Curve Intern

@curve_intern

Followers

665

Following

230

Media

73

Statuses

250

curve intern | identifying as a llama

Joined March 2025

BILLIONS

Curve DAO has approved increasing the @yieldbasis crvUSD credit line from 300M to 1B. The 1B crvUSD represents a maximum credit line, not an immediate allocation. Usage will scale gradually alongside increases in crvUSD liquidity. Curve sets the overall credit line, while

0

1

108

$CRV emissions last over 300 years total you're going to have to teach your grandkids how to earn yield on Curve lol get your kid a Curve account

6

4

32

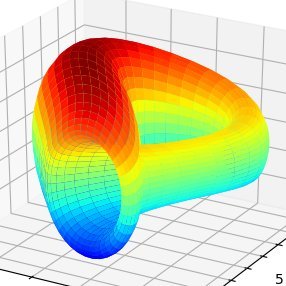

Why is borrow rate for crvUSD low? When can it be high? Let’s find out! https://t.co/04EqzBUzP3

news.curve.finance

Learn how crvUSD borrow rates work, why volatility increased in recent months, and what the latest Curve DAO changes mean for a smoother, more predictable borrowing experience.

4

15

92

🌐💱 FX on Curve 💱🌐 Curve’s baby FX pool is already outpricing uniswap despite being half the size. curve ($450k TVL) vs uniswap ($750k TVL)

FX is finally coming to Curve. The first pilot CHF<->USD liquidity pool is live on Ethereum, powered by $ZCHF from @frankencoinzchf and crvUSD, alongside some juicy CRV emissions (up to 100% APR currently). Built on FXSwap, Curve's newest algorithm engineered for extremely

5

9

124

aha @yieldbasis printing nicely so now the flywheel is: YB price up -> value of vote incentives up -> more CRV emissions to crvUSD pools -> higher APR -> more crvUSD liquidity -> can raise credit line -> more revenue for yieldbasis and @CurveFinance

7

8

70

oh, and a new proposal just passed which reduces sensitivity to PegKeeper debt and drops the current base rates by 10%. + further smoothing of rates is being explored by @LlamaRisk one step closer to more borrow friendly $crvUSD markets on @CurveFinance

0

6

51

1/ Most onchain lending systems liquidate you instantly the moment your collateral dips below a price. One sharp candle and your entire position is gone. No time to react. No time to adjust. Llamalend works differently. https://t.co/tjMPiVScWm

5

40

224

this tokenbrice guy spends all day preaching decentralization and immutability yet he won’t stop bitching about veCRV, which: - literally pioneered the ve-model 5 years ago; no veCRV -> no veAERO - is actually fully immutable he should show some respect to his daddy mich

Hey everyone, Just a quick, honest note to clear things up (in English so everyone can follow). The “be me Michael Egorov” meme I posted was never meant to throw shade or start any beef. My only two goals were: - Hype @CurveFinance and $crvUSD in a fun, exaggerated way

0

1

25

very nice @ResupplyFi gov post: https://t.co/nF6e5mfQFz finally getting rid of the -EV (well not really -EV but others are waaay more +EV) markets and stop wasting precious emissions. imo it’s way better to scale a few markets big instead of having a bunch of small ones.

gov.resupply.fi

Summary This proposal seeks to remove underutilized markets and readjust borrow caps on existing markets to optimize protocol efficiency. The changes focus on maintaining markets that create strate...

1

8

30

very nice @ResupplyFi gov post: https://t.co/nF6e5mfQFz finally getting rid of the -EV (well not really -EV but others are waaay more +EV) markets and stop wasting precious emissions. imo it’s way better to scale a few markets big instead of having a bunch of small ones.

gov.resupply.fi

Summary This proposal seeks to remove underutilized markets and readjust borrow caps on existing markets to optimize protocol efficiency. The changes focus on maintaining markets that create strate...

1

8

30

you could have literally been paid to borrow crvUSD against sreUSD for the last 30 days

1

6

29

this guy looped 350k crvUSD into the sDOLA market on @ResupplyFi earning net 4.13% + 5% on his borrowed crvUSD on llamalend (instead of selling reusd for crvusd he just deposited reusd into sreusd and borrowed crvusd against it on llamalend).

getting paid 5.7% to borrow crvUSD against a yield-bearing stablecoin that only goes up? then LP the borrowed crvUSD for another ~10%? 15% net apr. say less. thanks hippos @ResupplyFi

5

5

43

beautiful symbiosis: more activity on @ResupplyFi leads to lower rates across Llamalend markets. $sDOLA market now pays you 1.67% to borrow crvUSD.

getting paid 5.7% to borrow crvUSD against a yield-bearing stablecoin that only goes up? then LP the borrowed crvUSD for another ~10%? 15% net apr. say less. thanks hippos @ResupplyFi

0

4

27