CRED iQ

@cred_iq

Followers

3,580

Following

816

Media

410

Statuses

1,107

CRED iQ is a CRE & CMBS data & analytics platform that has property, loan, tenant, financial, comps, valuation, maturity, borrower contact info and much more.

United States

Joined October 2019

Don't wanna be here?

Send us removal request.

Explore trending content on Musk Viewer

#WWERaw

• 85822 Tweets

#พิมพ์กรกนก

• 69864 Tweets

Canucks

• 67361 Tweets

राजीव गांधी

• 37719 Tweets

Oilers

• 34669 Tweets

定額減税

• 32768 Tweets

給与明細

• 26931 Tweets

梅雨入り

• 26372 Tweets

Gunther

• 22947 Tweets

Vancouver

• 21651 Tweets

#ファンパレハーフアニバーサリー

• 19438 Tweets

ショートアニメ

• 18666 Tweets

金額明記

• 18308 Tweets

ドジャース

• 18209 Tweets

Edmonton

• 18146 Tweets

キングダムハーツ

• 15288 Tweets

#RajivGandhi

• 13317 Tweets

手紙110円

• 12943 Tweets

ZAGATKANDIAZ GalauerPRINCE

• 12785 Tweets

BikinBAPER LevelMAKSIMAL

• 12245 Tweets

भारत रत्न

• 11963 Tweets

国民実感

• 11821 Tweets

手紙84円

• 10998 Tweets

#TercerGrado

• 10214 Tweets

Last Seen Profiles

Shopping mall giant Macerich Co. looks poised to start defaulting on more of its maturing mall loans

@cred_iq

"As a borrower at Santa Monica Place, Macerich has been required only to pay interest on the $300 million floating-rate loan since it was originated at a one-month Libor

1

9

25

A $125M loan on 750 Lexington Ave., a 382,256 SF Office building in New York City, was recently transferred to the Special Servicer (LNR Partners) for Imminent Default.

For full loan, property, and ownership details, visit CRED iQ:

#commercialrealestate

2

5

14

Thanks

@MacroEdgeRes

!!

2

4

12

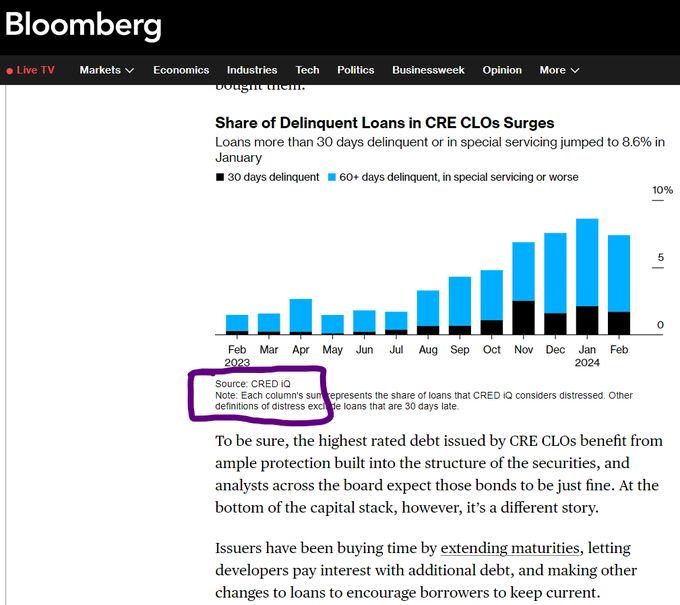

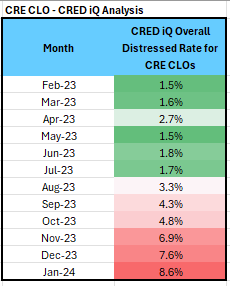

More multifamily distress within the CRE CLO sector.

0

2

12

A nice shout out here from

@unusual_whales

!! Whale szn is here. Let's go

0

1

11

CRED iQ first alerted our subscribers in May 2023 about the troubled loan behind the $66M Kingswood Center (130,218 SF Mixed-Use in Brooklyn).

@commobserver

reported that IPRG was appointed by the 2nd District Judicial Court as receiver for the collateral (More in comments)...

1

2

10

“Sometimes small triumphs and large hearts change the course of history.”

May your day be filled with pride!

#cre

#commercialrealestate

#MemorialDay2021

0

0

7

A $12M loan secured by a 37,000-SF retail property in Coral Gables, FL was added to the watchlist due to weak financials.

For full loan, property and ownership details, visit CRED iQ:

#crediq

#commercialrealestate

#coralgables

1

3

6

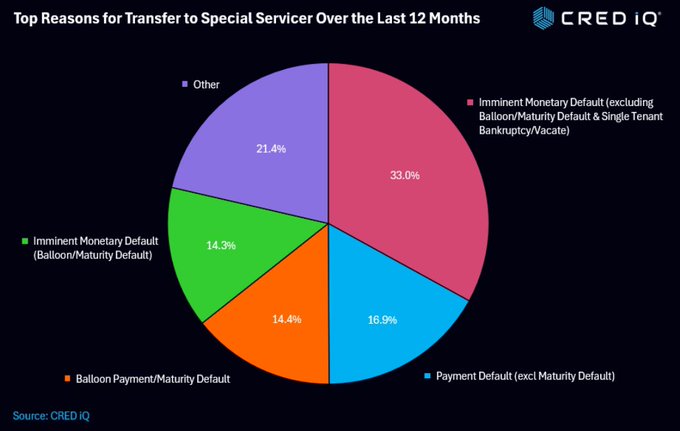

Some more research & data trends here

Top Reasons loans are transferred to the special servicer compiled by

@cred_iq

loan level data

1

6

9

0

2

7

@danjmcnamara

Going, going gone - $12mm down to $8.5mm

0

1

5

Imminent maturity default caused this $371.6M indebted mixed-use portfolio in New York City to transfer to the special servicer.

