Explore tweets tagged as #leveragedloan

How is the #PrivateCredit and #LeveragedLoan landscape evolving and what key trends should #investors watch for in the coming year?. Join @omelvenymyers to find out in the ICLG #Lending & #SecuredFinance 2025➡️:

0

0

0

An early milestone for the US #leveragedloan market. With 2 full months left in 2024 there already has been a whopping $1 trillion in leveraged loan activity this year. The trillion dollar figure includes issuance of new loans, as well as loan repricings, which don’t add net new

0

3

10

Fitch's February European Distressed & Default Monitor shows one default in January, increasing the European #HY default rate to 2.9% from 2.8%. No defaults in the #leveragedloan market lowered the TTM loan default rate to 1.5% from 1.8%. Learn more:

0

1

0

#CLOs prep for defaults are adopting more flexible restructuring provisions. "In previous default cycles, #LeveragedLoan providers would expect to get 70% to 80% of their cash back from failing companies. Currently, the implied rate is about 25%, according to BofA strategists.”💥

1

0

1

Fitch has published the European Leveraged Finance Chart Book – 2023. Read More: #LeveragedFinance #LevFin #CLO #privatedebt

1

0

3

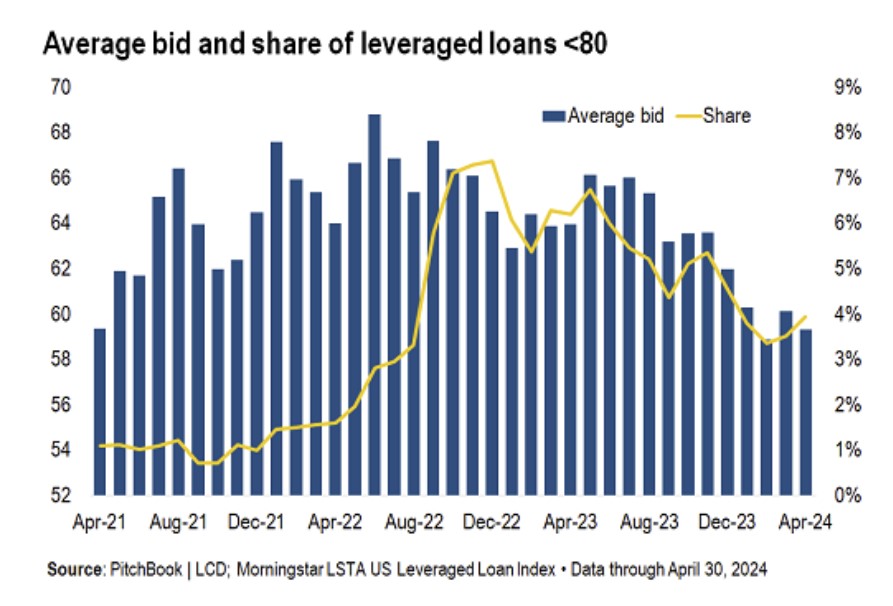

That rising US #credit markets tide is not lifting all boats. Those entities comprising the relatively thin ranks of distressed #leveragedloan debt aren't faring well. The avg valuation of this debt is at its lowest point in 3 years and is heading toward the level at which loans

0

3

10

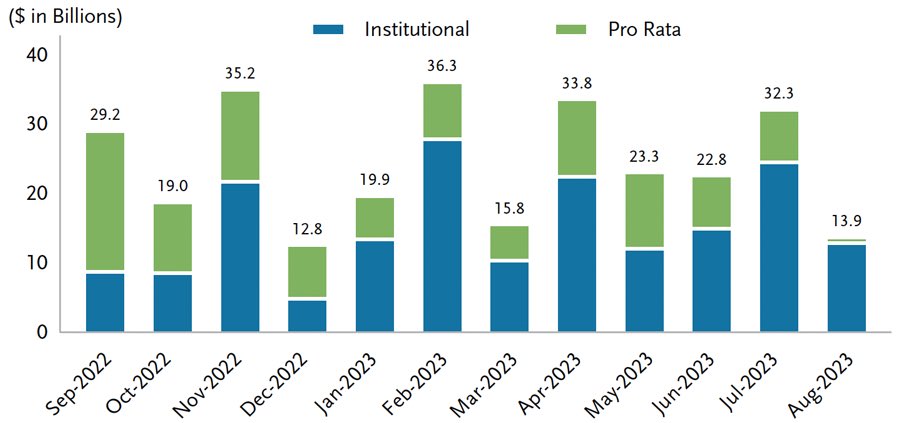

#CLOs represent ~60% of the $1.4T US #LeveragedLoan market with Sept one of the busiest months.

