Dora

@dora_labs

Followers

3K

Following

55

Media

2

Statuses

16

The next-gen infrastructure for bond trading

Just an API away

Joined January 2021

🚀 Ever wondered why bonds are a mystery to most investors?. DORA is changing that!. We are here unlocks the massive bond market—making it as easy as trading stocks. Join the future of finance!🔥 #Fintech #Bonds #Investing #DORA #Macro.

0

0

3

Stocks at all-time highs. Bonds pricing in cuts. So what’s the real story here?🧐.#DORA #fixedincome #bonds #equities #fintechsummer #macro.

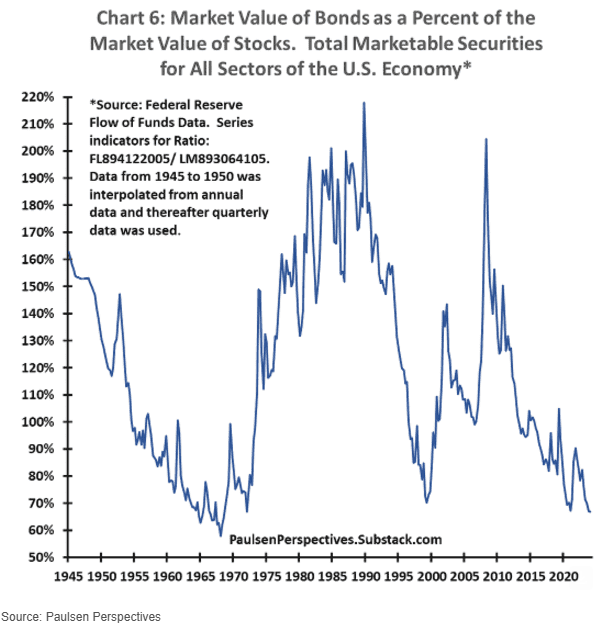

BREAKING 🚨: Bonds. The market value of Treasury Bonds as a % of the market value of Stocks has fallen to its lowest level since the 1960s

0

0

3

Imagine trading the yield curve of… an Apple bond🍎📈. Not just the price — the mood swings across maturities.inverted, steep, flat… pick your fighter. Bonds always tell a story.#fintechsummer #DORA #fixedincome #curvewars #bonds #yieldcurve.

Yield curves keep steepening as investors stay away from buying 10-year notes. The gap between US 10-year and 5-year yields is the widest since 2021.

0

0

7

Voter: “Vote for the future of New York!”. Kalshi user: Which is the perfect market?. DORA trader: scalping NY muni bond spreads on vibes alone 🧠📉📈😎. #fintechsummer #munibonds #DORA #NYC #electionalpha #bonds.

Zohran Mamdani stunned former Gov. Andrew Cuomo, who conceded the New York City mayoral primary race to the 33-year-old state lawmaker. Follow live updates.

0

0

8

me: bonds are boring. also me: building rails so anyone can short France and long Italy like it’s a vibe 😎. #fintechsummer #yieldfeels #justmacrothings #bond #macron #Meloni #DORA.

0

0

10

Fractional. Transparent. Provably fair. Welcome to bond trading, unplugged. #Fintech #FixedIncome #TradingInfrastructure #Bonds #DORA.

0

0

9

The best financial systems aren’t closed or open. They’re modular. Permissionless liquidity, compliance-aware logic. Happy Monday, frenz 🌱.

0

0

8

We’re working on something new. We think the right infra changes everything. More soon.

0

0

7

What’s missing isn’t a new marketplace. It’s execution-layer infra: a way to express pricing logic, contribute assets, and plug into flow.

1

0

8

The result:.🔹 Opaque pricing.🔹 Missed flow.🔹 Low turnover.🔹 High barriers to entry.

1

0

6

Institutions want to quote. Brokers want to route. Everyone builds one-off pipelines. It just doesn’t scale.

1

0

8

Most bonds don’t trade on exchanges. They move through phone calls, bars, golf courses, and "RFQs." Billions change hands every day, but there’s no real “order book.” . No shared rails. No liquidity.

1

0

7

1/ Bonds are a $130T+ market. But the way they trade is reminiscent of dial-up internet in the age of streaming. It’s wild how much value is trapped in an outdated system. Here's the problem:

1

0

9