David F

@TradingHurst

Followers

5K

Following

6K

Media

6K

Statuses

13K

Detecting cycles with novel signal processing techniques. DM for Discord membership / live cycle scanner. More info at https://t.co/S0qX1ORk3D

Cambridge

Joined January 2015

RT @PhysInHistory: The Fourier Transform is a mathematical operation that transforms a function of time (or space) into a function of frequ….

0

293

0

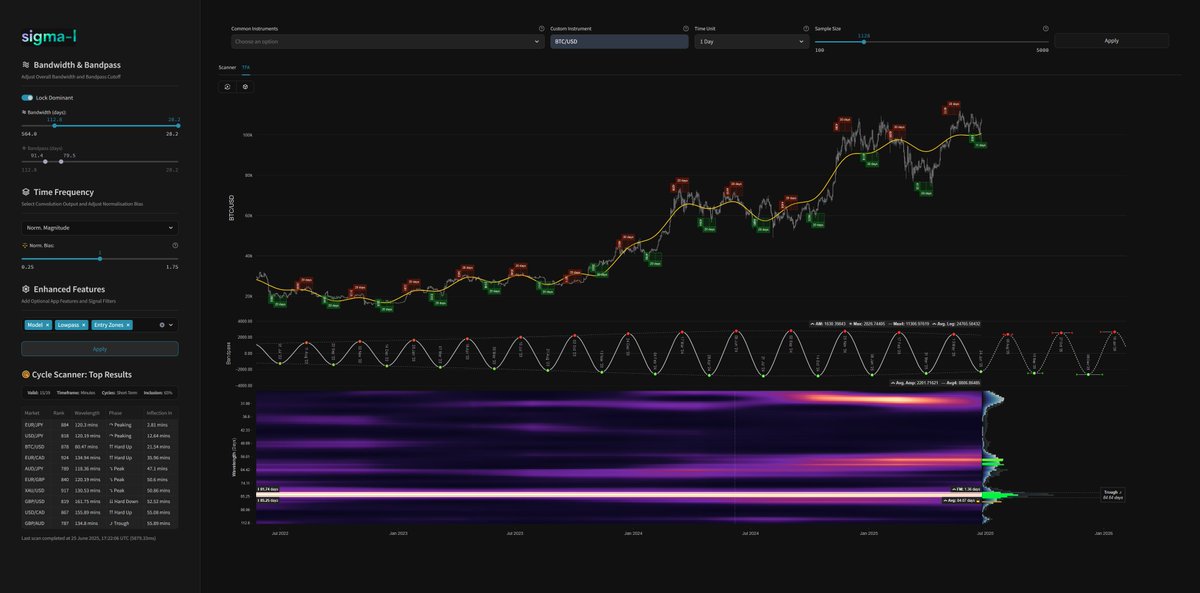

Progress of the ~ 30 day cycle in Bitcoin. Bullied in the latest down leg by the upward pressure of larger cycles (80 day etc.). Now has likely troughed and in phase for up leg.

Progress of the 30 day cycle in Bitcoin as we proceed in a rather turgid manner toward the next peak over the coming days.

1

1

6

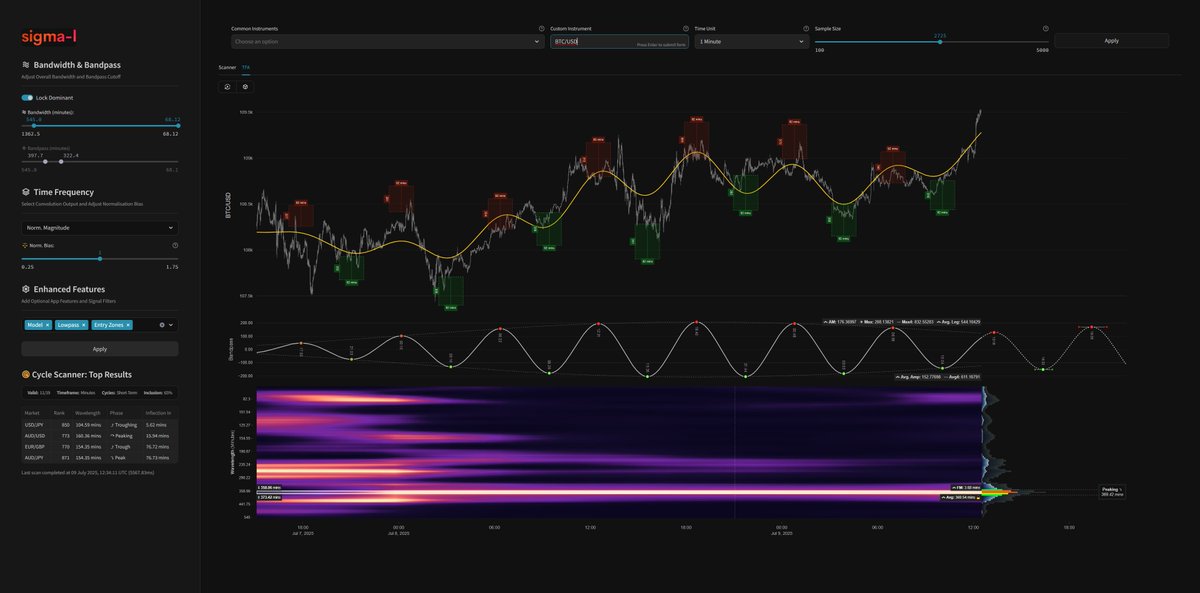

Not as good as yesterday but a wonderful cycle around 130 minutes in Gold and Silver the highlight today, intraday. Providing several profitable trades up and down as the day progressed. 1.20 GMT the highlight short when the Americans showed up with the volly. #goldcycles

1

0

1

A nice example of how to augment a vanilla approach to trading cycles with auction market theory and VWAP from @FrankinMyrrhh. Hopefully more examples coming soon from Matt, bravo.

1

0

2

Ready for the crunchpoint? . The dominant cycle in stockmarkets over the last decade or so, the 40 week nominal wave, approaches the next peak. Below, a composite of SPY, IWM and QQQ. #marketcycle #timefrequency

2

2

14