Florian Kronawitter

@fkronawitter1

Followers

13,970

Following

526

Media

959

Statuses

7,681

Here to share what I've learned during 17 years on the frontlines of the economy and markets

London

Joined April 2021

Don't wanna be here?

Send us removal request.

Explore trending content on Musk Viewer

こどもの日

• 537801 Tweets

#해피큥데이

• 104455 Tweets

Al Jazeera

• 84909 Tweets

GW最終日

• 80718 Tweets

Bernard Hill

• 71204 Tweets

Vlad

• 69993 Tweets

Spurs

• 58359 Tweets

West Ham

• 56810 Tweets

Tottenham

• 53834 Tweets

Sivasspor

• 44696 Tweets

سعد اللذيذ

• 43040 Tweets

#GSvSVS

• 40465 Tweets

Theoden

• 37081 Tweets

BBL Drizzy

• 33918 Tweets

#LIVTOT

• 31700 Tweets

Gallagher

• 26347 Tweets

Happy Cinco de Mayo

• 25303 Tweets

D-1 to BLOSSOM

• 21882 Tweets

Ange

• 20702 Tweets

Mertens

• 15816 Tweets

LOSE MY BREATH MV TEASER 2

• 14433 Tweets

Rohan

• 14283 Tweets

Tim Scott

• 13896 Tweets

Anfield

• 13597 Tweets

Gakpo

• 11038 Tweets

#محمد_عبده

• 10845 Tweets

Ziyech

• 10057 Tweets

Last Seen Profiles

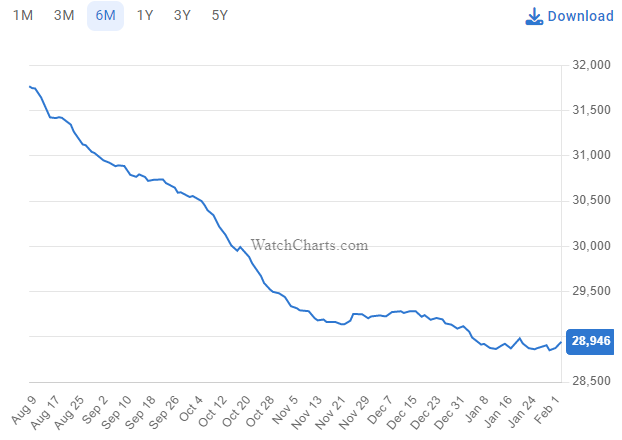

#Rolex

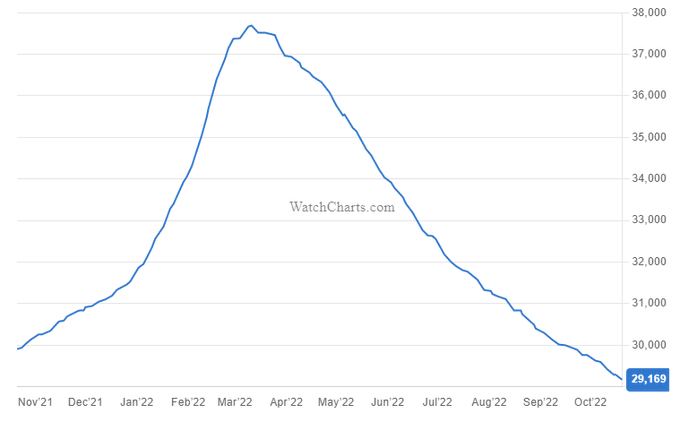

No relief in sight, prices continue to slide (ave. of 30 best selling models in USD)

47

66

928

@Gerashchenko_en

“According to some reports he is a neo-nazi”??

He has an SS tattoo on his right collar bone!!

22

12

410

#Rolex

prices trending down again (average of 30 popular models)

As you know I've been sharing this chart on a weekly basis

28

54

397

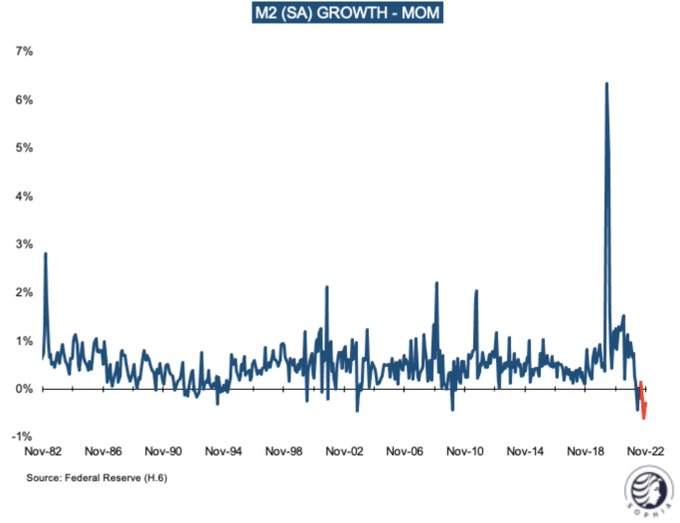

🇺🇸 Thirteen economists, NO ONE has acceleration on their bingo card

So guess that's what we'll get...