For full loan, property and ownership details, visit CRED iQ:

#crediq

#commercialrealestate

1

4

6

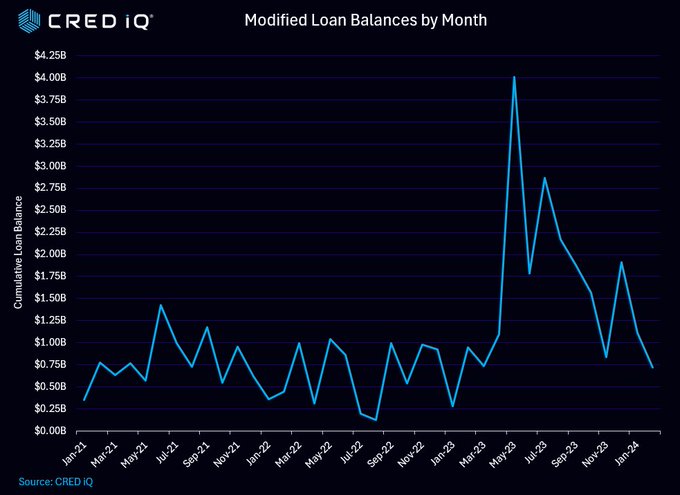

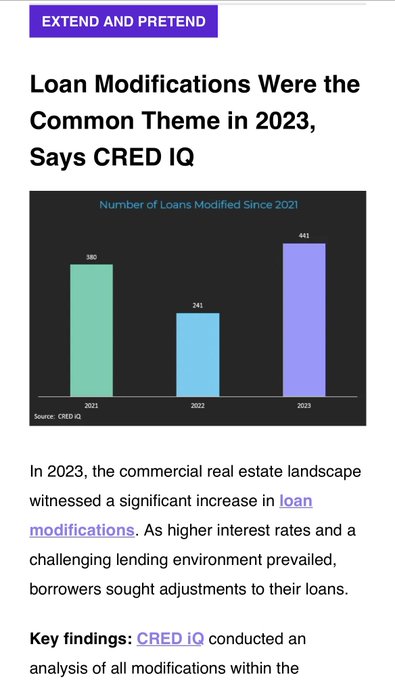

Loan modification data from CRED iQ featured on this morning’s newsletter from

@thecredaily

- one of the best in the game. 💪🏼

1

2

5

According to CRED iQ's updated data for November, 358 multifamily properties totaling $7.5 billion have been added to the servicer's watchlist.

To receive real time alerts on CRE properties, loans and portfolios, click here:

#commercialrealestate

0

3

5

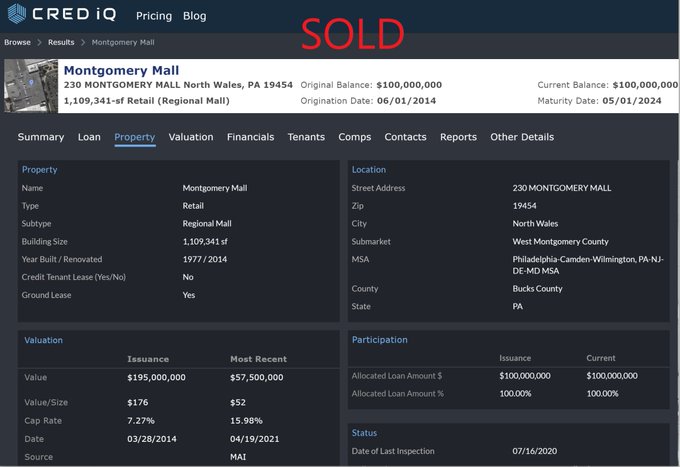

@ShlomoChopp

Typical mall appraisal cycle of life: $150M original, default happens…then new appraisal 75M, then $50M, then $35M, then $25M, then sells for $5-10M

0

0

5

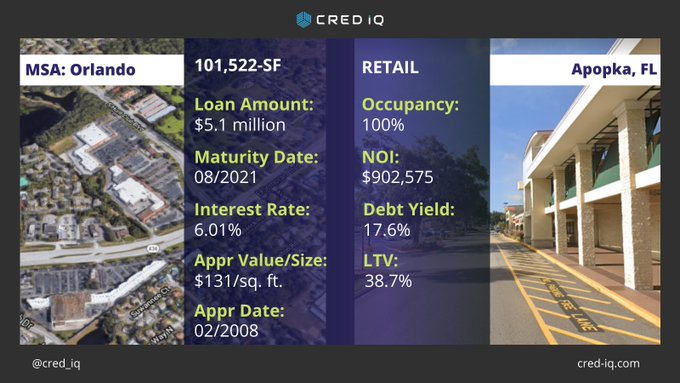

The $5.1 million loan backed by this 101,522 square foot retail property is scheduled to mature on 08/2021. In 2008, the property appraised for $13.2 million yielding an LTV of 38.7%.

Visit for more

#commercialrealestate

data. Free trial available.

#CRE

0

1

4