DC

@dimit

Followers

4,761

Following

945

Media

246

Statuses

681

Explore trending content on Musk Viewer

#MyLoveMixUpTHep1

• 349201 Tweets

#LoveBullyรักให้ร้ายEP1

• 188261 Tweets

ariana

• 137235 Tweets

ガイナックス

• 119933 Tweets

Sant Rampal Ji Maharaj

• 111254 Tweets

Corinthians

• 71578 Tweets

THE FIRST TAKE

• 66094 Tweets

ノーヒットノーラン

• 56643 Tweets

松岡茉優

• 53763 Tweets

大ちゃん

• 48657 Tweets

ギターと孤独

• 37667 Tweets

Sinner

• 35374 Tweets

THE SECRET REVEALED

• 32383 Tweets

雇用統計

• 29888 Tweets

ドラコー

• 29649 Tweets

#ใจพิสุทธิ์ep11

• 29338 Tweets

ジェイド

• 28057 Tweets

有岡くん

• 26692 Tweets

結束バンド

• 26273 Tweets

大瀬良投手

• 24713 Tweets

Carlos Miguel

• 23380 Tweets

ポーランド

• 22986 Tweets

Alcaraz

• 22923 Tweets

Cubarsí

• 21392 Tweets

BRANDY

• 17800 Tweets

ホタルちゃん

• 14960 Tweets

アルジェンティ

• 12546 Tweets

#ساعه_استجابه

• 11917 Tweets

Türkiye Yüzyılı Maarif Modeli

• 11034 Tweets

ミッションインポッシブル

• 10133 Tweets

Last Seen Profiles

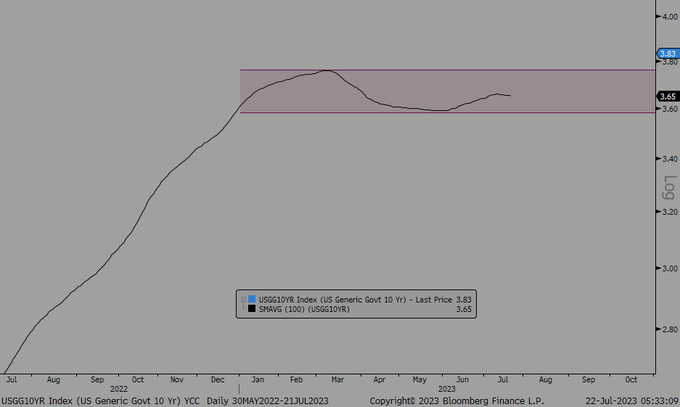

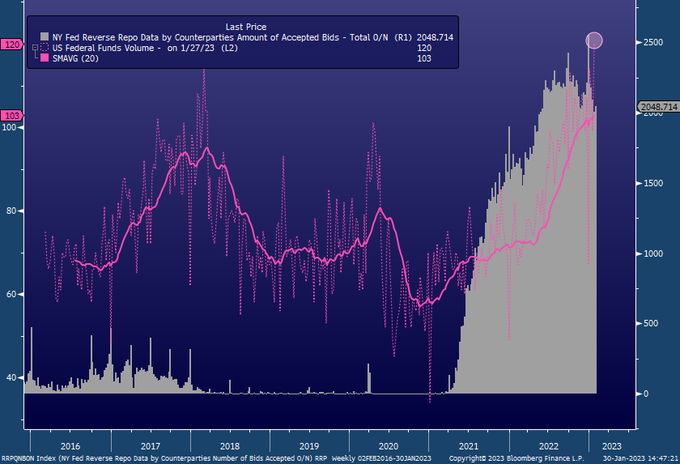

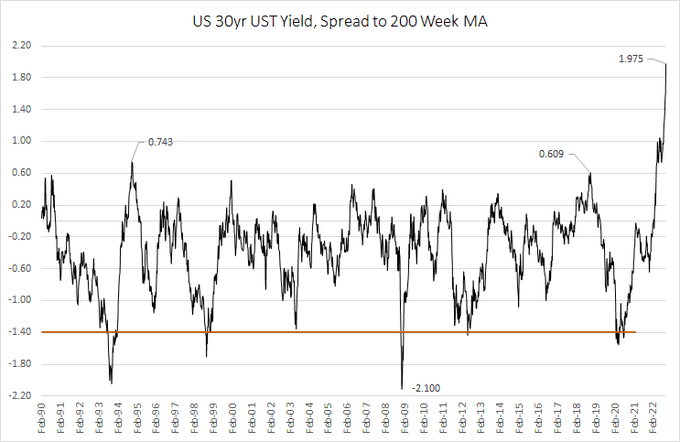

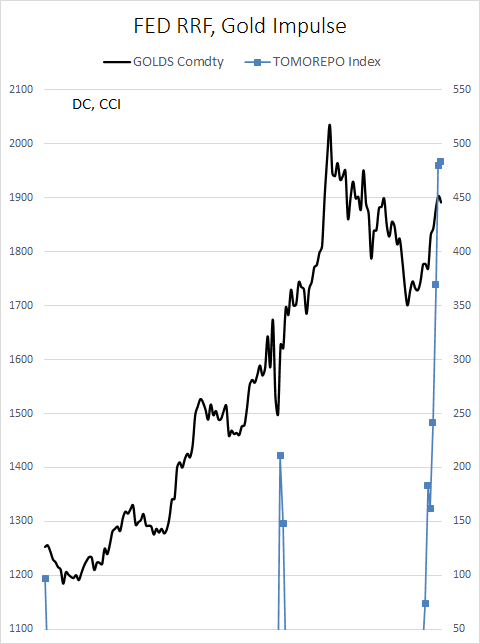

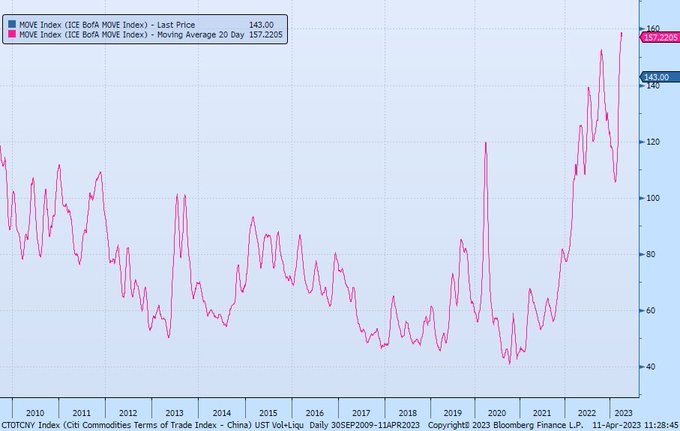

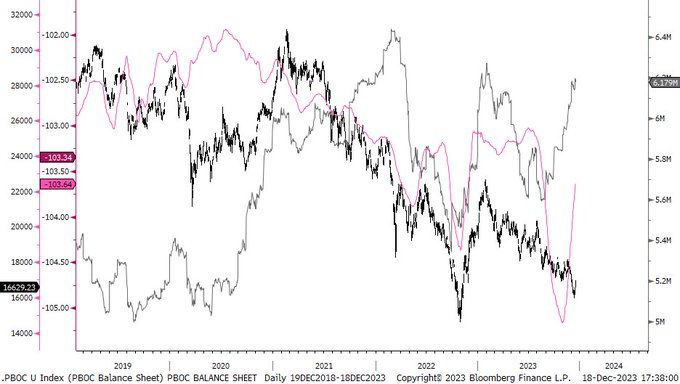

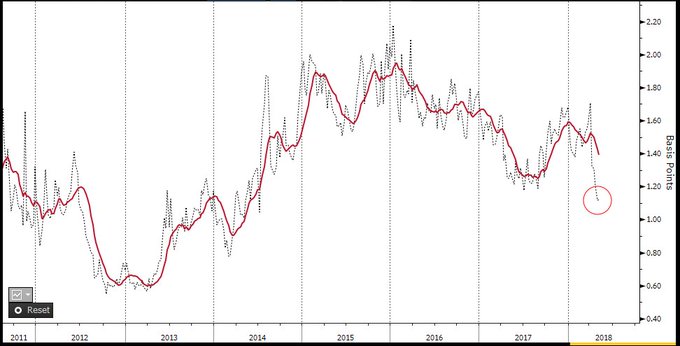

Eurodollar Curve (EDZ2Z3) has begun to shout. ~52bps inversion over past 2 weeks. WTI+Brent curves final dominos to fall. FOMC will then swiftly align with ED messaging.

