Yamco

@Yam_Trades

Followers

4K

Following

2K

Media

1K

Statuses

4K

Former Actuary using options flows to trade $SPX and various single names on abnormal flows.

Joined April 2022

$SPX.My early morning game plan.-As I posted in the morning note, I thought we had unfinished business lower . Today had a few good swings from volume node to volume node but largely been playing the ping pong from ~65 to ~90 and back down in small size . Just having fun

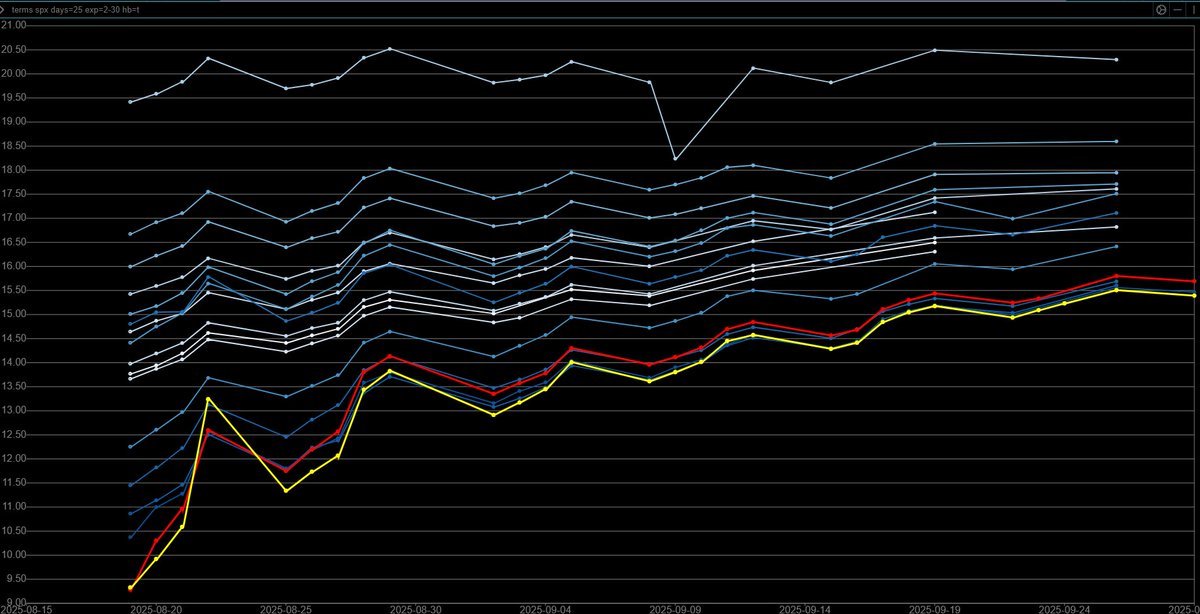

$SPX. Market Data from @ConvexValue .-Term structure has continued its retreat lower from middle of range yesterday on the generational sell (~1%).-30 pt straddle from SPX reference 6385 gives us a range of [6355,6415].-Weekly Straddle is [6370,6529].-POLR shows two paths; 6420

1

1

6

$SPX. Market Data from @ConvexValue .-Term structure has continued its retreat lower from middle of range yesterday on the generational sell (~1%).-30 pt straddle from SPX reference 6385 gives us a range of [6355,6415].-Weekly Straddle is [6370,6529].-POLR shows two paths; 6420

0

5

21

08-20 Flow Highlights . Make Cigarettes Great Again!. Flow Multiples.$MO 6.81x Bullish Premium.$EXC 5.41x Bullish Premium.$DHI 5.1x Bullish Premium.$INDA 3.56x Bullish Volume. Interesting Trades.$BLSH September Buy 1849x125C (Chinese Stable Coin Servicer).$GLXY EOM Buy.

08-18 Flow Highlights . Flow Multiples.$CVE 12.18x Bullish Premium.$RIG 8.17x Bullish Premium.$UPS 7.37x Bullish Premium.$EL 6.7x Bullish Volume.$CXW 5.02x Bullish Volume.$VITL 4.64x Bullish Premium.$ASTS 3.85x Bullish Volume (Weekly Roll Down).$SSYS 3.61x Bullish Volume.$BIDU.

1

2

24

$SPX.Took a few trades on the day. -Break under ON low (got in a bit late) and closed around 65. -4 pt stop on ES break of SPX 6350. -Longs from 65 to 80s.-Few shorts from 85-75 . In a pin trade for my flat close - Today is very important to get a fairly flat close. At the

$SPX. Market Data from @ConvexValue .-Term structure in middle of past weeks.-24 pt straddle from SPX reference 6406 gives us a range of [6380,6430].-Weekly Straddle is [6370,6529].-POLR shows two paths; 6435 to the upside and 6370 to the downside.-Overnight volumes on 0dtes

2

2

29

$SPX. Market Data from @ConvexValue .-Term structure in middle of past weeks.-24 pt straddle from SPX reference 6406 gives us a range of [6380,6430].-Weekly Straddle is [6370,6529].-POLR shows two paths; 6435 to the upside and 6370 to the downside.-Overnight volumes on 0dtes

0

3

25

08-18 Flow Highlights . Flow Multiples.$CVE 12.18x Bullish Premium.$RIG 8.17x Bullish Premium.$UPS 7.37x Bullish Premium.$EL 6.7x Bullish Volume.$CXW 5.02x Bullish Volume.$VITL 4.64x Bullish Premium.$ASTS 3.85x Bullish Volume (Weekly Roll Down).$SSYS 3.61x Bullish Volume.$BIDU.