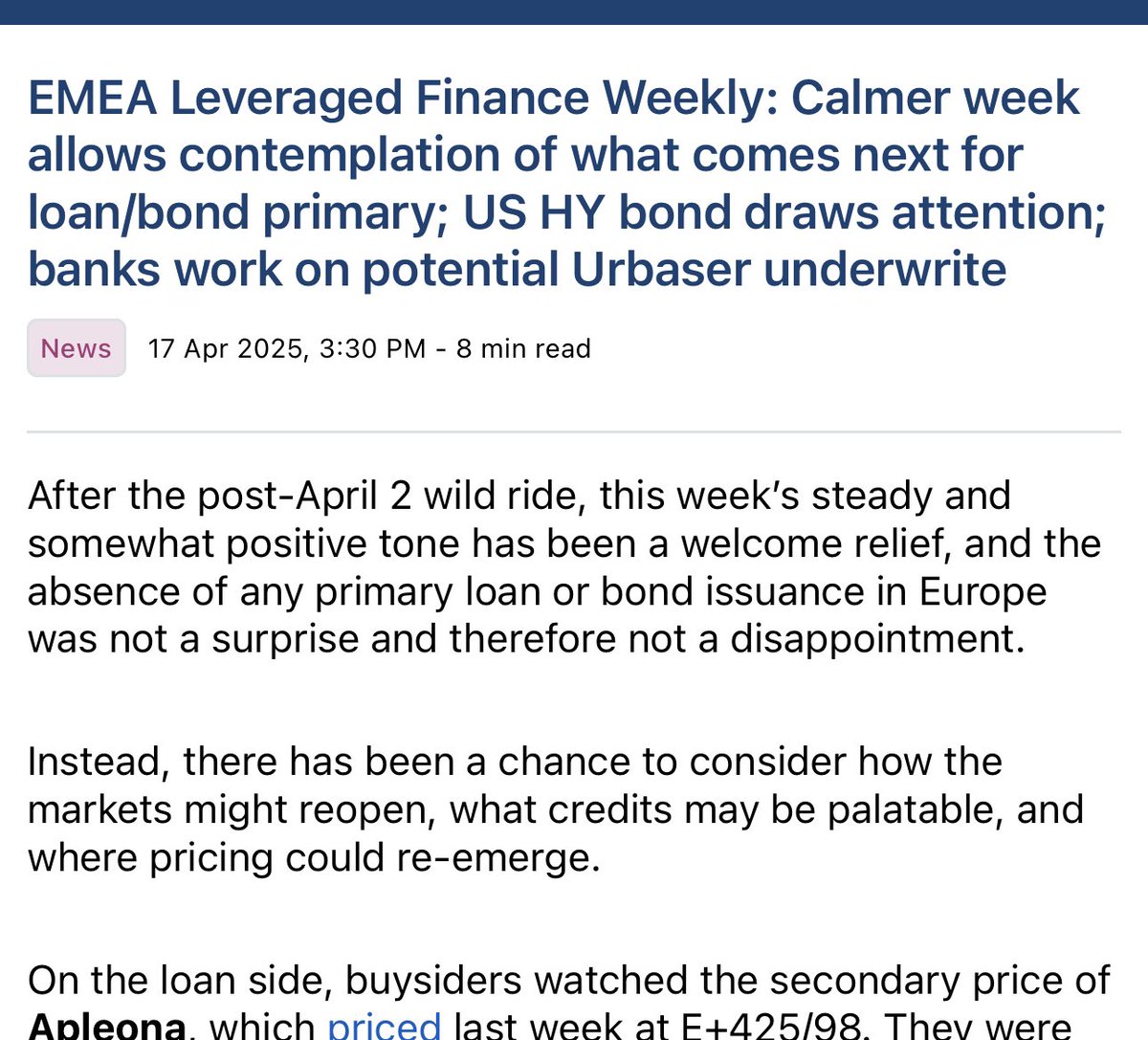

Around the credit markets: Private credit grabs more business from the syndications world (with the help of PIK debt in Europe); old-school leveraged loan picks up, nonetheless; #highyield adds security; plus CLOs, distressed, bankruptcy highlights