@LukeGromen

21

65

292

@DanielaGabor

@Kathleen_Tyson_

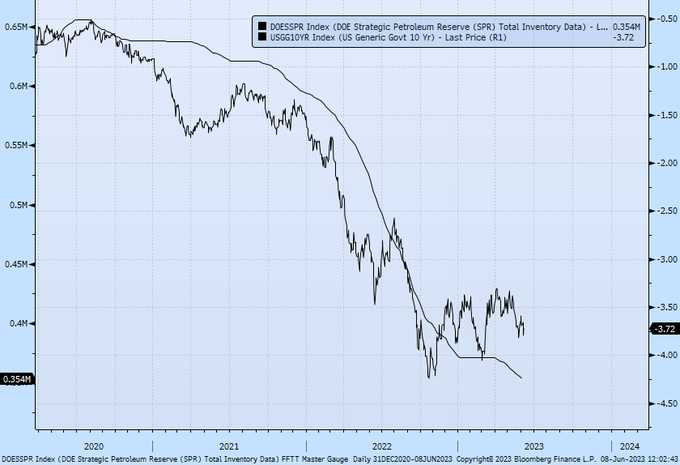

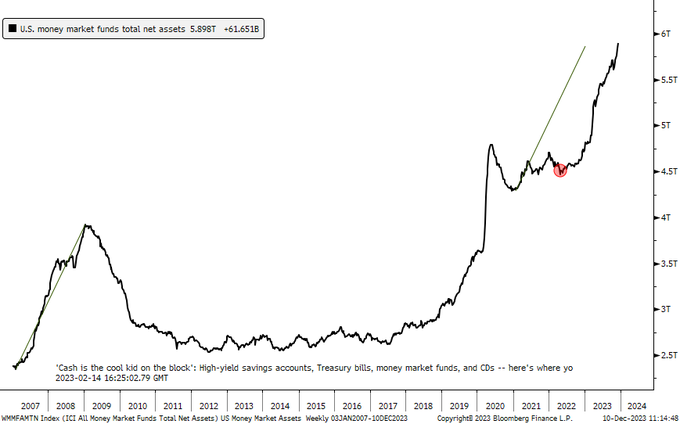

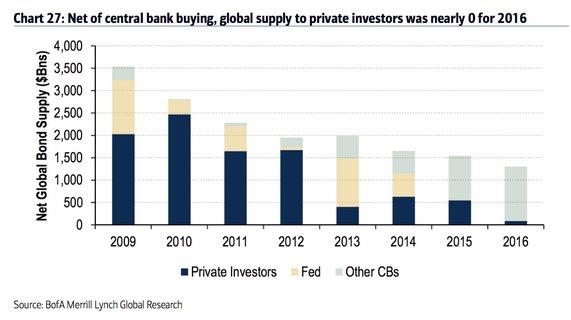

The FED has created a new subordinated USTreasury class. All non-US bank-held USTs = subordinated paper.

Immense US BoP implications.

@LukeGromen

3

13

83

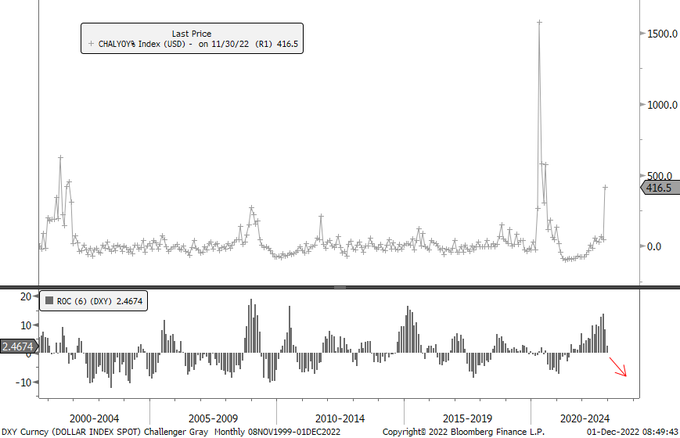

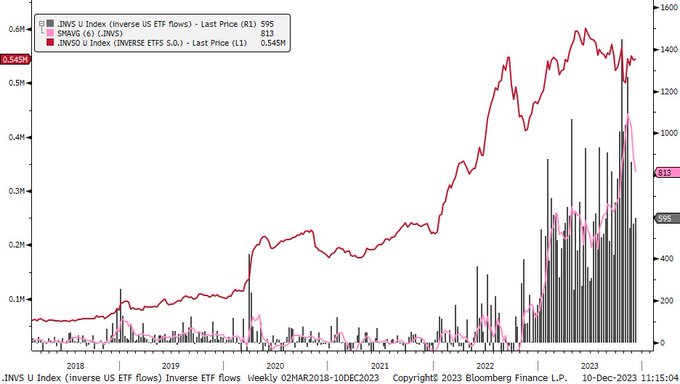

USA Trade Deficit on a ~$1.5 Trillion run-rate/annum. The mathematical definition of USA net export disintegration. USD is the only pragmatic release valve. [DXY, 102.97 last] (corrected, h/t

