Glaze

@glazecl

Followers

944

Following

3K

Media

127

Statuses

880

@iosgvc // Math & Stats // Developer // ex-CertiKer // @unblock256 newsletter co-founder // ex-Fundamental Labs// ex-OFR// Duke

NYC

Joined August 2016

Random thoughts after trying 3 amazing AI+consumer tools @a16z highlighted:. @mindseraAI provides coaching to improve journaling and reflection. It uses guidelines and methodologies, aiding those who struggle with writing, like ChatGPT's recommended questions.

2

0

4

Comet @PerplexityComet is good at certain tasks .- Repetitive tasks .- Parallel tasks It does a good job on finding all sbc events and register for me . It is bad at single webpage operations. Human can do better. Like booking hotels.

1

0

2

Would love to see more coming to @Chronicle_HQ :. - Improved import features, including image support.- More widgets; Cards could be more fun.- Data charts.- Auto-generated "napkin" graphs.- Easier image size and spacing alignment.- More themes and fonts.

0

0

2

@Chronicle_HQ help me solve these issues:. - Changing the layout is difficult, even with the same content.- People get easily distracted during presentations.- Can't fit everything into a PPT, and images can't be zoomed in.- Card-like widgets aren't native

1

0

0

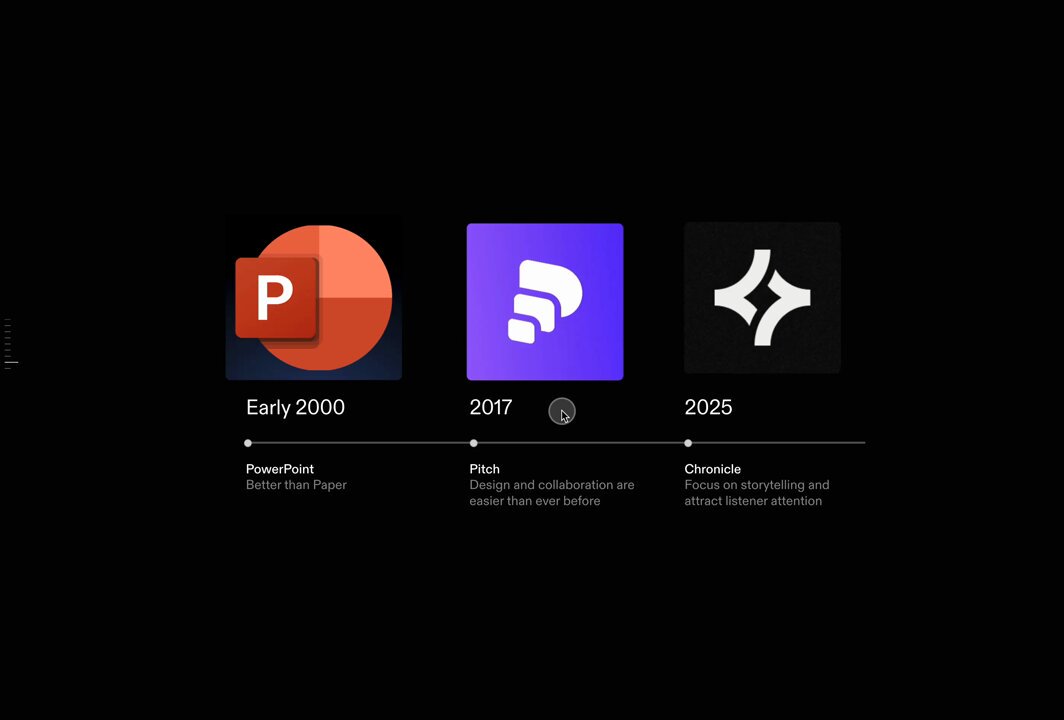

It @Chronicle_HQ makes creating PPT fun. My journey with PPT began with PowerPoint. @Pitch surprised me with its collaboration features and beautiful designs. Chronicle introduces a new narrative, "Storytelling," for the mundane PowerPoint space.

2

0

2

Asymmetric opportunity: QR payments in Asia. APAC leapfrogged cards and went straight to QR payments. Southeast Asia’s QR volume is projected to grow 590% by 2028, with >80% merchant acceptance. In China, almost every store supports QR. @PayWithRipe is a standout in this space.

1

1

3

非对称机会:亚洲扫码支付. 亚太早已跳过刷卡,直接进入 QR付款, 超级钱包的时代。东南亚 QR 交易预计到 2028 年增 590 %;商户接受度 >80 %。中国几乎每家商铺都支持扫码付款。 @PayWithRipe 是其中的佼佼者.

1

0

0