's up to each

#uranium

investor to decide whether the risk is worth the reward, but this is $GLO's latest numbers based on $80 price.

US $1.1 Billion NPV versus $360 million market value.

Start of 2023 with $48 price it was $450 mm NPV and $450 mm market value.

13

16

123

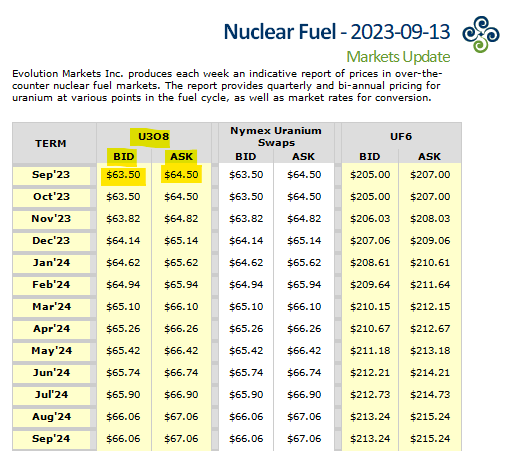

Does this mean

#uranium

investors are going to be up all night looking at the ASX quotes?🥱

Ka-boom!🧨💥🔥

#Nuclear

fuel brokers

@EvoMarkets

have just reported that their closing price today for Spot

#Uranium

soared +$2.00 to 🥁.......... a new 12-year high of $64.00/lb

#U3O8

🎆🎇🤯 which is a price not hit since 11 March 2011.🌊🇯🇵⚛️😲

27

107

597

17

4

120

I think it is important to note that Constellation (formerly Exelon), the largest NPP owner with 21 plants, is quoted as being not opposed to sanctions against Rosatom.

#uranium

.

11

22

116

Orano ships 1-1.2 million lbs

#uranium

every 2-3 mths including Niger govt's 37% share. It's been 1.5 mths since the coup.

The amount is not significant. What is, is the perception that security of supply is very fragile and just adds to all the other issues.

Boom!💥🪖 Orano halts

#Uranium

processing in

#Niger

due to sanctions on junta🇳🇪⚛️⛏️🏭⛔️

#Nuclear

#SupplyCrunch

#UraniumSqueeze

🗜️

#RideTheWave

🌊🏄🤠🐂

#nuclearsympo

10

52

280

4

5

118

China aiming for 1st mover advantage in

#uranium

by locking up lbs with largest producer.

CGN purchases 49% of Ortalyk

CNNC trading hub & warehouse at Alashankou

CGNPC fuel fabrication JV

Two term contracts executed quickly per Commercial Chief

They see what's coming.

6

9

115

1-A few thoughts on $KAP and the contribution of

#uranium

to the Kazakhstan government's treasury.

While $KAP has often been equated to Saudi Arabia (by default Aramco), the extent of their contribution is surprisingly not that large.

8

27

116

5-Urenco was not ramping up prior to the war, and I would expect Orano to be the same. It is not obvious to me that they can expand capacity quickly.

Rather, the only solution is to massively overfeed. That will require a lot of

#uranium

.

14

9

113

We have seen the valuations of many

#uranium

miners move down significantly this month. I have no idea whether they will continue going down or go back up.

I am certain of a few things.

The shortage in uranium will become more acute without a lot of new production./1