@LukeGromen

)

1

14

66

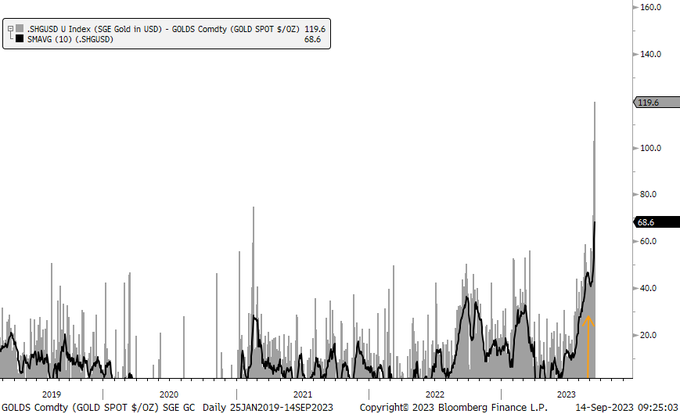

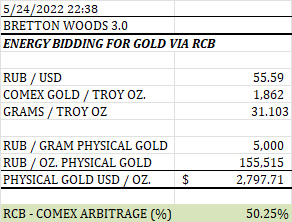

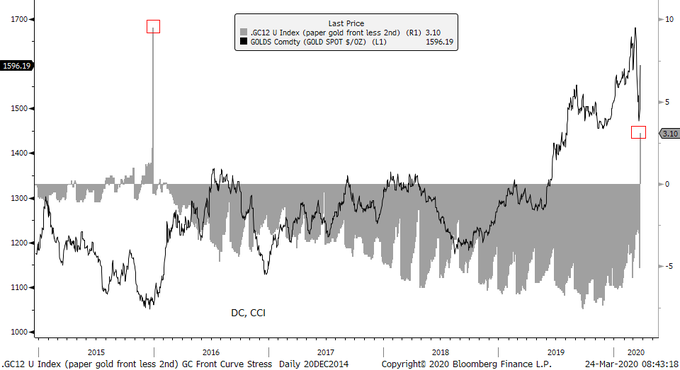

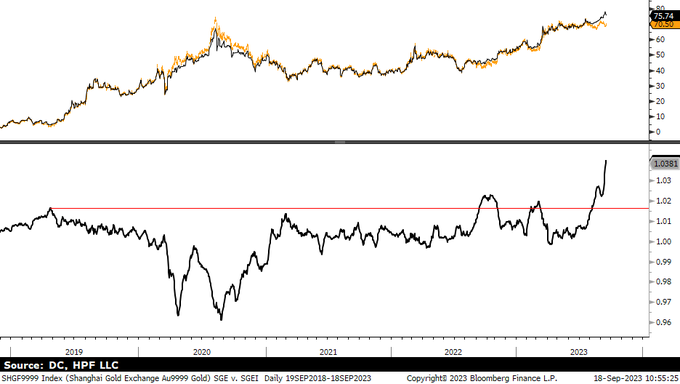

OPEN WATER 2

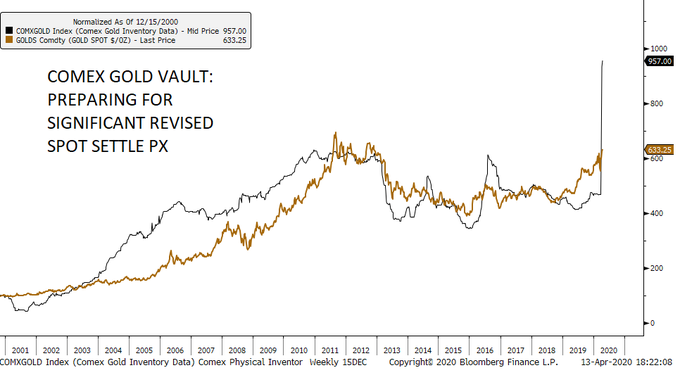

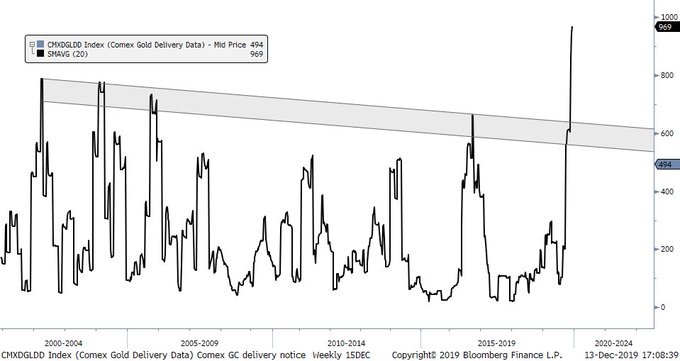

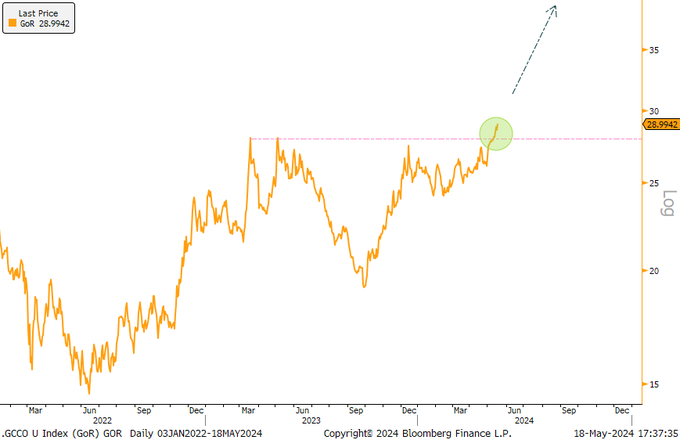

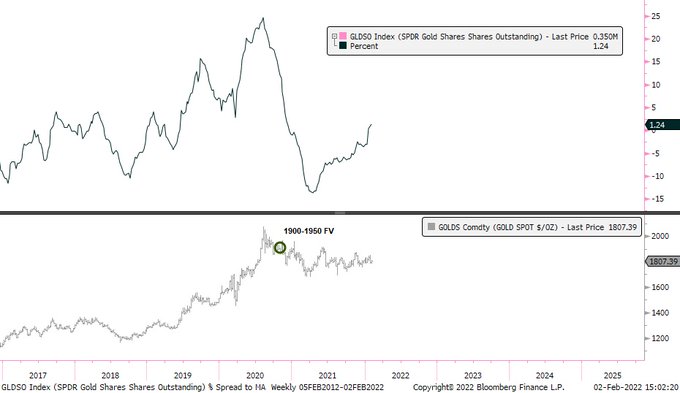

