Zharta Finance

@ZhartaFinance

Followers

9K

Following

6K

Media

1K

Statuses

4K

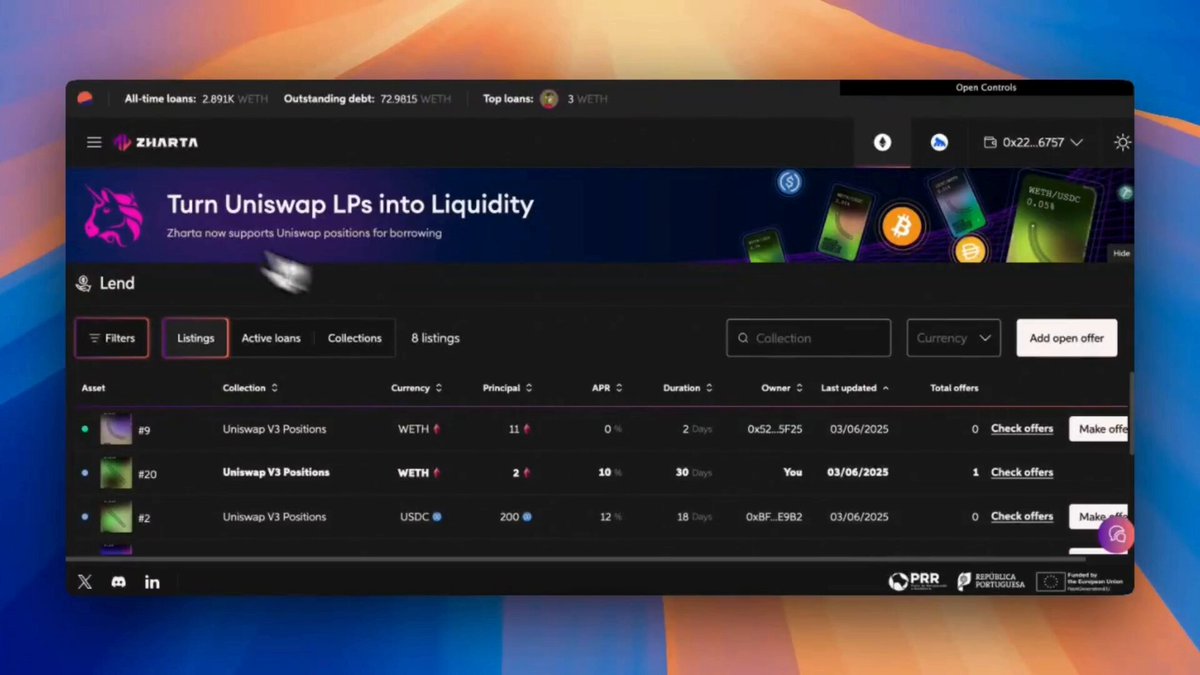

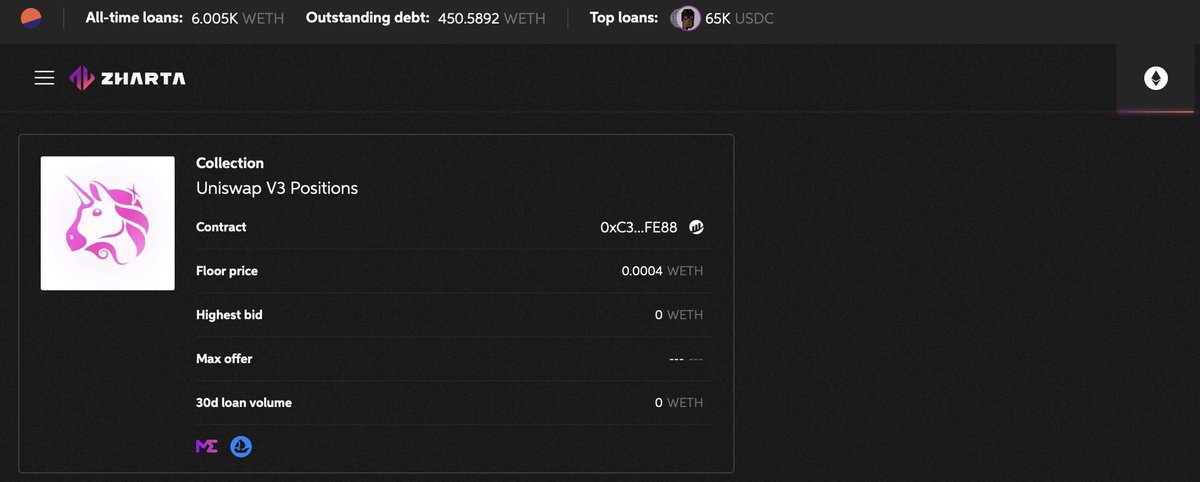

Where assets turn into liquidity. Boost your gains with the ultimate Finance tools for NFTs, AMM LPs and RWAs.

Joined October 2021

You’ve been underusing your Uniswap LP positions. That ends now. For years, LP tokens just… sat there. Earning fees, yes — but totally illiquid. Capital locked. Strategy stalled. Not anymore. With LP-as-collateral, you can now borrow stablecoins against your LPs. → Unlock

7

9

40

Liquidity ≠ parked capital. If your LPs are just sitting there….you’re leaving money on the table. Put them to work. Collateralize. Borrow. Reposition. That’s capital efficiency. That’s DeFi.

Elevate your liquidity strategies by using @Uniswap LP positions as collateral on Zharta. Enhance your liquidity while optimizing your portfolio's potential. See the smart way forward on our website below 👇

0

1

2

You farmed. You earned. Now borrow. Zharta lets you use your Uniswap LP tokens as collateral. Liquidity without selling. Let your position keep working while you move. @Uniswap @UniswapFND @growuniswap.

0

0

1