4

13

115

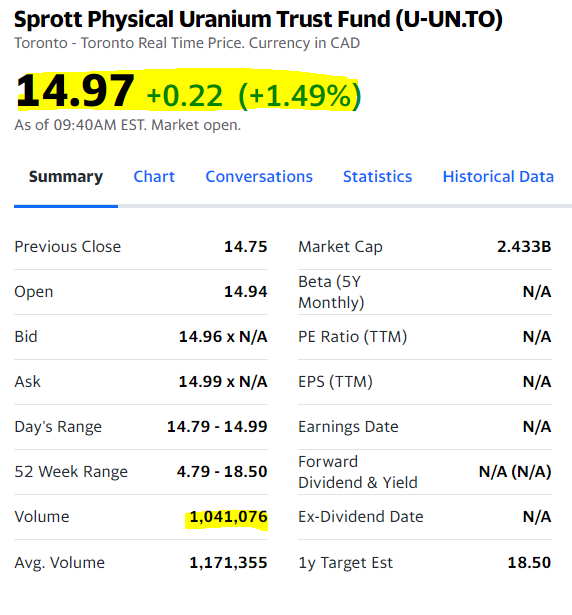

SPUT sending a very large confirmation this AM. Over 1 milion shares traded in first 10 minutes and nicely above NAV. They will be go shopping for

#uranium

.

2

8

112

A bit more info. As SWU is quoted in US$, Urenco also provides the fx rate in their reports. When converting the backlog to US$, the 2022 1/2 year demand is more revealing. This year will rank among the top 3 best years in the last 10, and could possibly be the best!

#uranium

5

16

110

A North American utility is willing to sign with $GLO $GLATF Global Atomic despite the coup, and the as yet not finalized financing. What are

#uranium

investors thoughts on this news?

Global Atomic has signed its third off-take agreement for the sale of uranium from its Dasa Mine, bringing total contracted volume to date close to 1.5 million pounds of

#uranium

per annum over Dasa’s initial five years of operation. ⚛️ $GLO $GLATF

8

48

336

19

8

113

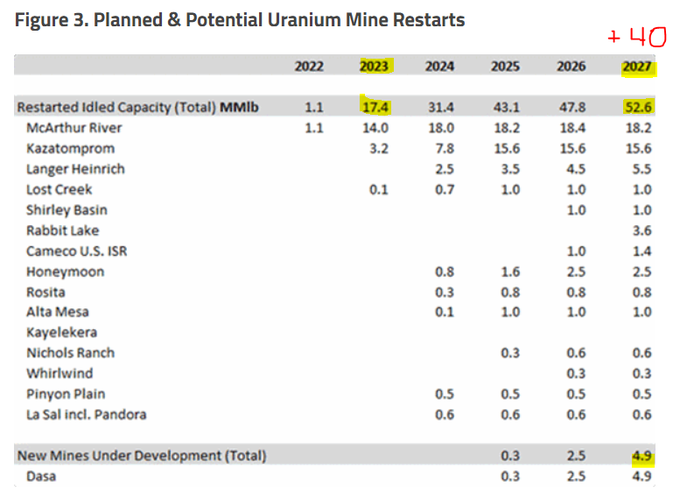

In 2023 the primary deficit between production and demand was $50+ million lbs. In Sprott's 2024

#Uranium

Outlook they are forecasting an extra 40 million lbs of production by 2027. This is the best case scenario assuming the restarted mines achieve their production targets.

6

19

113

BTW if you saw Dustin Garrow's Crux interview he notes that term contracts under $60 have been hoovered (i.e. vacuumed) up. What is incredible is that we are still so early in the

#uranium

term contract cycle. Not even yet at replacement rate.

@YahCork

@FbmHero

@CruxInvestor

I think where John B is intelligent is that he wants to be a high price seller (not a high cost miner), and he understands that this market is ripe for exactly that. I would not be surprised to see him announce a contract with a floor of $100/lb, as crazy as that reads.

3

3

44

6

17

112

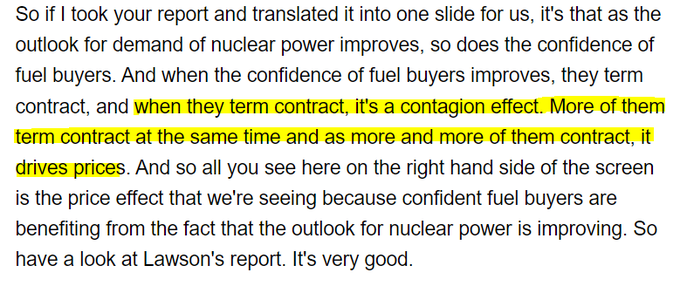

A few takeaways from the

#uranium

conferences from the Red Cloud conference fireside chat and PI Financial Trade Tech presentation. I recommend you listen to them.