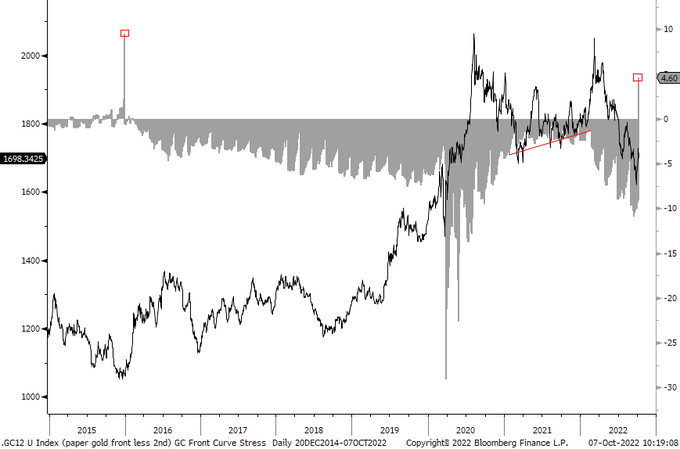

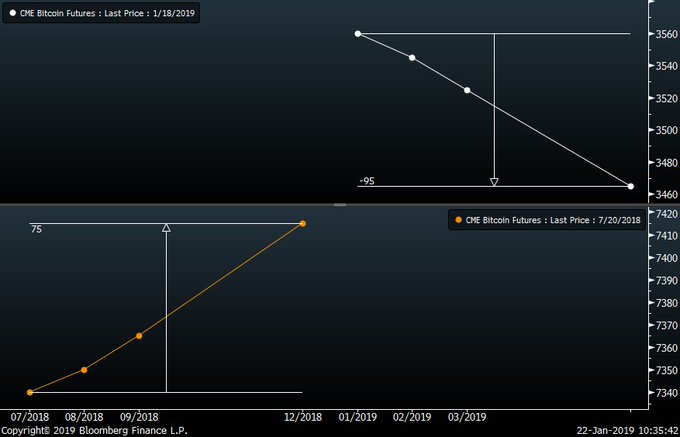

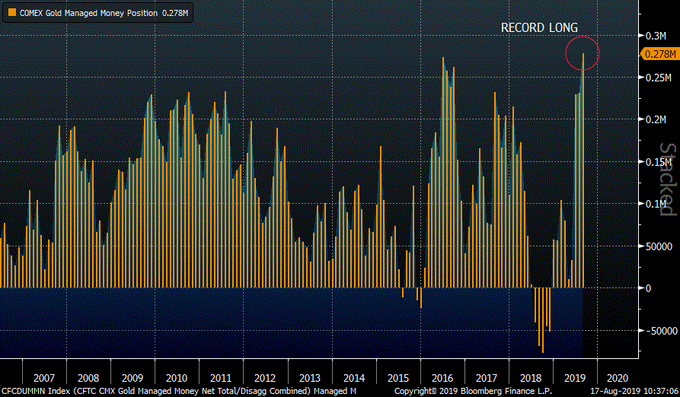

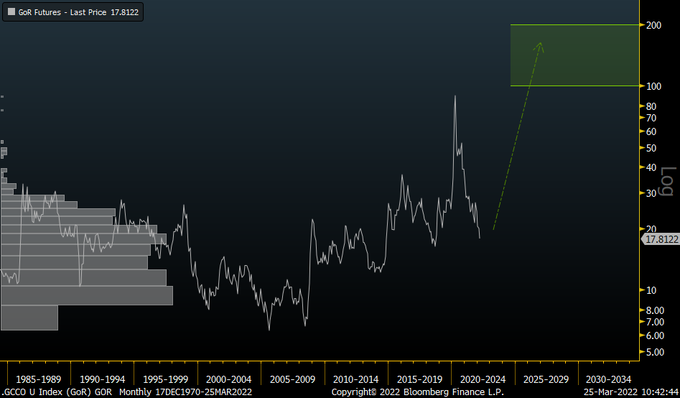

~3yr normalized comex gc open interest negative as $gold vaults away from 3.5yr shelf formation. DEC Gold

@2

,264

"[...] the move this time is very gold centric + physical buying driven with all gold crosses including XAUEUR, XAUCHF continuing to make new highs.…

