LlamaRisk

@LlamaRisk

Followers

7K

Following

1K

Media

526

Statuses

1K

Always-On Security for Decentralized Finance.

Joined February 2022

Introducing LlamaGuard NAV ⛊ A next-gen oracle for RWAs, built with @chainlink & @aave, is going live in production on Aave Horizon. It delivers dynamic, risk-adjusted NAV feeds with automated safeguards, powering secure and scalable DeFi. Read the full announcement ↓

13

30

227

Well done @Paxos, @MetaMask & @strata_fi 👏 Following our bug bounty review of 47 assets on @aave V3, we engaged multiple teams to strengthen security practices. We’re proud to highlight several concrete bug bounty commitments. We identified 10 protocols with either

1

0

19

Week 15 for @aave Horizon • TVL: $542M ($298M stables) • Borrowed: $166M Following the @federalreserve 25bps cut, LlamaGuard NAV parameters were adjusted. Our risk models and quant research now support higher capital efficiency—LTV/LT/LB have been updated. Read full recap ↓

5

1

22

APOL1 Genetic Testing at No Cost to Patients! Are you incorporating APOL1 genetic testing into your workflow? Discover No-Cost APOL1 Genotyping Program for eligible patients sponsored by Vertex Pharmaceuticals. Learn more today!

20

37

220

Interesting idea @gondorfi! However, a few details have sparked our curiosity! Integrating @Polymarket into DeFi is bold, but using prediction shares as collateral comes with some caveats. Naturally, it attracts interest—but is the binary risk truly managed? We have some Qs👇

1

3

14

🤝

As part of the onboarding process for PT-srUSDe to the Aave v3 Core instance proposed by @AaveChan, and after passing the @aave DAO Temp Check, @LlamaRisk engaged with Strata for due diligence as part of the ARFC. Security has been Strata's priority from day one. As a fully

0

0

2

We’re excited to share that as part of @aave’s onboarding of @strata_fi’s PT-srUSDe, the Strata team has committed to launching a public bug bounty program in Q1 2026. A strong move that reinforces trust, boosts user protection, and strengthens the ecosystem’s security baseline.

1

1

21

Get clear, healthy-looking nails with podiatrist recommended NONYX. NONYX is clinically proven for fungus damaged and discolored, thick, brittle, yellow and lifted nails. 90% of nails improve using NONYX. So effective its money-back guaranteed.

0

9

71

At LlamaRisk, we unpack the full balance sheet, break down borrower concentration risks, and evaluate the economic reality of these improved stability metrics. Read the full LlamaRisk Insight → https://t.co/oGhL1xSRn1

0

0

7

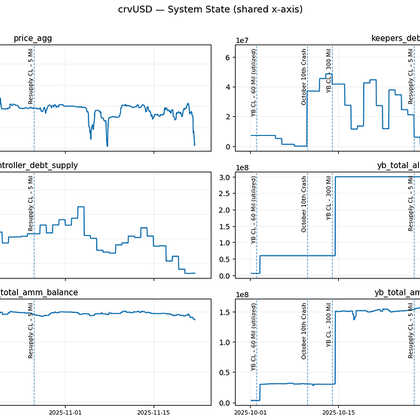

8/ See our recent analysis for how we are enhancing crvUSD for the YieldBasis era, and we'll be releasing more soon in collaboration with our partners Swiss Stake and Pangea 🦙🚀 https://t.co/ycp5w5QcgC

gov.curve.finance

Summary Curve’s new mint markets introduce a parallel issuance channel for crvUSD that operates outside the PegKeeper mint–burn stabilisation loop. As these credit lines expanded - especially via...

0

1

9

7/ We are partnering with @in_pangea on research that will be the basis for guidance on how to scale Yieldbasis while preserving the superior reliability of the crvUSD peg, which has become one of DeFi's most consistently pegged stabelcoins over the past year.

1

3

13

🚨 Actress Diane Keaton’s Cause of Death Revealed Read more

0

81

898

6/ We have also been working with the @CurveFinance dev team to design and implement adaptive EMA smoothing on borrow rates that enhances borrower experience while crvUSD is stable and remains highly reactive when it goes off peg.

1

0

4

5/ These updates help smoothen rates, improving the borrower experience. This is necessary as we observe heightened pegkeeper activity due to volatility absorption of Yieldbasis LPs. A robust crvUSD mint market remains essential for peg stability and driving direct revenues.

1

0

5

4/ To adjust for this growth and support Curve’s long-term scaling, we’ve updated the mint-market monetary policy across two key levers: 1⃣ Increase target_fraction → reduces sensitivity to PegKeeper swings 2⃣ Reduce rate0 → makes mint borrowing more competitive

1

0

6

3/ With YieldBasis, crvUSD is entering a new era of scale. But higher activity also means the existing mint-market monetary policy needs to evolve. We now see a gap between today’s market conditions and parameters that were calibrated for a purely CDP-backed stablecoin.

1

0

5

Shadow Killer weaves terror, art heists, and existential dread. A charismatic killer distorts reality, forcing Alexander and Alexia to face the arcane.

3

14

113

2/ Recent months brought surging Curve DEX volume, largely thanks to YieldBasis. This has been a major win for the DAO — higher DEX LP fees and more revenue for veCRV holders.

2

0

5

1/ The recent vote to increase @yieldbasis credit line from 300m to 1B is putting in the spotlight YB's influence on crvUSD stability. Here's what we're doing to address this question and help YB scale safely while preserving the stability of crvUSD 👇

6

9

53

👏

We’re pleased to share that MetaMask USD - $mUSD - is now included in MetaMask’s public HackerOne bug bounty program. We appreciate the guidance from @LlamaRisk during the onboarding process and look forward to further strengthening security and transparency! 🔗👇

0

0

5