Tyson Lester, MBA, ChHC®, REBC®, RHU®

@TysonLester

Followers

89K

Following

199K

Media

300

Statuses

17K

President @PolicyAdvantage | Insurance and ACA expert. Brand Dev & 4IR Tech. 3x @TheAmerCol alum— https://t.co/iD0hK60hmL MBA w/ Distinction. Influencer. Montana grown.

Los Angeles | CA Lic. #0F22799

Joined December 2008

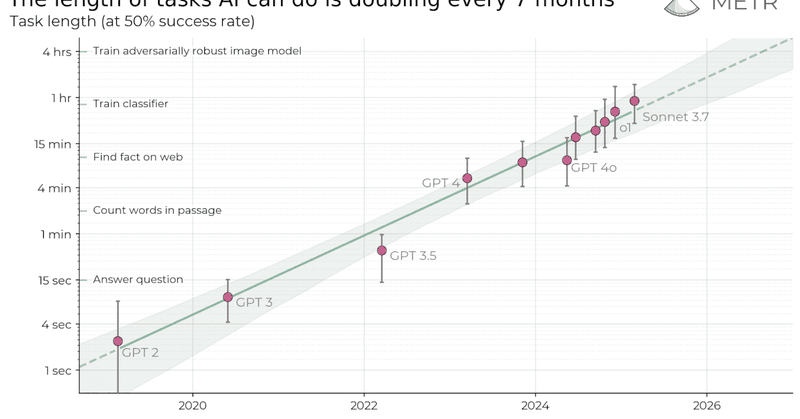

AI’s ability to complete longer, real-world tasks is growing rapidly— far faster than many realize. 4 key insights below, and @METR_Evals compelling NEW research here: https://t.co/ka6zQfCvr2 1⃣🚀 AI Long-Task Capability Is Growing Exponentially: AI’s ability to complete longer

metr.org

We estimate that, on our tasks, Claude Opus 4.5 has a 50%-time horizon of around 4 hrs 49 mins (95% confidence interval of 1 hr 49 mins to 20 hrs 25 mins). While we're still working through evaluations for other recent models, this is our highest published time horizon to date.

1

5

47

🎄🎅 University of Liverpool (@LivUni) glowing tonight on the final Friday evening of the fall term in the university square— Christmas in northwest England. (📸 Cred - UoL Official Facebook: https://t.co/Ux3kT1p41Q)

3

9

102

🚨NEW. "Risk Mapping for Small Business: How to Build an Antifragile Business That Gets Stronger Under Pressure." https://t.co/h79M2Rr5yl 7 key steps in the value-loop: 🧠 Step 1: Shift the Mindset From Risk Avoidance to Risk Intelligence 🗺️ Step 2: Identify Your Core Risk

policyadvantage.com

🌅 A Familiar Moment: When Everything Feels Fine Until It Is Not On paper, the business was healthy. Revenue was steady, clients were satisfied, payroll cleared on time, and nothing felt urgent. Then...

0

11

91

The latest payroll data and research about AI's effects on the contemporary workforce across sectors. 6 key insights below, and full @AdpResearch whitepaper here: https://t.co/h3otWySFPe 1⃣🤖 AI Drives Job Churn, Not Collapse: AI is boosting productivity without causing mass

adpresearch.com

In this issue, we meet the new hire, explore the wage cycle and more.

Workers in technology, information, and agriculture are the biggest on-the-job users of generative AI. But a big share of people in public administration, hospitality, and health care don’t use it at all. See what else our data revealed about AI adoption in the latest issue of

1

9

58

Why is EX (Employee Experience) so important, and is your organization ready to meet evolving real world needs? 4 key EX insights below, and take @Webex's "organizational AI readiness" assessment here: https://t.co/6kvd5LEPL6 1⃣🔥 EX Multiplies Performance: When employees feel

People do their best work when they feel supported aligned and connected. This EX maturity assessment reveals how well your workplace meets real employee needs highlighting strengths blind spots and opportunities for meaningful improvement. Gain perspective on your current EX

2

12

141

🇨🇳🔎NEW. The current state of Chinese AI— are they pulling ahead of global counterparts? 4 key insights below, and full @StanfordHAI paper here: https://t.co/wY3RWATCDA 1⃣🧠 Open-Weight AI Is Now Systemic: China’s AI ecosystem goes well beyond DeepSeek, with multiple open-weight

hai.stanford.edu

Almost one year after the “DeepSeek moment,” this brief analyzes China’s diverse open-model ecosystem and examines the policy implications of their widespread global diffusion.