3

9

67

@sentimentrader

@LukeGromen

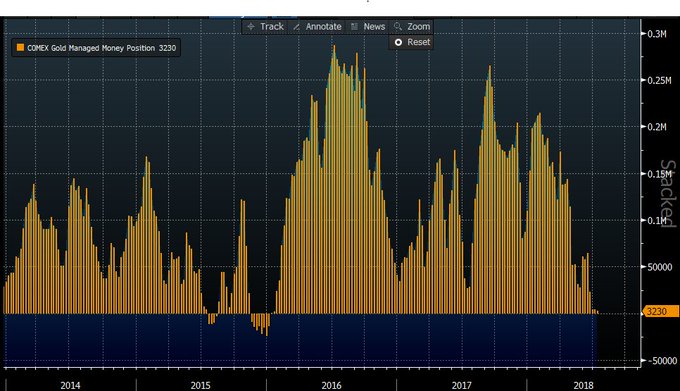

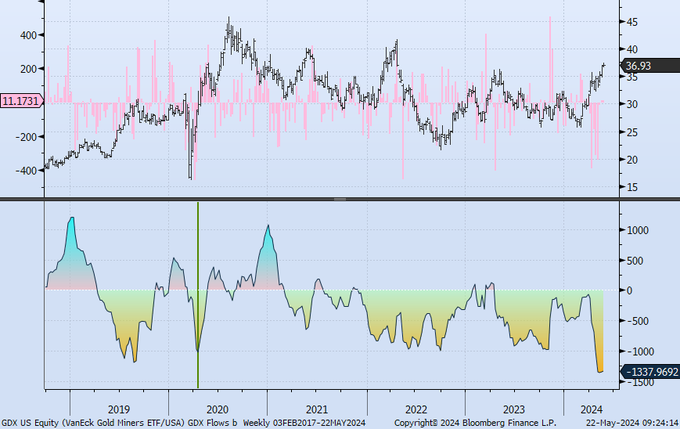

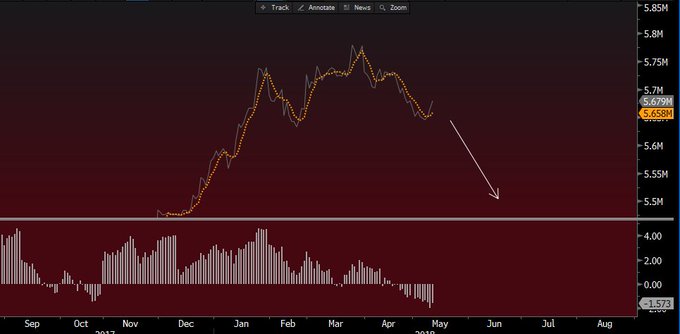

Yet, Gold Majors' equities (GDX) have been sold aggressively by funds (pink histogram) and cumulative money flows remain deeply negative (lower panel). "Nascent stages" indeed. Early doors.