h/t

@darioperkins

30

49

298

@ianbremmer

Wild guess- it was both the Trump and Biden administration flooding the world with printed USD, encouraged by the Fed

34

4

202

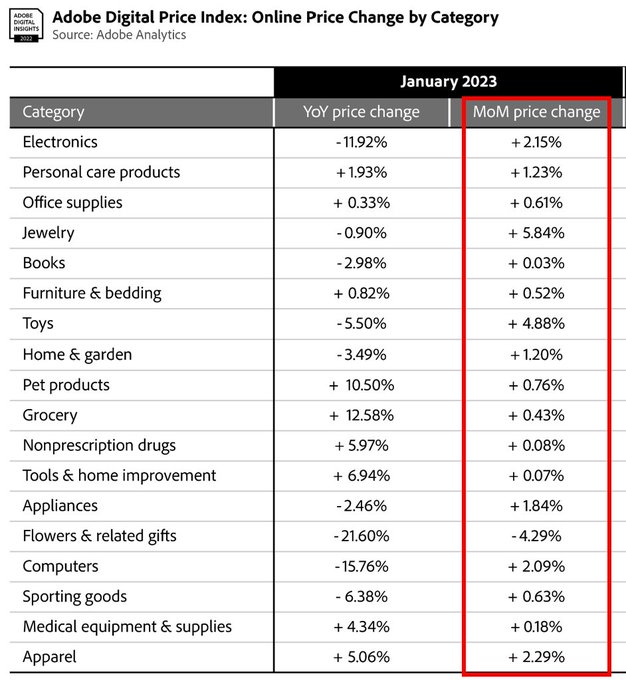

#Inflation

Adobe ecommerce price index sees month-on-month inflation across most categories

January seasonal bump in full swing

8

37

185

1 -

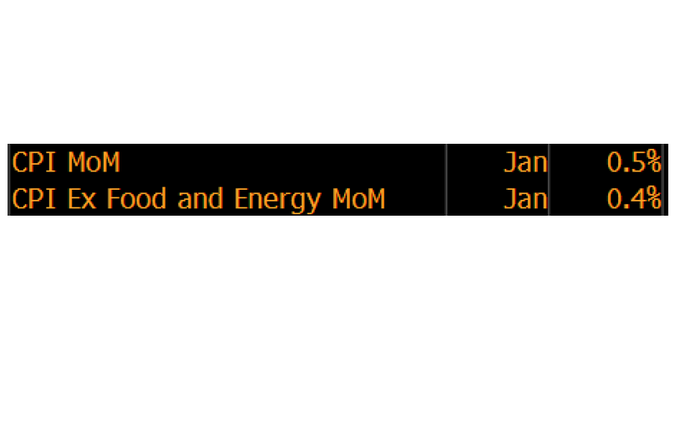

#ConnectingTheDots

The Bloomberg economist consensus for January is out

Expectations are for a "hot" month-on-month number, that annualises at ~5-6%

A significant step-up from recent prints

8

21

174

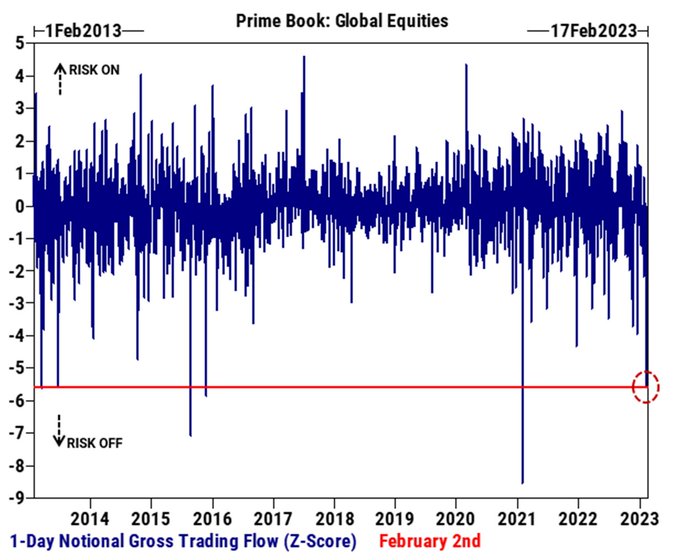

1-

#ConnectingTheDots

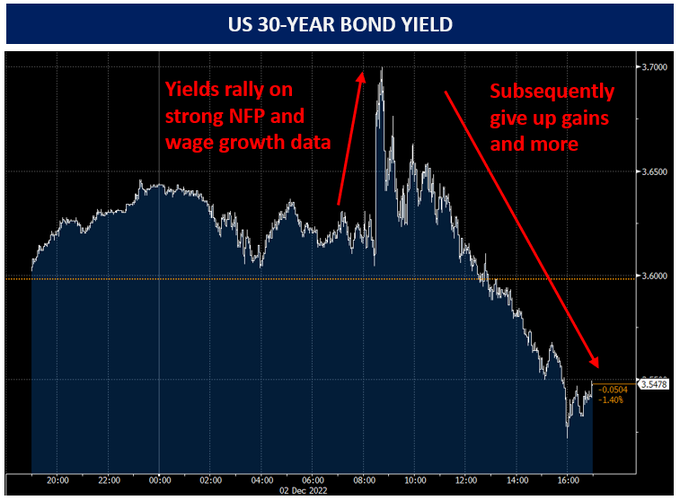

On Friday, the US released employment numbers

Of particular note was strong wage growth for November, +0.6% m-o-m (>7% annualised)

US bond yields should have RALLIED on this highly inflationary signal, instead they FELL