/1

2

14

110

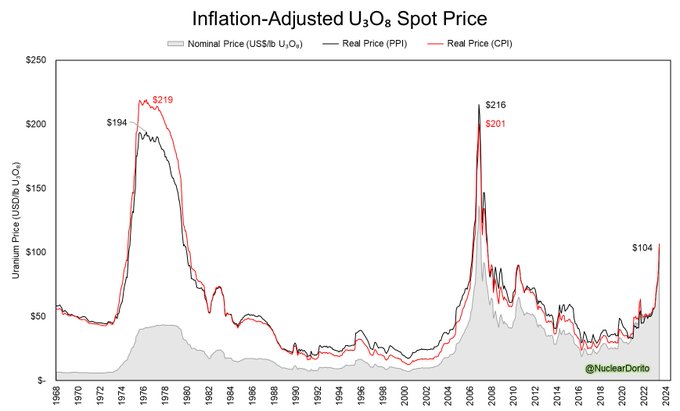

It would not be a surprise to hit a new

#uranium

price high that exceeds the inflation adjusted number of the previous bull runs, but the upper limit is unknown.

Flash!📸 For those of U asking for an inflation-adjusted chart for Spot

#Uranium

💲⚛️⛏️📈 my buddy

@NuclearDorito

has created a new chart that looks back from today's $104/lb

#U3O8

price to 1968☮️ covering the 2 prior U bull markets and this one that's just getting underway.🤠🐂🏄

12

62

372

6

13

112

Great find. It has often come into question whether KAP was high grading in the past. More evidence that the largest producer may have done exactly that.

#uranium

Pay close attention to the following: few months ago Mukanov stated that KAP would need 1.7MM tons of sulfuric acid for 2023´s

#uranium

production. Now Ibrayev says they need 2.2MM tons today. This is too significant increase in their new requirements.

9

32

192

2

9

109

Seeing

#uranium

stocks drop from their highs has led to a lot of angst among investors/traders/speculators/etc.

If you are more a long term investor, perhaps this brief thread may help (or not🤷). /1

6

17

107

It is clear that the

#uranium

spot price has gathered significant momentum.

On August 28 UxC reported a price of $58.50. A few days later TradeTech came in at $61.35. 14 days later the Ask is $68!

We are cutting through the $60s like butter.

Are U ready?😃 Spot

#Uranium

has spiked +$2.50🚀 to $66.50/lb

#U3O8

🌟 with sellers now asking an incredible $68🎇🎆😲 at

#Nuclear

fuel brokers

@EvoMarkets

& UP +$2.75 to $66.25/lb for US 'Uranium Markets'🚀 while

@Numerco

held the line UP +$2.08 at $65.51⏫ Next stop the moon!🌜

40

92

525

1

12

107

If Cameco can't get their

#uranium

shipments from Kazakhstan, how can anyone else in the west?

6

13

104

The Bloor Street Capital

#Uranium

virtual conference today brought up some important macro info that I thought might be useful.

A big thank you to

@JamesConnor1999

and

@BloorStreetCap

for putting on this event.

Feel free to add if you attended😀 (or if I misinterpreted 😲)/1

6

11

103

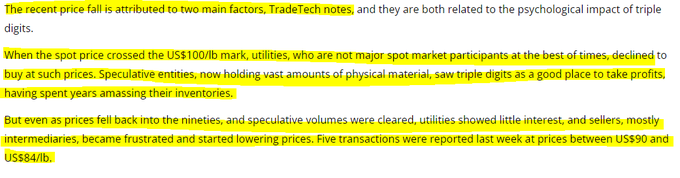

TradeTech's comments on the recent drop in

#uranium

spot prices. A combo of no one buying above $100 and profit taking.

Keep in mind that as supply shrinks and the need to secure supply becomes acute, they will be paying $100+.

8

8

106

7-Which should lead to contracting for everyone else.