08-18 Flow Highlights . Flow Multiples.$MDT 19.57x Bullish Volume.$FSLR 13.78x Bullish Premium.$XNET 12.41x Bullish Premium.$EL 7.6x Bullish Premium.$OPEN 5.67x Bullish Premium.$BE 5.35x Bullish Volume. Interesting Trades.$EL Weekly Buy 5478x85C.$MDT September Buy 6000x105C.$ASTS.

0

1

13

$SPX.Well. flat close obviously didn't happen - eventually the vol compression bubble pops - Thought it would pop a bit later in the week but it was all a guess on timing. I took an EOM reversion trade off 6427 and cut it against 6424 (saw a level of support and was leaning

$SPX. -I'm seeing a decent probability of another flat close. IC buyer thinks otherwise. Market Data from @ConvexValue .-Term Structure is about to be buried - You can only compress volatility so much for so long before it pops.-20 pt straddle from SPX reference 6444 gives us

0

2

13

$SPX. -I'm seeing a decent probability of another flat close. IC buyer thinks otherwise. Market Data from @ConvexValue .-Term Structure is about to be buried - You can only compress volatility so much for so long before it pops.-20 pt straddle from SPX reference 6444 gives us

1

2

22

08-18 Flow Highlights . Flow Multiples.$MDT 19.57x Bullish Volume.$FSLR 13.78x Bullish Premium.$XNET 12.41x Bullish Premium.$EL 7.6x Bullish Premium.$OPEN 5.67x Bullish Premium.$BE 5.35x Bullish Volume. Interesting Trades.$EL Weekly Buy 5478x85C.$MDT September Buy 6000x105C.$ASTS.

08-15 Flow Highlights . Flow Multiples.$OPRA 13x Bullish Premium.$GTLB 10.63x Bullish Premium.$RDDT 6.51x Bullish Premium.$O 5.79x Bullish Premium. Interesting Trades.$OPRA September Buy 3389x15C.$PDD 09/26 Buy 9838x127C.$SEE September Buy 3350x32.5C.$RBLX October Buy 3500x135C.

0

0

15

$SPX. Flow chart from @ConvexValue .- Deltas flattened until end of day when we saw an uptick.-Much of the oscillations were due to movements in VIX. -My best read is more compression tomorrow. Term Structure.-Volatility expectations are near multi-month relative lows. An

$SPX. Unless you were playing 0DTEs from the absolute edges of the day, there wasn't much to do today on the PA. Few inside days before we get some range expansion was my base case this week. Next 5 from @OptionsDepth .-Tomorrow looks like 6450 is going to be a very integral

3

1

17

$SPX. Unless you were playing 0DTEs from the absolute edges of the day, there wasn't much to do today on the PA. Few inside days before we get some range expansion was my base case this week. Next 5 from @OptionsDepth .-Tomorrow looks like 6450 is going to be a very integral

$SPX. Market Data from @ConvexValue .-Term structure increased a bit but remains at the low end of the past month. -23pt daily straddle and using 6443reference at 745 gives us a range of [6420, 6466].-Weekly Straddle is [6370,6529].-POLR as of close shows 6460 close.-Overnight

0

3

15

$SPX. Market Data from @ConvexValue .-Term structure increased a bit but remains at the low end of the past month. -23pt daily straddle and using 6443reference at 745 gives us a range of [6420, 6466].-Weekly Straddle is [6370,6529].-POLR as of close shows 6460 close.-Overnight

0

2

17

08-15 Flow Highlights . Flow Multiples.$OPRA 13x Bullish Premium.$GTLB 10.63x Bullish Premium.$RDDT 6.51x Bullish Premium.$O 5.79x Bullish Premium. Interesting Trades.$OPRA September Buy 3389x15C.$PDD 09/26 Buy 9838x127C.$SEE September Buy 3350x32.5C.$RBLX October Buy 3500x135C.

08-14 Flow Highlights . Flow Multiples.$DLO 21x Bullish Volume.$SIL 9x Bullish Volume.$PEP 6.37x Bullish Volume.$KSS 4.8x Bullish Premium.$Z 3.76x Bullish Premium.$ONDS 3.33x Bullish Volume. Interesting Trades.$AMD 08/22 Buy 4078x197.5C.$KSS 08/29 Buy 2804x13C.$SIL October Buy.

0

0

8

$DAY. Nice to see 800k in premium (I missed until weekend review) come in 20 minutes before close and then see this announcement on Monday morning.

THOMA BRAVO in talks to take DAYFORCE $DAY private in potential $9B+ deal, Bloomberg reports. The Minneapolis-based HR software company provides AI-powered recruitment, payroll and employee development solutions. Deal could be announced in coming weeks but talks could still.

0

0

4

$SPX. Week Ahead is out: Market data from @ConvexValue .Net options positioning from @OptionsDepth . Straddles.Straddle pricing has remained the same week/week with hot CPI/PPI data reported this week. The market is ultimately looking to Jackson Hole to

0

2

28

$SPX. OPEX days are boring - I put a small pin trade on and made 120% in paltry size - I generally don't trade OPEX but there was a REALLY nice dip buy (I was off desk when that happened). Next 5 days from @OptionsDepth .Guess Monday is a gap up . From left to right, it’s

$SPX. Lunch time update; OPEX days are generally a grass touching day. My game plan from this AM.-Was looking to put on a play at London close and haven't done anything. I lean to a flat close for the day and as long as 6450 holds, I think that's a decent opportunity. Flow

0

3

33