10

18

118

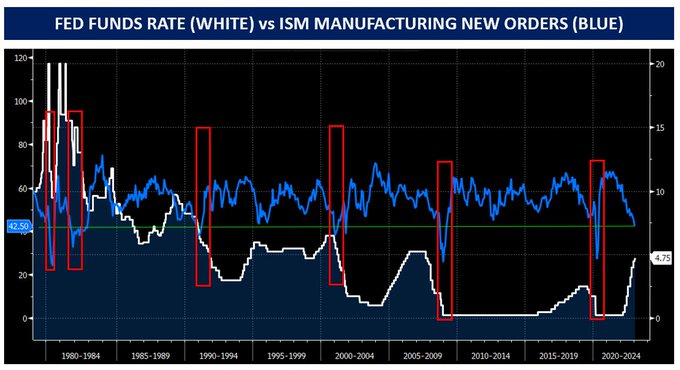

1-

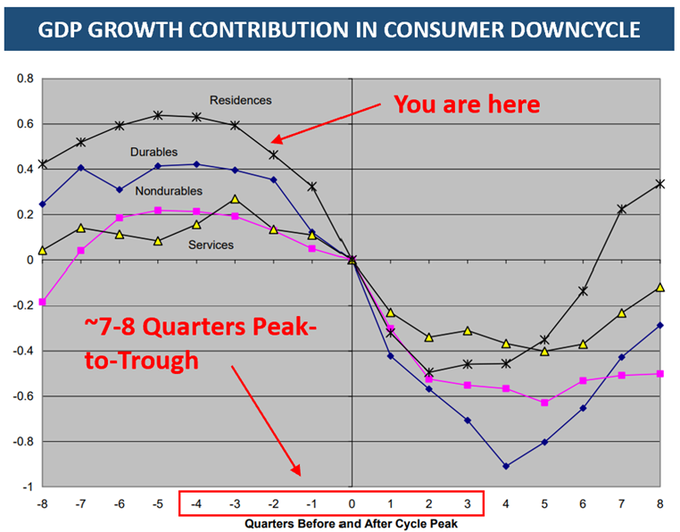

#ConnectingTheDots

Commodities/Oil & Gas

We are currently in the ~4th inning of an economic slowdown

8

22

110

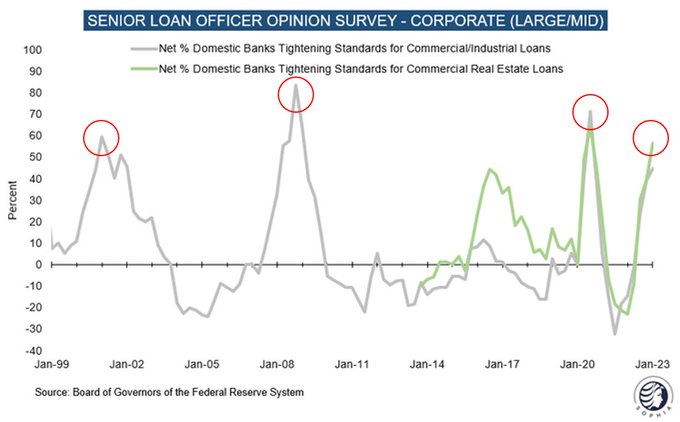

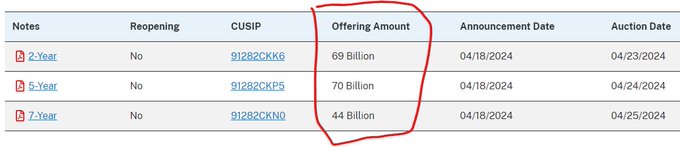

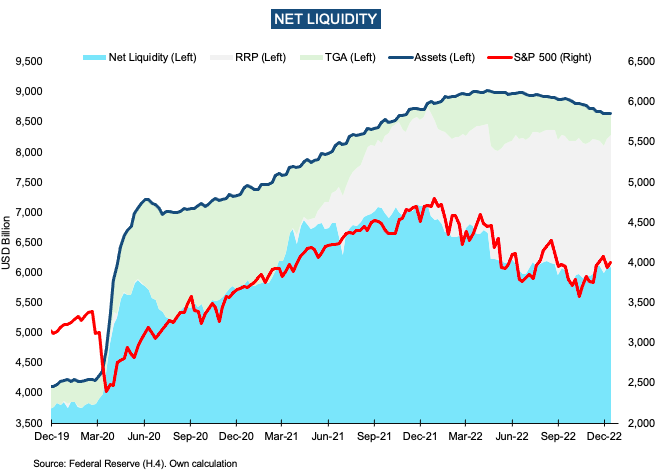

#Liquidity

This past year, the S&P 500 has tracked "Net Liquidity" closely

Over the next two weeks, this measure faces a ~$150bn headwind ⚠️