Finally, to come full circle, a

#uranium

bull market requires long term contracting (as noted by the chart from $KAP). This is ultimately what matters.

4

4

106

#uranium

acquisitions give us a sneak peek into what industry insiders are willing to pay and what is being bought.

Cameco and Orano are paying approx. CAD$187 million for a 7.875% stake in a low cost operating mine having approx 140 million lbs in reserves (by end 2022)./1

4

14

99

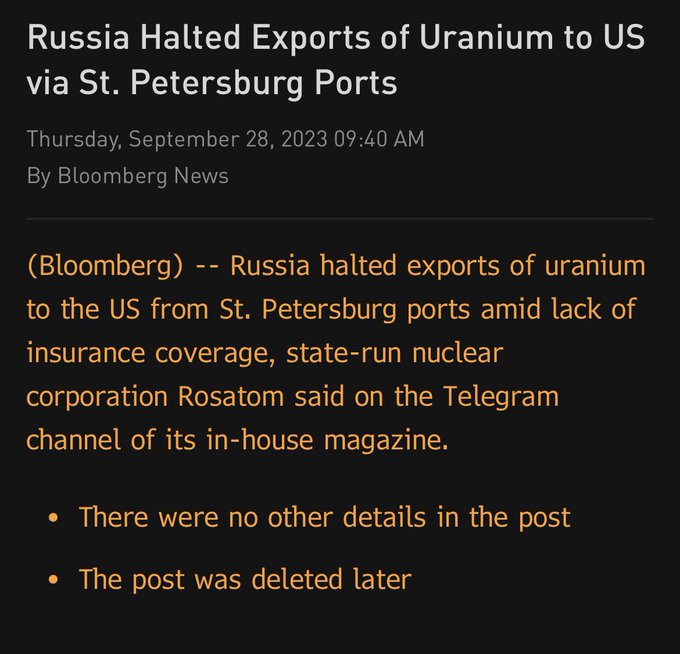

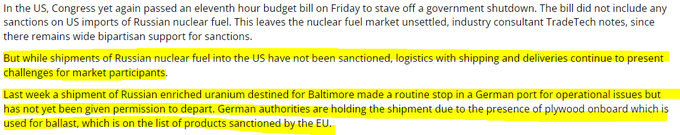

Today's news story about Russian

#uranium

shipments (true or not) highlights the precarious state western countries have put themselves in.

Many

#uranium

miners are needed ASAP!

While Western enrichers and converters need to be incentivized to expand capacity NOW.

6

8

100

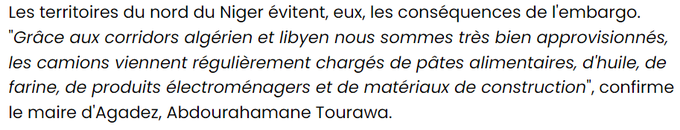

For those of you invested in $GLO $GLATF according to this report from TV5 from today, the mayor of Agadez says that they are able to receive supplies through Algeria and Lybia.

#uranium

7

7

100

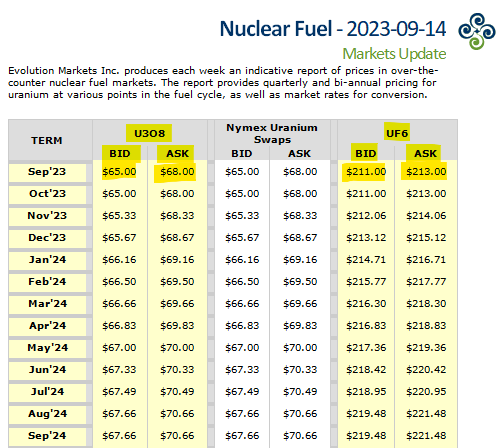

This is correct. The prices in the

#uranium

supply chain move together but not necessarily at the same time. It is early but the price increases we are seeing should move us up by at least 100% to over $100/lb keeping up with enrichment and conversion.