1

0

2

In a sign of today's bullish credit market times, the ranks of US #leveragedloan Weakest Links - a harbinger of default activity - just hit a two-year low. But this ostensibly cheery news is a largely a result of the proliferation of liability management exercises by distressed

0

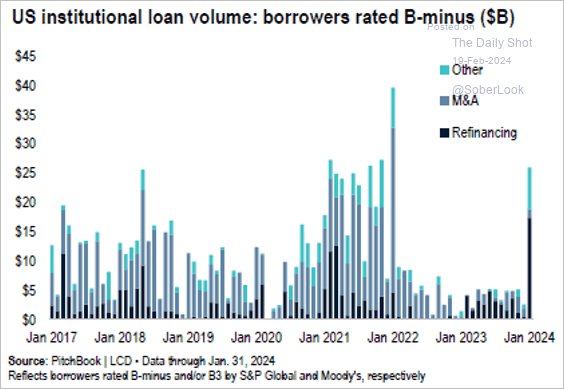

5

12

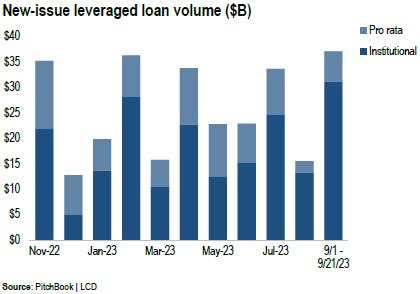

There was a lot of concern about many of the #Russell2000 companies needing to #refinance a lot of #debt at higher #rates. The workaround for that is to use the #leveragedloan market, which they are doing at a record pace. #WhatCouldGoWrong

5

11

67

HashLynx is proud to co-sponsor the Network Power Luncheon at the 2023 Annual LSTA Conference in NYC on October 12. Connect with us for live demonstrations highlighting features that streamline and improve the loan closing process for all stakeholders involved. #LeveragedLoan

0

0

2

Pricing range for cash flow or leveraged loans. What is the difference between bank and non-bank pricing for cash flow loans, and why should borrowers consider paying more for a non-bank loan?. #CAPX #MiddleMarket #DebtFinancing #LeveragedLoan

0

0

0

Let’s chat with a source who knows about #highyield and #leveragedloan and CLOs and equity and whatnot markets 🤯

0

0

0

Hung #LeveragedLoan and #HY bond fire sale!.Despite the rally in the index to highest since 5/2022, .Viasat talk $617m 7yr loan + $733m 8yr bond 14% yld, ~70% px

1

0

3

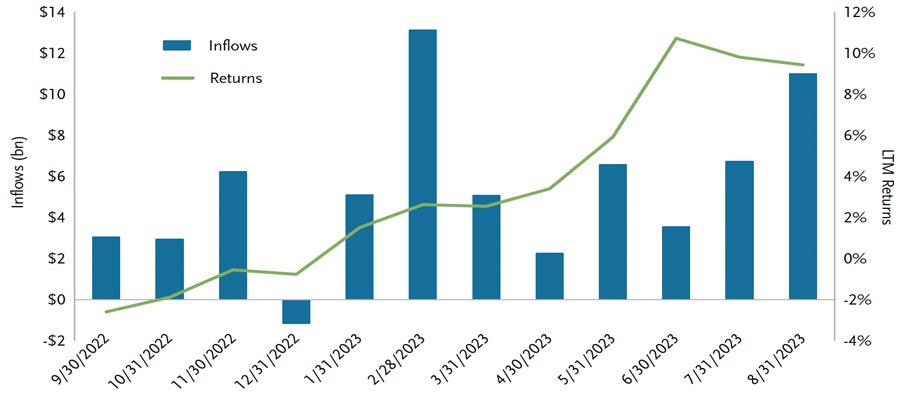

Continued outflows from retail #LeveragedLoan funds for 16mos running. Limited LL issuance (Sept getting busy) supported by brisk CLO issuance ($72B YtD, although ↘️ YoY -23%). #PrivateCredit (fka middle market) #CLOs gaining market share 1/4 of Aug issuance ($2.8B out of 11.1B).

1

0

0

#LeveragedLoan #PrivateCredit To hell with high rates, Q1 borrowing hits near-record levels. Now, just need #EBITDA growth to keep pace 😂

1

1

4