yieldbasis

@yieldbasis

Followers

35K

Following

221

Media

13

Statuses

127

Turning crypto into productive assets using original Automatic Market Making without IL. Focusing on $BTC first. Dm is open.

Switzerland

Joined January 2025

[update] migration: live -> ui at https://t.co/IQS4AkvyQl lps are encouraged to migrate asap. fyi: once migration completes, fee distribution will follow shortly.

yieldbasis.com

A new standard for liquidity provisioning without impermanent loss.

19

23

102

Dear arbitrage traders! Very important! Please connect your arbitrage bots to these VirtualPool contract to keep new markets on @yieldbasis healthy (and make arb profits). WBTC: https://t.co/LVFKYdrR7K cbBTC: https://t.co/qVFcxCmtnp tBTC:

10

25

131

As usually, checked if @yieldbasis algorithm liked the recent Bitcoin crash to 100k. It actually did: system as a whole made some profit! The most recent jump up on the graph is that, and pools are now perfectly balanced

13

18

135

🐘 Stake DAO Weekly Highlights MAIN FOCUS - $YB Liquid Locker Launch: • $sdYB for @yieldbasis now live on Stake DAO • Deposit $YB → receive $sdYB → unlock full $veYB benefits + $SDT rewards • Gain exposure to Yield Basis governance and revenue through Liquid Locker

8

6

36

@yieldbasis revenue calculations arrived👇 Protocol generated 4.81 BTC veYB fees over month (with 30 and then 150m TVL only) Let’s do napkin math: - With 4.81 BTC fee existing 16.77m veYB receive $0.03/month or $0.36/year - Next is $500m TVL extension. - If $500m TVL will

9

18

101

🎙️ New @edge_pod 🌽 Is This The Next Best BTC Yield In DeFi? 0:00 - Intro 5:43 - Building Curve Finance since 2020 8:36 - Why build yieldbasis? 11:53 - The challenge to productize BTC yield 19:13 - How does yieldbasis work? 26:29 - Current BTC yields and performance 28:20 -

14

27

134

The next Liquid Locker is coming: sdYB for @yieldbasis Proposal SDGP-61 plans to allocate up to 500,000 $SDT to bootstrap its launch and incentives, expanding Stake DAO’s integration in the $veYB ecosystem. 🐘

13

17

84

For @yieldbasis it doesn’t matter whether the $BTC price goes up or down. What truly matters for the protocol is $BTC volatility. The greater the volatility the higher the yield the protocol generates. Yield that will soon be distributed to $YB stakers in $BTC in milions of $

YieldBasis already generates x3 more weekly fees than Curve DEX, despite having x9 smaller TVL $YB - $40m MC $CRV - $700m MC

3

14

102

Some YB from @yieldbasis arrived for pyUSD/crvUSD @CurveFinance pool incentives for continuity (since this pool was not included in @ConvexFinance and @StakeDAOHQ vote incentives this time)

11

19

104

TVL went from $60M ➝ $315M. No outflows since launch. After proving stability since September launch, @yieldbasis is preparing to expand the cap from $150M to $500M TVL. More TVL = more trading volume = more fees ➠ All BTC vaults (tBTC, cbBTC, WBTC) at capacity ➠ ~2M in

21

15

108

YB vote incentives at @VotiumProtocol and @StakeDAOHQ for vlCVX and veCRV voters for crvUSD pools just arrived. Enjoy and help @yieldbasis and @CurveFinance to grow by voting!

14

28

146

After a long period of uncertainty regarding the activation of revenue for $YB tokens, an update outlining the next steps of the protocol has just been shared on the @yieldbasis Telegram channel It appears that within a month, admin fees will be enabled, and veYB holders will

11

18

66

Not exactly sure when caps will raise but there should a race to get into these 2x BTC/crvUSD LPs (aka @yieldbasis vaults) to earn the real BTC fees and/or YB token emissions.

I've just begun to better understand the new @yieldbasis protocol by Curve Founder @newmichwill. I find it very interesting for the simplicity it offers as a product seeking to maximize ease of access to higher yields on BTC. There's a multi-trillion-dollar market cap for BTC,

18

19

93

People apparently lock @yieldbasis YB tokens and vote to increase their own YB yield. YB wars are here, all proceeding as planned!

34

20

165

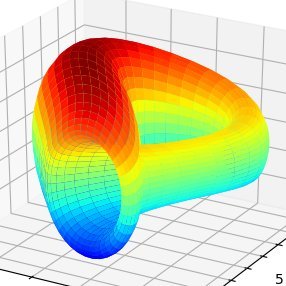

I analyzed @yieldbasis mechanics to determine if it outperforms IL. What's IL? Assume our BTC-denominated portfolio is pooled in an AMM. If BTC's price rises, we sell and hold less BTC. If it falls, AMMs (including @CurveFinance's cryptoswaps) buy more. How does YB manage this?

16

22

124

What was happening since @yieldbasis launched and what did it do at Curve? Let's find out https://t.co/lJIVWAwl8N

news.curve.finance

Curve and YieldBasis have seen a wave of DAO activity in recent weeks. Here’s a recap of what has been happening on Curve’s side, focusing on governance and ecosystem impact rather than YieldBasis...

34

48

214