3

7

100

If you've made it this far, my thread is not meant to be a criticism of $KAP. Rather it is to highlight the need for higher selling prices at the world's largest

#uranium

miner to compensate for cost increases. They, just like us investors, need the price of spot to move up./End

5

2

97

Justin does absolutely great work and is very kind to share it with everyone on a (almost) daily basis .

If you've invested in

#uranium

focus on what matters. Listen to what he says at 9:06!

Uranium Market Minute – Episode 138: Digging to China

7

9

96

It is incredible how quickly the capacity of

#uranium

mines returning from care & maintenance are filling up. We are very early in the contracting cycle whereby utilities refill more than their annual needs.

$PDN Macquarie conference.

$PDN provisionally contracted 48% of the production to 2030. Almost one third of which is market price related. Leaving 52% of next 7 year production uncontracted. Specific prices yet to be finalised but significant upside and exposure to spot

#uranium

prices.

2

6

48

6

10

98

1-This week the EIA released their

#uranium

marketing annual report on uranium marketing activities in the US.

The highlight of the report are the activities of the US nuclear plant operators.

I have a few thoughts about this information.

7

26

95

I wrote this back in December as to what we should see in

#uranium

prices. It is not a surprise to see conversion and enrichment price increases slowing down and uranium spot prices increasing much more. The pattern is once again repeating itself.

I am a fan of history. There is a lot to learn from it.

If the price pattern followed by spot prices is consistent, we may finally see a significant move up in the spot price of

#uranium

in 2023. 🧵/1

16

59

256

2

11

96

With mega dollars pouring back into

#uranium

stocks and $SPUT comfortably exceeding NAV today, the next step is for $YCA to get above NAV so it can take some more pounds off of $KAP. The 🌊 takes everyone with it.

5

3

95

$GLO $GLATF to be clear I don't like the issue price of $2.50 but this needs context.

The number of shares to be issued is less than 3%. Dilution is very low.

Having Traxys supporting Global Atomic and the DASA project is the key. Traxys is massive.

12

10

91

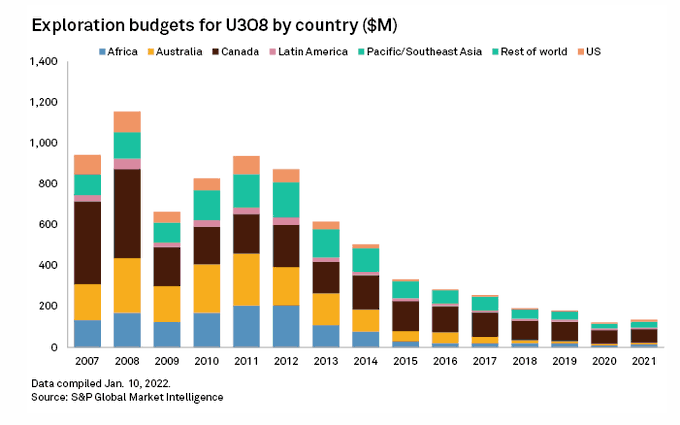

Two things that strike me about the chart below.

1-U3O8 exploration budgets have a long way to go to get back to previous levels.

2-Even one billion does not get you what it used to in 2008. The level of exploration required is way too low.

Walking into a

#uranium

crisis.

During last

#Uranium

bull market investment in exploration topped a $Billion in a single year in 2008 with global investment of $6B from 2007-2014, yet in 2021 less than $200M was invested.😯 Imagine what $Billions of new cash inflow will do for U

#stocks

.🤠🐂

#EarlyInnings

⚾️🧢

7

23

158

2

13

93

This is a fabulous behind the scenes discussion. It is 42 minutes well spent.

Thanks to

@hkuppy

for putting this out to the public.

#uranium

@hkuppy

's interview with Mike Alkin from the 2023 WNA is live...

Why haven't fuel buyers seemed to care about the risk of rising uranium prices?

Charlie Munger - "Show me the incentive and I'll show you the outcome."

Watch the full interview here:

36

72

405

2

3

93