The Treasury Account increases by $80bn with tax payments + $60-90bn QT rolls off between today and month end

@kittysquiddy

7

14

102

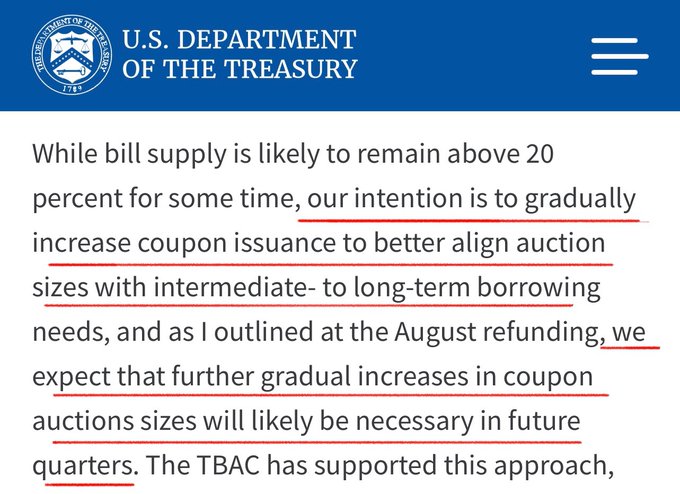

1-

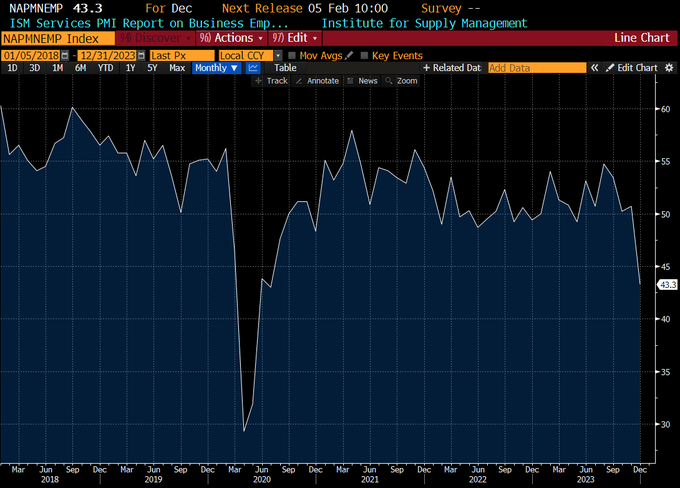

#ConnectingTheDots

Lots of focus on what the Fed will do next, and whether inflation comes down

That is the WRONG debate

Yes, inflation has PEAKED. Yes, it will come DOWN

But why is the 10-Year is UP, despite declining inflation expectations?

10

12

99