2

7

56

Sputnik Moment >>Google's Quantum computer performed in ~3 minutes, that which a would take a supercomputer 10K Years. Will make obsolete "the cryptographic codes that lock-up some of the world's secrets."

#cryptocurrencymarket

5

27

46

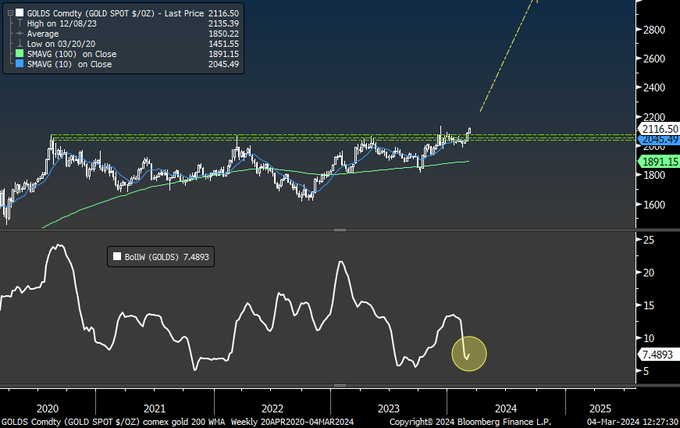

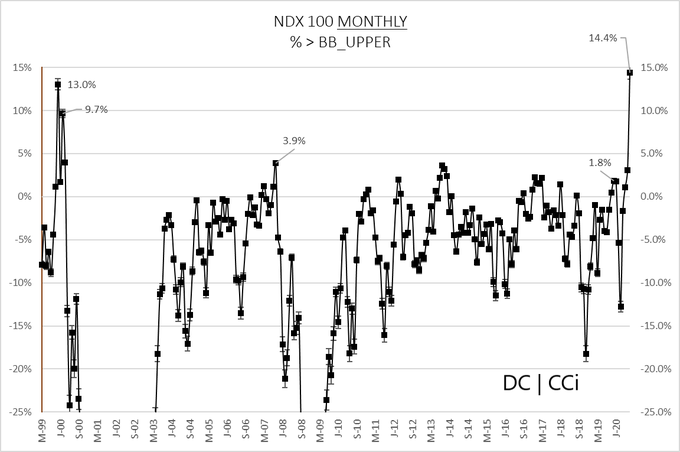

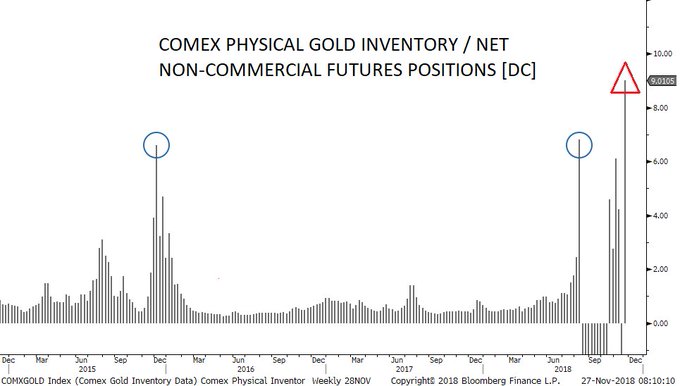

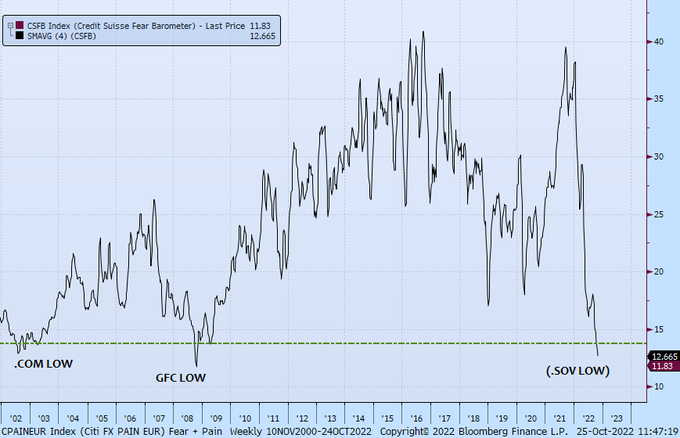

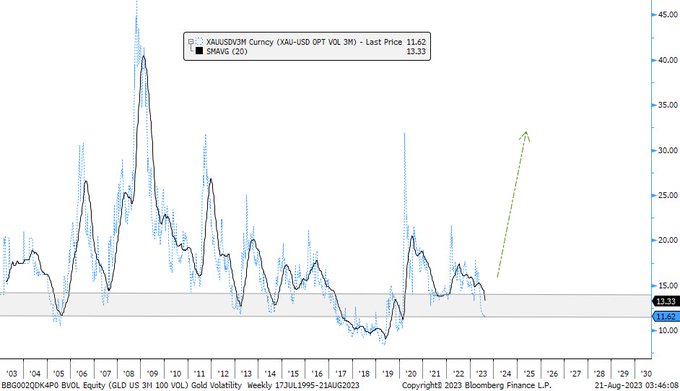

#Gold