📢 New issue brief: Have Chinese AI models pulled ahead of their global counterparts? Our latest brief analyzes China’s diverse open-weight model ecosystem and examines the policy implications of their widespread global diffusion. https://t.co/zkdBKf7N5F

1

7

105

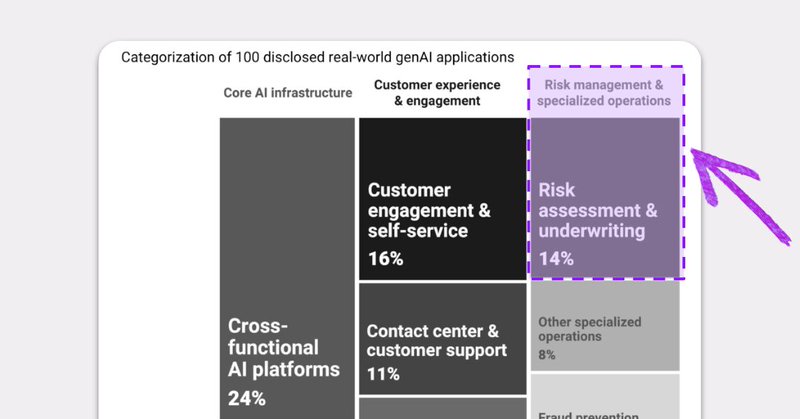

New via @FGraillot x @CBInsights— "CBinsights analyzed 100 startups and shares lessons learned in a recent report, which highlights where these technologies are mainly leveraged." 4 key #InsurTech takeaways below, and more here: https://t.co/uGnThkgbP6 1. Cross-functional

linkedin.com

Where do insurers (and banks) currently leverage Generative AI the most? While the market is vocal about operational efficiency and many startups are doing "AI in insurance", there are plenty...

Where do insurers (and banks) currently leverage Generative AI the most? → https://t.co/ivRP1oRh6l CBinsights analyzed 100 of them and shares lessons learned in a recent report, which highlights where these technologies are mainly leveraged. BestOfH2

3

8

143

"Agents are the next evolution of digital presence: intelligent, interactive, and always on." Are your brand's AI agents connecting with stakeholders and consumers yet? More here: https://t.co/Gluw3MG2hN ✔️Create Your Agent: Design a smart Agent that reflects your brand's voice,

Your website waits. Your Agent acts. It can answer, book, negotiate, compare, check inventory, and coordinate with other agents. Fetch Business makes it possible for SMEs, creators, and enterprises to build verified agents instantly. Step into the Agent Economy:

2

8

91

Hill Dickinson Stadium was crowned Project of the Year at last night's @stadiumbusiness Design & Development Awards 2025. 🏆

3

52

814

💙🫶 Liverpool you're a gem. Had an opportunity to visit @Everton Football Club's brand-new, state of the art stadium in England's Premier League today— it is Hill Dickinson Stadium (@EvertonStadium). And it's a stunner. #EPL #Everton

1

26

256

New cutting edge research from the @ASI_Alliance. My 4 key insights below and the full article here: https://t.co/Z57nvnr02e 1⃣🎯 LLMs Become Reasoning Engines: The shift from chat to multi-step reasoning and tool-use is accelerating across the ecosystem. 2⃣🌍 Open-Source Models

openrouter.ai

An empirical study analyzing over 100 trillion tokens of real-world LLM interactions across tasks, geographies, and time.

Recently @OpenRouterAI conducted this research that shows the current 'State of AI'. https://t.co/lvOnAQqGqg CEO of @Fetch_ai and chairman of @ASI_Alliance @HMsheikh4 comments: "The latest OpenRouter analysis offers one of the clearest empirical signals yet: LLMs are no longer

3

12

137

A look ahead to 2026 within insurance via @jasonsmith0119 and @Wipfli_Official— 4 key insights below, full article here: https://t.co/w0E7LsDuoW 1⃣🌪️ Industry Pressures Intensifying: The insurance sector is facing rising claim costs, climate-driven disasters, increasing

wipfli.com

As the insurance industry heads into 2026, firms are facing challenges like rising claims, uncertainty and a major talent drain. Can the right AI strategy help?

What are the key trends that will shape the insurance industry in 2026? Here’s what to watch for. https://t.co/2xUZUp3f4M

0

14

156