spot hesitantly erased ~100pts over past 4wks, as 125T. paper gold shorted ahead of BRICS+ Summit. Gold DSI printed 12, level zone which marked ALL intermediate entry points since 2018.

Weekly 3m Gold volatility has compressed little over past month. 20wk 3m GV sitting atop…

2

10

42

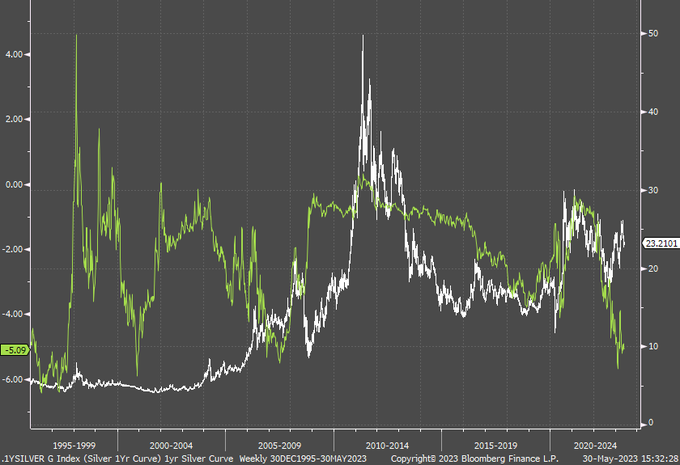

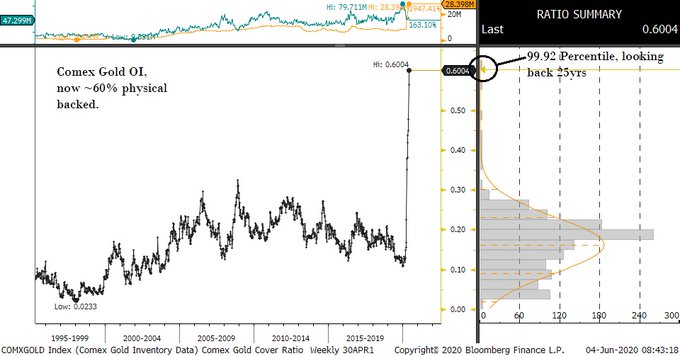

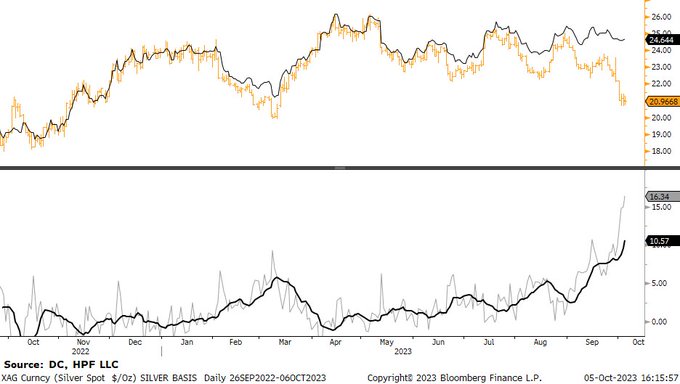

[Premonition of Silver (physical-comex) basis rupture...]

*JPMORGAN IS REVIEWING COMMODITY EXPOSURE AFTER NICKEL CHAOS

@WallStreetSilv

1

2

33